For any startup, securing the right mix of funding is vital for growth and longevity. Venture debt is a distinctive option that complements equity financing and can be an alternative to traditional bank loans. The benefits of this type of debt can vary based on a startup’s specific circumstances. Therefore, understanding its key aspects can help founders evaluate potential options for incorporating it into their financial strategy.

What is venture debt?

Venture debt is a type of financing that startups and early-stage businesses may consider. It is typically provided by specialized venture debt lenders or banks with experience lending to businesses that may involve higher risk, such as startups. Venture debt providers are usually interested in startups that have a strong potential for growth and history of raising capital from venture capitalists (VCs). This type of debt can be a funding option for founders who have raised money from VCs but are looking to avoid further ownership dilution.

Unlike traditional bank lending, venture debt may involve options for unique terms to accommodate the high-risk nature of startups. As a result, venture debt may have higher interest rates than more traditional debt to compensate the lender for assuming a higher level of risk. Traditional banking models tend to lend to businesses with more consistent operating cash flows and assets that can be used as collateral. Startups often do not have assets to be used for collateral or positive cash flow, making venture debt a potential option for these early-stage businesses.

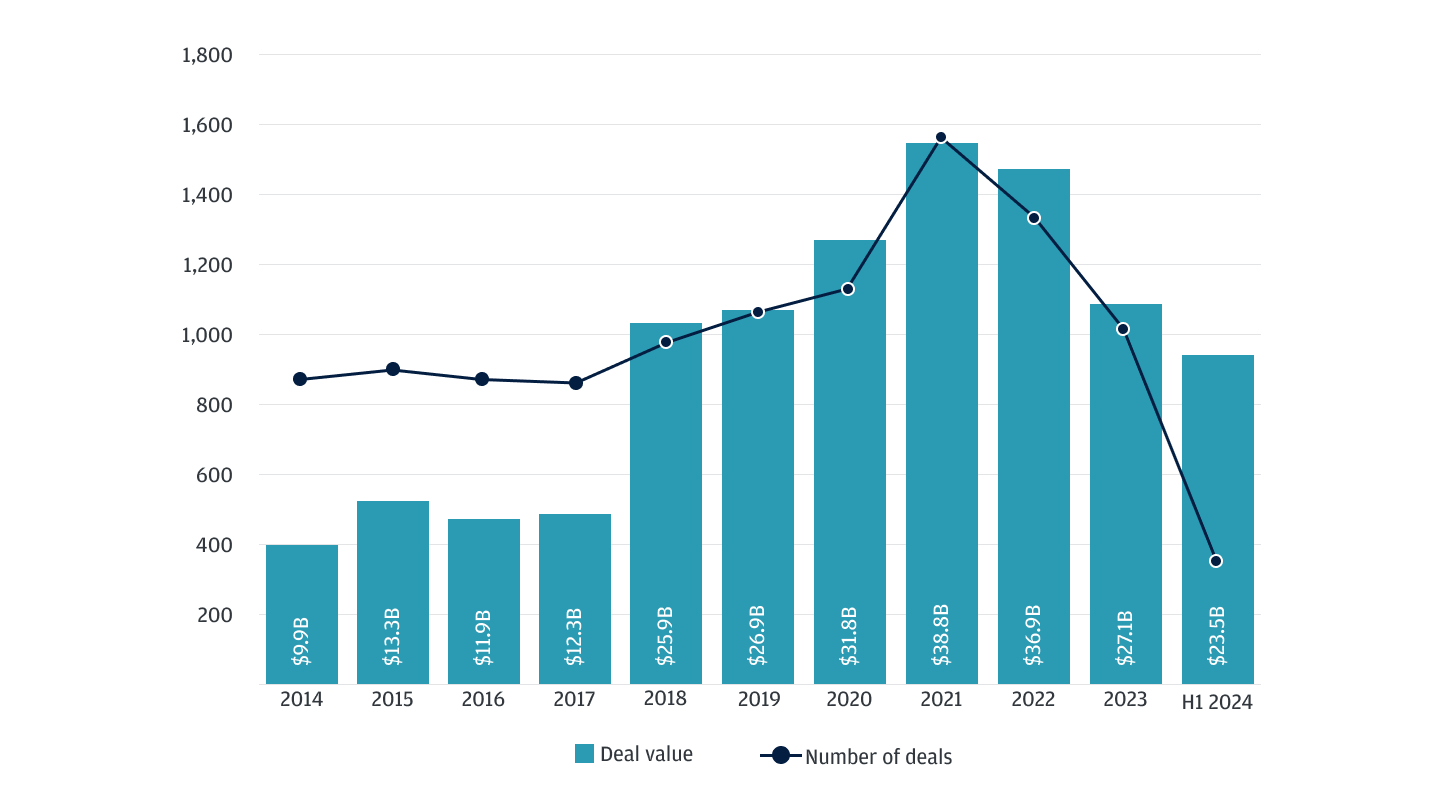

Over the past decade, the venture debt market has seen significant growth, reflecting its increasing importance as a financing option for startups.

U.S. venture debt activity

Source: PitchBook

How is venture debt financing different from other loans and types of financing?

Venture debt is a loan that requires repayment and does not convert to equity. Other forms of early-stage financing, such as convertible debt, are typically not repaid and instead convert to equity at the startup’s next funding round. One commonly used convertible debt option is a SAFE note—a simple agreement for future equity.

