As the pandemic continues to bite, global industries are dealing with the corollary of frequently conflicting priorities and challenges. In parallel, many energy players- bolstered by profitability and with one eye on the future - have been building out and evolving their treasury set-up. In this first-of-its kind treasury benchmarking analysis1, J.P. Morgan’s exclusive research critically examines the impact this is having, and how other firms can learn from it.

Crucially, this research highlights the need to structure treasury to support legacy business growth while also consider future developments – particularly in the renewables space. On the flipside, it appears that the availability of data is not yet sufficiently translating into either process efficiencies or analysis that really help drive the business. The (admittedly slow) adoption of supply chain finance solutions shows room for improvement, whereas liquidity solutions – employed wisely – have demonstrated their full value during the pandemic.

- Different scale, different outlook.

38% enjoy the benefits of an in-house bank, but this average figure does not properly illustrate the huge differences that exist based on company size. For example, 60% of players with $50B+ revenues have adopted in-house banking, but this proportion falls to 21% across players with less than $10B revenues. Therefore, while selected players have a unique leapfrogging opportunity to position their treasury for ongoing growth, they may need – even more than others – to review their treasury set-up, account structure and treasury policies to face an evolving future. - Data is available. Systems are implemented. But Treasury still faces perennial visibility and reconciliation challenges. Why?

With 85% having a treasury management system (TMS) and 80% using XML to communicate with their bank, clients enjoy a solid Treasury technology backbone. But Treasury is still working through the perennial challenges of cash visibility, forecasting or account reconciliation. While we see many reasons to this, one key consideration is batch processing, that hinders real-time functions. It’s time to move to APIs. - The rise of supply chain finance.

Almost a third (28%) have implemented a supply chain finance solution, while 13% have a single use account program in place globally. By far the biggest adopters of this are North American companies – a trend we also see reflected in the use of P-Cards (84% in North America, 34% globally). The tide is changing however, with a considerable rise in uptake for these solutions during the COVID-19 pandemic, especially in EMEA. - From physical into virtual: addressing the perennial liquidity challenge.

Over two-thirds of clients have already established an automated single or multicurrency physical cash concentration set-up. The adoption of automated physical cash concentration is seen to be more pronounced as client revenues increase: for clients with revenues less than $10B, 54% have a cash concentration arrangement. For clients with revenues in excess of $50B, this proportion reaches 86%, and growing – particularly on the back of increased adoption of Virtual Accounts, allowing for immediate consolidation and usability of Group cash.

