For Companies and Institutions

-

Commercial Banking

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

-

Global Corporate Banking

We help clients achieve their long-term strategic goals through financing, liquidity, payments, risk management and investment banking solutions.

-

Investment Banking

Providing investment banking solutions, including M&A, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Institutional Investing

We support the entire investment cycle with market-leading research, asset management, analytics, execution, and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

For Individuals

-

Wealth Management

With J.P. Morgan Wealth Management, you can invest on your own or work with an advisor to design a personalized investment strategy. We have opportunities for every investor.

-

Private Bank

A uniquely elevated private banking experience shaped around you.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

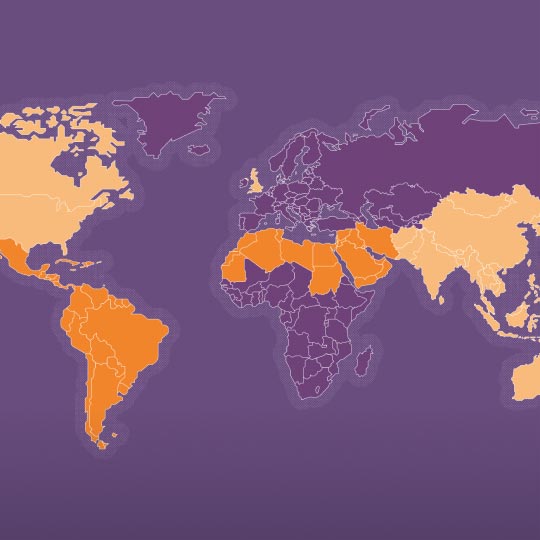

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Payments

- Payments Unbound

- Payments Unbound - The digital magazine

- Payments Unbound Articles

- An Interview With Sharyn Tan of PayPal

Featuring future-thinking clients

Payments Unbound unites clients from a wide range of industries to bring you innovative insights that help you navigate the future of payments.

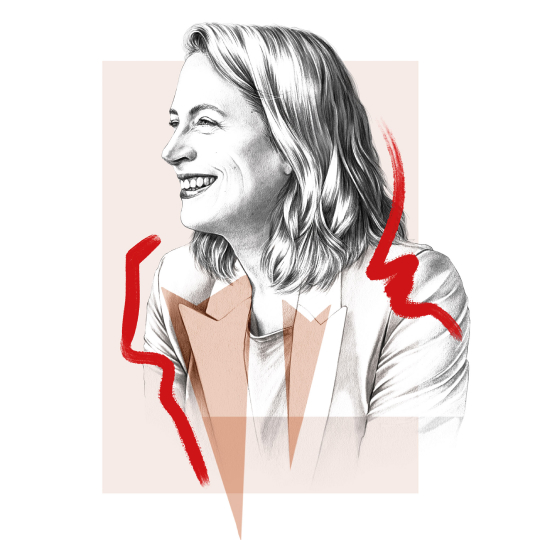

Beyond the balance sheet: Sharyn Tan

Beyond the balance sheet

Over the past two decades, PayPal has revolutionized commerce. It is now one of the most valuable digital payments companies in the world, and has helped transform how consumers and businesses send, receive and manage money. Sharyn Tan was previously a Regional Treasurer covering Benelux and MENA for a bank and moved to PayPal in 2017, where she is Head of Product Cash & Treasury M&A.

In one sentence: What do you do?

I manage a multi-continent treasury team that makes sure we have sufficient cash in the right places in the right currencies to ensure that our business functions.

What are you working on right now?

The team is split between managing day-to-day operational issues and working on strategic projects. Currently, we are working on enhancing our banking and technology infrastructure to automate the way that we move money across an extensive network of bank partners.

In-office or WFH?

Both. For us, it’s about getting the job done.

How many people do you manage?

I manage around 20 people across the world.

What’s the innovation that’s most disrupting your world?

The notion of instant payments creates greater expectation for people to have the ability to send and receive cash 24/7 anywhere in the world and to have access to this cash immediately. But the underlying banking technology and reporting infrastructure hasn’t always caught up to match this expectation. It can be a challenge to manage and move liquidity.

