The big play

Feature

Top-end racing cars are some of the most advanced machines on earth, combining light-weight materials, precision aerodynamics, turbo-charged propulsion and hundreds of sensors that produce billions of real-time data points. If you want to zip around a racetrack for two hours at speeds of 200 miles per hour, and get to the finishing line faster than the next guyracer, you need all the innovation you can get.

With such a focus on new technology, it is perhaps unsurprising that motor racing has also created a cutting-edge fan experience. At a typical Grand Prix, there are giant HD high definition screens displaying all the action, apps to access live driver data or audio feeds from the cockpits of the cars, as well as a huge array of events, activities, concerts, luxury lounges and bars that are open across the entire weekend. Fans can buy a walk-about ticket allowing them to stroll through the campus, picking different viewing spots at will. If they’re still not satisfied, they can jump in a virtual reality (VR) simulator and experience what a race feels like from the cockpit.1

In many ways, it is more like a festival than simply a race. And the fans are responding. In 2023, total F1 attendances were just under six million for the season, up five percent year-on-year2—or around 260,000 per race on average and far more than even the Super Bowl.3

Other sports are taking a similar approach. A new generation of stadiums are being built around the world, and they are centering on the fan experience, offering first-class amenities, retail options and leisure activities, underpinned by frictionless digital platforms. Meanwhile, for those that prefer to watch the action at home, a new era of streaming platforms are bringing unprecedented levels of choice, interactivity and engagement.

As the sports world puts fans in the driver seat, a forward-thinking approach to payments has become a necessary condition for success. We take a closer look under the hood...

Throughout most of the 20th century, the main design imperative for sports arenas seemed to be to cram as many people into the space as possible.4 For fans at the biggest events, it could sometimes be as much about endurance as enjoyment. But a new generation of stadiums aims to address this. Spacious seats, unobstructed views, high-quality food, well-designed bars, lightning-fast wi-fi. UK soccer club Tottenham Hotspur, which recently opened a new US$1 billion stadium, has a fine dining restaurant and its own microbrewery on site.5

So, what’s driving this new fan-focused approach? Partly its rising expectations. Ticket prices have been increasing faster than inflation for decades.6 Supporters are demanding a live experience commensurate with what they’re paying; cramped seats and long lines won’t cut it anymore. There is also competitive pressure. But it’s not rival teams that sports organizations are worried about– it’s enticing fans away from their sofas and 60-inch TVs, or convincing them to spend on a game ticket rather than the myriad other leisure options they could choose from. In the US, sports attendances for the major sports have been plateauing for years, leading to ever more investment in building or renovating stadiums.7

In this new environment, payments are emerging as a star player key consideration. Many new stadiums are turning ‘cashless’ into a key selling point: phasing out physical money in favor of contactless cards and mobile payments. On the one hand this makes good business sense. Fans appear to spend on average 25 percent more at stadiums when they don’t have to use cash.8 Multiply that by 70,000, and the numbers quickly stack-up. Cashless payments can also help to prevent some instances of theft and fraud as fans and vendors do not have to carry money, which can get lost or stolen.9

But going cashless is also—crucially—about improving the experience. Long lines are a perennial problem for live events due to the sheer volumes of people in such a small space. Research shows that 42 percent of fans are frustrated by long wait lines for concessions in stadiums.10 After all, a supporter doesn’t want to spend hundreds of dollars on a ticket only to spend half the game with their back to the action. The Hard Rock Stadium, home of the Miami Dolphins and the Miami Grand Prix, first went cashless in 2020.11 As their Chief Commercial Officer, Ged Tarpey, explains: “The beauty of [going] cashless is speeding things up. We want as short wait times as possible for checkout, whether you are at the retail store or looking at food and beverage options.” Cashless solutions are quicker, as there is no need for a retail assistant to count the money, ring up the till or provide change.

Such is the need for speed, some sports organizations are looking to go beyond solutions like contactless cards and mobile wallets, and are exploring emerging, even more frictionless forms of payments.

This includes biometric transactions. Biometric transactions involves using unique physical characteristics to authenticate someone’s identity. In 2023, J.P Morgan piloted the use of biometric payments at the Miami Grand Prix,12 a first for the sport. After enrolling in the program via a one-time mobile registration, fans were able to pay for merchandise in a retail store with a swipe of their palm or a facial scan, no card required. On average, authentication and payment was processed in less than a second.13

According to Niall McClean, Director of Finance for the Irish Football Association, “there is a growing demand for faster and more convenient payment methods. As fans become more accustomed to using biometric payments, it is very likely this solution will become more common in stadiums.” Of course, getting people to sign up can be a challenge, as biometric transactions are still relatively new, and people can be nervous about having physical identifiers stored by a third party.14 But this presents an opportunity for established financial institutions, as they have a reputation for security and privacy that can reassure customers.15

The other big queue-killing idea edging into the spotlight is grab-and-go technology.16 This uses RFID scanners and computer vision to identify when an item is picked up off a shelf by a customer and taken out of the store. Each customer has an online account linked to a bank card, and when they leave, the items are automatically charged to them.

