The inside track

VC HOT TAKES

The payments sector has become white hot over the past ten years. Once a sparse corner of the start-up scene, today there are thousands of payments companies, all vying to make payments faster, cheaper and more frictionless. A recent report estimated that paytech now constitutes 25 percent of all fintechs, and is valued at more than $2 trillion.1 So how to separate the signal from the noise and glimpse the path ahead? We asked five VCs for their insights...

Will Orde

Partner at Passion Capital

A prominent London VC, Passion Capital has a strong reputation for backing fintech stars, a number of which have since become unicorns.

Julia Andre

Partner at Index Ventures

Once dubbed “Europe’s start-up success factory” by WIRED, Index Ventures is highly active in fintech. Andre has a particular interest in businesses that increase transaction efficiency.

Jay Reinemann

Co-Founder at Propel Ventures

Before he set up Propel Venture Partners in 2016, Reinemann had a career in banking and payments. Naturally Propel’s portfolio has a hard fintech skew.

Lauren Kolodny

Co-Founder and Managing Partner at Acrew Capital

Acrew Capital believes that “we’re still in the dawn of how modern technology can rewrite the world’s financial system” and argues that “now is the time to build”.

William Bao Bean

Managing General Partner at Orbit Startups

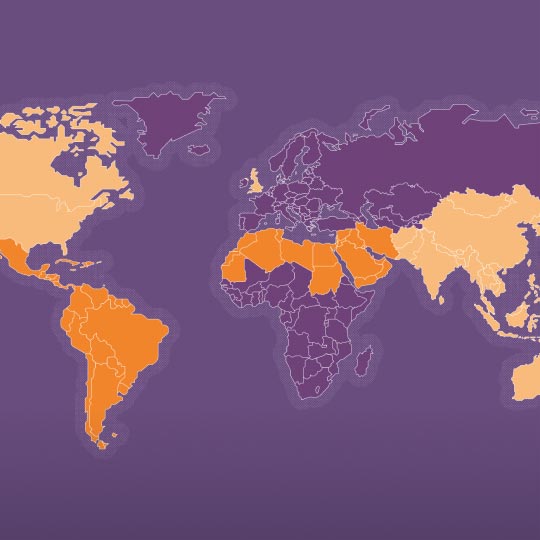

Orbit Startups is a member of the SOSV consortium. It invests in technology that can drive transformation in emerging markets, in particular fin- and pay-tech.

Will Orde:

“Atoa. This is a payments platform that enables merchants to take payments directly from their customers’ accounts, rather than via a debit or credit card, which reduces costs. All the customer has to do is follow a link through a QR code.”

Julia Andre:

“Adfin. It’s a UK startup that helps small businesses and sole traders get invoices paid more easily. Using the platform, they can automate every step of the invoice-to-cash process.”

Jay Reinemann:

As new technology disrupts industries, companies are increasingly compelled to achieve that same level of internal cooperation. Many businesses have organizational silos without enough sharing of information between teams. As the pace of change accelerates, companies are finding they need to break down these barriers if they are to stay at the front of the pack.

Lauren Kolodny:

“Nala. It enables people to send money into and out of Africa. Remittance flows into and out of the country have risen dramatically in the past 10 years, but most of those payments are expensive and slow. To send money efficiently, Nala has built their own payment rails.”

William Bao Bean:

“24Seven Apni Dukan, a commerce platform that connects and fully digitizes mom-and-pop stores in Pakistan. By ordering collectively these stores can order supplies at wholesale prices and, using data from sales, receive trade financing. The app also gives stores a POS so customers can pay digitally. 24Seven will take a cut from the financing as well as each payment.”

Lauren Kolodny

Will Orde:

“As fraudsters use AI to optimize their outreach messages, fraud is becoming an even bigger risk for merchants and banks, who foot the bill. Merchants and banks don't want to add extra friction to the process for customers, with additional steps in a transaction, so they are embracing AI to identify the fraudulent ones in real-time. It’s an arms race, and this is creating a new market for AI-based fraud prevention tools.”

