Enhance your liquidity and gain the flexibility to capitalize on growth opportunities.

Get in touch

Hide

Get in touch

Hide

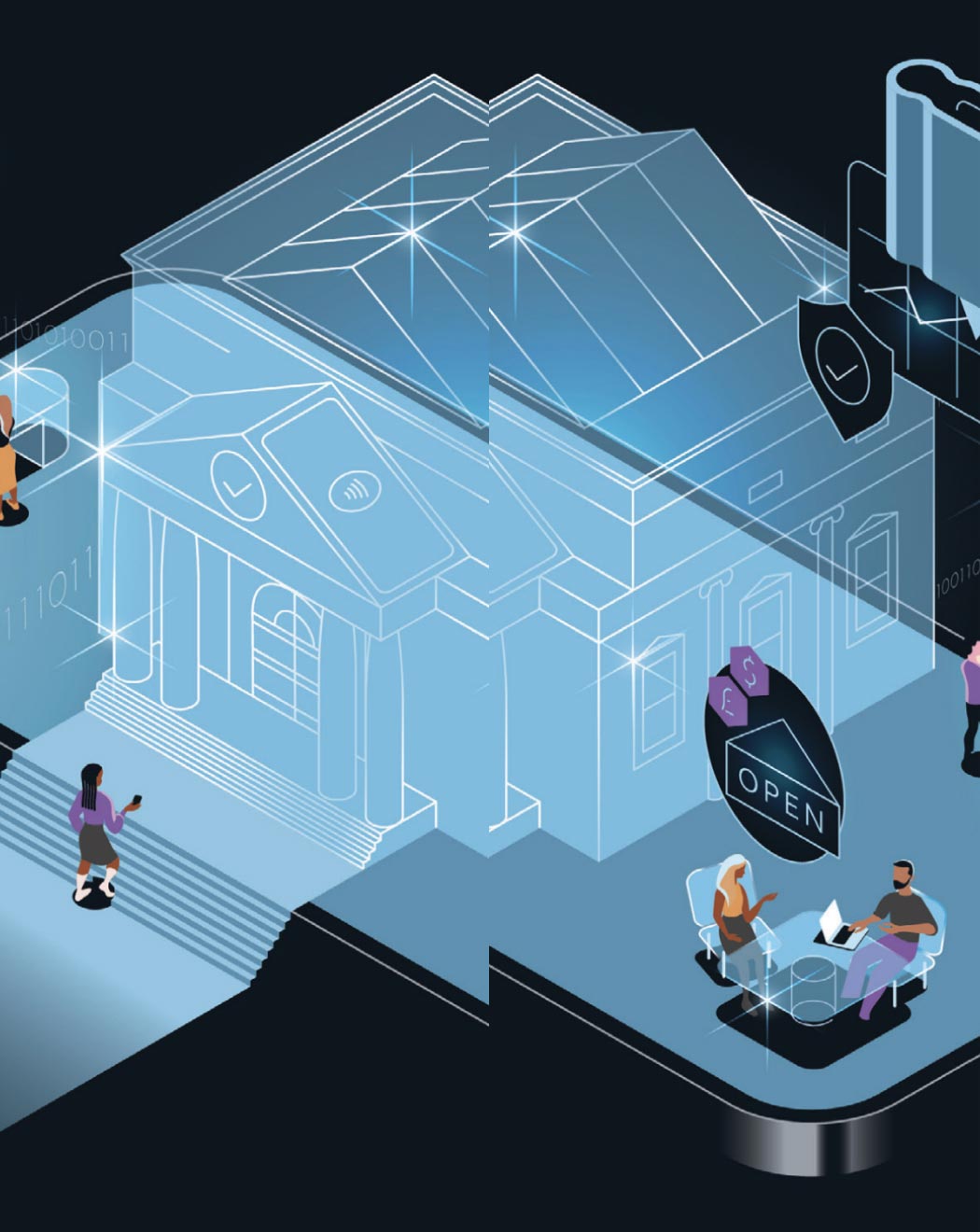

A trusted leader in payments innovation

Global and local expertise you can bank on, with the security you’d expect from one of the world’s largest payments franchise.1

“We pride ourselves on listening to our clients and their needs. By doing so, we help strategize and come up with the right solutions that make sense for them.”

