For Companies and Institutions

-

Commercial Banking

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

-

Global Corporate Banking

We help clients achieve their long-term strategic goals through financing, liquidity, payments, risk management and investment banking solutions.

-

Investment Banking

Providing investment banking solutions, including M&A, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Institutional Investing

We support the entire investment cycle with market-leading research, asset management, analytics, execution, and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

For Individuals

-

Wealth Management

With J.P. Morgan Wealth Management, you can invest on your own or work with an advisor to design a personalized investment strategy. We have opportunities for every investor.

-

Private Bank

A uniquely elevated private banking experience shaped around you.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Insights

- Treasury

- Liquidity Management

- The opportunity to leapfrog

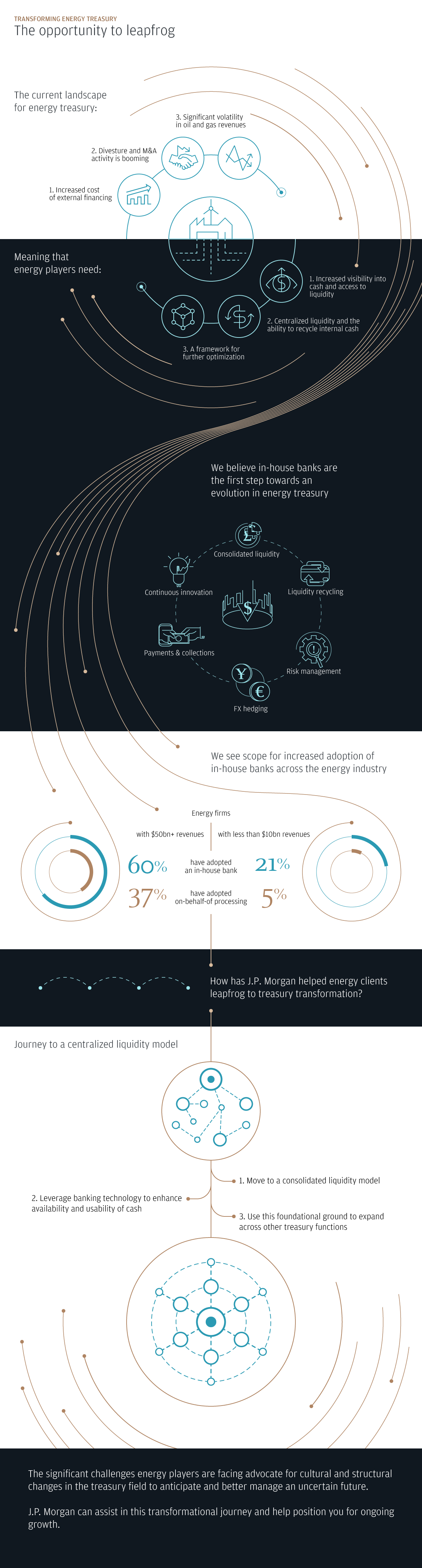

The Opportunity to Leapfrog

Introduction: In-house banks (IHB) can help energy players leapfrog to a long-term Treasury set-up with a centralized liquidity model. Setting up and running a next generation IHB isn’t as complex as it may seem on the surface. If done right, the benefits can be considerable.

The current landscape for energy treasury:

- Increased cost of external financing

- Divesture and M&A activity is booming

- Significant volatility in oil and gas revenues

Meaning that energy players need:

- Increased visibility into cash and access to liquidity

- Centralized liquidity and the ability to recycle internal cash

- A framework for further optimization

We believe in-house banks are the first step towards this much needed sophistication, and see scope for increased adoption across the Industry.

