What if your phone knew your entire purchase history?

Reality check

Payments have radically evolved since currency first emerged around 4,000 years ago, but they are still essentially a single moment in time. People enter a store or shop online, make a purchase, then go their own way. There is no ongoing connection after the purchase.

The dynamic has been enhanced to some extent. Your credit card statement shows where you shopped and how much you spent, and the store’s records indicate the shopper’s name and card data. And there are countless bespoke loyalty schemes that build a post-purchase, brand-centered rewards structure. But the store couldn’t get in touch with you based on the payment transaction alone, and if you wanted to know what items you bought, you’d have to refer to your receipt, assuming you kept it.

In other words, the system is much as it was, despite the wealth of advances that have come with the information age such as wireless internet and AI. “Since time immemorial, we’ve been able to barter by simply taking out our drachma or our pound and giving it to the guy on the other end. I could get my pig or my cow and go on with my day. Sadly, that pretty well summarizes what we've got going on up to present day,” says Peter Lugli, a payments veteran who has worked at major credit card and tech companies and is now Principal at payments consultancy Digital Pylon.

It’s hard to envision how this can be changed, but some experts believe it’s not only feasible but could create a whole new source of business value.

Imagine a world where every card transaction included data about the specific items you purchased and the “stock-keeping unit” (SKU) product information that retailers hold. It might also include details about provenance: Where and when was it made? Who was involved in its production or distribution? Such a set-up would allow payment companies to connect dots in a way that facilitates ongoing and beneficial post-purchase interactions between manufacturers, retailers, and consumers. All within the bounds of consumer-determined permissions and consent, of course.

Consider product recalls. Suppose you bought a pack of biscuits from a flawed batch—perhaps they contained nuts when they weren’t meant to—the retailer or even the manufacturer could send a push notification informing you and automating a refund. This could potentially be less costly than having to recall every unit of that product sold nationwide. It would also be a more effective notification method than a media announcement, and it would make it more likely you would get your money back. The retailer could make the best of a bad situation by also offering you a coupon on a future purchase, re-building the customer relationship.

Another application is reducing friction in reward schemes. In current reward programs, customers must often take an additional step to get points from their purchase, such as scanning a loyalty card or typing in their membership number. A platform that enabled businesses to track what their customers had purchased could remove this friction.

And think of the completely novel kinds of customer experiences that those businesses could then offer post-purchase. Perhaps they could make AI-driven suggestions such as how to cook a beef tenderloin bought at the market, as well as which of your past wine purchases pairs well with it.

There’s also another benefit that particularly appeals to the payments industry: fighting fraud. Bob Solomon, a payments expert who has worked with credit card companies and food industry supply chains—and is now Principal of Software Platform Consulting—notes that many transactions on bank statements appear as a jumble of letters and a price. This often makes it “impossible to tell whether it's fraud or not,” he says. “That’s sort of extraordinary in this day and age.” Consumers who received an itemized notification on their phone every time a transaction went through their bank account could play a bigger role in preventing fraud. What’s more, if credit card companies had a more granular picture of customer spending, they could fortify their own fraud protection measures and screens.

Erin McCune, an expert partner in payments and fintech at Bain & Co., says that the idea in principle is possible. She notes that comparable systems already exist in business-to-business supply chains. “Some of the best use cases I've seen for B2B supply-chain blockchain are to trace the provenance of food,” she says. “This is where they’re tracking all the way from the field through to the bag of greens that the grocery store is selling.”

However, McCune thinks it will be harder to take this idea from B2B to B2C. The core reason is that merchants will be wary of revealing detailed SKU-level data to third parties like payment networks or card companies. “What the consumer is actually buying is the holy grail. The merchants don’t want other merchants to know.”

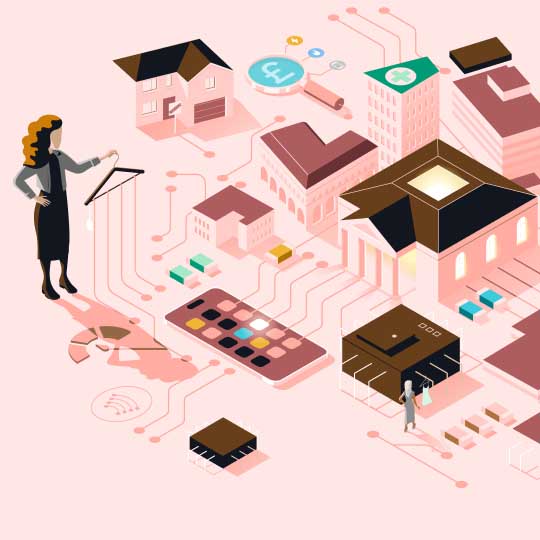

Whoever would implement such a system would therefore need enough leverage to persuade merchants to share that precious data. They would need to be sufficiently influential within payments such that they had the clout to persuade merchants to participate. That player would also need an iron-strong reputation for security and privacy where relevant, otherwise consumers and businesses would be reluctant to opt in. Lugli has a hypothetical candidate: a major smartphone manufacturer that offers a digital wallet. By 2027, digital wallets are forecast to account for 49 percent of all e-commerce and in-store transactions. And since the tech giants that operate them are not traditional payments players, they may have greater appetite—and innovation budgets—for paradigm-shifting ideas. Perhaps such a tech company could function as the prime mover to encourage the kind of multi-party collaboration necessary for getting this kind of system up and running—not only persuading merchants to approve the use of SKU and provenance data, but convincing payment processors to include it in transaction records and card providers to capture and track it.

It would be a profound shift for the industry. But it could be a significant opportunity. “Just as phones are now about much more than calls, the payment event could be something more than just the exchange of money for a good or service,” says Lugli. “It could unleash, as the smartphone did, a massive new value ecosystem as a result. It could be the beginning of whole new relationships.”

SOURCES: WWW.JPMORGAN.COM/PAYMENTS-UNBOUND/SOURCES

ILLUSTRATION: ADRIÀ Voltà