Venture debt is often raised alongside equity financing to maximize available capital. The dynamics of raising equity capital vary based on a startup's progress, but there are a few strategies that can help a wide range of startups.

Interest rates and repayment schedules for venture debt

Venture debt interest rates vary since they are set by the lender and can be based on the Wall Street Journal prime rate. Repayment schedules also differ based on the type of debt. Types of repayment schedules include:

- Amortized: This payment schedule functions much like a real estate mortgage, where both the principal and interest are spread across a long period.

- “Bullet” payments: Other types of repayment schedules can include a period of interest-only payments followed by a “bullet” payment—a payment that satisfies the principal and interest at the end of the term, or the maturity date. These types of schedules are less common for bank venture debt lending.

Get in touch

Our dedicated Startup Banking team can help you find solutions for your business.

Benefits of venture debt financing and venture loans

One of the benefits of debt financing is that it allows for the preservation of founders’ ownership and can extend a startup’s runway between equity rounds. Founders might consider venture debt to avoid dilution of ownership while still securing the necessary capital to grow the business and meet operational needs. Some other benefits of venture debt are:

- Founders can delay raising an equity round in a difficult fundraising environment, allowing them to grow the company, meet critical milestones and in turn attain a higher valuation.

- Companies can negotiate for their next round with additional access to capital, potentially increasing their leverage and demonstrating their creditworthiness to vendors and other outside parties.

When to consider venture debt

Startups typically secure venture debt after raising equity financing. Venture debt is more suitable for early-stage companies since profitable, later-stage companies often have more established revenue streams and access to a wider array of financing options.

