5 min read

According to Bureau of Labor Statistics data, 20-25% of new information startups fail within their first year, and this figure rises to over 50% by the fifth year. A frequent reason cited for startup failure is running out of cash. Therefore, it is crucial for founders to closely monitor the rate at which cash is being spent (cash burn) and how long the company’s cash reserves will last (cash runway).

What is cash runway?

Cash runway indicates how long a startup can sustain its operations at the current spending rate before exhausting its available cash. For startups not yet generating income, the cash runway is calculated by dividing the total available cash by the total monthly expenses. Available cash refers to funds that are immediately accessible or can be accessed within a reasonable time frame to cover expenses. This calculation should not include anticipated fundraising or other uncertain capital infusions.

Why is cash runway important?

A startup’s cash runway is an important component of budgeting, strategizing, forecasting and fundraising efforts. For founders, it is essential to have the most up-to-date information, which requires regularly updating and recalculating the cash runway. Understanding the current cash runway and its historical trends is vital for balancing a startup’s growth ambitions with financial stability and aligning management’s expectations with reality.

Calculating cash runway

The steps to calculate cash runway are:

- Decide on the time period: A typical time frame used is monthly. However, to avoid any unusual cash inflows or outflows, a quarterly or annual period is sometimes used.

- Determine current cash balance: This is the total amount of cash the startup has on hand, including cash in bank accounts and any other liquid assets that can be converted to cash within a reasonable period of time (typically 30 days).

- Calculate expenses: Sum up all expenses, including payroll, rent, utilities, marketing, R&D, insurance and taxes, and convert to a monthly amount.

- Calculate revenue: Determine the total monthly revenue. This includes all income generated from sales, services or any other sources.

- Find the cash burn rate: This is the difference between monthly expenses and monthly revenue.

- Find the cash runway: Divide the current cash balance by the net burn rate.

Net Burn Rate = Monthly Cash Expenses - Monthly Cash Revenue

Cash Runway = Current Cash Balance / Net Burn Rate

Taking the startup’s current cash and dividing it by the current month’s expenses is a good shorthand for the number of months left of cash runway. However, expenses (and revenues) can fluctuate and generally increase month over month for a startup. A comprehensive cash runway assessment should also consider capital investments and other significant expenditures necessary to support the business.

How much cash runway is enough?

A variety of factors influence the length of a startup’s required cash runway. These include the stage of the startup, its capital requirements, the industry it operates in, its business model and its existing investors, among others. For instance, a startup that is still in the process of developing its solution, such as creating a minimum viable product (MVP) or testing product-market fit, typically requires a longer cash runway compared to one that already has a developed product and paying customers. Additionally, the type of milestones a startup needs to achieve before raising additional funds plays a crucial role. Some milestones may depend on developing new technology, navigating third-party processes like securing government contracts, or achieving unpredictable outcomes such as obtaining FDA approval. Startups facing milestones that are more challenging or uncertain should consider extending their cash runway buffer to accommodate these potential hurdles.

When the venture capital market is less active, founders should allocate more time to secure a new round of financing than when the market is thriving. Understanding the size of deals similar startups are raising can help ensure that one round secures sufficient capital to provide an adequate runway. The composition of investors also influences runway requirements. Additionally, the types of existing investors are important. For instance, a startup primarily backed by seed-stage investors that is planning to raise a Series A round will likely need to identify a new investor to lead the round.