In-house bank graphic here

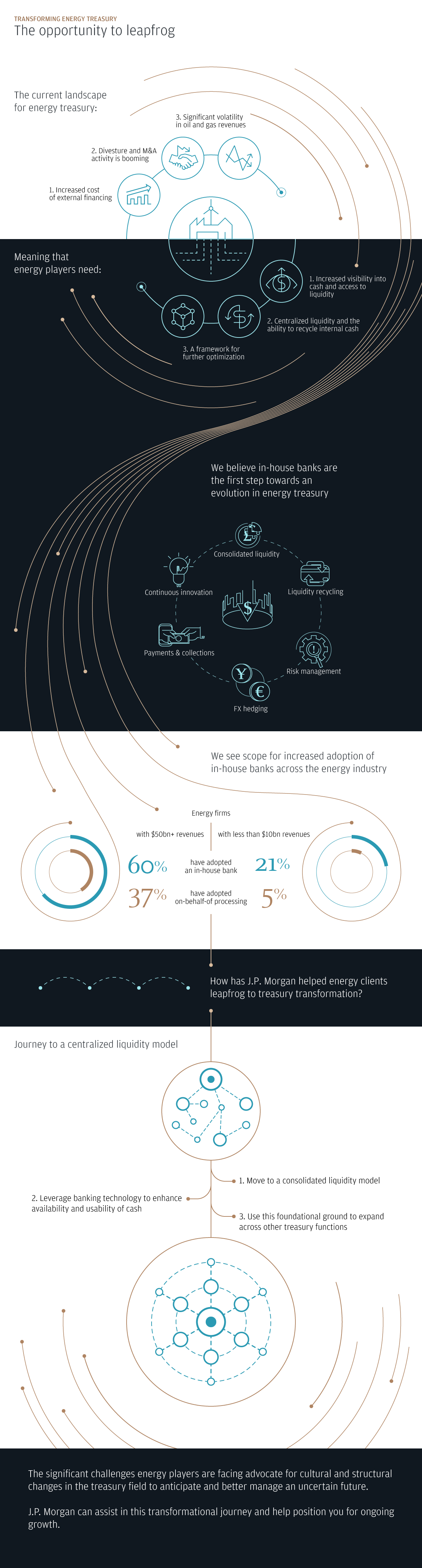

Energy firms with $50bn+ revenues

o Over 60% have adopted an in-house bank

o Only 37% have adopted On-Behalf-Of processing

Energy firms with less than $10bn revenues

o Only 21% have adopted an in-house bank

o Only 5% have adopted On-Behalf-Of processing

Source: J.P. Morgan internal data, August-September 2021

How does this work in the real world?

Corporates can nominate an entity to be their in-house bank. The first step is generally to move to a consolidated liquidity model and then add other functions such risk management and payments and collections. We have worked with several firms who were culturally operating in a decentralized fashion and helped them to leapfrog to a long-term treasury set-up. These players have leveraged the latest IHB tools to initiate and progress their journey towards centralized liquidity models. Clients have adopted full-fledged Virtual Account solutions allowing for immediate visibly and availability of cash at Treasury entity level, and a swift redeployment across the Group. These set-ups can help Clients retain their existing operational processes and ensures scalability and the emergence of a more centralized model.

The significant challenges Energy players are facing advocate for cultural and structural changes in the Treasury field to anticipate and better manage an uncertain future.

J.P. Morgan is well placed to assist you on your transformational journey. Connect with your J.P. Morgan representative to find the right solution for your business.

How does this work in practice?

Corporates can nominate an entity to be their in-house bank. The first step is generally to move to a consolidated liquidity model and then add other functions such risk management and payments and collections. We have partnered with several firms who were culturally operating in a decentralized fashion and helped them to leapfrog to a future-proofed Treasury set-up. These players have leveraged the latest IHB tools to initiate and progress their journey towards centralized liquidity models.

Clients have adopted full-fledged Virtual Account solutions allowing for immediate visibly and availability of cash at Treasury entity level, and a swift redeployment across the Group. These set-ups can help Clients retain their existing operational processes and ensures scalability and the emergence of a more centralized model.

Connect with your J.P. Morgan representative to find the right solution for your business.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of J.P. Morgan, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed to be reliable. Neither the author nor J.P. Morgan makes any representations or warranties as to the information’s accuracy or completeness. The information contained herein has been provided solely for informational purposes and does not constitute an offer, solicitation, advice or recommendation, to make any investment decisions or purchase any financial instruments, and may not be construed as such.

JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.

Related insights

Treasury

9 practical steps for setting up a regional treasury center

Feb 02, 2026

Establishing a regional treasury center (RTC) is a strategic imperative for multinational businesses. The process is complex, but manageable. Get started with our guide.

Treasury

A strategic planning framework for Corporate Treasury to remain pragmatic as well as forward-looking, to capture key drivers of innovation and growth in the years to come

Treasury

Connect ERP and treasury systems for automated workflows

Jan 29, 2026

Eliminate manual data entry and payment delays by integrating your ERP with treasury systems. Get real-time cash visibility and automated workflows that reduce errors.

Treasury

Understanding the cash application process

Jan 12, 2026

Optimizing your cash application process can help fuel your company’s success. Find out how.

Treasury

Enhance your corporate treasury's risk management with FX exposure netting solutions

Nov 24, 2025

Discover how virtual netting can provide a scalable framework for currency risk management, optimizing treasury operations and driving financial performance in a complex global landscape.

Treasury

The check is dead, long live the check

Nov 13, 2025

Wholesale lockbox may not mean much to the average consumer, but to businesses across the US, this method of check and payment processing is a critical part of driving business efficiencies and profitability.

Treasury

Your cash conversion cycle—what it is and how to optimize it

Oct 14, 2025

Discover how the cash conversion cycle impacts business efficiency and learn strategies to optimize cash flow management.

Treasury

Being resilient relies on connected treasury tools

Oct 10, 2025

In the face of a variety of obstacles, businesses are looking to improve their resiliency. Having a trusted treasury partner can help.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.