For Companies and Institutions

-

Commercial Banking

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

-

Global Corporate Banking

We help clients achieve their long-term strategic goals through financing, liquidity, payments, risk management and investment banking solutions.

-

Investment Banking

Providing investment banking solutions, including M&A, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Institutional Investing

We support the entire investment cycle with market-leading research, asset management, analytics, execution, and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

For Individuals

-

Wealth Management

With J.P. Morgan Wealth Management, you can invest on your own or work with an advisor to design a personalized investment strategy. We have opportunities for every investor.

-

Private Bank

A uniquely elevated private banking experience shaped around you.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Payments

- Payments Unbound

- Payments Unbound - The digital magazine

- Payments Unbound Articles

- Would a Cashless Society Be a Better Society?

Featuring future-thinking clients

Payments Unbound unites clients from a wide range of industries to bring you innovative insights that help you navigate the future of payments.

Would a cashless society be a better one?

Two Sides of the Same Coin

As physical cards, digital wallets and payments apps come to account for ever more of our transactions, some believe we will one day live in a cashless society. Indeed, Sweden is almost—for all intents and purposes—a digitized economy1. It’s not a stretch to imagine that others will follow suit, but what would the implications be, and is this the future we want? We asked two experts to weigh in on either side of the debate...

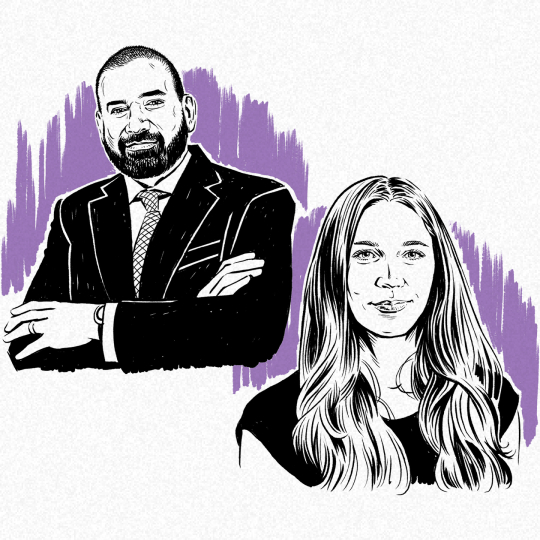

A British think-tank that promotes "social, economic and environmental justice"

I love not having to go to a cash point machine, but a cashless society would exclude too many people if you were to implement it now. That includes some elderly who may be averse to or struggle with digital technology, and also rural communities who suffer from poor internet and cellular service. A surprising number of people are also unbanked—they do not use traditional financial services—because of a variety of reasons such as having no fixed address, not trusting the banking system or not having sufficient funds to meet minimum requirements. So, they need access to physical cash instead.

Only in the future, when essentially everyone is digitally literate and there are no internet blackspots, do I think we should even consider a cashless society.

But I fear it still creates greater privacy and security challenges. One reason people favor a cashless society is because transactions can be tracked and recorded. People don’t want anyone, including the government, being able to monitor their transaction data, and the institutions entrusted to guard this data are vulnerable to being hacked. Plus, cash isn’t vulnerable to mass IT failures, which in theory can take down digital payments systems.

On a more personal level, think about the person who is the victim of an abusive relationship. Without cash, they might not be able to buy anything without their partner knowing. Cash also helps people to keep track of spending, which is vital for some low-income households; it’s too easy to overspend when you’re not looking at a finite, physical sum of money.

Still, I would be surprised if we didn’t have a cashless society in the next 50 years. If that becomes the case, then it’s crucial that we ensure that the necessary safeguards are in place.

Author of August of Money: Quest for Cashless Society; expert in-residence at the Polsky Center for Entrepreneurship and Innovation at the University of Chicago

The beauty of cashless payments is that they are convenient and becoming ubiquitous.

You don’t have to carry lots of coins or notes if you want to buy something expensive. And while cash is easily misplaced, you’re usually protected if your bank card is lost or stolen.

There’s also an electronic record of every transaction. This is useful for consumers, because they can easily monitor their spending, and for businesses it brings traceability and transparency, as they can track all incomings and outgoings, and minimize the risk of not being paid on time or at all. On a macro scale, it can help governments in their efforts on financial inclusion and the fight against poverty. Each year, trillions of dollars are in effect stolen from developing nations through corruption and tax evasion, but if you could follow the money, as you could do with a cashless environment, it would enable money to be more efficiently recouped and reinvested into these countries.

My long-term vision of a cashless society is one that leverages a digital currency issued by a central bank like a state-backed utility, rather than a private provider. At the same time, we need that government to establish safeguards and provisions to protect the vulnerable and help them participate in this system in a way that meets their needs. The priority should not be to eliminate cash entirely, but to instead promote cashless transactions and to develop a robust and scalable infrastructure to support it.

And I think we must embrace this reality now. There’s a growing appetite for a cashless society. If a digital currency organically becomes adopted at scale, driven by a rogue agenda and without due checks and balances in place, that leaves us vulnerable. Let’s get ahead of this and do it right.

BY WIRED

SOURCES: WWW.JPMORGAN.COM/PAYMENTS-UNBOUND/SOURCES

ILLUSTRATION: ADI GILBERT

MAGAZINE

Volume 6: Open Banking Is Just Getting Started Volume 5: Game Changer Volume 4: Ready Payer One Volume 3: Bank to the Future Volume 2: The New World of Commerce Volume 1: The Money Revolution Browse all articlesWEBINARS

View all webinarsYou're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.