Executive summary

Nearly two-thirds of middle market executives express optimism about the national economy heading into 2025, marking an extraordinary shift in business sentiment. Our annual Business Leaders Outlook survey captures varying levels of confidence across different spheres—while only 29% of respondents are optimistic about global conditions, leaders show strong confidence in closer-to-home metrics: 59% express optimism about their regional economies, 60% about their industry performance, and 75% about their own companies in 2025.

This confidence is translating to improved growth outlooks. Almost three-quarters (74%) of leaders expect revenues to increase in the coming year, while 65% project higher profits. About half (51%) plan to expand their workforce, even as 77% of businesses report rising costs.

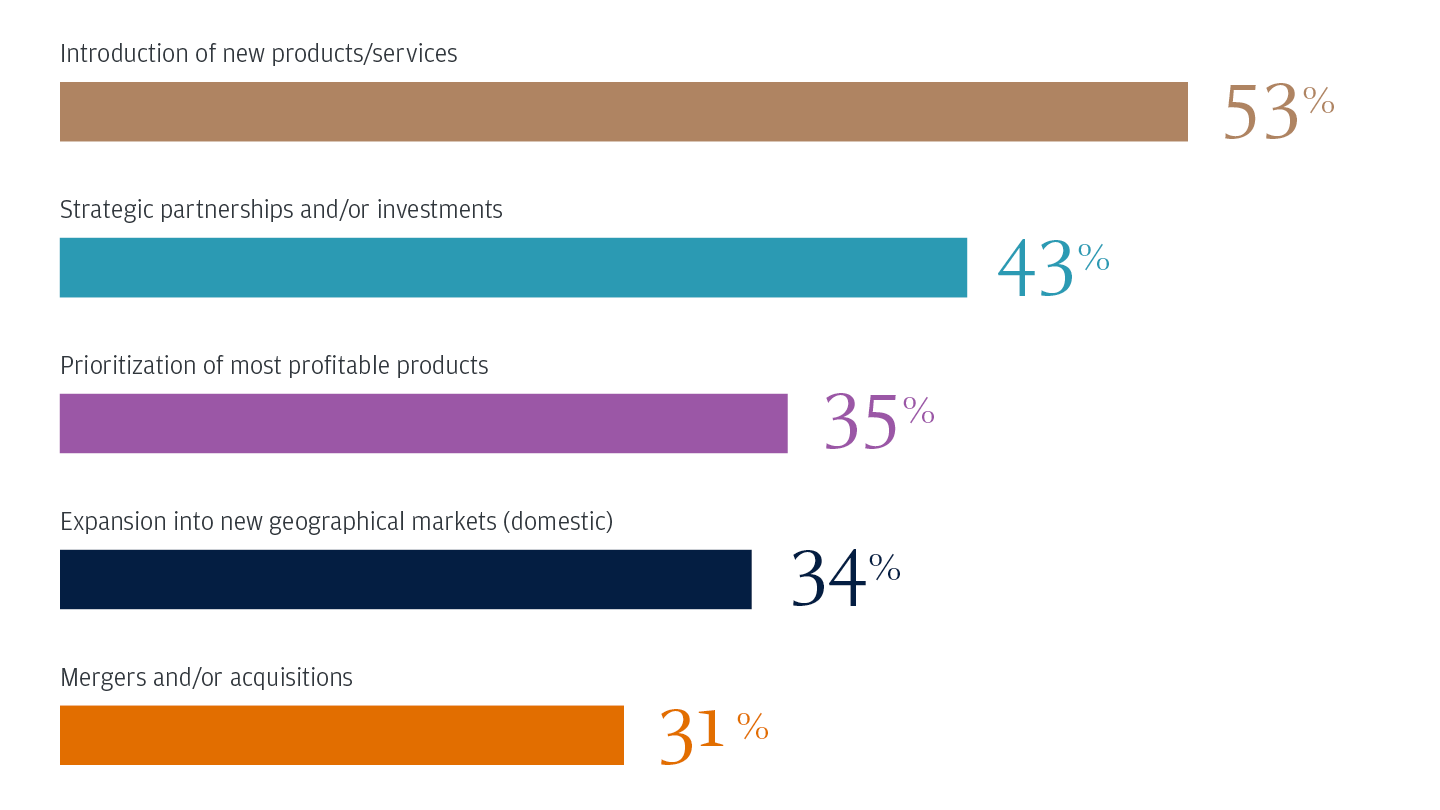

Roughly 53% plan to introduce new products or services, 43% are planning strategic partnerships or investments, and one-third (34%) plan to expand into new domestic markets.

