In the U.S., more than 12.51 million people own the rights to the energy resources under their property. For producers of oil and gas, royalty payments to landowners are a complex and strategically important obligation, particularly as energy production reaches record heights across the U.S.

Revenue from onshore federal oil and gas leases alone totaled $4.2 billion in 2019 year — the majority of this revenue, $2.9 billion, came from royalties.2 When one considers that 90 percent of U.S. oil and gas production takes place on non-federal land, the challenge facing upstream energy companies becomes clear.3

Calculating, disbursing and reconciling thousands of monthly royalty payments is critical, but such finance and accounting business processes are by no means core to companies that succeed by finding and producing oil and gas. Even so, these companies recognize that fairly and accurately compensating landowners — and doing so on a timely basis — is important to their long-term success.

Despite the rapid acceleration in U.S. oil and gas production volumes over the past decade, most oil and gas operators still rely on mailing a paper royalty checks to landowners. While paper checks and remittances have been an enduring solution for royalty payments, this reflects a system that has been used to settle royalty payments for more than a century and times have changed.

Land ownership is often family-based and passed down from one generation to the next. A single landowner or royalty beneficiary in the 1950s may have become 10 or 20 beneficiaries in 2021 as land is inherited and divided.

Today, this means royalty recipients can be many and diverse — living far from the land that is producing the energy. Crucially, they now expect the same digital-based payments freedom of choice and ease they are already experiencing in other areas of their life to be available when it comes to receiving their royalty payments.

Digital payments platforms offer multiple payment options, including traditional payment types such as ACH and wire transfers as well as recently developed modern payments such as digital wallets like PayPal and Zelle, all from a single access point.

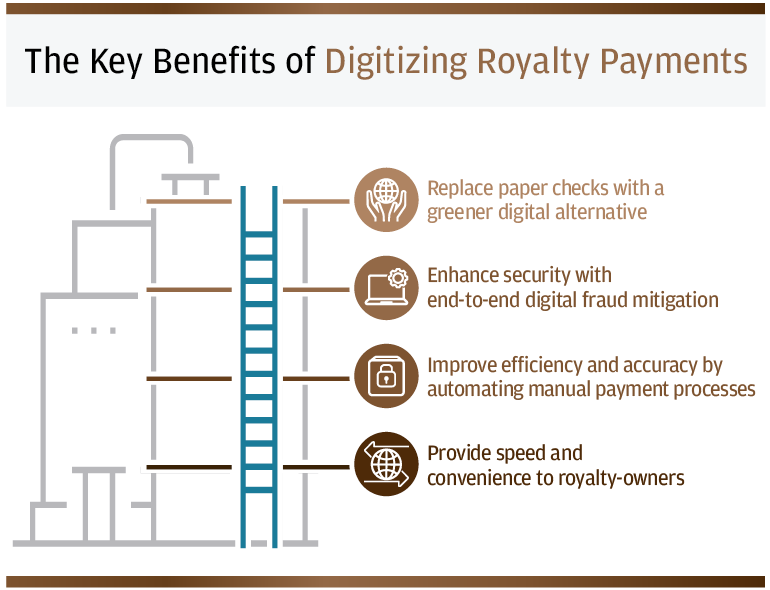

Establishing a secure, digital connection with landowners achieves more than getting royalty payments delivered on time and to the right person. The use of digital payments can avoid the risk of a paper check being intercepted and reliance on postal services which may experience delivery delays.

During unexpected events — take this year’s storms in Texas, or the ongoing COVID-19 pandemic — being able to deliver these payments electronically provides security and reliability given these files can be issued and sent over the internet and avoid physical delivery. Additionally, establishing electronic payments provides another operator / royalty owner communication touchpoint allowing for more opportunity to communicate with owners.

Better communication makes for better relationships with landowners. With online customer service portals, costly call centers can be replaced with an efficient self-service platform that speeds beneficiary access to royalty payments and statements.

With the 2021 Association of Financial Professionals Payments Fraud and Controls Survey identifying paper checks as the payment method most frequently targeted for fraud, payment digitization should be a top priority for energy companies.

By deploying a bank’s digital payments platform, the operator removes the need to take on the privacy and administrative burdens of handling landowner banking and personal data — and can simply allow the platform to securely store and handle this information instead.

Even with legitimate transactions, with only an address to rely on, many checks simply don’t meet their intended recipient, or lie unopened amongst other mail. Many recipients damage, lose or forget to cash checks, or move home without leaving a forward address, meaning operators must at some point begin the lengthy, resource-intensive process of escheatment. But with landowner data securely stored on a consistently updated digital platform, the risk of escheatment is lowered.

The shift to digital royalty payments carries another key advantage for operators: it can offer a significant improvement to their Environmental, Social and Governance (ESG) ratings. Evolving from paper to digital payment processes cuts carbon emissions and can be incorporated into a wider-ranging ESG policy. As landowners become younger, they will rightly expect more from their oil and gas operators from an ESG perspective, and demand environmentally-conscious stewardship of the resources on their land. Migrating from paper to digital is one way to assure landowners of a commitment to ESG values. Digitization of payments is an area that J.P. Morgan has demonstrated leadership for decades, most recently in pioneering blockchain and distributed ledger solutions currently used to authenticate and improve the speed of high value transactions between global financial institutions.

J.P. Morgan’s payment platforms can be scaled to optimize virtually any organization’s inbound and outbound payments and technology is particularly well suited for oil and gas producers seeking to fully digitize royalty payments and reconciliation data. J.P Morgan’s payment platform can also meet the needs of the companies that produce solar, wind, geothermal and other forms of renewable energy.

Both current and future generations of landowners will expect digital payments. In fact, many of the upcoming royalty recipients, members of the Gen Z generation, will have never used a paper check before.

Digitizing the payments processes provides greater choice and flexibility for landowners, drives data security and results in more predictable cashflow for operators. It also opens the door for further digital transformation across an operator’s entire payments portfolio.

To learn more about our digital payments expertise, please contact your J.P. Morgan representative.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of J.P. Morgan, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed to be reliable. Neither the author nor J.P. Morgan makes any representations or warranties as to the information’s accuracy or completeness. The information contained herein has been provided solely for informational purposes and does not constitute an offer, solicitation, advice or recommendation, to make any investment decisions or purchase any financial instruments, and may not be construed as such.

JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.