Key takeaways

- Siemens Treasury evolved from a supporting role to a business driver by embracing new technologies and fostering a culture of innovation, agility and adaptability, encouraging experimentation

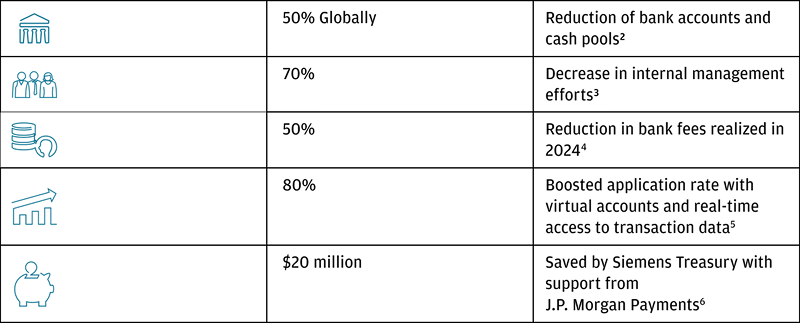

- In collaboration with J.P. Morgan Payments, Siemens Treasury implemented advanced technologies, like programmable payments and blockchain-based and virtual accounts, reducing banks accounts and cash pools by over 50%, streamlining workflows and cutting costs significantly

- Siemens Treasury achieved a 70% reduction in internal management efforts, 80% automated cash application rate and over $20 million in annual savings, enabling scalable operations and aligning treasury processes with its technology-driven business model

In the rapidly evolving landscape of global finance, the ability to innovate and adapt is crucial for maintaining a competitive edge. Siemens, a leading technology company with a rich history spanning over 175 years, has consistently demonstrated its ability to adapt and thrive in an ever-changing global landscape.1

Recognizing this imperative, the Siemens Treasury team, under the leadership of Group Treasurer Peter Rathgeb, challenged today’s standards and evolved its culture to become more innovative, open to new ideas and willing to experiment with novel approaches. This transformation resulted in the adoption of cutting-edge treasury technology and shifted the Siemens Treasury team from a back-office function to a partner to the company’s leaders.

Central to this transformation has been Siemens Treasury's collaboration with J.P. Morgan Payments, which has enabled the treasury team to simplify and automate much of its operations through solutions such as blockchain-based bank accounts, programmable payments and multi-entity virtual bank accounts. These innovations have streamlined processes, automated cash allocation and enhanced real-time treasury capabilities, freeing up valuable resources and working capital. 7

“J.P. Morgan Payments is a trusted collaborator with an innovative mindset. They are not just reacting to change — they are investing heavily in developing products and solutions that are at the forefront of treasury and payment technology. Both Siemens Treasury and J.P. Morgan Payments prioritize innovation to stay ahead of technology trends and drive market developments rather than being driven by them.”

Heiko Nix

Global Head of Cash Management and Payments, Siemens

Opportunity

Siemens Treasury goes beyond simply solving current problems or optimizing existing processes or tools; it is dedicated to advancing treasury operations to the next level while creating opportunities to support Siemens' industrial business.

Recognizing incremental improvements wouldn’t be enough to future-proof its treasury, the team needed to challenge conventional methods and innovate new, automated technologies to meet the demands of its dynamic global business into the future. “The future of the Siemens business model will get away from manual business cases,” says Rathgeb. “We will move to a culture that creates these platforms—that will be the future of the treasury business.”

This transition marked a cultural evolution, emphasizing the importance of experimentation and learning. “You can’t be creative if you’re fearful you’ll make a mistake. When it comes to new technologies and new ways of doing things, embracing failure culture is essential,” notes Nicola Bates, President and CEO of Siemens Capital Company.

Siemens Treasury faced a number of opportunities in its existing infrastructure:

- Reducing complexities and improving time to market: Traditional pooling structures can take months to set up and often require intricate configurations and administrative efforts, far too long and cumbersome for a future-forward treasury like Siemens Treasury.8

- From local cash pooling to global working capital optimization: Managing a complex network of thousands of decentralized bank accounts across multiple time zones works with today's standards but did not provide the real-time visibility and flexibility required for global liquidity optimization. “At a big company like Siemens, money isn’t always where it needs to be. Having over 2,000 bank accounts is a huge, manual task that our people were responsible for,” explains Rathgeb.

