Money’s new need for speed

Data viz

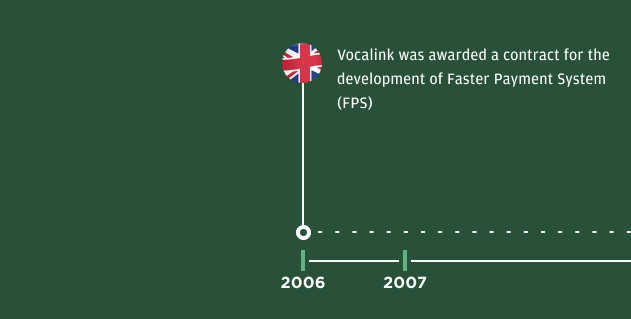

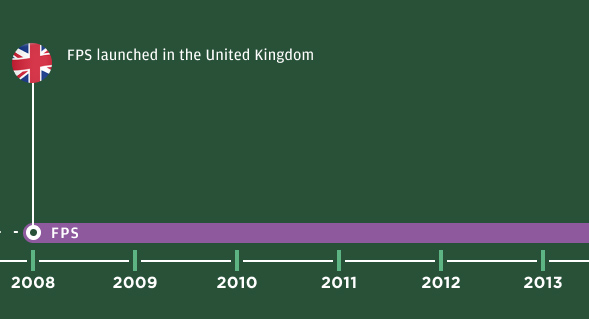

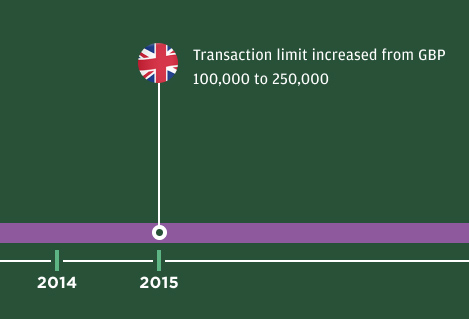

In 2008, the UK blazed a trail. That was the year when it launched its Faster Payments System (FPS), designed to streamline smaller business-to-business and bank-to-bank transactions. But its timing—at the very beginning of the smartphone revolution—meant that the FPS underpinned a far bigger shift in the digital economy1. Today, millions of individuals and businesses in the UK use the near-instantaneous settlement system to pay for goods and services online and in-person, often using their smartphones as the conduit.

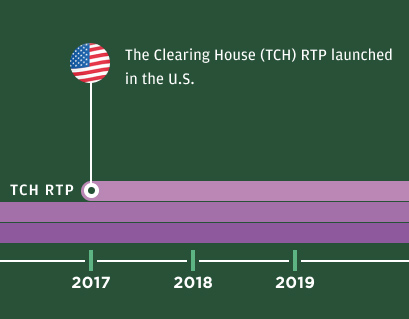

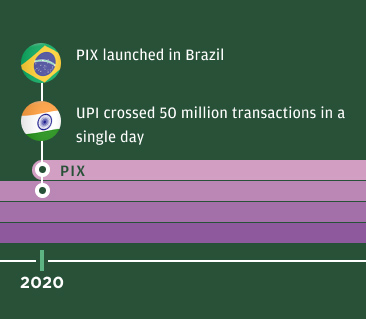

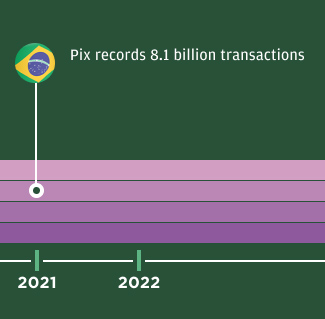

Over the past decade and a half, more than 50 other markets have put in place their own real-time payments systems2, looking to create infrastructure that reduces the friction of digital payments, and which creates a solid platform for technology companies, from small startups to massive global businesses, to build out their own services and tools.

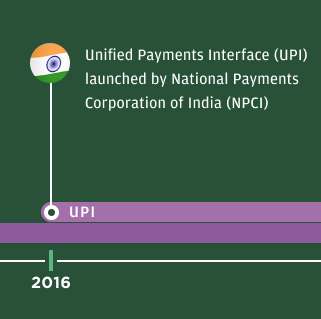

Despite the benefits of real-time payments, merchants haven’t always jumped to adopt it. In markets where payment cards are ubiquitous, brick-and-mortar and digital retailers don’t necessarily see an immediate need to add new payment methods. But in some markets—such as India, where the UPI real-time payments system is becoming the preferred mode for low-value transactions—merchants are highly motivated to start using real-time payments infrastructure. In those markets, where card penetration is low, real-time payments systems offer an alternative to cash3, 4.

Transacting at speed does create risks. Real-time payments are quick and irrevocable, making them easier for fraudsters to exploit than slower transfer systems. Authorized push payment (APP) scams— where a fraudster convinces an individual to send them an instant payment by pretending to be a legitimate business, friend, or love interest—have risen since the adoption of real-time payments. In 2022 alone, £485 million ($616 million) was stolen in the UK via APP fraud5. Customer awareness and consumer protection rules are catching up, but this fraud presents a huge challenge for governments, consumers, banks, and payment companies.

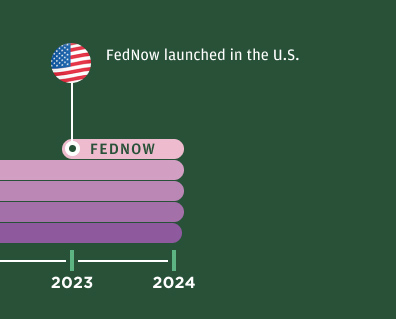

Still, the global real-time payment infrastructure is only going to continue growing. The U.S. Federal Reserve launched its FedNow service in July 2023, transforming the payments business in the world’s largest economy6. And with new data standards, such as ISO 20022, which will allow greater interoperability between financial institutions and payments networks, real-time payments are likely to increasingly cross borders. In this infographic, we explore the state of play right now...

volume

payments

volume

payments

volume

payments

volume

payments

Brazil

14.2

India

7.4

United Kingdom

5.9

United States

0.9

Future real-time payment adoption plans

Real-Time Payment Predictions