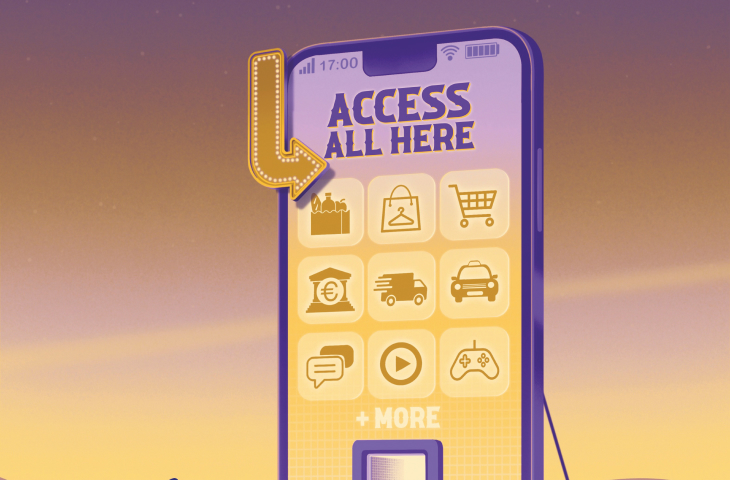

Julia Andre:

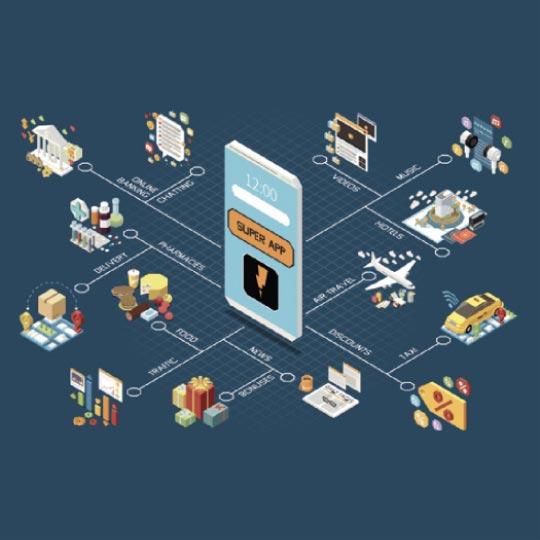

“A large portion of B2B transactions are still quite archaic in the way they are conducted. The process normally involves sending the customer a paper invoice with your bank information, followed by a bank transfer. But there’s a growing demand among businesses to have consumer-grade, seamless, embedded workflows and the ability to pay, buy, bank, exchange, invest, and borrow in one place. This has created an opportunity.”

Jay Reinemann:

“It’s hard to beat card payments—but open banking payments, which allow shoppers to directly pay from their bank through an account-to-account payment (A2A), are quicker, easier, and more secure. For businesses, open banking payments are also cheaper, and they don’t have to worry about a chargeback or fraud.”

Lauren Kolodny:

“We are on the brink of a significant transformation in the paytech sector, propelled by the ability of large language models to clean, structure, and standardize formerly unused financial data. Long-sought-after advancements in paytech such as true payment automation, dynamic pricing and software driven dispute management will be achievable...”

William Bao Bean:

“In many developing countries you’ve got hundreds of thousands of people working online doing freelance work. But their biggest challenge is getting paid. If you're in Africa, for instance, it can be hard to receive USD or GBP so people get paid in stablecoins then turn it into their local currency so they can pay for food and rent. An increasing number of companies are tackling this problem by offering good stablecoin exchanges.”

Will Orde:

“That we’re dependent on the US for innovative paytech. We’re going to continue to see lots of innovation come out of the UK and Europe because there are good founders and a blanket regulatory system in Europe. We’re also going to see some interesting solutions come out of the emerging markets; with less regulation, people can move quickly.”

Julia Andre:

“There is a lot of focus on AI, and how that’s going to shape payment technology, and it’s easy to get lost in that. But don’t lose sight of something more straightforward: most transactions are still done in an inefficient way; they’re expensive with a lot of manual back and forth, which means there are many opportunities to push new products that streamline how money flows.”

Jay Reinemann:

“It's very easy to underestimate the complexity of ensuring that paytech reaches a broad user base including those in underserved, remote regions. Enabling accessibility presents more challenges than some imagine, such as infrastructure development, user education, integration with existing systems, security and regulatory compliance.”

Lauren Kolodny:

“Apart from a handful of consumer P2P payments apps, few payments companies have figured out how to build real k-factor [a measure of virality] into their products. This is ironic because payments are the ultimate network effect. There is a massive (and, to date, missed) opportunity for the next generation of payments companies to get this right.”

William Bao Bean:

“The biggest misconception is that payment itself is the hot space. The hot space is actually not just processing payments but also connecting merchants to customers in return for profit share. The most powerful way to do this is to directly integrate other services into your payment app.”

ILLUSTRATION: Joern Kaspuhl