In the ever-evolving world of startups, the path from a groundbreaking idea to a thriving business is often paved with challenges. Securing the first round of professional financing can be one of the first hurdles a startup will face. Learn about the process of seed funding, including how it works and how to raise it.

What is seed funding?

Seed fundraising is the process of obtaining early capital to bolster a startup’s development. A seed round is typically the first institutional round a startup will raise, following funding from friends and family, angel investors, or an incubator or accelerator program.

A seed round will usually be led by a seed investor who specializes in this stage of investing. The goal of both a seed investor and founder is to invest or raise capital quickly and without the burden of substantial due diligence.

Seed funding can be used to fund product development, assess and validate market fit, make key hires and deliver on any proofs of concept. A founder can expect to raise a meaningful amount of capital, but it often takes multiple seed rounds to get a startup in the best position to meet investors’ expectations for the next round, a Series A funding round.

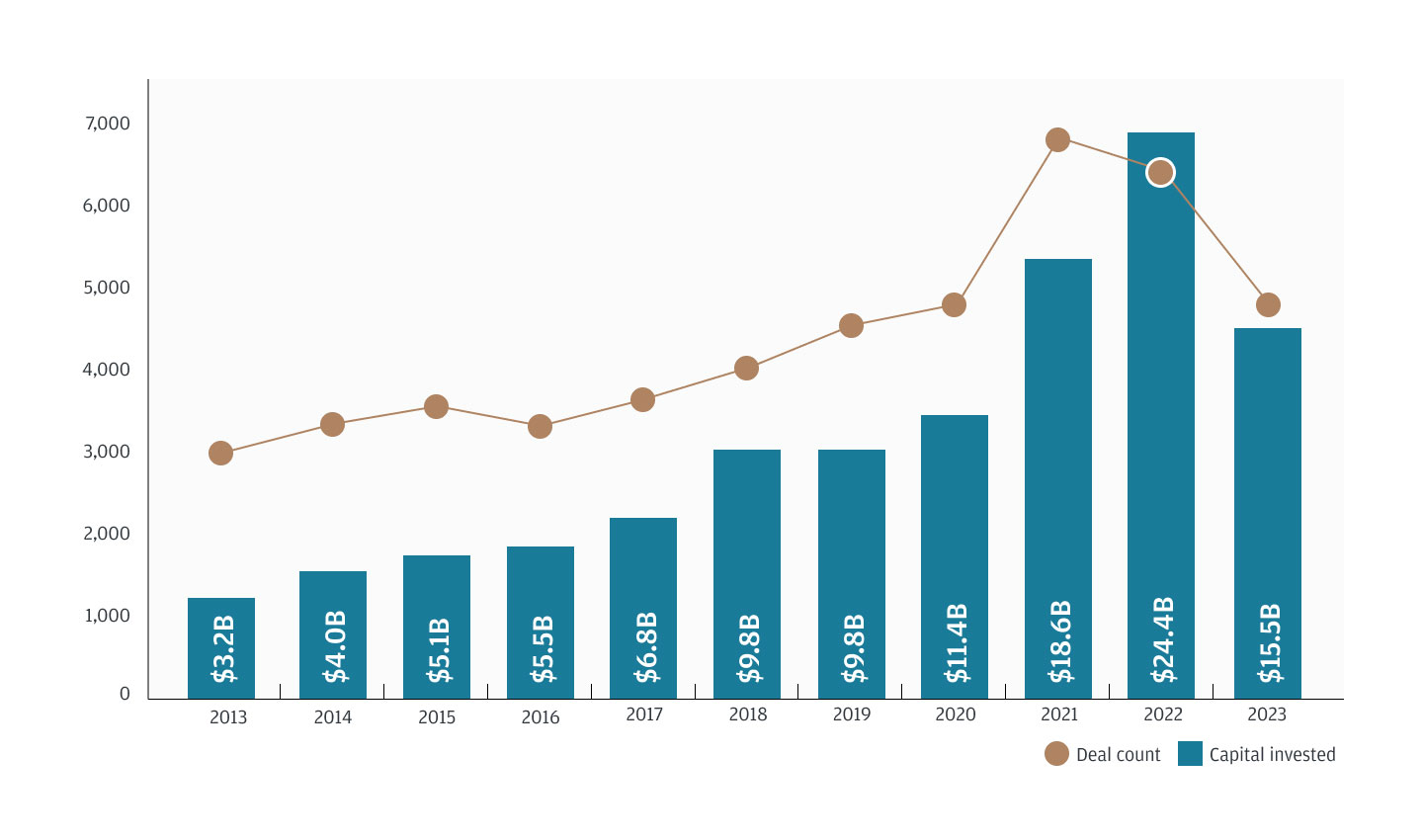

After U.S. seed fundraising activity reached a record high in 2021, deal counts and amount of capital invested per year have since declined, according to PitchBook data.

U.S. seed fundraising activity

Source: PitchBook.

Types of seed funding

Seed funding can come from a variety of sources, but seed funds are generally structured like a typical venture capital fund, with capital raised from limited partners like pensions and endowments, among others. Some types of seed funding include unpriced rounds, SAFE notes and angel capital.

Unpriced rounds: Depending on the state of a startup, a founder may choose not to set a valuation or give up preferred stock. Instead, they might choose to raise an unpriced round, typically in the form of a convertible security.

SAFE notes: It’s fairly common for a startup to raise convertible debt before or after a seed round. The most common type is a SAFE note—shorthand for simple agreement for future equity—which gives the holder the right to obtain equity at a later date. These types of convertible debt instruments are simple and easy to raise. Structured much like a loan, they typically get converted into equity at a startup’s next funding round rather than being repaid with cash.

Angel financing vs. seed funding: Although angel financing can also be a source of pre-series A funding, there are some important distinctions between the two in how the funds are typically used and the size of the investment.

- Seed capital: These funds are used to build a startup’s momentum and are often spent on activities to bring in customers and ramp revenues. A typical seed round investment is around $2 million to $3 million per investor.

- Angel capital: This money is often used to develop a prototype, conduct market research or make a startup’s first hires. These activities are often necessary for later seed-stage activities. A pure angel investment is usually in the range of $25,000 to $100,000 per investor.

Get in touch

Our dedicated Startup Banking team can help you find solutions for your business.

When would a founder typically raise seed funding?