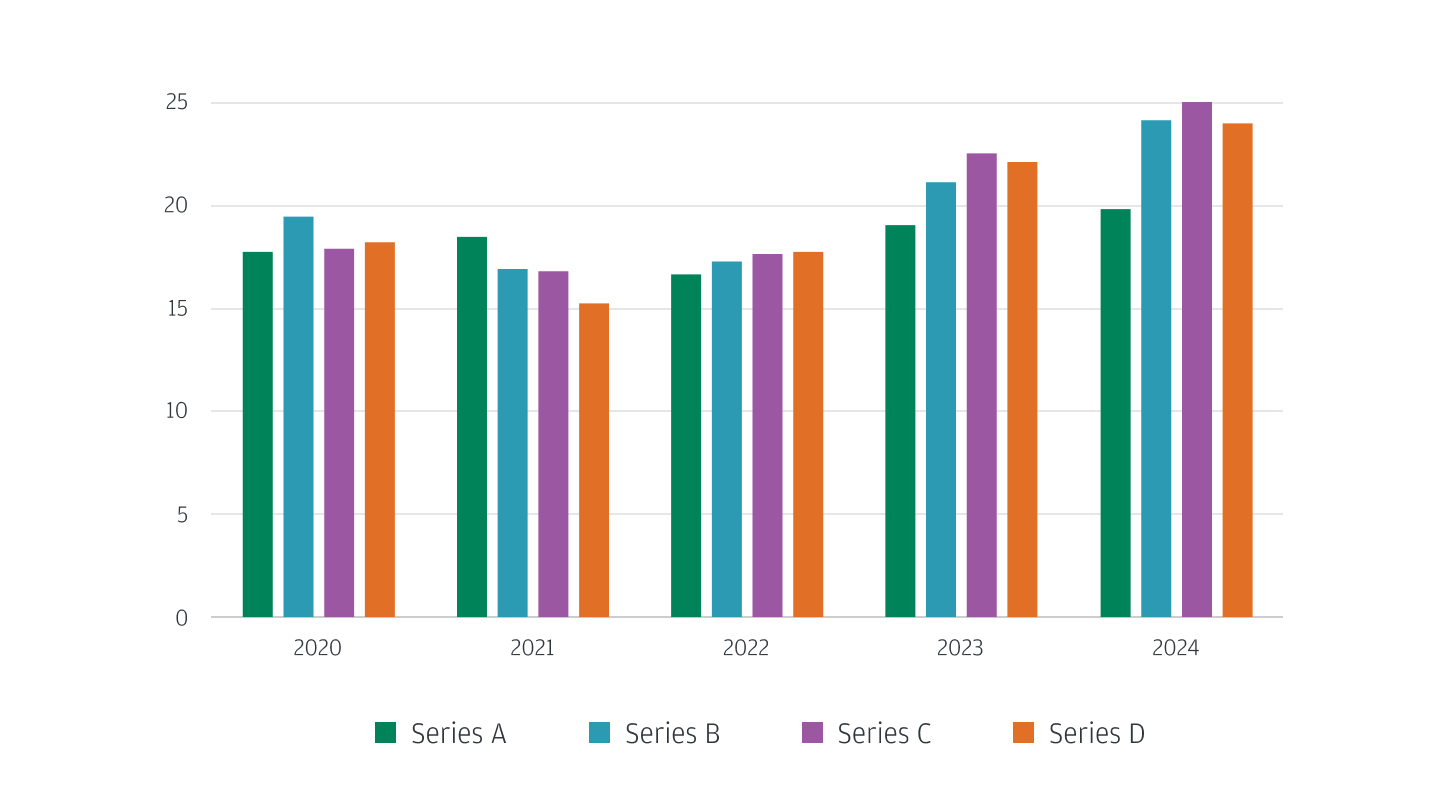

Median time (months) between rounds by series

Source: PitchBook.

For many years, the rule of thumb was to raise enough capital to last 18 to 24 months. However, in a tighter fundraising environment, a more conservative runway of 24 to 36 months is more frequently recommended. While there are instances of startups successfully raising funds just before reaching the end of their cash runway, investors generally scrutinize those with less than six months of runway more cautiously. It’s also crucial to understand the rate at which a startup spends money. Startups pursuing a market opportunity often need to invest heavily in sales, marketing and product development to grow rapidly and capitalize on the opportunity. This approach contrasts with that of a mature company, which may focus more on achieving profitability.

A related and helpful metric is the burn multiple. Typically used for SaaS companies, it measures how well a company uses its cash to grow. It is calculated by dividing net burn by net new annual recurring revenue (ARR) for a given period.

Burn Multiple = Net Burn / Net New Annual Recurring Revenue

Where:

Net Burn = Cash Revenue – Cash Operating Expenses

Net New ARR = New ARR + Expansion ARR – Churned ARR

Typically, a burn multiple of less than 1 is considered excellent, 1 to 1.5 is great, 1.5 to 2 is good, 2 to 3 is suspect and more than 3 is considered poor.

Extending cash runway

Startups can extend their runway through three main strategies: increasing revenues, reducing operating expenses or raising additional capital. To manage operating expenses, startups might focus on areas such as staffing, office space and infrastructure costs. On the capital front, many companies consider venture debt alongside equity financing to extend their runway. As part of financial planning and forecasting, startups should calculate, model and test various scenarios, each based on different combinations of these strategies. By creating and evaluating these forecasting models, startups can gain insights into the potential runway range each scenario might provide.

Summary

Actively managing cash runway is crucial for startup survival and growth. With a significant percentage of startups failing due to cash shortages, founders must closely monitor their cash burn rate and runway. Calculating cash runway involves assessing current cash reserves, expenses and revenue to determine how long a startup can sustain operations. The length of runway needed varies based on factors including the startup’s stage, industry and milestones. In tighter venture capital markets, startups should plan for longer runways and consider strategies such as increasing revenues, reducing expenses or raising additional capital. Regularly updating financial models and understanding metrics like the burn multiple can help startups make informed decisions to extend their runway and align growth ambitions with financial stability. While a simple calculation at face value, a cash runway analysis is nuanced and unique to every startup and can be impacted by a multitude of circumstances.

Build your future with J.P. Morgan

We are committed to being the leading bank of the innovation economy—bringing together founders, investors, startups and high-growth companies. Learn more about J.P. Morgan Innovation Economy Startup Banking solutions.

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/commercial-banking/legal-disclaimer for disclosures and disclaimers related to this content.