The business landscape is complex, and entrepreneurs often face challenges as they seek to scale. These range from limited access to capital and smaller contracting opportunities to cash liquidity vulnerabilities and difficulty navigating economic uncertainty.

Hispanic- and Latino-owned companies are the fastest-growing segment of the U.S. business landscape, with nearly 5 million entities generating $3.2 trillion in total economic output. It’s an innovative and resilient community that has consistently grown, creating new job opportunities for the past 15-plus years. According to research from the Stanford Graduate School of Business and Latino Business Action Network, the number of Latino-owned businesses grew 57% between 2007 and 2022. By comparison, the number of non-Hispanic white-owned companies increased 5%.

But challenges remain for business owners seeking to scale. These range from limited access to capital and smaller contracting opportunities to cash liquidity vulnerabilities and difficulty in recruiting talent.

Here, we’ve collected content to help business owners drive growth, optimize operations and become better leaders. From guides and research to insights and inspiring stories of entrepreneurship, these resources are aimed at supporting business leaders throughout their journey.

Access to capital

Securing capital is a vital step for entrepreneurs and communities aiming to achieve their financial goals. Learn about the resources and strategies available to help navigate the complexities of funding.

Scaling for growth

Scaling a business requires strategic planning and adaptability. Explore these articles and videos to gain insights from industry leaders on how to successfully grow your business, navigate mergers and acquisitions and prepare for unexpected challenges—all while maintaining a focus on long-term success.

- Scaling for growth: The keys to success (video)

- Barry’s: A fitness industry revolution (video)

- He thought it was a prank (article)

- Mi Golondrina: Bringing Mexico’s beauty to the world (article)

- Expect the unexpected: Creating a business continuity plan (article)

- Leading through M&A: 4 lessons for CEOs (article)

- From growth to profitable exit—actionable strategies as you sell your business (article)

Joey Gonzalez, Global CEO of Barry’s

Navigating the economic landscape

Understanding the complexities of the economic landscape requires foresight and adaptability. Explore these articles, videos and reports to examine the latest economic trends, the role of middle market businesses and the experiences of entrepreneurs who have successfully adapted to changing conditions.

- 2025 Business Leaders Outlook (report)

- Understanding the middle market: Economic impact and opportunities for growth (article)

- A guide to growth in uncertain times (report)

- Navigating uncertainty: A path for business owners (article)

- When opportunity knocks: How economic cycles shape entrepreneurial ventures and their success (report)

- Thriving in uncertain times: Martha de la Torre (video and article)

- Conversations with founders: Jorge Vargas of Aspen Power (video and article)

Martha de la Torre, CEO and co-founder of EC Hispanic Media

Supplier network opportunities

Diverse and inclusive supply chains are key drivers of economic growth and business success. Discover strategies to open doors to new opportunities, enhance your business reputation and attain a strategic advantage in the marketplace.

“It’s a marathon, not a sprint. You’re not going to get an overnight success solely by virtue of being a diverse business. But over time, you’ll have the potential to win contracts and build and grow your business.”

Frederick Royall III

Head of Inclusive Banking

Discover how we can help support your business.

