J.P. Morgan Payments in Argentina

We have participated in many landmark transactions in Argentina by advising local and international corporate clients and providing financing for the Argentine government.1 Today, we provide clients with a range of services that combine specialist knowledge with market leadership positions from our local office in Buenos Aires.

Grow your business for the future

Trusted, scalable payments and treasury solutions help you achieve your unique business goals in Argentina and around the world.

Global connectivity

See your full cash picture with end-to-end connected payments solutions around the world.

Local expertise

With a commitment to Latin American clients dating back to the 19th century, we combine global reach and deep understanding of local banking needs.1

Overcome challenges

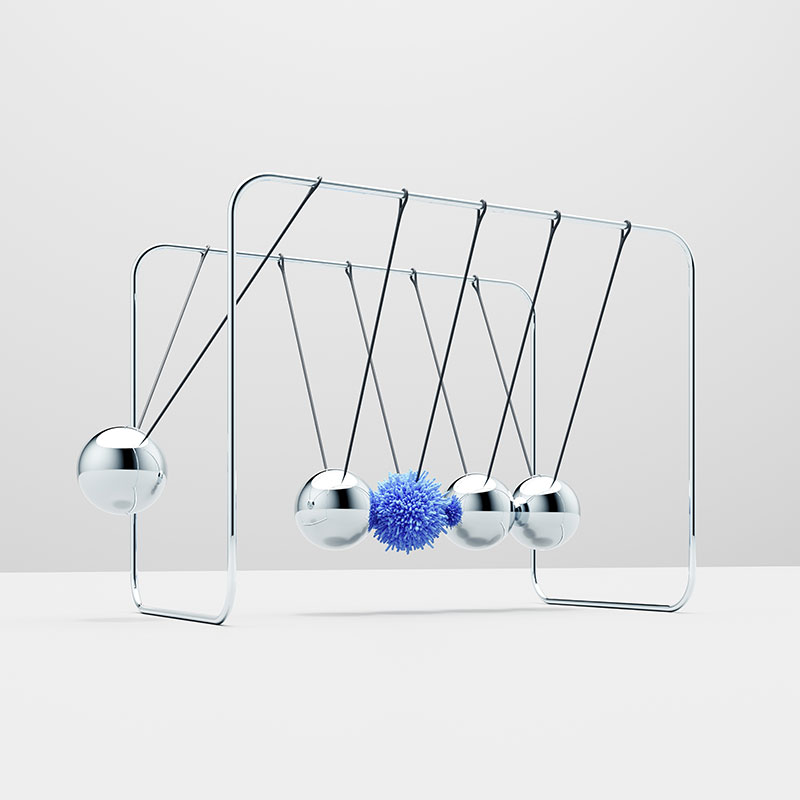

Navigate uncertainty with the reliability and security of a world-class bank, and the innovation and agility of a fintech.

Unlock opportunities

Uncover new possibilities by finding efficiencies and simplifying complex treasury processes.

“J.P. Morgan has been in Argentina since 1884, and we have a meaningful and strong commitment to the country. When it comes to our clients and our community, we provide a range of services and solutions that support expansion and growth across Argentina and beyond.”

Maria Ganin

Head of Banking and Payments - Argentina, Uruguay, Bolivia and Paraguay, J.P. Morgan

Digital-first strategies and payments innovation

Discover solutions that can help you navigate change and risk, innovate to grow and deliver an outstanding customer experience.

Onshore cash management

Cash management is vital to keep your business thriving. The key to success is to plan ahead and stay agile so that you can respond to changes.2

- Optimize resources and gain efficiencies with solutions to increase visibility and control

- Our award-winning treasury solutions are built to support short-term goals and future growth3

- Unlock benefits that save you time and protect your business

Liquidity & Account solutions

Grow your business with an account strategy that makes your liquidity work smarter.

- Build a competitive edge with embedded finance solutions for a streamlined experience

- Create a payments strategy that moves liquidity intelligently and unlocks more value from your cash through advanced, real-time currency optimization and global connectivity

- Transform your treasury with more visibility, control and optimization

E-channels and reporting

Simplify your payables processes with custom solutions that scale to meet your organization’s needs and goals.

- Lower costs and improve working capital with an optimized payment strategy

- Our digitally driven tools help sharpen your oversight, lower resource costs, reduce reliance on paper processes and payments and decrease payment risk

- A simplified, frictionless payments experience for you and your suppliers

Global reach, local expertise

J.P. Morgan Payments in LATAM

Home to a multitude of cultures, languages, currencies and regulatory complexity, the Latin American region presents a vast range of untapped opportunity.

icon

Loading...

Related insights

Related insights

How to benchmark and optimize your working capital in Latin America

As the post-pandemic economic recovery accelerates, effective working capital management is critical for companies seeking to optimize supply chains and unlock liquidity needed to fund daily operations and expansion opportunities in Latin America.

Four trends to watch in Latin America

Discover how a resurgent economy has reshaped consumer behavior and built value.

“One of the biggest challenges is to break the tradition”: Women in Payments in LATAM

On one day, she’s the only woman in the room, and on the next, she’s meeting a bank run exclusively by women. Latin America’s payments landscape is as varied as the countries it’s comprised of. Understanding these complexities is key to progressing in what was a traditionally male-dominated industry, says Angelica Valencia.

Tectonic shifts

Globalization has been under pressure in recent years. The Covid pandemic and geopolitical conflict have led companies to relocate supply chains to countries or build supplier networks closer to home. Some countries have also been imposing export restrictions on vital goods such as food, fertilizer, and raw materials. According to the International Monetary Fund (IMF), the number of trade barriers introduced each year has tripled since 2019.

Supporting future strategies: Working capital index Latin America 2023

Through insights derived from the analysis of working capital metrics, this report aims to help treasury and finance professionals for Latin American companies track working capital trends and guide their initiatives to optimize working capital management for recovery and growth.

The ‘quantum leap’ for LATAM payments

The international banking system has often been criticized for being opaque and convoluted. In Latin America, digitalization provides an opportunity to create, a faster, cheaper and more transparent payments network.

Become a client

Hide

Become a client

Hide

References

J.P. Morgan Wealth Management. The importance of business cash management

J.P. Morgan #1 rankings in Greenwich Award 2023 https://www.greenwich.com/corporate-banking/us-corporates-reassess-bank-relationships-while-banks-question-lack-demand-esg & https://www.greenwich.com/corporate-banking/2023-greenwich-leaders-us-large-corporate-banking-cash-management-trade-finance

J.P. Morgan Client Service Experience Touch-Point Survey 2023