With 71% seeing no recession on the horizon, the focus has shifted from caution to growth.

“Leaders are optimistic and focused on growth for 2025. Recession concerns have dropped as businesses, consumers and markets have handled a period of elevated inflation and interest rates better than expected. Confidence in the soft-landing scenario has increased, and business leaders are facing forward with a positive mindset.”

Ginger Chambless

Head of Research, Commercial Banking

Economic outlook and expectations

Business leaders’ recession expectations have fallen significantly since our 2024 survey. Only 14% of respondents anticipate a recession or believe we’re already in one—a sharp decrease from 40% at the start of 2024. The majority (71%) do not expect a recession in 2025.

The shift in sentiment comes after the Federal Reserve’s rate cuts in late 2024—its first since 2020—and signals from the Federal Open Market Committee about further easing. Our survey data suggests business leaders are moving past recession worries and focusing instead on growth opportunities.

Recession expectations for 2025

71%

of leaders said no/do not expect a recession in 2025

14%

of leaders said yes/we’re already in a recession

16%

of leaders said they’re unsure

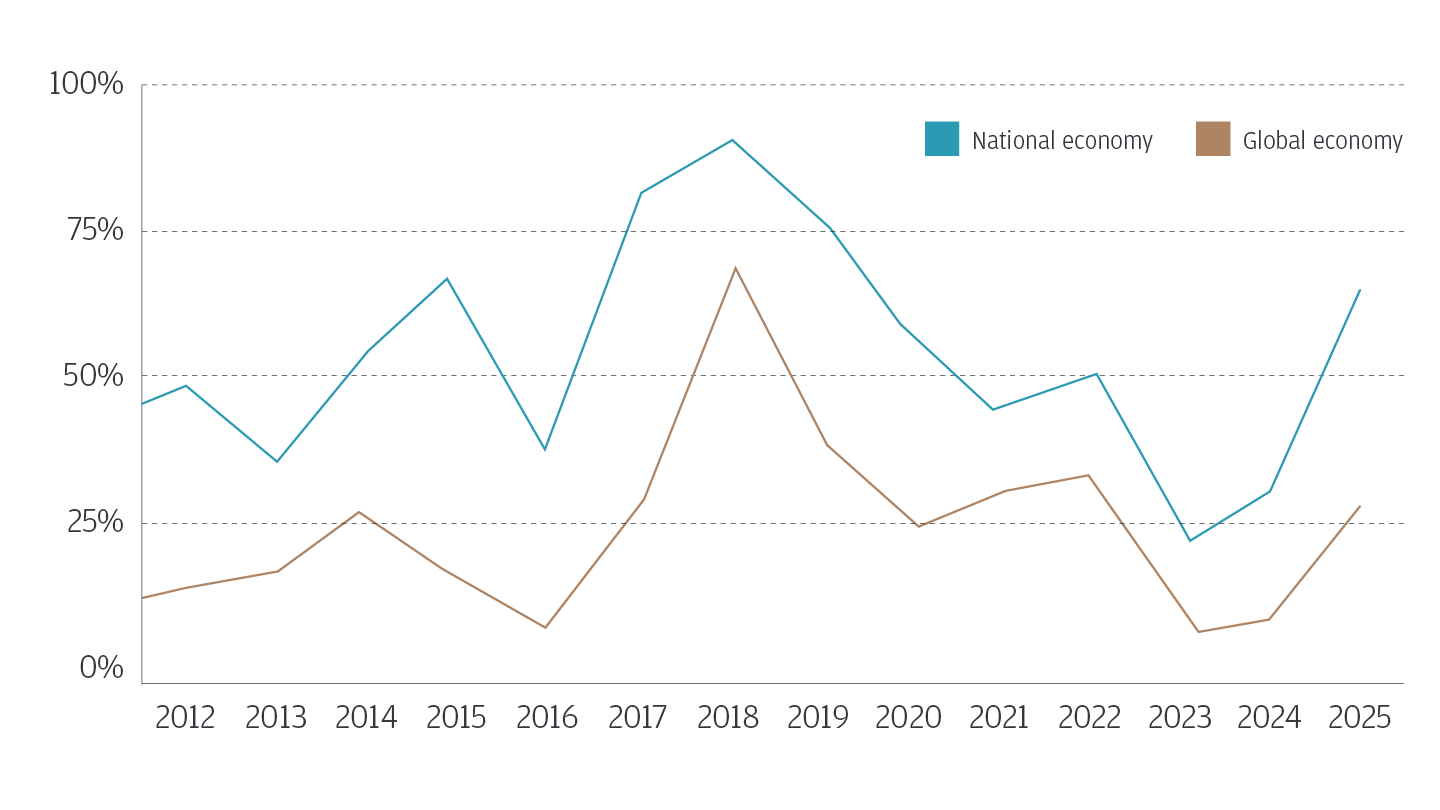

National confidence outpaces global outlook

National economic optimism stands at 65% among business leaders, marking a strong rebound from recent years. This increase represents the largest single-year gain since our 2017 survey, suggesting a fundamental shift in business sentiment.

The global economic outlook presents a more nuanced picture. While optimism improved to 29% from last year’s 10%, half of respondents remain neutral (50%) and 21% express pessimism. Against a backdrop of ongoing military conflicts in Ukraine and the Middle East and heightened geopolitical tensions, this 36-point gap between national and global optimism highlights the distinct differences between domestic and international sentiment.

National and global optimism

Challenges and opportunities

Labor and cost headwinds persist

Even as leaders pursue growth strategies, familiar challenges remain. Labor issues dominate business concerns, with 46% of leaders citing workforce challenges including shortages, retention and hiring. Revenue and sales growth ranks second among challenges at 39%, followed by uncertain economic conditions at 37%. While still significant, interest rates have become relatively less pressing: 26% list them among their top concerns, down from 36% last year.

