Crowdfunding is a popular financing option for innovative, disruptive businesses. These companies typically use two types: product crowdfunding and equity crowdfunding.

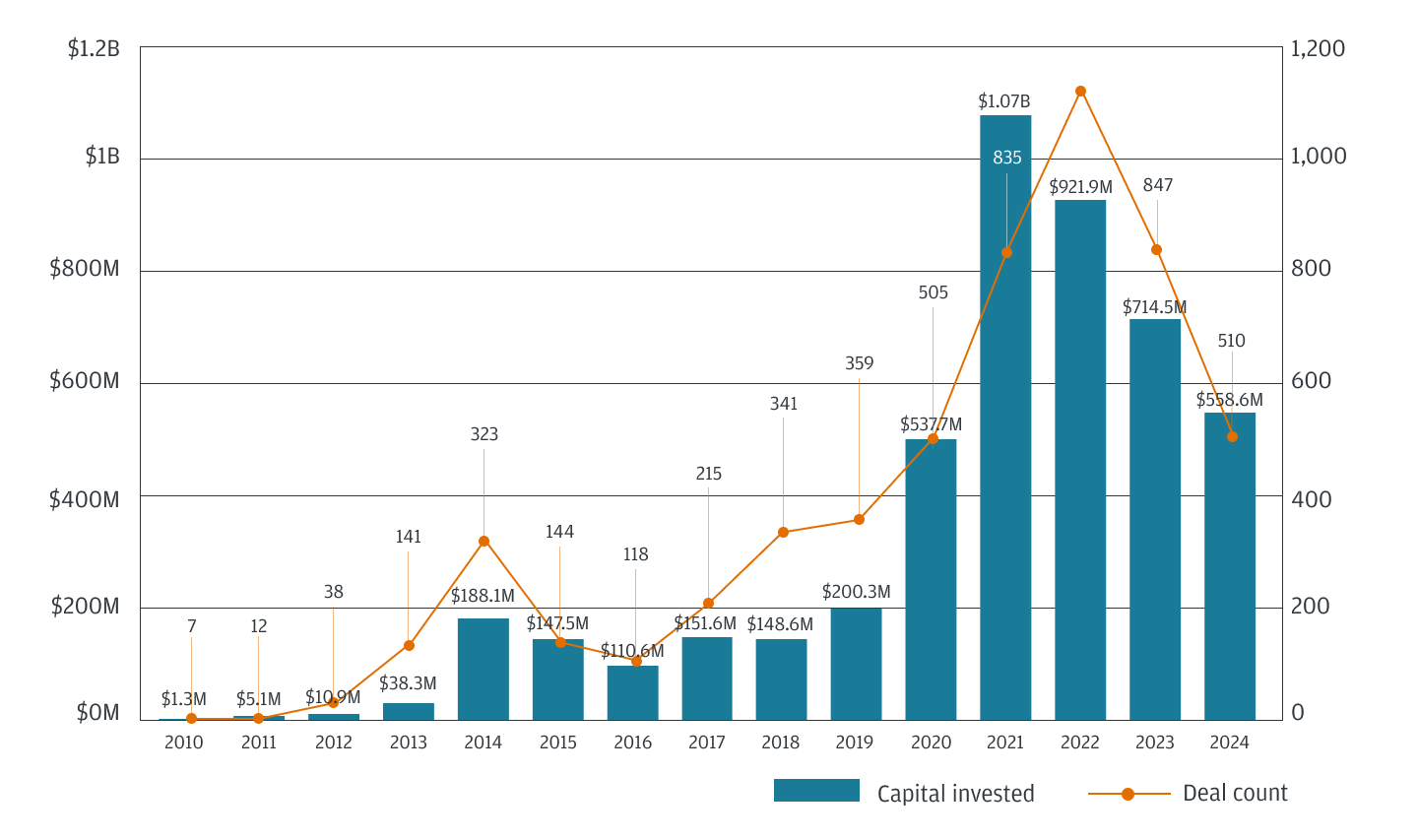

Startups including Allbirds, Koia and Peloton started with product crowdfunding campaigns and are now major brands worth millions. Other startups opt for equity crowdfunding campaigns, which saw more than $558 million of capital invested in 2024 alone.

