Raising capital is an intensive process for founders, one that takes significant time, energy and perseverance. However, with enough research and an effective plan, founders can save time and improve their chances of success.

What to consider before raising capital for your startup

One important step is identifying who you might want to invest in your startup. By focusing on investors whose interests and expertise align with your startup, you can tailor a pitch more effectively, build stronger relationships and gain strategic support. Often initial investors act as advisors or mentors to a startup, so it can be helpful to pinpoint investors specializing in the same sector, region or stage as your company.

An investor’s expertise can help fledgling startups handle the numerous hurdles that come their way, such as hiring and retaining key personnel and growing a customer base. They may also have a network of connections who could be future investors or customers.

Lead investors

Typically, each new (outside) funding round has at least one lead investor who provides the largest portion of capital. Founders should be thoughtful about who they select. Lead investors can potentially join the startup’s board and be involved with the company for a long period of time. A reputable lead investor can also provide validation and serve as a positive signal to other investors.

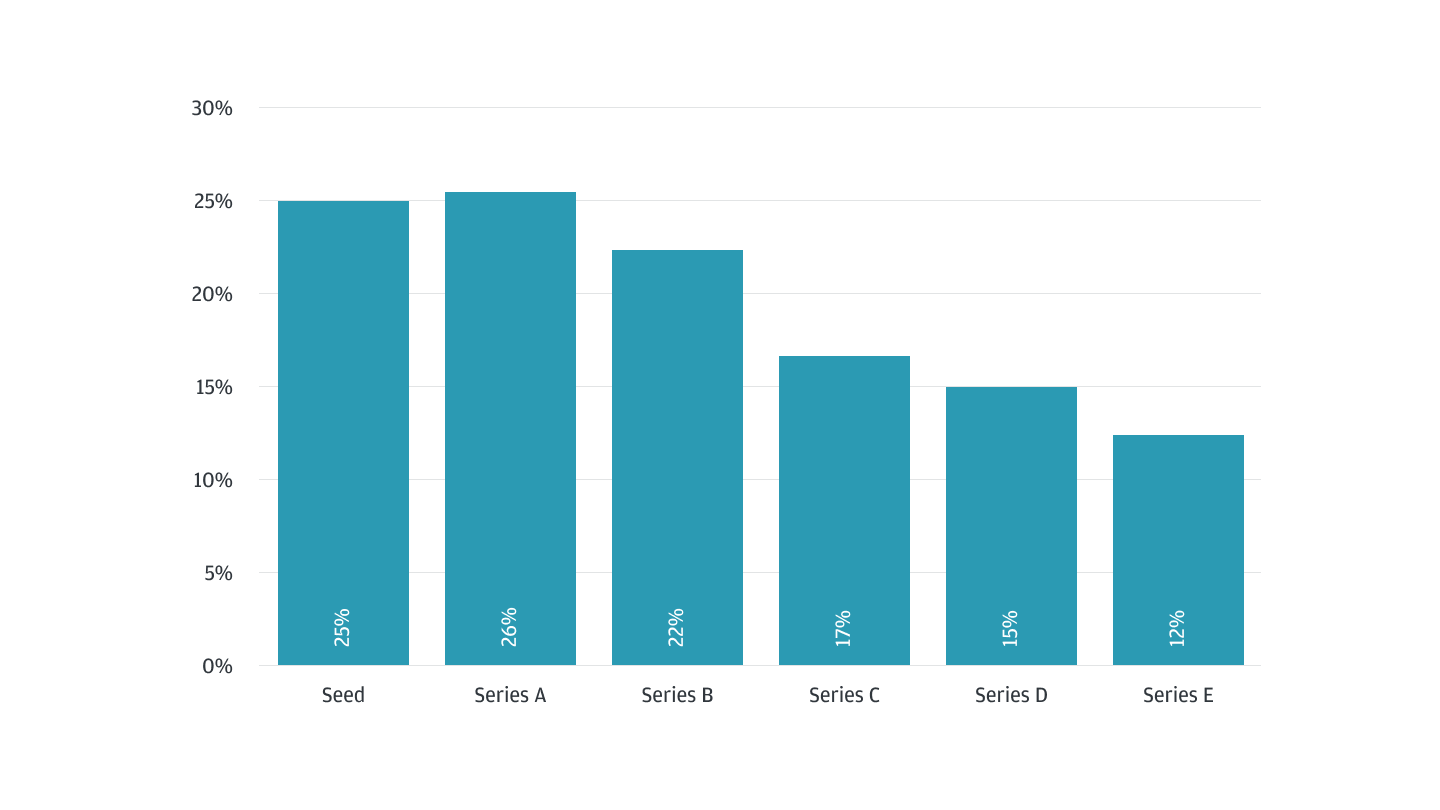

Early on, founders should plan out how much funding they want to raise in each round. This means taking into account key development milestones within each phase. Securing enough capital to fund the company for 18 to 24 months is typical. Related, founders should also consider how much ownership they are comfortable transferring to investors in each round. The chart below shows the median percentage acquired by investors by round. Note, not all startups will raise a seed round.

