The earliest funding for a startup typically comes from a founder’s family and friends. At some point, the capital needs of a startup grow beyond what family and friends can provide. This next phase is when an angel investor becomes involved. An angel is someone who invests money in a business in exchange for equity or convertible debt. The term is thought to come from Broadway theater, where wealthy individuals called “angels” would invest in plays to prevent them from being shut down.

The role of angel investors

The primary role of an angel investor is to help a founder get from the initial startup capital stage—where funds are often supplied by the founder, their family and friends—to the startup’s first professional round of financing, often led by institutional investors.

Angel capital is usually used to develop a prototype, conduct market research and make initial hires. Angels can play a crucial role in validating the startup by providing the capital for the founder to prove their idea and signaling to other investors that they have belief in the startup’s potential.

Angels typically have prior experience within industry and entrepreneurial endeavors and use this knowledge to mentor and provide advice to founders they invest in. The expectation is for angels to be involved, helping to navigate early challenges, refine strategy and generally point founders in the right direction.

Angel investors usually have an extensive network they make available to a founder, ranging from technical support to customers, hires, future investors and more. Ultimately, many angel investors view their role as helping a company make progress toward key milestones and de-risk the business so it’s in a better position to raise its first institutional round.

How is angel financing different from venture capital?

While similar in many ways to venture capital, there are several notable differences. Angel investors are typically individuals investing personal funds, compared to venture capitalists (VCs) who are part of professional firms and invest pools of capital raised among limited partners.

While the lines are often not clearly defined, angel investors usually invest earlier than VCs, sometimes when the entrepreneur only has an idea or prototype. Angel investors on average write smaller check amounts than their VC peers, typically in the range of $25,000 to $100,000. By virtue of being individuals investing their own money, angel investors can often decide more quickly whether to invest.

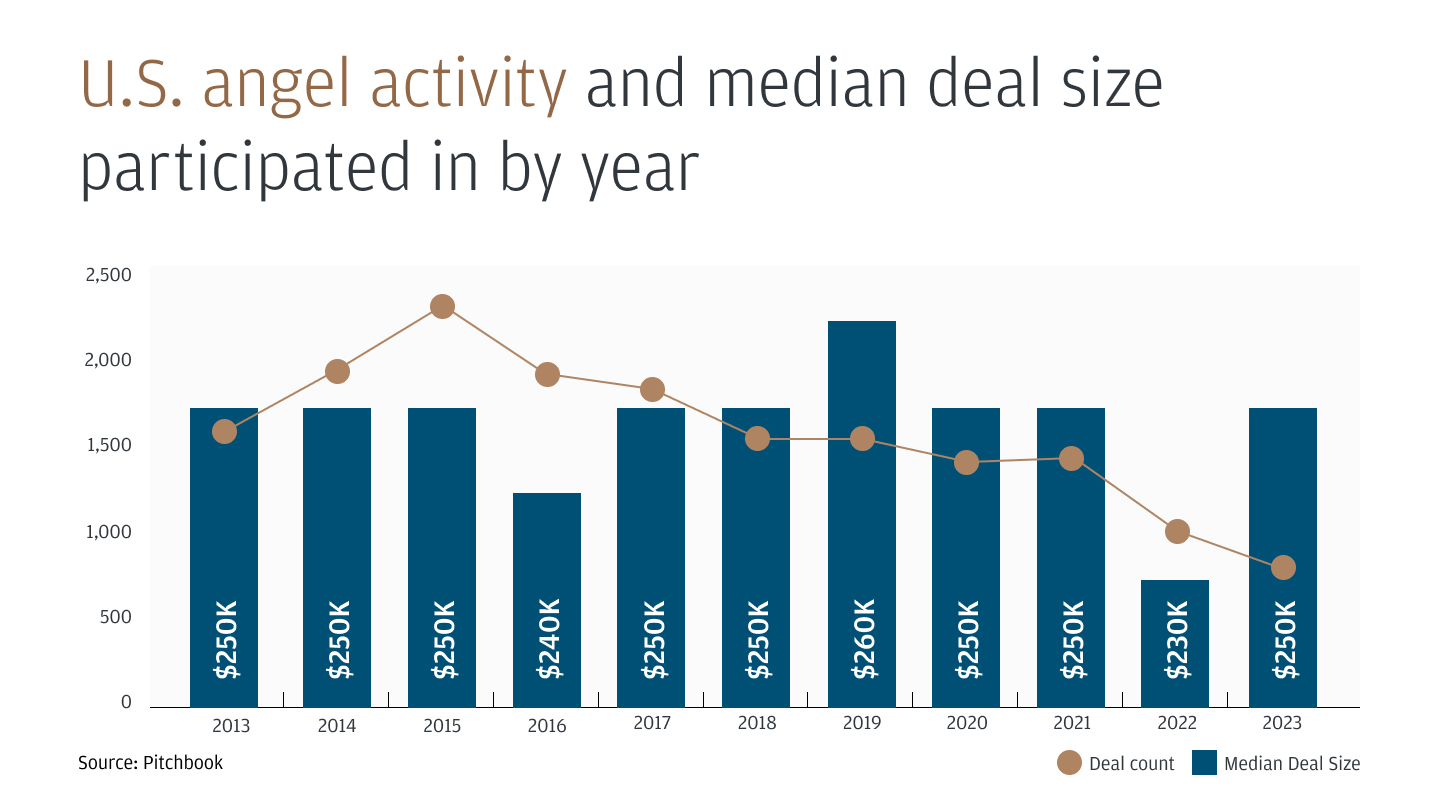

The size of funding rounds that U.S.-based angel investors participate in has stayed relatively constant, based on a median deal size of $250,000 over the past decade.

Get in touch

Our dedicated Startup Banking team can help you find solutions for your business.

Different models of angel investing

The typical angel investor is a wealthy individual. They have likely been part of the venture ecosystem in some capacity and want to give back in addition to providing capital to the next crop of entrepreneurs. Their main strength is being willing and able to invest in an idea and help founders bring it into reality.

Other forms of angel investing, like syndicates and affinity groups, also exist. Angel syndicates are private groups of investors who come together to invest.

Angel syndicates come in two main forms:

- Groups of individuals who invest in startups together, pooling their resources into a special-purpose vehicle. Generally this type of syndicate can write larger checks than a standalone angel investor. However, due diligence can be more involved, and the process can take longer due to the need for all syndicate participants to sign off on a deal.

- Groups of individuals who source investment pitches, but let each individual decide which companies they want to invest in. No group consensus is required. Regardless of the syndicate’s structure, individual investors will expect the founder to have a product and show some traction.

Affinity groups are typically structured like syndicates, but they have an identified focus or alignment. This could be supporting women founders, a very local region or underrepresented groups. Similarly, many alumni groups exist to support entrepreneurs from their alma maters.

Benefits of angel financing for startups

There are several benefits to angel financing. For founders, having an angel investor can expedite the process for developing a prototype or raising a first institutional round.

Angel financing also provides startups with other benefits, as angel investors can do all of the following:

- Invest earlier than venture capital (and other) investors

- Reach a decision to invest or not invest more quickly

- Offer experience and expertise on running a startup

- Give guidance on positioning the startup for its first institutional raise

- Leverage a network to facilitate connections to investors, talent and customers

For angel syndicates, one benefit can be easier shareholder management, as there is just one entry on the cap table.

Build your future with J.P. Morgan

We are committed to being the leading bank of the innovation economy—bringing together founders, investors, startups and high-growth companies. Learn more about J.P. Morgan Innovation Economy Startup Banking solutions.

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/commercial-banking/legal-disclaimer for disclosures and disclaimers related to this content.