For Companies and Institutions

-

Commercial Banking

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

-

Global Corporate Banking

We help clients achieve their long-term strategic goals through financing, liquidity, payments, risk management and investment banking solutions.

-

Investment Banking

Providing investment banking solutions, including M&A, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Institutional Investing

We support the entire investment cycle with market-leading research, asset management, analytics, execution, and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

For Individuals

-

Wealth Management

With J.P. Morgan Wealth Management, you can invest on your own or work with an advisor to design a personalized investment strategy. We have opportunities for every investor.

-

Private Bank

A uniquely elevated private banking experience shaped around you.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Payments

- Payments Unbound

- Payments Unbound - The digital magazine

- Payments Unbound Articles

- Can Saudi Arabia Build a Thriving Fintech Hub by 2030?

Featuring future-thinking clients

Payments Unbound unites clients from a wide range of industries to bring you innovative insights that help you navigate the future of payments.

Can Saudi Arabia build a thriving fintech hub by 2030?

Ideas bank

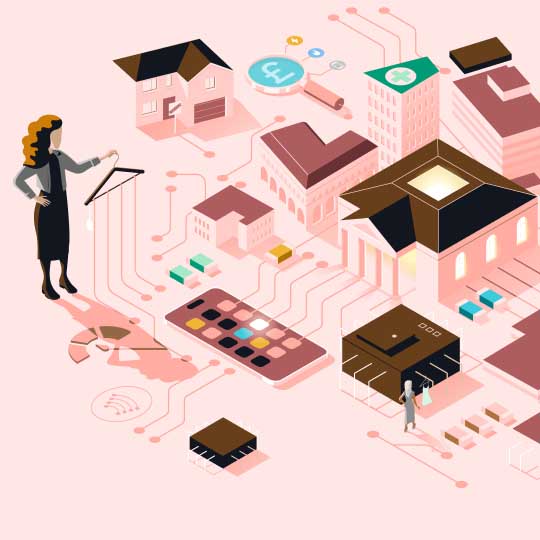

The FDI boom is a product of Saudi Arabia’s ‘Vision 2030’ plan, first announced in 2016.1 Driven by a desire to diversify away from hydrocarbons, Saudi Arabia is looking to transform its economy by nurturing new industries, attracting investment and positioning itself as an early adopter of advanced technologies.

One area that Saudi Arabia is focusing on is financial services. The country has committed to creating a thriving fintech hub by 2030, and early indicators are promising. In 2022, there were 89 fintechs in Saudi Arabia, but this had reached over 200 by the end of 2023.2 That compares to just 10 in 2018.3

Research shows that most planned innovation hubs fail to achieve any meaningful traction.4,5,6 So, what is Saudi Arabia getting right?

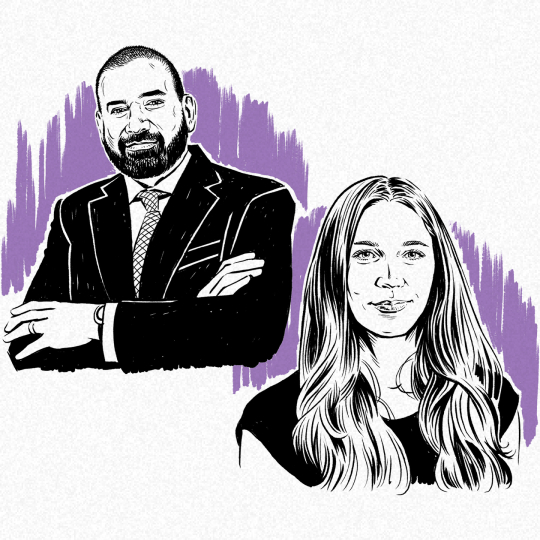

According to Christos Kolimenakis, Managing Director, Head of Payments Saudi Arabia at J.P. Morgan, “it’s not a specific piece of regulation or legislation. Rather, it is the level of coordination and cooperation between the major local stakeholders in Saudi Arabia which is making the difference.”

This is because catalyzing a tech cluster requires more than just capital and ideas. It necessitates support in areas such as regulation, finance, planning, tax, infrastructure, utilities, labour and more. Boston Consulting Group argues that tight orchestration across government agencies is a key requirement for an innovation hub to succeed.7

Saudi Arabia has set up Fintech Saudi to help coordinate the country’s effort. An initiative from the Saudi Central Bank and the Capital Markets Authority, it sits in the middle between government entities, regulators and the private sector, and helps fintechs navigate the different requirements they need to set-up in the country.

Let’s say an international fintech is looking to come to Saudi Arabia. First, Fintech Saudi will have a consultation with the company to understand its business model and determine if it needs to be regulated by the major financial bodies. If so, it brings in subject matter experts, law firms as well as other companies in the industry to give the relevant guidance, while involving the main regulators throughout the entire process. Next, Fintech Saudi will connect the company with the Ministry of Investment, which can provide support with setting up an entity in Saudi Arabia.8 Finally, Fintech Saudi can give the company links to private service providers in the country–such as office space or software businesses–that can help it get up and running quickly.

On its current trajectory, Saudi Arabia looks on course to achieve its goal of 525 fintechs operating by 2030, supported by over SAR12.2 billion in direct venture capital.9 An encouraging sign has been the approval of three digital banks–a new generation of financial institutions that offer a range of traditional banking services via smartphones and other online channels. Even in mature markets, these challenger banks can spend years trying to get licenses 10 as the regulatory regimes cannot adapt as fast as innovation moves.

As Nezar Alhaidar, CEO of Fintech Saudi, explains, “solid regulatory frameworks enable and encourage innovation within the sector and ensure that companies can comply with those regulations. This directly impacts the inflow of local and foreign investment into fintechs, knowing that there is a robust process vetting licensed companies.”

However, it is not a given that Saudi Arabia will achieve its target–there is still work to be done. The greatest requirement is digital infrastructure: more fibre-optic cabling, more data centers. The recent announcement that Amazon Web Services (AWS) is investing $5.3 billion in data centers in Saudi Arabia is a positive development.11 However, tens of billions more will be needed by 2030 to bring Saudi Arabia’s infrastructure in line with other mature tech regions,12 something the country is looking to achieve through a mix of public and private investment. As with its approach to the fintech sector, a coordinated effort from multiple government bodies, coupled with the swift creation of a conducive regulatory environment, will be crucial for success.13

BY J.P. Morgan Payments

SOURCES: WWW.JPMORGAN.COM/PAYMENTS-UNBOUND/SOURCES

IMAGE: GETTY IMAGES / HASAN ZAIDI

Disclaimer: The features discussed in this article are intended to illustrate future trends in payments only. The information set forth herein has been obtained or derived from sources believed to be reliable. Neither the author nor J.P. Morgan makes any representations or warranties as to the information’s accuracy or completeness. The information contained herein has been provided solely for informational purposes and does not constitute an offer, solicitation, advice or recommendation, to make any investment decisions or purchase any financial instruments, and may not be construed as such.

MAGAZINE

Volume 6: Open Banking Is Just Getting Started Volume 5: Game Changer Volume 4: Ready Payer One Volume 3: Bank to the Future Volume 2: The New World of Commerce Volume 1: The Money Revolution Browse all articlesWEBINARS

View all webinarsYou're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.