Median investor ownership acquired by series, U.S. venture capital (2023)

Source: PitchBook

Typical funding options for startups based on stage

Your startup’s stage matters—it can help determine the most suitable types of funding and investors. Early-stage startups can access options like accelerators, incubators and angel investors, while growth-stage startups tend to require greater amounts of capital, which are typically provided by firms with larger funds.

Early-stage startup funding options

At the beginning of a startup’s journey, founders can explore many avenues in the search for capital, such as:

- Friends and family

- Angel investors

- Crowdfunding (particularly in the consumer goods/retail space)

- Small Business Association (SBA) loans

- Incubators/accelerators

- Bootstrapping, or funding startup activities with their own money

Eventually, a startup will need more capital than these options and will need to raise a seed funding round; usually the first round of funding from professional investors. Raising a seed round is generally simpler than raising later rounds, but it can have significant ramifications for the company and founder, so it’s important to be prepared. Some considerations can be found in our guide to seed funding.

The Series A round

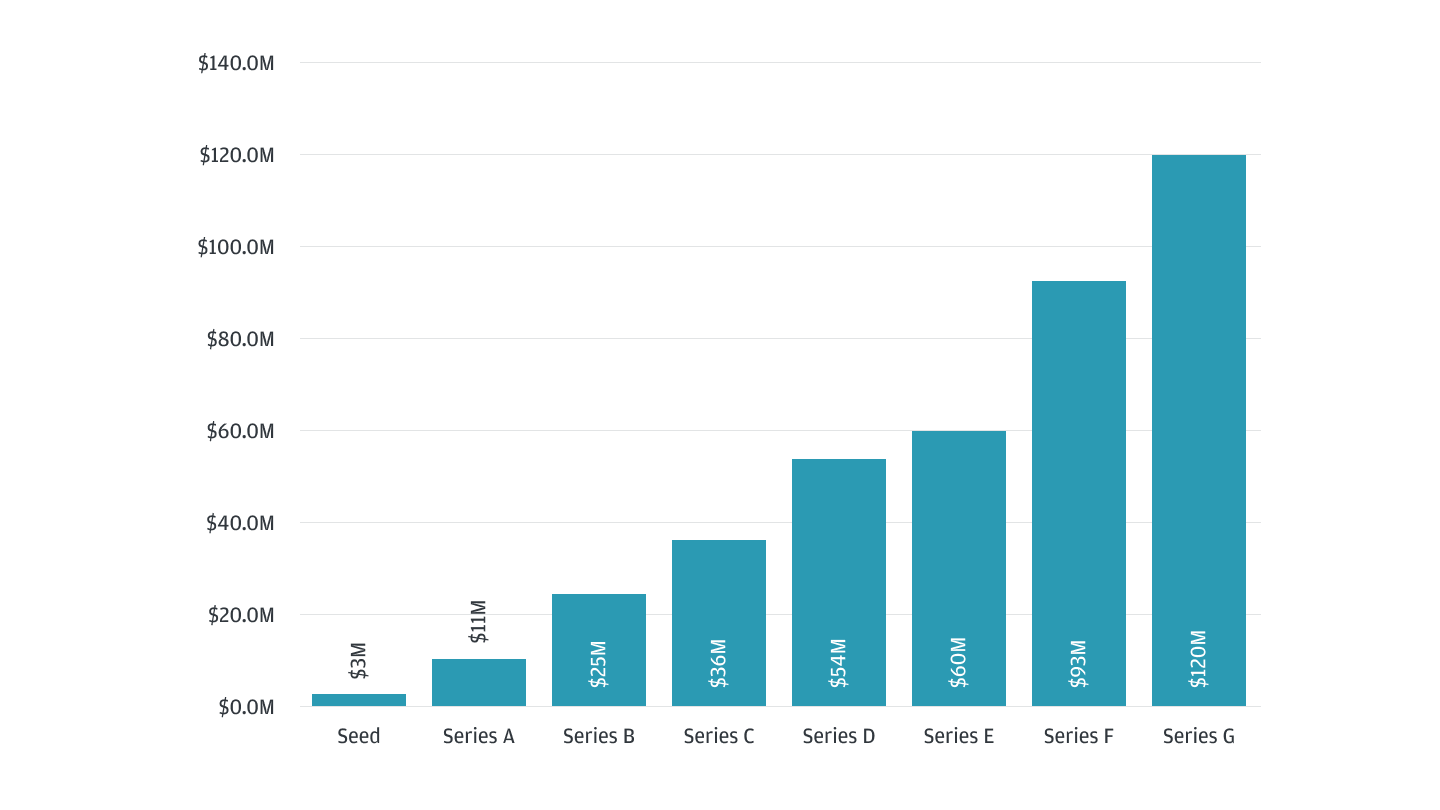

While the dynamics of fundraising can vary greatly depending on the startup’s progress and level of development, the bar to raise a Series A round is usually higher. The jump between seed and Series A funding rounds is noticeable. In 2023, the median Series A venture capital round in the U.S. was $11 million, four times the median seed round size. Larger amounts of capital typically mean greater scrutiny and diligence.

It’s wise to be prepared for what Series A investors want to know before they make their decisions. Series A investors typically look for clear evidence of traction, including:

- Revenue growth

- A growing customer base

- Official partnerships

- Positive unit economics

- Intellectual property protection, such as patents

Understanding the typical deal sizes at various stages of funding can help you set realistic expectations and plan your fundraising strategy effectively. The graphic below illustrates the median U.S. venture capital deal size by series in 2023, although the range of deal sizes can vary quite drastically.

Median U.S. venture capital deal size by series (2023)

Source: PitchBook

Growth-stage startup funding options

As a startup develops, it will typically require larger rounds of capital. For example, in 2023, the median U.S venture capital deal size for a seed round was $3 million, whereas the median deal size for a Series D round and beyond was $50 million or higher.

- Non-traditional investors: In recent years, less traditional investors—such as asset managers, sovereign wealth funds and large private equity firms—have become more active in the venture capital ecosystem. Although funding from these investors has slowed, they have a profound impact due to the substantial sums they can invest. However, unlike traditional venture investors, they tend to be more hands-off and passive with their investments.