Learn more about crowdfunding for startups.

What is crowdfunding?

Crowdfunding is a financing approach that relies on the collaborative efforts of a large pool of individuals or investors to fund a new product or startup. It allows entrepreneurs to raise funds from a large number of people, each contributing a small amount.

Our dedicated Startup Banking team can help you find the right solutions for your business.

Product vs. equity crowdfunding for startups

There are many types of crowdfunding options, including donation-based and debt crowdfunding. Startups most frequently use product and equity crowdfunding, two notably different strategies.

Product crowdfunding

Product crowdfunding frequently uses reward-based measures, which helps startups pre-sell products while raising capital. Backers receive non-monetary rewards such as early access, reduced rates or backers-only versions of a product. For example, a fitness tracker’s campaign might offer a discounted price for contributions up to $200 and access to exclusive colorways for contributions between $200 and $500. Early-stage and pre-launch startups benefit the most from product crowdfunding, as it lets businesses test their concepts with minimal upfront investment. Plus, it can help build a community around your product and doesn’t dilute equity.

Equity crowdfunding

Equity crowdfunding provides investors with ownership shares in the company in exchange for their financial contributions. This option is best for startups that want to raise larger sums and offer ownership stakes. Equity crowdfunding can help growth companies in all stages.

Equity crowdfunding has been an attractive option for decades. But the Securities and Exchange Commission crowdfunding limit set in in 2021 helped boost its appeal, allowing businesses to raise up to $5 million annually via equity crowdfunding.

The change helped equity crowdfunding investments balloon to over $1 billion in 2021, with deals topping 1,000 in 2022, according to PitchBook.

The evolution of U.S. equity crowdfunding

Source: PitchBook

Benefits of crowdfunding for startups

Product and equity crowdfunding offer several benefits:

- Access to capital: Crowdfunding provides an alternative to traditional funding sources, which can be particularly valuable for startups that may not yet qualify for bank financing or aren’t ready for venture capital discussions. Product and equity crowdfunding may also be used alongside traditional methods.

- Market validation: Startups can gauge market interest through their crowdfunding campaign’s performance. A strong response from supporters may signal strong demand. A campaign that doesn’t achieve its funding goals may offer valuable feedback to help founders further refine their products.

- Marketing and community building: A crowdfunding campaign can double as a marketing launchpad, helping startups build awareness and develop a community of early adopters and brand advocates.

- Valuable feedback: Financial backers are often emotionally invested in the product’s success. They can provide startups with direct feedback so they can fine tune their product before a full-scale launch.

Is crowdfunding right for your startup?

Crowdfunding isn’t right for every startup. Before launching a campaign, evaluate your startup, asking:

- Is your industry well-suited for crowdfunding? Consumer products, creative projects and tech startups with tangible offerings frequently succeed on crowdfunding platforms. B2B services often face challenges because of their limited appeal, while highly regulated industries may encounter legal and compliance hurdles that complicate campaigns.

- Does your product resonate with a broad audience? Your offering needs to be easily understood by a general audience within a short window time—usually around 30 days. Consumer-facing products and services succeed most often because potential backers quickly grasp the offerings’ value. Beyond the product itself, you should have a compelling story.

- What are your startup’s funding needs? Equity crowdfunding can raise anywhere from tens of thousands of dollars to several million. Product crowdfunding typically works best for raising smaller amounts than venture capital or angel investment rounds, but enough to hit meaningful milestones—think hundreds of thousands of dollars, not millions.

The bottom line: Crowdfunding can be an effective growth method for startups, while helping create buzz around your product, build community and preserve ownership and control.

Build your future with J.P. Morgan

Our team of experts is dedicated to serving the innovation economy—bringing together founders, investors, startups and high-growth companies. Learn more about Startup Banking solutions.

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/commercial-banking/legal-disclaimer for disclosures and disclaimers related to this content.