The Hard Rock Stadium has been testing this approach at some concessions. “At halftime there is such a rush that it might take somebody ten or more minutes to checkout,” says Tarpey. “People want to get back to their seat for the start of the second half. We see that when people are using check-out-free options that those transactions are happening in less than a minute at those locations.”

Since August 2022, the number of check-out free stores increased from 44 to 18017,18 across US stadiums. Whereas this technology has run into some problems in grocery stores, it seems well suited for arenas because the retail locations are small, with far fewer items. It is much easier for the technology to keep track of 20 SKUs than it is the 30,000-50,000 you would see in a typical supermarket.

One obstacle is that check-out-free options are not suited to selling alcohol. Conventionally, staff members have to manually check IDs when offering alcoholic drinks. However, integrating biometrics with check-out-less technology could be a winning play, as users can confirm their age during enrollment and store it along with their payment information for quick verification. After the restrooms, the lines at bars are often the longest in the stadium. Leading vendor Zippin has now created a system whereby customers are verified via facial recognition when they enter, an idea tested at the Denver Broncos’ stadium in 2023.19 A similar approach is also being used for vending machines (see box out).

Another major trend among sports organizations is offering a campus of events and activities to entice fans to come earlier and stay later. They even want to attract those who don’t have game-day tickets but want to enjoy the atmosphere and amenities. SoFi Stadium, home of the NFL’s Los Angeles Rams and Los Angeles Chargers, has a ‘shared reality’ facility outside the stadium, provided by technology company COSM.20 This lets fans watch the NFL games from earlier in the day, or other sports altogether, on giant curved 8k screens. It also offers films, documentaries and immersive art shows.

Making payments as frictionless and invisible as possible could help to elevate the experience further in these entertainment districts. Rather than frictionless payment options being limited to specific amenities, imagine a stadium offering a single biometrics or grab-and-go payment account for the whole campus. People could move between the different offerings, transacting simply and easily wherever they are. Omnichannel options could also be integrated, allowing fans to purchase merchandise or food and drink, say, through their smartphone, before picking it up in-store at a convenient time.

Xavier Asensi, President of Business Operations at Major League Soccer (MLS) club Inter Miami CF, says that for his organization this is about being mindful of what they don’t want their campus to become. “I don't know if you have been in an airport recently—we want the exact opposite of that!” he says. “The idea is that you can move around the place without going through any hassle. It's a matter of being flawless in terms of experience.”

Whatever solutions are adopted, whether it’s mobile wallets, biometrics or checkout-free technology, a basic challenge is that they all require reliable, high-speed wi-fi. Point-of-sale terminals, biometric scanners and autonomous stores all need to be able to connect to the internet, as do the tens of thousands of people paying with their devices. Wireless data consumption by fans is also exploding, adding additional pressure to infrastructure. Attendees want to be able to take and upload videos of the action or listen to live commentary as they watch the game.

This can present a challenge. Having so many people using the internet in such a small area can strain bandwidth. And while 5G technology can provide high-speed internet, and support up to a million devices per square km, public 5G networks are not available everywhere, and private 5G networks are typically expensive to build and operate.21 The emerging solution? Wi-Fi 622, which can offer up to four times more bandwidth than previous Wi-Fi technology.23

The ultimate goal is to bring the same level of seamless connectivity that consumers experience in their everyday lives to the sports stadium. It is a blending of the physical and digital experiences, an approach that is also being increasingly used by sports broadcasters.

As well as being an important component of live sports, ultra-fast internet is transforming the at-home experience. This is because it is enabling live streaming: watching online from the device of your choice. Live sports have traditionally been a challenge for streamers, as they are fast-moving and require ultra-low latency. Even a pause of a few seconds can ruin the viewing experience. But as home and cellular internet speeds increase, live streaming has exploded. Indeed, out of a total TV audience of three billion at the 2024 Paris Olympics, more than a third was attributed to streaming, breaking all records24.

Going global

Sports broadcasting in major markets has traditionally been dominated by cable or satellite TV options. In return for expensive monthly subscriptions, or standalone payments for some of the biggest events, fans got to watch their favorite sports. Commonly, these packages were ring-fenced geographically. In the US, for example, the sports packages are mainly regional,25 with fans having to pay extra to see teams from different parts of the country.