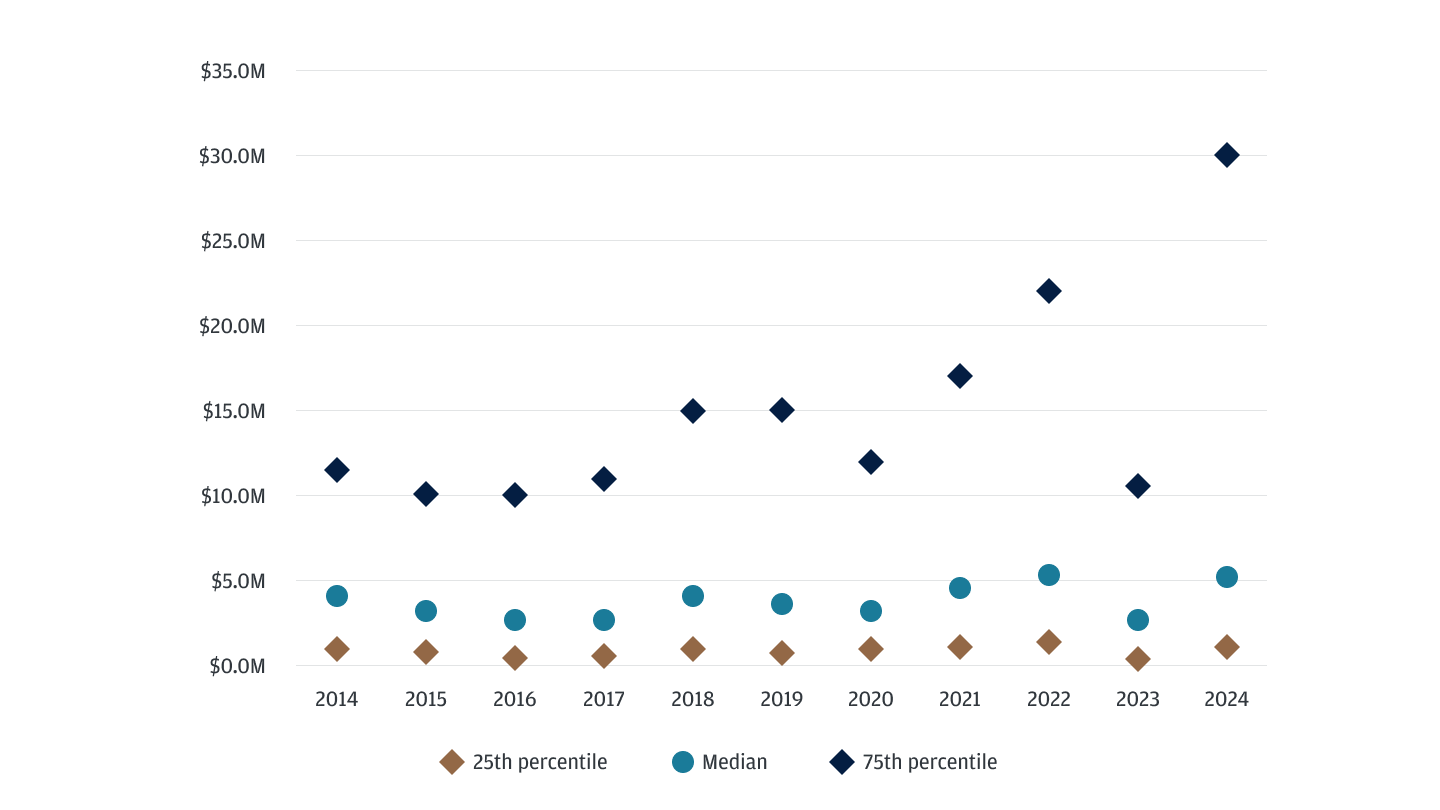

Understanding the range of deal sizes for venture debt can be important. While median venture debt deal sizes have shown relative consistency, ranging from $2.5 million to $5.3 million each year since 2014, the upper quartile of deal values has seen a dramatic increase, particularly since 2020. This shift highlights the flexibility of providers to support high-growth startups with greater capital needs.

U.S. venture debt deal sizes

Source: PitchBook

What to consider before taking on venture debt

While the primary benefit of venture debt is the ability to access capital without diluting equity, there are several things to consider before deciding if it is right for your startup’s situation.

- The obligation to make regular payments can have a negative impact on cash flow.

- Some debt providers require monthly financial reporting and include covenants in the lending contract that can mandate a certain level of financial performance. These contractual obligations can also prevent the company from making certain strategic actions—such as payment of dividends, M&A and asset sales, among others—without lender consent.

- Venture debt lenders and equity investors are very different. Equity investors understand that every investment will not generate a return; venture debt lenders expect to be repaid in full.

- Taking on debt can affect how funders of future equity rounds look at their investment in a company, seeing the scheduled repayment of debt as a inefficient use of growth capital.

- Too much leverage can limit a company’s ability to exit or raise additional financing. It can also impact growth spending as principal payments start.

Venture debt can positively affect a startup’s valuation by extending its runway and allowing the startup to achieve milestones without diluting ownership. However, it does add a liability to the balance sheet and puts pressure on cash flow.

Build your future with J.P. Morgan

We are dedicated to being the leading bank of the innovation economy—bringing together founders, investors, startups and high-growth companies. Learn more about J.P. Morgan Innovation Economy Startup Banking solutions.

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/commercial-banking/legal-disclaimer for disclosures and disclaimers related to this content.