Banking the unbanked

SPOTLIGHT

Some 1.4 billion people globally are currently unbanked.1 This has a serious impact on economic development: Without access to a bank account, individuals are prevented from being able to safely save money, earn interest, accept and send digital payments, and access credit. There are societal consequences, too. Unbanked people are vulnerable to exploitation, less likely to be homeowners, and experience low social mobility.

Fixing the problem has become an urgent priority. The United Nations (UN) names financial inclusion as a key enabler for a many of its Sustainable Development Goals for 2030.2

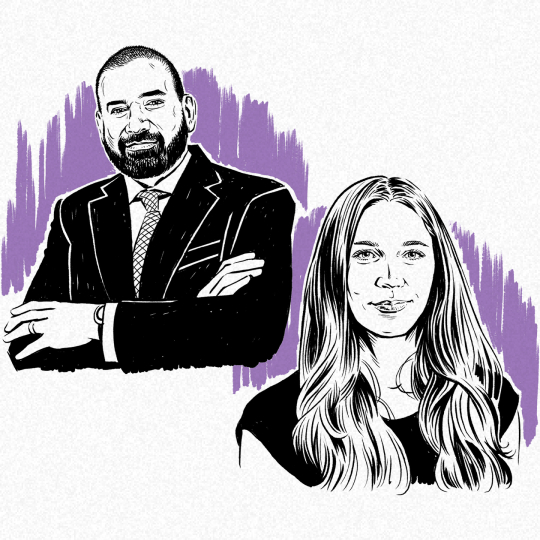

Christine Tan, Head of Financial Institutions Group, APAC, J.P. Morgan Payments, is a leader on the bank’s financial inclusion work. Tan notes that key banking access pain points include “accessibility to banking infrastructure—both physical and digital; high costs and fees; financial literacy; and limited access to identification documents.” Many of these are long-term, systemic issues, and so “building trust and security in the formal banking systems both for individuals and wider communities who have previously been denied these services is crucial,” she says.

Here are three efforts that show how payments innovation is helping overcome these issues...

United Arab Emirates

The UAE is a hub for migrant workers, who make up around 80 percent of the total population.3 A large proportion work in areas like construction or domestic services.

A key problem they face is that many local banks will not accept people earning below a certain threshold, around $1,400.4 This leaves low-income workers unable to formally save, access credit or send money abroad.

Al Fardan Group is one of the leading family-owned conglomerates in the Middle East. UAE-based financial services arm Al Fardan Exchange was launched in 1971, as the region witnessed a rapid influx of expatriates and overseas businesses, to address the access-to-banking problem. Exchange houses like theirs allow people without access to the formal banking system to transfer money abroad. “The genesis of the business was based on a genuine need,” CEO Hasan Al Fardan says, “it was to enable foreign residents who had migrated to the UAE for work to have legitimate and safe ways to send money home to their loved ones.”

Today, Al Fardan is leading a digital transformation effort with online services. In the UAE, the majority of remittances from low-income workers are still transacted in cash through physical locations, impacting financial inclusion. “Now, we're one of the largest players within our market in terms of digital trading volumes,” he says.5,6 This means users don’t have to visit branches, which can be difficult if they are in isolated areas, or if they are working shift patterns and can’t get to a location during opening hours.

The company is adding additional services. This includes the ability to borrow against earned wages in the middle of a pay cycle. Often low-income workers will have little in the way of savings so an unexpected bill or expense can leave them in financial difficulties. Being able to access their wages ahead of time can be helpful, preventing them turning to predatory money lenders.

Al Fardan Exchange is also investigating voice-enabled smartphone transactions, “so the customer can dictate, by voice, which transaction they want to carry out, so they don’t need to be able to read or write.” This can help make financial services more accessible, as many workers may struggle with literacy, especially when it is not their native language.

Indonesia

World Bank data reveals Indonesia has the fourth largest unbanked population in the world, at around 98 million adults. This is equivalent to 48 percent of the country’s adult population.7 One of the key reasons for this is the country’s unique geography, comprising over 17,000 islands, with many citizens living in small villages.8,9

BRI is one of the largest banks in Indonesia and has been in business for more than 128 years.10 President Director of BRI Sunarso says the bank’s current inclusion work is focused on “penetrating financial products and services in the micro and ultra-micro segments.” Microlending—allowing those who lack collateral or conventional credit records to borrow small sums at low interest—can be a lifeline for new or small businesses, or people beginning their journey into using regulated banking and lending.

BRI’s microlending initiative, Holding Ultra Micro, facilitates access to financing for micro, small, and medium-sized enterprises (MSMEs). MSME make up 61 percent of Indonesia’s GDP.11 Three years after its launch, Holding Ultra Micro has provided 36.1 million new customers with financing, savings and insurance products.12

It also runs education initiatives. One thousand villages have participated in the “Brilliant Village” program.13 This provides training on entrepreneurship, sustainability, innovation and communication, and also connects standout village startups with national incubator schemes.

With the national economic structure dominated by MSMEs, many of which are run by women14, providing low-cost loans to these players “creates a high multiplier effect,” Sunarso says. “It will have a significant positive impact on the Indonesian economy and on women who have long been underserved by the banking community.”

Bangladesh

Established in Bangladesh in 1972, BRAC is an international development organization that focuses on helping communities suffering from poverty and inequality. It is currently the largest non-government organization (NGO) in the world.15 In 2001, BRAC’s founder Sir Fazle Hasan Abed launched a banking arm with the goals of aiding fair, rapid and ambitious economic growth in Bangladesh. BRAC Bank is now the largest collateral-free financier of small-to-medium sized enterprises in the country.16

Bangladesh is set to graduate into an upper middle-income country by 2031 and emerge as a developed country by 2041.17 As it does so, “new technology will shape the financial landscape in Bangladesh, absorbing millions of unbanked people into the formal banking system,” says CEO Selim R. F. Hussain.

BRAC Bank wants to drive this shift. One priority is supporting people living in remote locations without access to banks or their own digital devices. BRAC Bank’s ‘Agent App’ banking service sees approved BRAC agents visit individual customers to provide real-time digital banking transactions at their doorstep. The transactions are secured by two-factor authentication, with both the customer’s and the agent’s thumbprints used to validate the transaction via a biometric device. The bank is also rolling out faster, simplified loan disbursement to SMEs and individuals, to provide greater access to finance in marginal areas of the country. These digital loans can be applied for via mobile and without traveling to bank branches or filling out physical paperwork.18

“We have proved that SMEs can flourish when given support within the formal economy,” says Hussain. “The banks that invest in financial inclusion now will reap a harvest later.”

SOURCES: WWW.JPMORGAN.COM/PAYMENTS-UNBOUND/SOURCES

ILLUSTRATION: ANDREW NYE