Kiat-Seng Lim

Global Head of Financial Institutions Group, J.P. Morgan Payments

Supporting your business growth strategy

Navigating an unpredictable financial climate

Whatever the challenge, we’re here to support you through changing market cycles. With our fortress balance sheet, robust controls, resiliency, risk management and security, we help you navigate uncertainty with consistency.

Decades of experience

A global bank with decades of experience banking other financial institutions, helping simplify payments at scale. We support you at every stage of your payments lifecycle with global connectivity and client-centric solutions.

Focusing on the client

Our clients come first. And with over 200 years of experience, our expertise and global reach allow us to deliver dependable services and solutions, helping you expand your business and navigate regulations and requirements.8

Building the future

We continually invest in payments technology, working across industries to help build the future of financial infrastructure with a client-centric approach to innovation backed by dedication to security and compliance.

Solutions that deliver, no matter your financial institution

Payments are changing rapidly, bringing both challenges and opportunities. Our solutions can help you meet your needs of today, and tomorrow.

Liquidity optimization

Create a payments strategy that can help grow your business, intelligently move liquidity and unlock more value from your cash.

Global clearing

Cross-currency

Send and receive payments across the globe. With a global network spanning 160+ countries, send in 120 currencies and receive in 40+7.

Innovative technology

Leverage innovative technology solutions to solve real-world business problems at scale, and across global markets.

See how we’re transforming the way money, information and assets are moving around the world.

Trade & working capital

Expand into new markets with our Trade Finance solutions, tailored to help streamline and future-proof trade operations.

Related insights

Payments

Financial Services & Banking for the Unbanked

We share several innovative organizations helping to provide financial inclusion, payments access and education to some of the world's unbanked people.

Learn more

Payments

Making cross-border payments faster, safer and less costly for financial institutions

To help their clients send money all over the world, banks must adapt with the times.

Read moreRelated products and

services

Gain access to one of the world’s largest wealth managers.

Defend your organization against electronic payment fraud, natural disasters and other threats.

Multiple payment solutions to help meet the needs of your organization and employees.

Plan for your business' and employees' future with objective advice and financing.

Preserve working capital without compromising competitiveness with flexible equipment financing.

Fine-tune your payments strategy to help lower costs, improve working capital, reduce fraud and more.

Automate accounts receivable, reduce DSO and improve your working capital.

World-class investment experts with local expertise and global solutions.

Monitor and control your cash to optimize returns across your entities, geographies and currencies.

Manage costs, drive sales and better navigate the omnichannel payment landscape.

Loan syndication expertise tailored to your company’s daily and long-term needs—not your deal size.

References

Coalition Greenwich Competitor Analytics. Based on JPMorgan Chase’s internal business structure and internal revenue. Excludes the impact of Archegos in 2021 Historical Coalition Greenwich competitor revenue and industry wallets have been rebased to ensure consistent taxonomy and accounting/structural adjustments Market share reflects share of the overall industry product pool, unless noted that share reflects share of Coalition Index Banks Rank reflects JPMorgan Chase’s rank amongst Coalition Index Banks as follows: – CIB and Markets: BAC, BARC, BNPP, CITI, CS, DB, GS, HSBC, JPM, MS, SG and UBS – Treasury Services and Supply Chain Finance (SCF): BAC, BNPP, CITI, DB, HSBC, JPM, SG, SCB and WFC – Securities Services: BAC, BBH, BNPP, BNY, CITI, DB, HSBC, JPM, NT, RBC, SCB, SG, and SS.

Coalition Greenwich Competitor Analytics FY23

JPMC Investor Day Presentation, May 2024. Value reflecting 2024 firmwide technology expense outlook

J.P. Morgan Proprietary Data, 2024. Please note that currency footprint may vary by debit account branch location, subject to change.

JPMorganChase, History of Our Firm

Coalition 2023 Greenwich Competitor Analytics. Based on JPMorgan Chase’s internal business structure and internal revenue. Payments reflects global J.P. Morgan Treasury Services (Firmwide)