What’s the biggest question facing payments today?

That money moves as fast and as easily as the customer experience of making a payment. RTP isn’t available everywhere, and cross-border payments can be complicated and time-consuming.

What’s the most important quality for being a leader in payments?

I think staying curious. Keeping up to date with what is happening in the industry, being open to change and leading others to adopt change.

And what’s the trait that’s least helpful?

Unwillingness to adapt. When faced with change, people, including leaders themselves, do go through a phase of denial and resistance. As a leader it’s about how quickly you can get yourself to embrace change, and to then help others in the organization get there as well.

Who is your industry mentor and what’s the most important thing they’ve taught you?

A former Senior Director at PayPal. He taught me that people skills are just as important as technical skills if you want to inspire change in a large organization. He was never afraid of tackling difficult conversations head-on, but always did it with a little bit of humor and was just able to bring people along with him.

What’s the advice you wish you could give a past you as you entered this field?

To have done it quicker, sooner, faster.What’s the cast-iron “work tip” you’d like to share with us?

Always, always maintain your integrity. No matter what, choose to do the right thing.

What’s a secret that only people who do your job know?

That cash management can be extremely manual and keeping tabs of every movement of money is not easy. Poor visibility into where cash is and working out how much is available and then getting cash to where it is needed in time, is a more common challenge in treasury than people realize.

Make a fearless prediction: How will payments be different in ten years’ time?

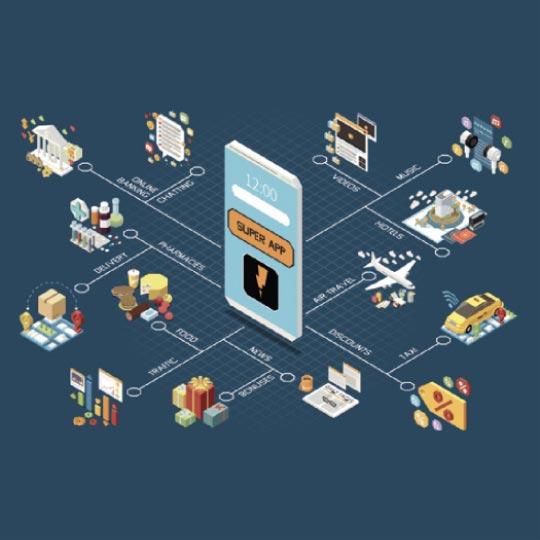

In ten years, I really do think that fast, digital payments will be the norm and blockchain-based payments will be a big element. So, being able to handle that in the treasury space is a must.

Outside of work, how do you relax?

My main passion is food. Any time I plan a weekend away or holidays, I always choose places where the food is good.

If you weren't working in payments what would you be doing?

Recently, I was thinking that I would probably be working with puppies and kittens!

AI. Are you worried?

I'm actually quite excited and I want to learn how to use it. We’re trying to encourage the team to learn about GenAI. I'm envisaging a future where you will be able to prompt the system to generate a forecast, a prediction, or a model, based off vast amounts of both macro and enterprise centric data, to manage liquidity. Now that would be super cool.

BY J.P. MORGAN PAYMENTS

SOURCES: AS PER WIRED, SEP 2024

ILLUSTRATION: Ewelina Dymek

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of J.P. Morgan, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed to be reliable. Neither the author nor J.P. Morgan makes any representations or warranties as to the information’s accuracy or completeness. The information contained herein has been provided solely for informational purposes and does not constitute an offer, solicitation, advice or recommendation, to make any investment decisions or purchase any financial instruments, and may not be construed as such.

MAGAZINE

Volume 6: Open Banking Is Just Getting Started Volume 5: Game Changer Volume 4: Ready Payer One Volume 3: Bank to the Future Volume 2: The New World of Commerce Volume 1: The Money Revolution Browse all articlesWEBINARS

View all webinarsYou're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.