For Companies and Institutions

-

Commercial Banking

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

-

Global Corporate Banking

We help clients achieve their long-term strategic goals through financing, liquidity, payments, risk management and investment banking solutions.

-

Investment Banking

Providing investment banking solutions, including M&A, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Institutional Investing

We support the entire investment cycle with market-leading research, asset management, analytics, execution, and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

For Individuals

-

Wealth Management

With J.P. Morgan Wealth Management, you can invest on your own or work with an advisor to design a personalized investment strategy. We have opportunities for every investor.

-

Private Bank

A uniquely elevated private banking experience shaped around you.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Payments

- Payments Unbound

- Payments Unbound - The digital magazine

- Payments Unbound Articles

- Using Biometrics to Fight Health Insurance Fraud

Featuring future-thinking clients

Payments Unbound unites clients from a wide range of industries to bring you innovative insights that help you navigate the future of payments.

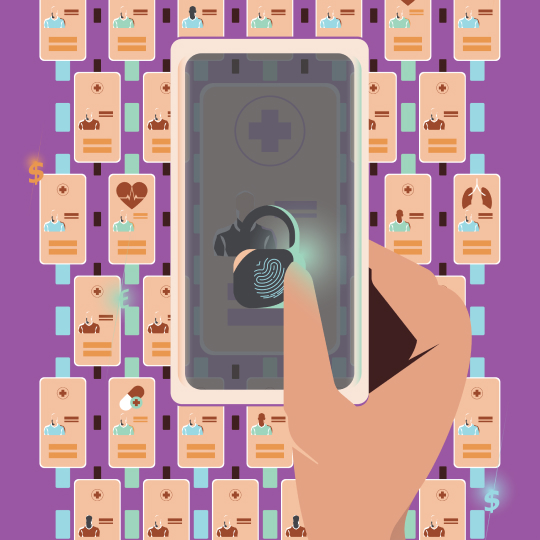

Biometrics could be the cure for health insurance fraud

Ideas bank

If data is the new gold,1 then medical data is the 24-carat version. At least, that is certainly what the hackers think. A single stolen electronic health record (EHR), which includes the patient’s complete medical history and social security number, can fetch hundreds of dollars on the black market, more than even a credit card number.2 Stolen EHRs can be used to swindle health insurance companies and receive reimbursement for procedures that never happened.

It is estimated that fraud costs health insurers between five and 10 percent of annual revenue.3 An area that has promise is biometric authentication. Biometrics verify the identity of an individual via unique physical characteristics, such as a fingerprint or iris, making it harder for bad actors to impersonate them. Precedence Research forecasts the global healthcare biometrics market will reach up to $22 billion by 2030.4

One scam involves fraudsters posing as healthcare providers and using stolen medical records to submit false claims to insurance companies. Darren Snoxell, Executive Director, Head of Insurance, EMEA at J.P. Morgan Payments, has heard stories of some insurers reporting entire fake hospital units that were set up just to commit fraud.

Linking biometrics to a patient’s health insurance policy could be a solution. As Snoxell explains, “whenever a claim or a payment is made against the policy it would trigger an automatic biometric authentication with the patient, to ensure everything being claimed is accurate.” This authentication could include a link sent to the patient via their email or a device, prompting them to scan a fingerprint or other identifier.

There are other scams that biometrics could help crack. In several countries, patients pay for medical procedures or pharmaceuticals out-of-pocket and then make a claim to their health insurer and receive reimbursement. But fraudsters can make fake claims and receive the compensation themselves. France’s health insurance system is currently developing a biometric version of its national insurance card, Carte Vitale5, that authenticates the patient and links directly to their bank account, creating a far more secure path for reimbursements.

Despite the potential use-cases, biometric adoption in the health sector still remains relatively limited. Partly this is due to the complexity involved at large healthcare organizations. A large biometrics project “could require buy-in from IT, security, compliance, legal, as well as your tech platform group, to all be involved in order to drive a project from pilot to completion,” says Noah Dermer, Head of Payment Security at J.P. Morgan Healthcare Payments, which provides payments and billings solutions for the health industry. In addition to the cost and complexity involved for organizations, for patients there is the annoyance of having to on-board and provide their biometric information.

For biometrics to scale across healthcare we might therefore need to see a wider shift in biometrics in general. Consider how consumers can use their email account to log into third-party apps—a cloud-based biometric identity service could let consumers set up a single biometric account for use across multiple different businesses, including those in the health sector. If a single biometrics provider was used widely enough, that would save time for patients who would no longer need to go through multiple on-boarding processes. It would also make deployment easier for businesses, as biometrics could be integrated ‘as a service’ into their products. Of course, that biometric identity service would need to have a watertight reputation for security and reliability if it were to enjoy the required network effects to achieve mass adoption. Is it an opportunity for a payments company, perhaps?

BY J.P. Morgan Payments

ILLUSTRATION: MARCUS MARRITT

SOURCES: WWW.JPMORGAN.COM/PAYMENTS-UNBOUND/SOURCES

Disclaimer: The features discussed in this article are intended to illustrate future trends in payments only. The information set forth herein has been obtained or derived from sources believed to be reliable. Neither the author nor J.P. Morgan makes any representations or warranties as to the information’s accuracy or completeness. The information contained herein has been provided solely for informational purposes and does not constitute an offer, solicitation, advice or recommendation, to make any investment decisions or purchase any financial instruments, and may not be construed as such.

MAGAZINE

Volume 6: Open Banking Is Just Getting Started Volume 5: Game Changer Volume 4: Ready Payer One Volume 3: Bank to the Future Volume 2: The New World of Commerce Volume 1: The Money Revolution Browse all articlesWEBINARS

View all webinarsYou're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.