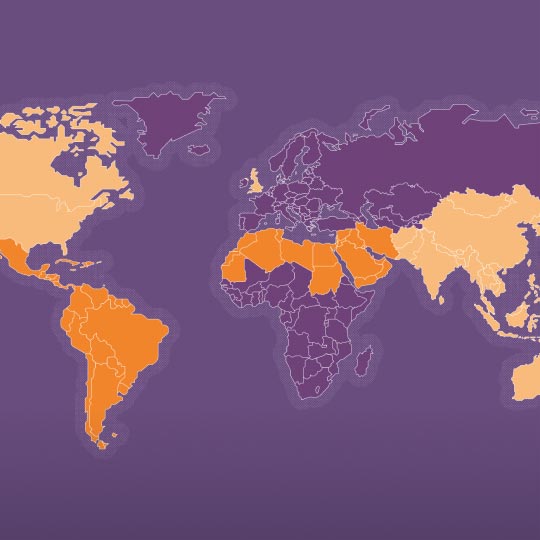

One result is that many sports have remained defined by a particular geography. Around 98% NFL’s media rights income is from the U.S26. An overseas supporter would have to hope one of their domestic TV channels had acquired rights to certain games. But when Amazon Prime bought a package of NFL games for streaming, these boundaries were erased. Thursday Night Football27 is now available to its 200 million global subscribers.28 The potential for global reach was one of the reasons that MLS in the US signed a ten-year, $2.5 billion agreement with Apple29, making the league available in around 50 percent of the world’s countries.

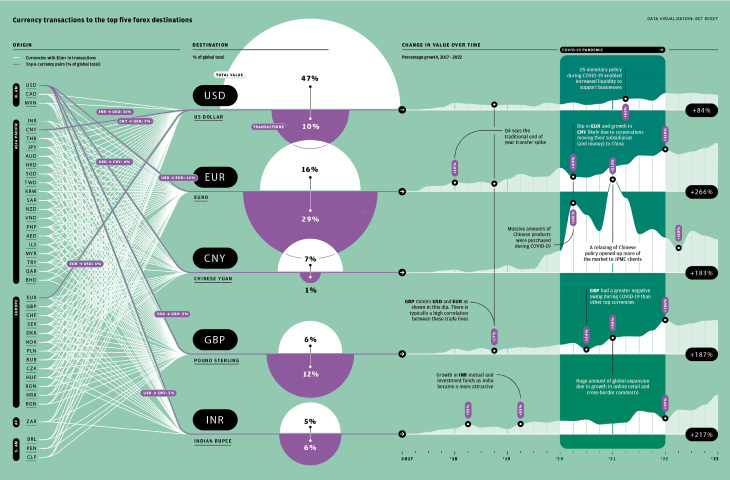

But taking a global approach can also create payment challenges. Niche sports that typically do not get as much national TV coverage are also using streaming as a way to build their audience. The World Surf League, for example, has its own platform and draws millions of views.30 However, one of the challenges for direct-to-consumer streaming models is enabling the fans to pay, wherever they are. Different countries have different payment methods, all of which have to be supported. Some of these methods will not be well-suited for subscription models, which traditionally have always been built around debit or credit cards. One solution is instead of building out the infrastructure for each country, streamers can opt for orchestration platforms that integrate hundreds of local payments options. The most advanced services also aggregate all the payments data streams from the different markets, giving real-time reporting and analysis.

Another challenge is that all streamers, regardless of size, must be able to handle sudden surges in volume. On-demand models can mean thousands or even millions of fans buying a game-pass at the last minute, causing significant strain on the system. Each user has to be verified, and then their transaction must be processed. Even the biggest e-commerce operations have been known to have outages during promotions or sales events, when spikes in demand are way above forecasts and breach capacity.31 One strategy that streamers can use is to try and stagger purchase times. They can offer exclusive online content, such as player interviews or locker room access, to draw in viewers ahead of the start time and cut system load.32

New ways of viewing

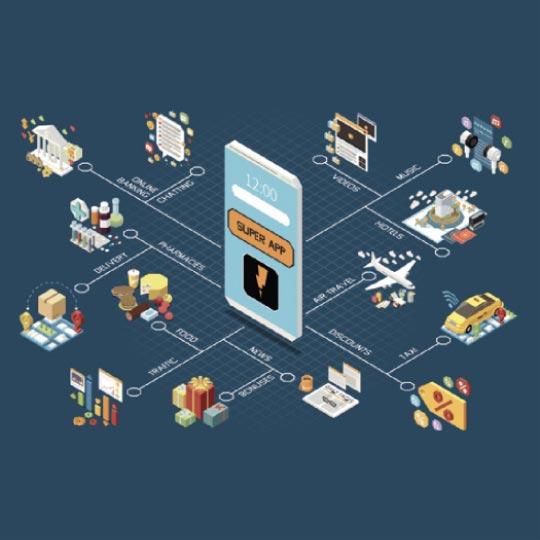

Offering digital add-ons plays into one of the strengths of streaming platforms, which is the ability to provide interactive features that conventional television can’t match. This could include options for multiple screens, customized content, additional stats or control over camera angles, giving fans much more choice over how they view games.

