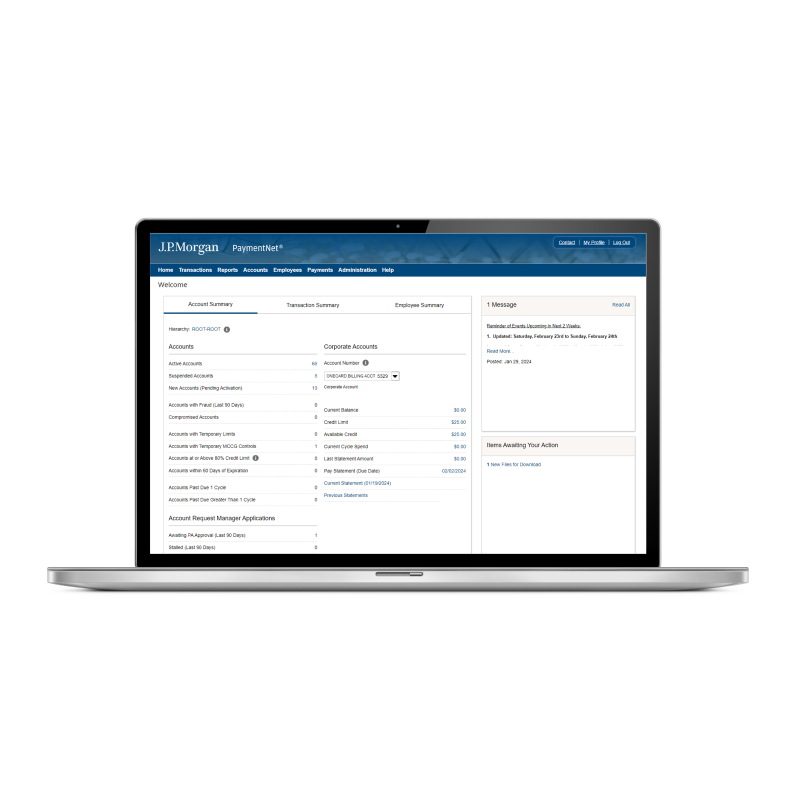

Leverage our PaymentNet® platform to power streamlined Commercial Card administration and reporting.

Virtual Card

Accelerate your business with a flexible, rewarding way to efficiently manage and securely digitize payments for procurement and beyond.

Virtual Card

Streamline accounts payable payment processing

Further digitize and monetize your accounts payable by integrating card payments seamlessly. Use one-time, single-purpose cards to pay specific suppliers a specific amount with a specific expiration date—which can reduce fraud to nearly 0%* and maximize your working capital.

Virtual Card benefits

Go beyond procurement purchases with a digital payments solution that meets your needs today and grows with you into tomorrow.

Automate your payables

Switch from labor-intensive payment processes to digital ones.

Earn more

Monetize costly disbursement processes to earn a rebate on your spend.

Optimize working capital

Extend your days payable outstanding and pay your suppliers faster.

Help prevent fraud

Help safeguard against fraud with a one-time-use card number resulting in nearly 0% fraud.*

“Our virtual card solution is built on the foundation of J.P. Morgan’s unparalleled expertise and reputation. With our global scale, industry-leading technology investments and deep understanding of businesses across all stages and sectors, we’re uniquely positioned to deliver a world-class virtual card offering that can be tailored to meet your unique payment needs."

Aisha Abbas

Virtual Card Product Director

Optimize the supplier experience

360-degree AP spend review

Our in-house Supplier Experience team can analyze your accounts payable spend, leveraging proprietary J.P. Morgan supplier preference data and industry benchmarks to identify suppliers likely to accept virtual card payments.

Supplier recruitment

Educating suppliers about the benefits of card acceptance is key to program success, and our specialists can offer custom recommendations.

Virtual Card supplier benefits

Faster payments

Virtual cards can help you pay suppliers faster, which can improve their sales outstanding.

Process and savings

With virtual cards, suppliers can skip the manual reconciliation process, leading to process efficiencies and cost savings.

Managing your programs

Access customizable reporting to gain transparency into your spend and drive efficiencies.

Support where and when you need it

Training for your business and cardholders

We’ll help you take advantage of our platform to save time, reduce administrative costs and gain greater control over your spend.

24/7 program support

Call or email any time to manage your card operation needs.

Hear from our clients

Payments settlement solution enhances Agoda’s in-house virtual card program

Agoda wins Best Card Solution for implementing self-issue virtual card facility to help double the number of settlement currencies to save costs.

Driving commercial card program success

When you begin a Virtual Card program with us, we’ll dive deep into program design, push hard on control measures and sweat the details to help you achieve your goals. Even if you have an existing program, our industry experts can offer a fresh look at your goals and help you deliver stronger results.

Design

Our consultative, tailored approach can help you determine the best setup for your organization’s specific needs.

Build

Our team does the heavy lifting so you don’t have to. We’ll dig into program configuration details, including systems integration and reporting.

Launch

Before the program goes live, benefit from training, communications templates and best practices to share across your company.

Treasury

A Payments win-win for a supplier and their buyers

March 22, 2023

Construction company Ricon sought a streamlined way to move from accepting paper checks to electronic payments. Despite a lack of experience with digital payments, the company was able to implement a successful virtual card platform—and reap the benefits of faster payments and improved cash flow.

Read moreFAQs

Virtual cards serve as a component of a company’s payments strategy. With a virtual credit card, one-time-use cards can be requested automatically to pay for specific transactions with specific controls, ensuring end-to-end efficiency and easy reconciliation.

Virtual cards are ideal for businesses looking to streamline their accounts payable processes and other payment functions. They give your employees and vendors more flexibility, help reduce your exposure to fraud and can reduce costs across the payments process. Companies can also monetize on previously costly payment processes.

There are no costs to pay with a virtual card. This is a credit card product. Merchant discount rates apply.

Our experts can help you determine how Virtual Card can optimize your payments. Reach out to us by completing the contact form on this page.

Related insights

Payments

What is PCI compliance?

Mar 25, 2025

Protect your business and customer relationships through strong payment security. Learn how PCI DSS requirements safeguard card data and help prevent fraud while building trust.

Read more

Payments

What are card-issuing APIs?

Mar 20, 2025

Card issuing application programming interfaces (APIs) can help enhance the efficiency, security and overall management of corporate credit card programs.

Read moreReferences

*0.0005% Gross fraud rate for virtual card – Internal J.P. Morgan Data, 2024