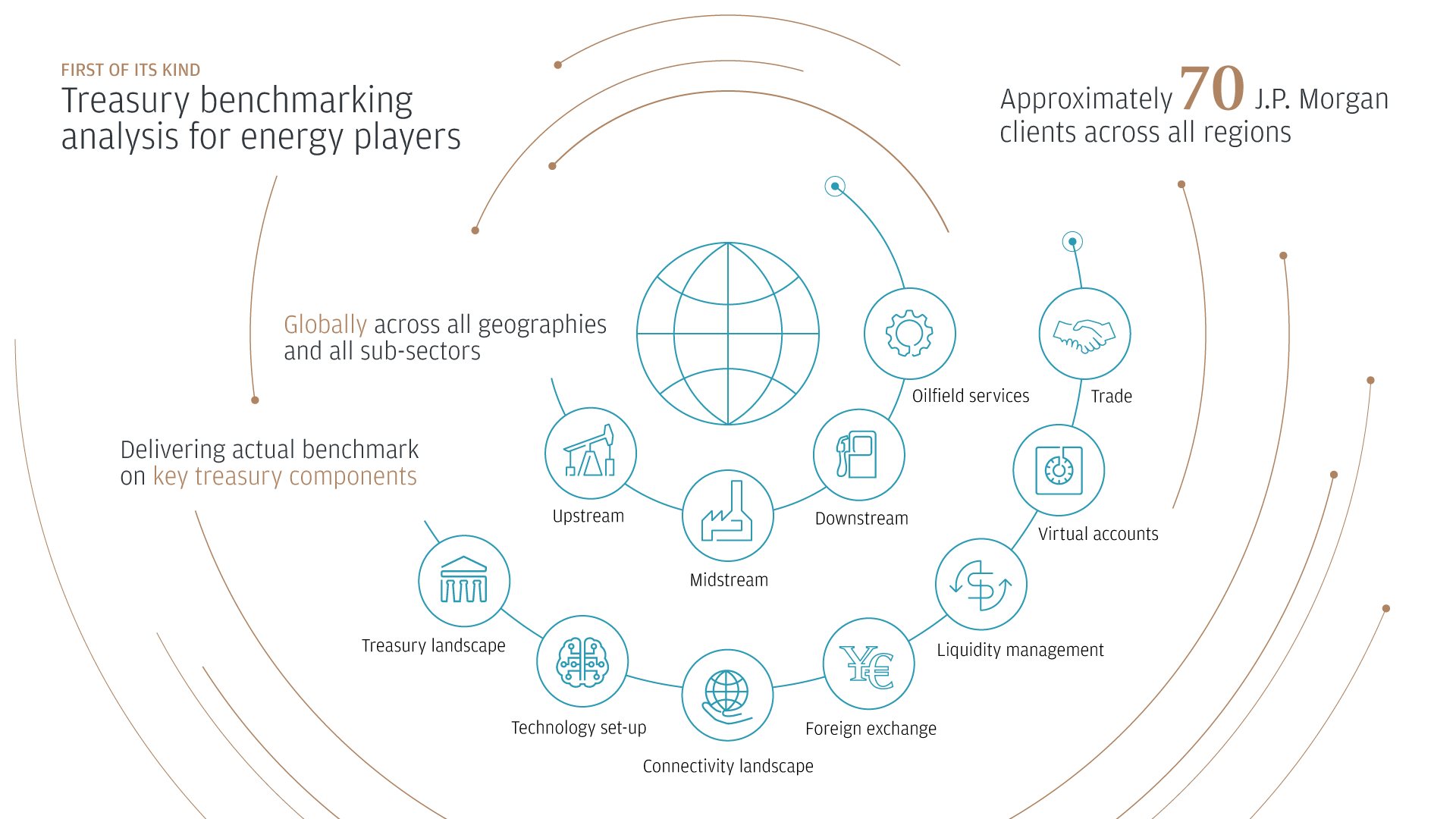

This global research gives a unique industry insight, across geographies and sub-sectors, delivering an actual benchmark on key treasury components. Considering core pillars (treasury landscape, technology set-up, connectivity landscape, foreign exchange, liquidity management, virtual accounts and trade), the results from 67 J.P. Morgan clients highlight an active and engaged treasury function, overcoming challenges but with room to grow.

Commenting on the launch of the research, Alexandre Baudon, Global Energy Industry Coverage, J.P. Morgan Payments, said: “These findings are a fascinating insight into energy firms of all sizes, and provide essential learnings on how the industry players have structured their Treasury, how they operate and where they could selectively improve.

As with many other industries, the pandemic has highlighted the need to flex and adapt the Treasury to rise to the immediate industry challenges while preparing to capture the opportunities ahead. I am delighted to be able to share this research across regions and sub sectors, as I truly believe the trends we have identified could be a catalyst for change within the industry as a whole.”

Infographic: The opportunity to leapfrog

In-house banks (IHB) can help energy players leapfrog to a future-proofed Treasury set-up with a centralized liquidity model. Setting up and running a next generation IHB isn’t as complex as it may seem on the surface. If done right, the benefits can be considerable.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of J.P. Morgan, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed to be reliable. Neither the author nor J.P. Morgan makes any representations or warranties as to the information’s accuracy or completeness. The information contained herein has been provided solely for informational purposes and does not constitute an offer, solicitation, advice or recommendation, to make any investment decisions or purchase any financial instruments, and may not be construed as such.

JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.