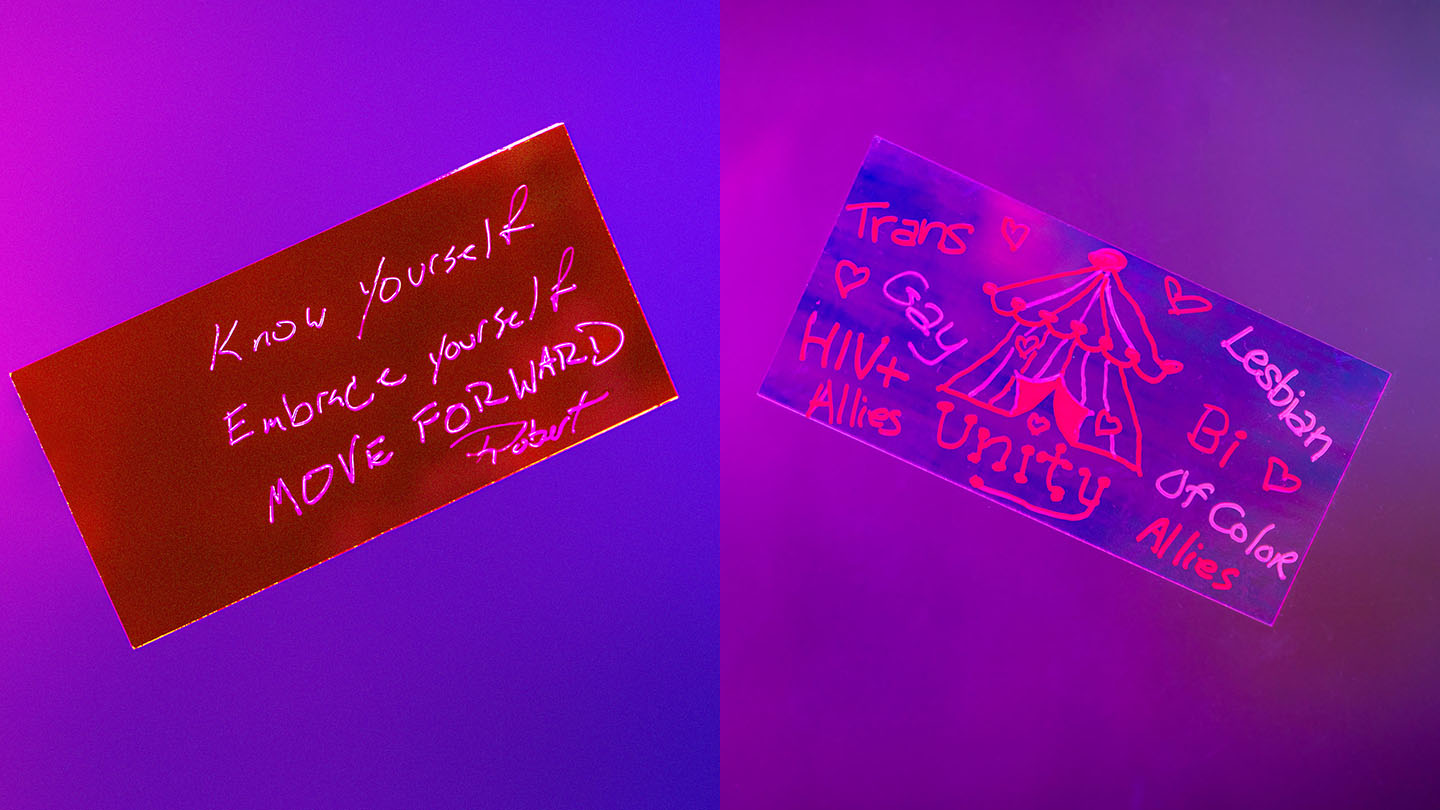

Leadership, inclusion and community building

Building strong inclusive communities that benefit everyone is key to driving social impact. Discover stories of individuals and organizations that are breaking barriers, transforming neighborhoods, and championing inclusion in the workplace and beyond.

- Meet the people behind Community Development Banking’s investments: Raza Development Fund (videos)

- Transforming abandoned lots into affordable homes (video and article)

- Helping women define and achieve success, with Luminary founder and CEO (podcast)

- Latina entrepreneur and DEI expert talks inclusive workplaces and more (podcast)

- How to find purpose, according to motivational speaker Gaby Natale (video and article)

“As the largest Latino-focused Community Development Financial Institution (CDFI), Raza’s impact is immeasurable. We’re proud to support Raza’s work—especially in education, community health care and burgeoning small businesses in underserved communities—as the CDFI helps shape the servant leaders of tomorrow.”

Kevin Goldsmith

Head of Tax Credit and Intermediaries, JPMorganChase Commercial Banking

JPMorganChase Leadership

JPMorganChase empowers businesses and communities through strong leadership and strategic support. Learn how our resources, expertise and community-focused initiatives are helping businesses grow and thrive.

- Build your future with JPMorganChase Commercial Banking (video)

- Building stronger communities together (guide)

- Keeping community at the core (article)

- Diversity, opportunity & inclusion (programs)

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/commercial-banking/legal-disclaimer for disclosures and disclaimers related to this content.