“At ESPN, for some college football games we use a sky cam, which follows behind every college football play so you get to see the quarterback’s view,” says Zachary Malet, Senior Director, ESPN Business Development & Innovation. “On a Saturday night, I'll have the regular game, and I'll have it side by side on the screen with the actual sky cam, and be able to look at alternative angles, and really get a rich fan experience.”

Virtual reality (VR) could take this even further, allowing fans to immerse themselves in the action. Apple is making the MLS available on its Vision Pro Headset. Technologist Mathew Ball – author of The Metaverse – recently predicted that in a few years you will be able to use VR to watch a star player take a freekick while ‘standing’ right behind him.33

Other potential enhancements include the ability to buy sports-related merchandise through the streamer’s app. By hosting merch from different providers, as well as the players themselves, streamers could create their own marketplaces. This will require embedded banking services, such as streamlined onboarding for sellers on the marketplace, a wider range of payment options, as well as the infrastructure to hold cash on behalf of third party companies. But the opportunity is sizeable, especially as star players increasingly look to monetize their image rights (see box out). The global sports merchandise market is set to reach US$58 billion by 2032.34

Some platforms may allow access to games covered by other providers, becoming one-stop-shops for sports coverage. For example, one streamer may not have access rights to a major sport, but will offer a link to another company’s streaming platform and vice versa, with a revenue sharing model set out between them. Making sure that there is a smooth payment process when accessing a game hosted by another broadcaster will be essential. Just as a fan does not want to be stuck in line in a stadium, they don’t want to be stuck creating an account or inputing card details while the game is underway. Eliminating ‘digital queues’ will be crucial for sports platforms to give fans the type of flexible, interactive experiences they demand.

Personalization potential

Frank Nakano, Managing Director, Sport and Entertainment at J.P. Morgan, believes that as well as reducing friction, payments can be used to create more tailored experiences. “The offer should be seamless, with as many interactions as possible. This will also allow more accumulation of data. What is the fan into? What types of events are they looking at?” he says. “Payments providers can then improve personalization and provide more targeted offers.”

Payments data can offer a wealth of insights including what fans are typically buying, when they are buying it and what related products they also purchase. Transactional data can then be used alongside indicators like demographic segmentation, buyer personas, and user information to craft tailored offerings. A digital broadcaster could offer a fan additional sports in their subscription package, or discounts on game passes, based on predictions of their preferences.

ESPN is one channel exploring the possibilities. “We are discussing how we can work with different data companies to triangulate the info with our user data to better understand and serve the fan,” says ESPN’s Malet.

After evaluating some of its data, ESPN is experimenting with ESPN Experiences, where fans get VIP trips to multiple different sports stadiums, including behind-the-scenes access to ESPN talent and presenters. At the same time, stadiums are also offering digital subscriptions as add-ons to match-day tickets.

It highlights how boundaries are disappearing between the physical and digital realms. In the future, the live and at-home experience will be increasingly connected, powered by data and enabled by payments. It will be a new way of viewing and engaging sports, with fans increasingly in control. However, as Asensi points out, despite the shifts ahead, one thing will always remain true. “Do not forget,” he says, “what really matters most to the fan is the scoreboard at the end game.”

College athletes in the US can now make money from their name, image and likeness for the first time. It follows an explosion of endorsement deals and licensed merchandise for the leading players. The trend could not have come at a better time for athletes, as there are more opportunities and channels than ever to monetize their intellectual property (IP) including social media and influencer platforms, sports-based marketplaces, and even digital platforms for non-fungible tokens (NFTs)–exclusive digital goods that are authenticated and stored on blockchain networks.

This is raising interesting questions about how much control over their IP athletes will be given, especially as younger generations of fans gravitate more to star players than teams.35 It can be common for players to take equity stakes in brands in exchange for their endorsement, but in the future will they start to demand a cut of TV or streaming money too? And what about ticket sales at the stadium? If so, how would royalties be split between the multiple different stakeholders in the ecosystem? Whatever the answers, sports organizations will need innovation to facilitate all the new payment flows in this new environment.

ILLUSTRATION: JVG