Innovation is a key economic driver and persistent differentiator in the United States. Many pioneering technologies, such as semiconductors, computers, the smartphone and artificial intelligence, would not exist without the risk-taking, entrepreneurship and venture capital that made them possible. Here’s an overview of venture capital, including how it works, the role it plays and how to raise it.

How does venture capital work?

Venture capital provides financing to startups working on novel technologies and innovations with a high potential to create value—but also with a high risk of failure. Venture capital usually takes the form of equity shares or a future claim on equity, such as convertible debt, which in return allows the venture capital firm to receive a share of ownership in the business.

Venture capital investors come in all shapes and sizes, but they generally have a long-term perspective. The time it takes for a company to grow and achieve success can be years, if not decades. From an investor perspective, success looks like an M&A or IPO transaction big enough to provide liquidity for all shareholders. However, the likelihood of any one investment resulting in a successful transaction where the return is much higher than the amount of investment, is very low. As a result, venture capitalists usually take a portfolio approach, spreading their investments across tens, if not hundreds, of companies.

The role of venture capital when building your startup

Venture capital’s main purpose is to help new, innovative startups grow. Before raising capital from a professional investor, a founder will tap their network of friends and family or participate in an incubator or accelerator to validate their idea and develop a minimum viable product. Some venture capital goes toward funding exploratory research and development and prototyping, but most is used to scale and commercialize a startup’s product or service. This includes investing in fixed assets for manufacturing, building out marketing and sales functions, or bolstering working capital.

The role of the venture capitalist or investor is to help the founders of a startup succeed. This can take many forms, but it usually boils down to advising on things like the state of the industry, achieving commercialization and benchmarking to peers. With a founder’s time often stretched, venture capitalists who advocate for and market a startup to their networks can be a big help. In addition, venture capitalists can leverage their networks to provide connections to the founder, such as other investors, potential customers and talent.

Get in touch

Our dedicated startup banking team can help you find solutions for your business.

How to raise venture capital

For a typical venture capital firm, capital is committed by a group of limited partners—institutions such as pensions, university endowments and insurance companies—who expect a higher rate of return given the inherent riskiness of their investment bets. To generate these returns, investors need to identify startups with the potential to create significant value.

Here are some considerations when raising venture capital:

- Venture capitalists tend to be highly selective. Venture capitalists typically invest in only one or two companies out of potentially hundreds. Venture capital is a “power law,” which assumes only a small number of investments will be successful.

- Consider the current environment. The ease of negotiations depends on competition between investors. When a lot of capital is chasing fewer opportunities, as seen during the 2021-22 period, negotiations are easier for founders.

- It’s a numbers game. Typically, through a combination of networking and cold calling, a founder will line up many investor meetings. Additionally, a banker can have a network of connections to investors and capital that founders can explore.

- The bar is generally high. Certain founder characteristics are often favored more than others—including the founder’s degree, university and previous experience as an entrepreneur.

- Position yourself for success. Each investor will have their own list of preferred characteristics. You should conduct research before meeting with an investor to tailor your pitch.

- Prepare, prepare, prepare. The founder should prepare a pitch deck and be ready to answer any questions the investors may have. Questions are typically related to the problem trying to be solved, the size of the opportunity, development of the product or service, traction to date, the state of competition or the founding team’s experience.

- Don’t rush into a deal. If a venture capitalist agrees to invest, their team will start the due diligence process culminating in a term sheet. The term sheet has terms and conditions that may be unfamiliar to founders. Founders should take the time to understand and evaluate the terms as they can have a significant impact on the allocation of value in the future. The term sheet will list the deal amount and the valuation, which translates into the amount of ownership the founder is offering in return for the capital received. In addition, things like liquidation preference, participation rights, cumulative dividends and conversion rights are often evaluated.

