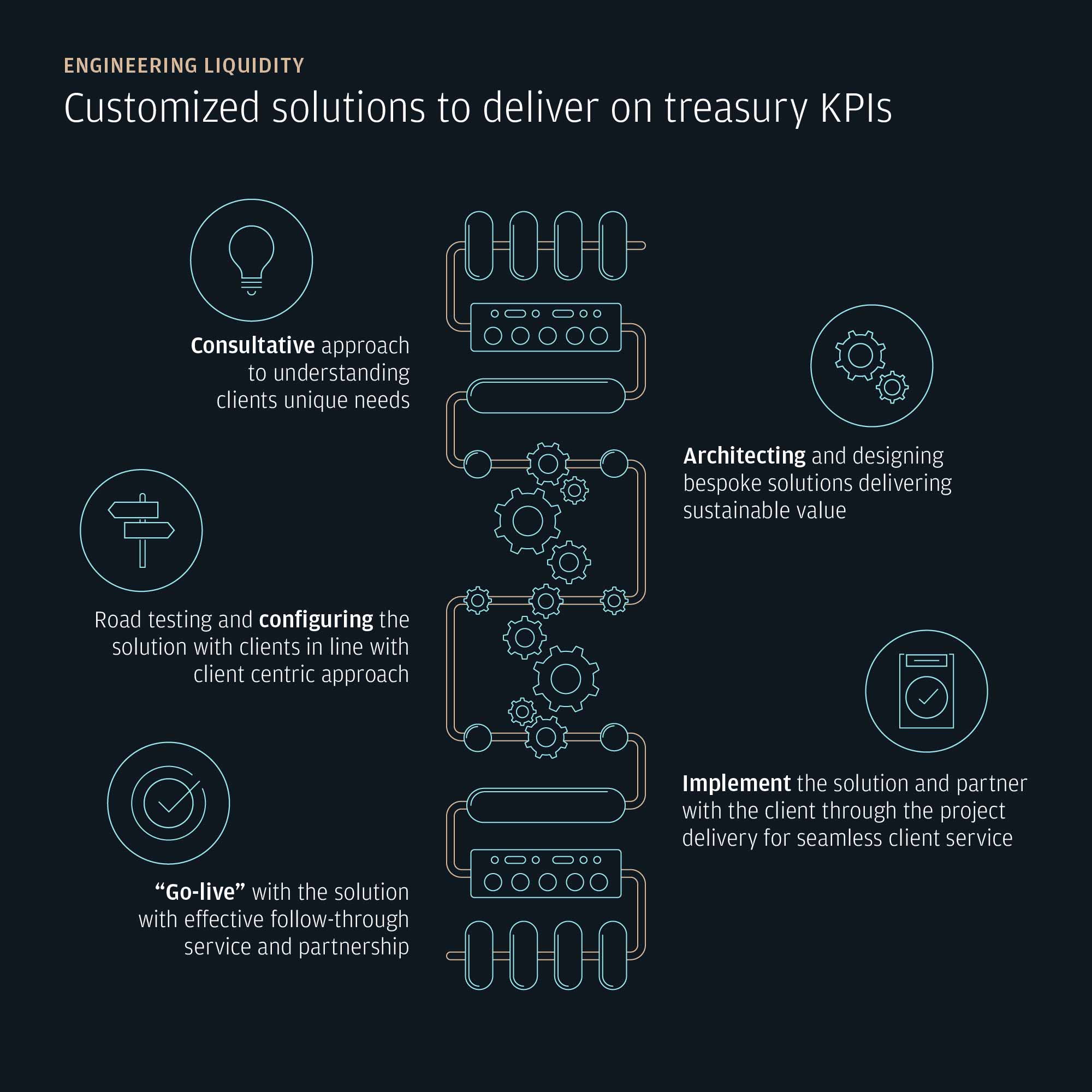

Treasury optimization is a phrase that is becoming more commonplace, as treasurers seek to turn cash positions into information and insight, driving action and decision making. With no ‘one size fits all’ solution, J.P. Morgan has developed a fresh approach, building out an architecting process that follows a journey to help treasurers focus on what matters most - core objectives and delivering on KPIs.