- Manual workflows weren’t acceptable to support a 24x7 business: Even with standardized processes, Siemens Treasury understood that automating cash allocation and payment workflows support always-on cash management and enable data-driven, automated decision-making.9

- Pushing past paper-based collections: Reliance on manual, paper-based collections delayed applications, are highly expensive and increased Siemens Treasury’s exposure to fraud risk. Additionally, there’s simply no room for paper payments in the organization’s philosophy of simplification, automation and making treasury leaner. 10

Solution

Siemens Treasury saw these challenges as opportunities to transform its operations and create a more efficient, forward-looking treasury. By questioning the status quo of complex and manual treasury management, the team prioritized simplifying processes as a foundational step to enable automation wherever possible.11

“Innovation really means being a leader, not a follower. Being at the forefront of change. That’s how we really try to foster innovation within the team. So they are constantly challenging the status quo, challenging what they do. On our treasury team we don’t ask them to do change necessarily, but we ask them to be change.”

Nicola Bates

President and CEO, Siemens Capital Company

Leveraging a suite of J.P. Morgan Payments solutions, Siemens Treasury established an always-on, real-time cash management infrastructure that streamlines treasury operations and improves efficiency.12

Blockchain-based accounts and multi-entity virtual account structures form the foundation of Siemens Treasury’s future liquidity management system. These accounts function like standard bank accounts but offer significant technical advantages, including real-time access to transactions, cross-border payments, 24/7 availability, programmability and delivery-versus-payment (DvP) capabilities.13 This gives treasury teams the opportunity to create a global cash pool with a comprehensive payment-on-behalf-of (POBO) and collection-on-behalf-of (COBO) structure and automate standard tasks with programmability based on real-time data.14

Recognized by Treasury Management International, this setup also allows Siemens Treasury to scale operations and respond to evolving business needs more efficiently. “Speed and time to market are increasingly important as Siemens has evolved into a technology and software company where customer preferences and market trends can change rapidly,” adds Heiko Nix, Head of Cash Management and Payments at Siemens.

“Payments has become the most dynamic and innovative area in treasury, driven by rapid advancements like instant payments, digital currencies, and blockchain, transforming the way we operate and unlocking unprecedented opportunities.”

Heiko Nix

Global Head of Cash Management and Payments, Siemens

Siemens Treasury’s setup incorporates solutions provided by J.P. Morgan Payments:

- Blockchain-based accounts are fully compliant with regulatory requirements and functionally equivalent to standard deposit bank accounts but offer significant technical advantages, including real-time access and transactions, cross-border payments, 24/7 availability, programmability and DvP capabilities.15 Siemens Treasury has opened several blockchain-based accounts in the U.S., Germany and Singapore to provide an always-on, real-time corridor in euros (EUR) and U.S. dollars (USD).16

- Virtual accounts facilitate real-time pooling to the assigned header account and improve automated cash application by mapping customer payments to the entity level. By implementing the solution in the U.S., Siemens Treasury consolidated over 100 accounts into a single physical account, using one virtual account per entity to support cash application for incoming customer payments.17

- Cross-border, real-time, always-on blockchain payments through Kinexys enable global sweeping to utilize existing cash across Asia, Europe and the Americas, including foreign exchange between Siemens Treasury’s main funding currencies, EUR and USD.18

- Programmable payments workflows, which are pre-configured rules to automate cash allocation, intercompany funding and liquidity concentration, offer Siemens Treasury instant access to account or payment data via API.19

- To streamline the settlement process for high-value transactions, reduce counterparty risk and align treasury operations, Siemens Treasury implemented a blockchain-based DvP solution, a settlement mechanism where the transfer of securities or assets occur only if the corresponding payment is executed simultaneously.20

By uniting cultural shifts with next-gen technology, Siemens Treasury built a highly automated, optimized and efficient treasury, reinforcing its role as a key business driver.