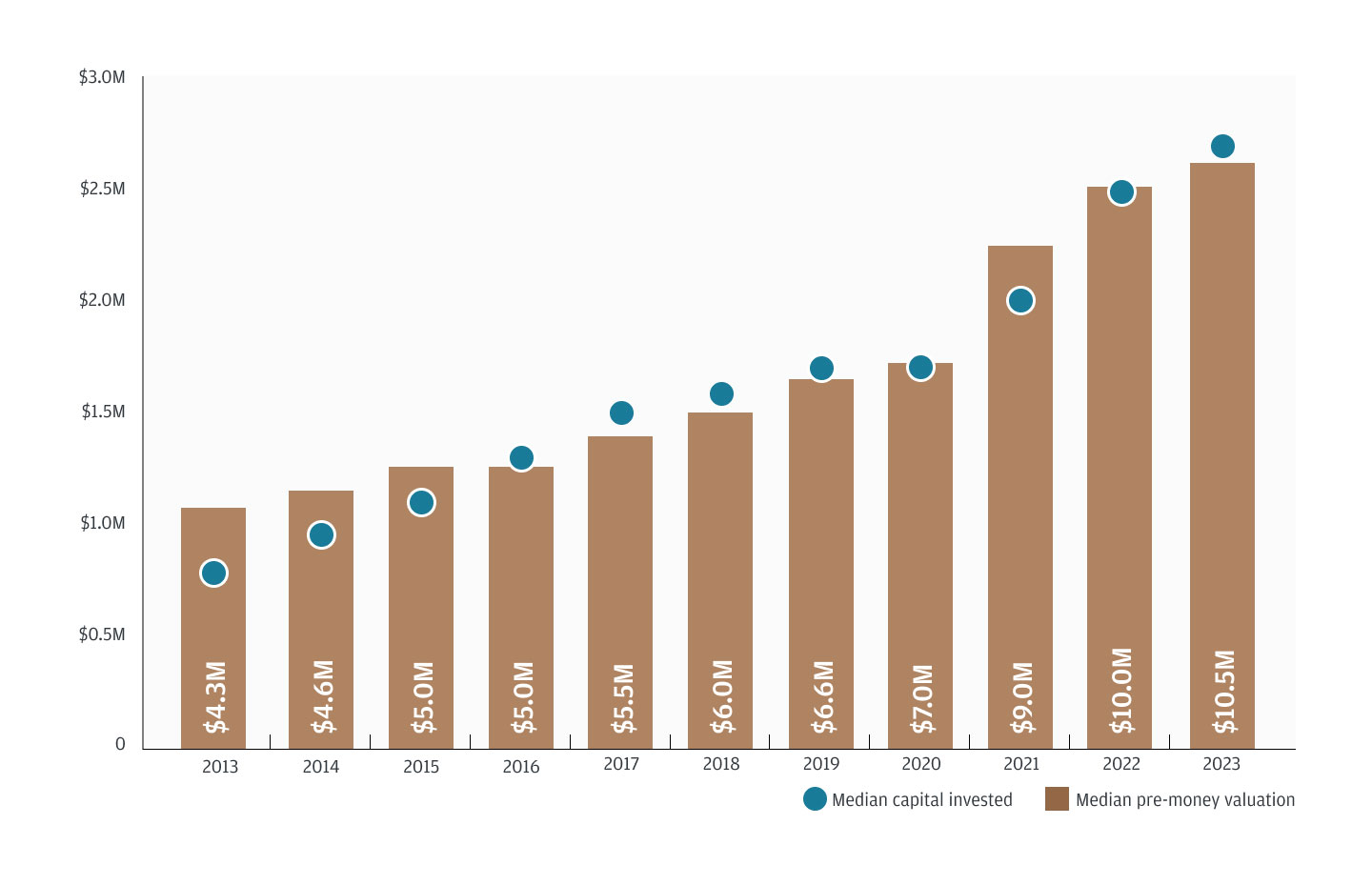

Before raising funds, it’s important for a founder to, among other things, work with their advisors to create a business plan and calculate the capital needed to fund the business for a period of time, typically 18-24 months. Frequently, founders balance these needs with prevailing market conditions. Although the median size and valuation for U.S. seed deals has consistently risen over the past decade, according to PitchBook data, unrealistic expectations might make fundraising more difficult and jeopardize the company’s momentum.

U.S. seed median deal sizes and pre-money valuations

Source: PitchBook.

How to raise seed money for a startup

Reaching the seed funding stage can be an exciting time. Keep in mind that persistence is key, as is preparation. The first step is usually leveraging your network, including prior investors like angels, to build an extensive pool of potential seed investors. It’s important to research investors to see if they are actively investing where your startup is focusing.

Approaching investors

Once meetings with potential investors are lined up, a well-prepared pitch deck with any necessary solution demonstrations is key. Here are some tips for presenting:

- Create a compelling pitch deck that highlights the experience and abilities of the founding team, the problem you are trying to solve, development of the product and your ask of the investor.

- Tailor your pitch to emphasize what the particular seed-stage investor is looking for.

- Practice and prepare for tough questions.

- Clearly articulate the problem and solution in simple terms.

- Bring evidence of traction—including metrics such as revenue, number of users and official partnerships.

Closing the deal

If an investor chooses to invest, they will typically issue a term sheet. This might include unfamiliar terms, especially for first-time founders, so make sure you review them and consult with your own advisors before finalizing terms and agreements.

What’s next?

After securing seed capital, sticking to a business plan that outlines spending and budgeting can be helpful. A startup should also consider:

- Working toward reaching certain milestones, such as securing talent, increasing revenue and user acquisition, before beginning a Series A funding round

- Actively monitoring cash flow and cash reserves

- Exploring other financial products, like a credit card, to increase spending power, earn rewards and streamline payment processing

- Regularly updating current investors and maintaining transparency

Build your future with J.P. Morgan

We are dedicated to being the leading bank of the innovation economy—bringing together founders, investors, startups and high-growth companies. Learn more about J.P. Morgan Innovation Economy Startup Banking solutions.