What is engineering liquidity?

Not all cars are made the same and in a similar vein, liquidity solution specialists address the needs of individual clients in tailoring multi-product structures to suit. This differentiated approach to supporting a treasury optimization journey considers meticulous focus on providing best-in-class solutions that are cutting edge in the current operating landscape.

Each client’s unique needs are understood, addressed and met in our approach of engineering specific solutions. We leverage best practice guidance across industries, with in-depth knowledge and understanding of cross-border requirements and challenges faced by clients operating in a multi-currency, multi-faceted globe. This is then married into the client’s unique needs to help deliver a robust and sustainable solution.

More than ever, with account structuring solutions and agile liquidity management specifically architected for their needs in mind, treasurers need someone to help them transform from an operational partner to a critical business growth engine within their own organisations.

J.P. Morgan’s engineering approach understands that treasury optimization is a journey, and a long- term partnership with a view to delivering sustainable value.

In this, we help to demonstrate quantifiable benefits of implementing bespoke structures leveraging pooling, virtual solutions, and optimum payment and multi-currency management. No single implementation is ever the same. At the heart of our approach are tailored solutions that help client treasuries become more competitive, optimize working capital/funding, achieve greater productivity and improve efficiency.

Vivek Chikballapur, Head of EMEA Liquidity & Account Solutions Specialists, J.P. Morgan Payments explains: “We help our clients realize the power of global presence with local expertise to achieve visibility, control and optimization of their precious working capital. Additionally, and in tandem with our clients, we create a payments strategy that moves liquidity intelligently and unlocks more value from cash through advanced real-time currency optimization and global connectivity.”

What is the end result?

Clients benefit from having liquidity – at the right place, in the right currency at the right time. We strive to engineer strategies that move liquidity intelligently and unlock more value from client cash through advanced real-time currency optimization and global connectivity.

When it comes to designing a solution, we help clients deploy accurate, targeted, digitalized and automated liquidity management which achieves and streamlines operating processes and minimizes physical bank account management.

The structures we implement give visibility into cash inflow/outflow dynamics, allowing cash to move around the globe on a same-day basis to help you identify the originating location and amounts of extracted cash, where and how much was invested and where to extract and invest next.

Most critically, we provide centralized information that gives the right representation of what is available in the organization and prepares for swift processing of incoming and outgoing payments.

We create a payments strategy that moves liquidity intelligently and unlocks more value from cash through advanced real-time currency optimization and global connectivity.

Vivek Chikballapur

Lead Liquidity Products Solution Specialist

Engineering client benefits

This is all underpinned by our client service model. We think of implementations, service and operations as one cohesive experience and our teams and technology are connected at each step, across the globe.

And our solution isn’t one-size fits all.

This means your experience with us is flexible to your goals, personalized, and not only answers your questions today, but sets you up for the future. Our keys to success include planning, testing, tracking and transparent communication with you, so you know what to expect and rest assured details are cared for, issues are prevented and quickly resolved.

Our product solution specialists are here for you around the clock and around the globe to ensure your goals are met and you deliver on your treasury objectives.

Connect with your J.P. Morgan representative to find the right Liquidity & Account Solutions for your business

Implementing a true global intraday liquidity platform

Accelerating change was critical for J.P. Morgan client Dana, who were eager to unlock the value of their global liquidity hampered by a fragmented banking landscape and legacy platforms.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of J.P. Morgan, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed to be reliable. Neither the author nor J.P. Morgan makes any representations or warranties as to the information’s accuracy or completeness. The information contained herein has been provided solely for informational purposes and does not constitute an offer, solicitation, advice or recommendation, to make any investment decisions or purchase any financial instruments, and may not be construed as such.

JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.