Results

Siemens Treasury took risks in shifting its culture, piloting new technologies and challenging the way that treasury business had been done for decades—and it paid off. With the support of J.P. Morgan Payments, Siemens Treasury is gradually realizing its objective of running a real-time treasury that requires little manual intervention, enabling its Treasury to be able to partner with business leaders to commonly establish new digital business models and support the future needs.

- Accelerating time to market: Siemens Treasury created its own cash concentration system using programmable workflows, enabling real-time, automated fund allocation. This agility allows Siemens to scale operations and respond to evolving business needs more efficiently. Speed and time to market have become increasingly important in an environment where customer preferences and market trends can shift rapidly. Virtual bank account structures further enhance flexibility by reducing the time required to open new bank accounts from several months to just a few days.21

- Eliminating unnecessary complexities: By simplifying processes, Siemens Treasury has shifted from relying on legacy systems to innovating a streamlined, future-forward model. Siemens’ emphasis on simplification resulted in reduction of bank accounts and cash pools by over 50% globally.22 The new setup reduced internal management efforts by 70% and helped realize a 50% reduction in bank fees in 2024.23

- API-powered access: Siemens Treasury boosted its automated cash application rate to 80% with virtual accounts and real-time access to transaction data via APIs.24

- Overcoming optimization obstacles: Siemens Treasury now operates a global real-time infrastructure that eliminates traditional barriers to liquidity optimization. High-value, cross-border payments can be made within seconds anytime, anywhere.

- Enhancing efficiency: Implementing programmable payments based on automated workflows helps Siemens Treasury eliminate most of the manual tasks in operative cash management (cash disposition). “By minimizing human intervention in routine tasks, automation helps us scale treasury services so we can adapt to business needs as they evolve over time,” says Nix.

- Supporting new use cases: The blockchain-enabled infrastructure positions Siemens Treasury to support DvP use cases, like issuing tokenized Commercial Paper within seconds.25

"We partner with J.P. Morgan Payments because we're both innovators that strive to find simple, elegant solutions to complex problems. As a cutting-edge technology company, Siemens strives to find partners who are equally cutting-edge in terms of thinking and technology development.”

Nicola Bates

President and CEO, Siemens Capital Company

The collaboration between Peter Rathgeb, Nicola Bates and Heiko Nix illustrates how strong leadership and strategic partnerships redefine treasury operations. Siemens Treasury's focus on innovation, supported by J.P. Morgan Payments, transformed its treasury into a highly efficient, scalable and innovative business-enabler, contributing to more than $20 million in cost savings annually while positioning itself for long-term growth.26

By aligning payments and treasury processes with technological advancements, Siemens Treasury and J.P. Morgan Payments have redefined treasury's role—not as a support function, but as a core driver of business impact and innovation.

Visibility is Intelligence. Control is confidence. There’s power in clarity. Learn more about:

References

LinkedIn, "Siemens," LinkedIn, https://www.linkedin.com/company/siemens/

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Rathgeb, P. (September, 2024). Interview with Treasurer at Siemens Group. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Bates, N. (September, 2024). Interview with Head of the Regional Finance Center for the Americas at Siemens. J.P. Morgan Payments.

Rathgeb, P. (September, 2024). Interview with Treasurer at Siemens Group. J.P. Morgan Payments.

Bates, N. (September, 2024). Interview with Head of the Regional Finance Center for the Americas at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Bates, N. (September, 2024). Interview with Head of the Regional Finance Center for the Americas at Siemens. J.P. Morgan Payments.

Bates, N. (September, 2024). Interview with Head of the Regional Finance Center for the Americas at Siemens. J.P. Morgan Payments.

Nix, H. (September, 2024). Interview with Head of Cash Management and Payments at Siemens. J.P. Morgan Payments.

Legal

Not all products and services are available in all geographic areas. Eligibility for particular products and services is subject to final determination by JPMorganChase and or its affiliates.

J.P. Morgan is the marketing name for J.P. Morgan Payments business of JPMorgan Chase Bank, N.A. and its affiliates worldwide.

JPMorgan Chase Bank, N.A. Member FDIC. Deposits held in non-U.S. branches are not FDIC insured. Non-deposit products are not FDIC insured.

Visit jpmorgan.com/disclosures/payments for further disclosures.

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.

© 2025 JPMorgan Chase & Co. All Rights Reserved.