Evolution of venture capital

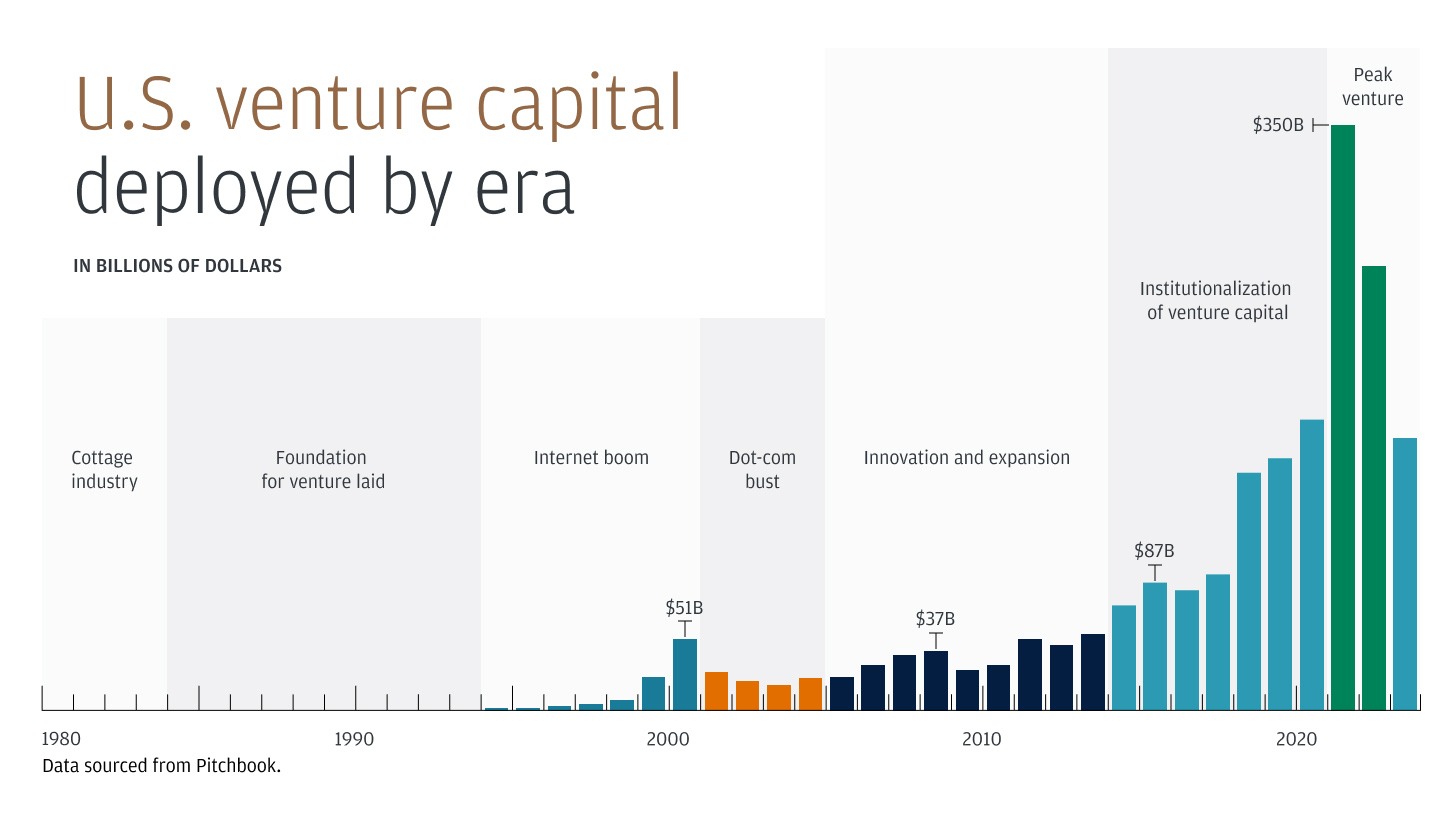

The origins of venture capital dates back to the 1940s. In the 1960s, venture capital was still a cottage industry, but by the 1970s that started to change. In the 1990s, the advent of the internet galvanized the industry, helped by notable venture-backed companies including Google, PayPal, eBay, Amazon, Netflix and Salesforce. The venture capital industry hit a setback toward the end of the decade as the dot-com bubble burst. This didn’t put off investors for too long. Since then, the venture capital industry has matured into an established asset class, hitting peak investment of $350 billion in the U.S. in 2021, $750 billion globally, per PitchBook.