- Venture debt: Venture debt is an option for startups that have already raised equity capital. Venture debt is a loan, typically provided by specialized venture debt lenders or banks that focus on startups.

How to attract investors

As a startup matures and raises more rounds of funding, founders typically have to be more rigorous and thorough in the materials they prepare for their meetings with investors. At earlier stages of development, the bulk of investor interest focuses on the team, product and market opportunity. As the company matures, investors will be looking for detailed financial information, considerations around growth versus profitability, and insight into exit plans.

Founders typically prepare performance metrics and benchmarks before a meeting with a potential investor. Investors will usually ask for this data to gauge how the business is performing. While the most important metrics are industry- and sector-specific, the most common to include are:

- Annual recurring revenue growth

- Unit profitability

- Customer acquisition costs

- Churn

- Customer lifetime value

For more information on raising venture capital, view our guide on venture capital.

Tips for managing the fundraising process

- Be clear on your startup’s unique offering, target markets and scalability. These factors paint the picture of the who, what and why of your business. Who is your primary audience, what problem do they need a solution for, and what kind of meaningful impact does your product or service offer?

- Relationship building is key. Relationships build one’s network, and founders’ networks are crucial drivers of their business’s success. Founders’ networks can unlock new investors, business partners and clients. Moreover, a founder’s reputation is an important part of their brand; VCs want founders to be people they want to work with.

- Avoid burning bridges. Being a founder comes with ups and downs. However, founders should understand that the venture capital world is much smaller than it may appear. A founder should aim to not ruin any relationships, no matter how upsetting a situation may seem.

- Expect to talk to a lot of investors. Patience and perseverance are key. Founders should also see these meetings as an opportunity to assess if and how the investor could help as an advisor or mentor.

- Don’t take it personally. Rejection is part of the fundraising process. Investors are assessing how an investment fits into their portfolio, which means there are a number of factors they are considering outside of considering investing in a startup, like portfolio mix.

- Keep your finances in check. Managing a startup’s finances is stressful, so founders should make sure to carefully set up their own finances so that they do not need to worry as they navigate the startup ecosystem. Learn more about financial planning for a startup.

Build your future with J.P. Morgan

We are dedicated to being the leading bank of the innovation economy—bringing together founders, investors, startups and high-growth companies. Learn more about J.P. Morgan Innovation Economy Startup Banking solutions.

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/commercial-banking/legal-disclaimer for disclosures and disclaimers related to this content.