Treasury breaks free

Communities

The information age has shown the power of convergence—not just for technologies but for teams. Businesses have learned that when they break down boundaries within their organizations, they are not only better placed to adapt to digital disruption but can drive innovation themselves.

Yet even within the most integrated companies, certain teams are so specialized they have often been left in their silos. Treasury is one—but now, that’s changing. Treasurers are increasingly compelled to ensure they don’t sit in isolation. Identifying opportunities to integrate treasury closely and comprehensively with other facets of the business is becoming essential.

We spoke to treasury leaders who are placing collaboration at the heart of their work about how to do it successfully...

Treasury can—and should—be a partner to all areas of a company. We work closely with many different teams. One is procurement, where we are providing tailor-made support, including inventory financing and export credit support to suppliers, as well as payments solutions to access different currencies or payment types. We also frequently work with sales by providing them with financial solutions that can make our products more financially viable for the customers.

In the future, alongside our usual ‘hard’ skills, which now have to include AI skills, treasurers will also need a bank of ‘soft’ skills. Treasurers need to be able to talk with each internal business area, so we can understand their specific goals and how we can support and work with them.

Storytelling with numbers is such a skill and it can take years to master. If you get it right, it's easier to bring stakeholders into the vision of what treasury and the wider business is trying to achieve.

For example, at Invesco we are constantly deepening our relationship with finance, especially with financial planning and analysis (FP&A). The more we all understand, ‘Where's the business headed, from a revenue perspective and an expense perspective?’, the more accurately we can forecast our cash.

With 'good' forecast data, we’re explaining what that data means month-on-month, quarter-on-quarter from an actual cash perspective. Treasury can explain to business functions that these are not just numbers on an Excel spreadsheet—this is actual cash, which has real implications for all of us. We can then encourage that stakeholder mindset of, ‘Treat it as your own money’ and with that mindset we all feel more engaged in what we do.

A large element of my role is ensuring other business functions and external stakeholders understand the ‘why’ when treasury implements changes—such as enhancing the financial control framework—and the benefits it will bring.

In practice, this means being able to lobby, negotiate and ensure expectations are met. It also requires communicating the business’ global requirements to get buy-in from local teams, and vice versa—understanding local needs and nuances and parlaying them into our global agenda.

To be successful in the role therefore requires building emotional intelligence. In such a complex landscape for treasury, the ability to foster strong relationships with people to facilitate the work that you're doing is vital. Treasurers cannot be siloed any more. Half of my role is now based on relationship-building and building a good network of stakeholders that understand the broader context and the benefits of our strategy.

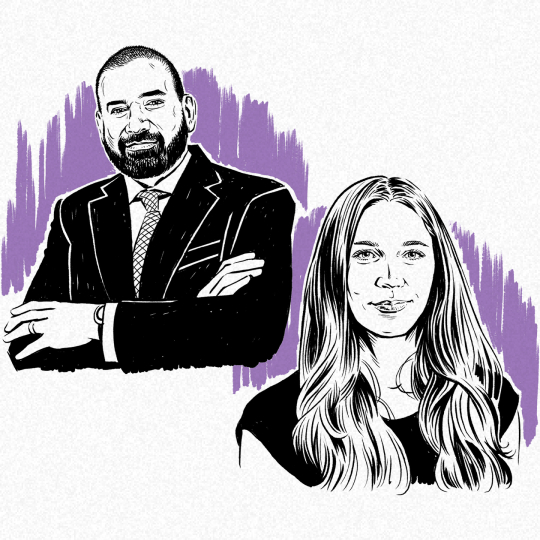

Adeline Chua

APAC Treasury Manager, Kimberly-Clark Asia Pacific

Kimberley Clark is a multinational manufacturer of consumer goods and personal care products

Prediction #1: Treasurers will need to be technologists

Post-2030, treasury will be more data-driven, technology-centric and strategically focused.

We will increasingly leverage AI and machine learning tools to automate repetitive processes and improve cash flow forecasting. We will also be able to rely on advanced data analytics, resulting in a more precise and informed decision-making. Therefore, it will be critical in the future for treasurers to have the technological proficiency to be able to operate emerging technologies.

In addition, with growing digitalization, cybersecurity threats will become more prevalent, so treasurers will need expertise in managing these risks to protect financial transactions and sensitive data.

Charlene Tan

APAC Regional Treasurer, Archroma

Archroma is a global specialty chemicals company

Prediction #2: Serious talent will be drawn to the profession

Treasury historically had a reputation for being a somewhat staid, back-office function. That simply isn’t the case anymore.

We’re now highly visible, having evolved into a trusted partner that proactively supports the business, optimizing cash resources to meet operational and strategic needs while safeguarding the company’s financial stability. This involves collaborating with finance, IT, procurement, supply chain, investors and rating agencies to hone our processes and boost our company’s external profile.

The most relevant, exciting treasurers I encounter are engaging with emerging tech and ever-changing regulations. They’re dynamic, willing to be visible and to engage with new people and ideas. They’re leading by example. This will influence who is drawn to the profession: I predict we’ll see some serious talent join our ranks in the coming years.

ILLUSTRATION: SELMAN HOSGOR