Stages of venture capital

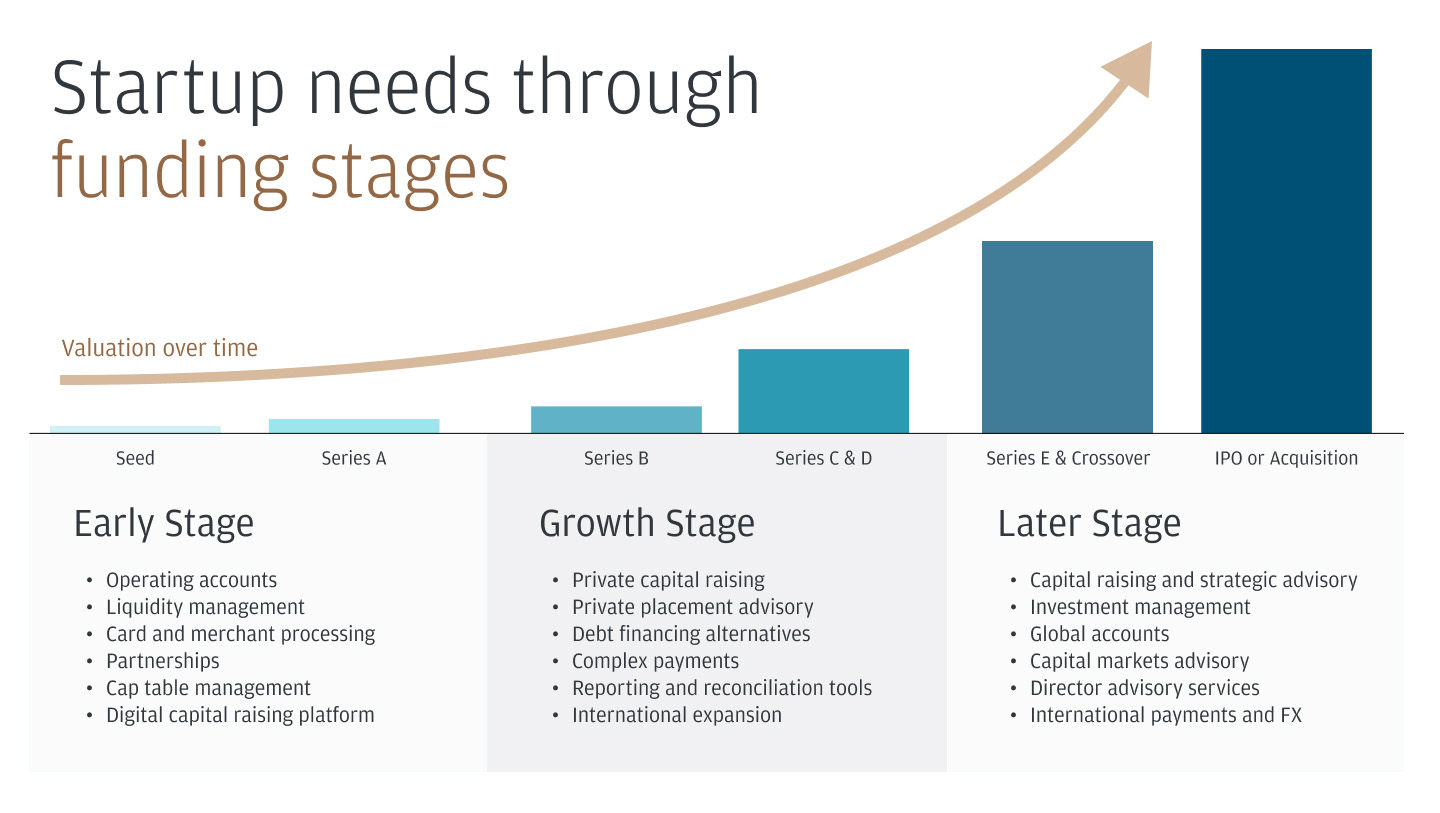

Venture capital covers a broad range of companies, from seed through IPO. However, many investors prefer to focus on a particular stage of company, and founders should consider this when evaluating new and existing investors. The needs and priorities of a company varies at each stage, as reflected in the types of services J.P. Morgan offers.

Benefits of venture capital

Venture capital fills a pivotal gap in the funding ecosystem and benefits portfolio companies in various ways, including:

- Access to capital. Venture capital provides significant funding that startups often can't obtain through traditional methods, allowing for rapid scaling and development.

- Expertise and mentorship. Venture capital firms often bring industry expertise, business acumen and mentorship, helping startups navigate challenges and make strategic decisions.

- Networking opportunities. Venture capitalists have extensive networks, including potential customers, partners and future investors, which can be invaluable for a startup's growth.

- Credibility and validation. Securing venture capital can enhance a startup's credibility and market perception, making it easier to attract additional investors, customers and top talent.

- Support for risky ventures. Venture capital firms are more willing to invest in high-risk, high-reward ventures compared to traditional financing sources, fostering innovation and development in cutting-edge sectors.

- Long-term focus. Venture capitalists often have a long-term investment horizon, allowing startups to focus on growth and development rather than short-term profitability.

Without venture capital, many innovation companies would not succeed. However, it’s important for a founder to assess if venture capital is right for their company.

Build your future with J.P. Morgan. We are committed to being the leading bank of the innovation economy—bringing together founders, investors, startups and high-growth companies. Learn more about J.P. Morgan Innovation Economy Startup Banking solutions.

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/cb-disclaimer for disclosures and disclaimers related to this content.