The cost environment continues to challenge businesses, with 77% of leaders reporting rising expenses, though that has moved down from its peak (91%) in 2023.

46%

of leaders report labor workforce challenges including shortages, retention and hiring

77%

of leaders report costs are rising

Mapping multiple paths to growth

Business leaders are pursuing a range of growth strategies in 2025. More than half (53%) plan to introduce new products or services, while 43% are exploring strategic partnerships and investments. About one-third of companies are focusing on optimizing their existing portfolio (35%), expanding into new domestic markets (34%), or pursuing mergers and acquisitions (31%).

The growth mindset extends to staffing: More than half (51%) of leaders plan to expand their workforce, 41% will maintain current headcount and only 8% expect reductions.

Growth strategies for the next 12 months

About the survey

Now in its 14th year, the annual Business Leaders Outlook survey series provides snapshots of the challenges and opportunities facing executives of midsize companies in the United States. These companies, with annual revenues between $20 million and $500 million, span a variety of industries and business types, from family-run businesses to seed-stage and high-growth startups.

This year, 1,641 respondents completed the online survey between Nov. 12 and Dec. 4, 2024. Results are within statistical parameters for validity; the error rate is plus or minus 3.6% at the 95% confidence interval.

Helping midsize businesses grow

With a No. 1 ranking in overall middle market client satisfaction1 and a presence in more than 135 U.S. markets and worldwide, our middle market bankers and specialists deliver proactive, local support combined with global expertise. When you bank with J.P. Morgan, you gain access to all of our resources, from expertise and insights to practical strategies and simple solutions. Contact a banker to learn more.

References

2023 Coalition Greenwich Excellence Awards

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/commercial-banking/legal-disclaimer for disclosures and disclaimers related to this content.

Download the report

Hide

Download the report

Hide