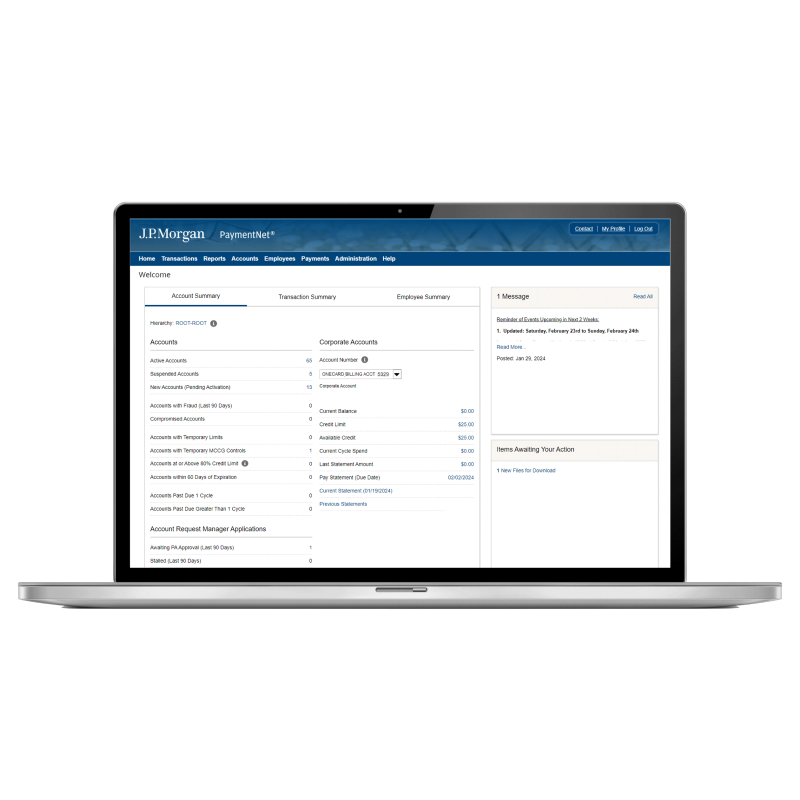

Program administrators can take action on core tasks, make payments and gain visibility into their card programs directly from their homepage.

Managing your commercial card program

We designed our PaymentNet® program management platform to power streamlined Commercial Card administration and reporting.

Customizable implementation and ongoing training

Streamlined program setup

An experienced implementation manager guides you through every step of the process and provides support along the way—including in-depth discovery to understand your processes and structure, configuration, testing and the transition to business as usual.

Training opportunities for your team

We offer regular training for program administrators, including weekly program administration webinars, monthly knowledge share webinars and ad hoc custom program administration sessions. We also offer a suite of resources program managers can leverage to train their employees.

Customizable controls

With PaymentNet, users can set controls and promote policy adherence, which can lead to greater transparency into their spend.

Define user roles

Set different levels of access, screen views and functionality for various user needs.

Set spend limits

Limit when and how much employees can spend. Accommodate unique needs, including one-time purchases, travel and emergencies.

Limit spend types

Designate the types of purchases employees can make by setting merchant and category restrictions.

Optimize administrative functions

Automate approval workflows based on criteria you set, such as transaction amounts or merchant category codes.

Enable employees to request a card online and allow managers to review and approve these requests.

Streamline reporting and account management

Access a suite of standard reports for common data needs. Users can also create custom reports, layouts, filters and advanced queries to capture the information they need.

Store your reports for later use or automate them to enhance your reconciliation processes. You can also securely transmit files to your enterprise resource planning system (ERP) or accounting software.

Create flexible file extracts to map information and push transaction data directly to your ERP and financial systems. You can share your mappers across your company to reduce manual work and enable cross-functional support.

Simplify cardholder tasks

PaymentNet helps clients streamline their commercial card programs, creating efficiencies for businesses and cardholders alike.

Go digital

Leverage receipt imaging to replace paper-based processes. Eliminate the need for your cardholders to export receipt images through a bulk export that can be transmitted to your systems.

Specify default settings

Set default settings that match your internal policies and point cardholders to relevant data like department cost centers.

Empower cardholders

Let cardholders update their account information, as well as cancel, suspend or issue a replacement for their card, and manage their PIN. Additionally cardholders can gain real-time visibility into account balances and transaction activity from their dashboard.

FAQs

PaymentNet is J.P. Morgan’s proprietary, web-based program management platform to help clients manage the day-to-day administration and reporting for their commercial card program.

PaymentNet helps businesses create efficiencies by automating administrative functions, simplifying cardholder tasks and streamlining account reconciliation. The platform also allows users to set controls and promote policy adherence across divisions, locations and departments. Further, users can gain greater transparency into their spending to help them manage business expenses.

Yes. PaymentNet is included with all commercial card programs, including J.P. Morgan One Card, Virtual Card, Purchasing Card and Corporate Card.

Clients can access PaymentNet by visiting paymentnet.jpmorgan.com.

More resources

Related insights

Payments

What is PCI compliance?

Mar 25, 2025

Protect your business and customer relationships through strong payment security. Learn how PCI DSS requirements safeguard card data and help prevent fraud while building trust.

Read more

Payments

What are card-issuing APIs?

Mar 20, 2025

Card issuing application programming interfaces (APIs) can help enhance the efficiency, security and overall management of corporate credit card programs.

Read more