4 min read

Key takeaways

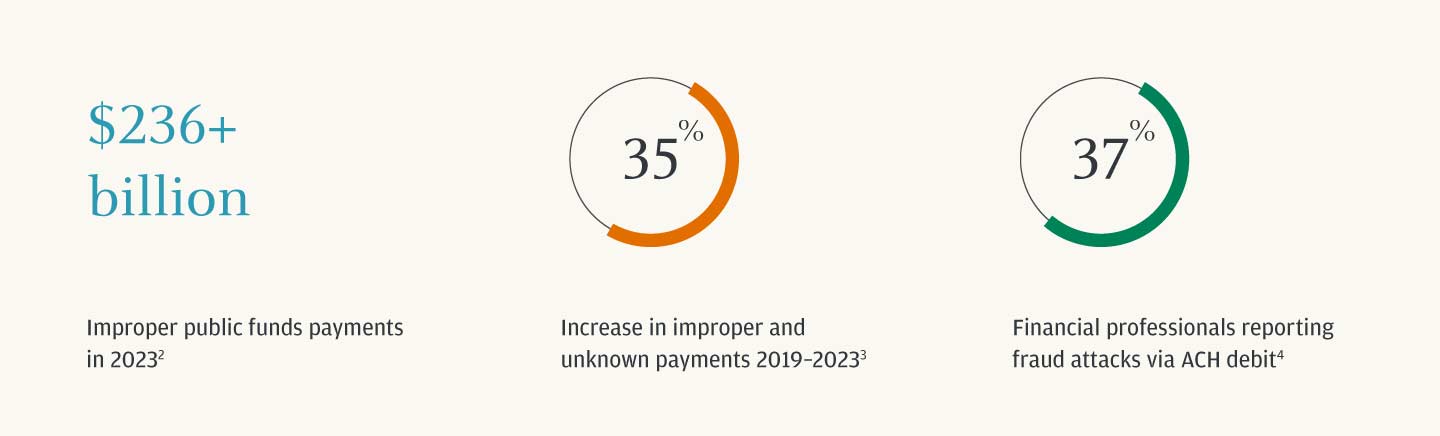

- Fraudsters are increasingly focusing their attention on government agencies and the funds they provide

- Agencies, many with legacy systems, are falling prey to these attacks. It is essential that government/state-owned enterprises evaluate the risks and manage them effectively

- By implementing cutting-edge, data-driven solutions to your platforms, you can help strengthen security and enhance operational efficiency

As the digital age advances, it is projected that global cashless transactions will surge to $3 billion by 2030.1 This evolution brings with it increasingly complex fraud schemes, which present a significant challenge that must be met with equally advanced fraud prevention strategies.

Financial management leaders of federal agencies stand on the front lines of this battle, charged with the critical task of advocating for and implementing cutting-edge fraud prevention measures to help safeguard public funds. Here are four compelling reasons why those federal agency leaders must help lead the charge in adopting these solutions.

Improve public service delivery and trust

One of the main responsibilities of a federal agency is maintaining the trust of the citizens it serves. Advanced fraud prevention measures, like account validation and identity verification services, are pivotal in this regard.

By streamlining processes—such as onboarding while proactively preventing fraud—you not only enhance the efficiency of public service delivery, but also increase the trust citizens place in federal services. When onboarding is expedited by leveraging data and industry solutions to validate key data points at enrollment, the citizens’ interaction with government services becomes more seamless and secure.

Modernize legacy systems seamlessly

Today, a financial management leader’s responsibilities include integrating new technologies into the existing government infrastructure. It is important that the adoption of modern fraud prevention tools does not disrupt operations.

By ensuring that tools, like API-based security technologies, can be integrated with legacy systems, you can maintain operational continuity, while setting the stage for future technological advancements. Plus, this strategic foresight prevents the accumulation of tech debt, thereby safeguarding the government’s technological agility.

Facilitate streamlined implementation

The practical aspects of introducing new fraud solutions into an agency’s workflow is a critical area of focus for a public sector financial manager. Clear, actionable timelines and well-defined resource allocations are important to achieve successful implementations. Autonomous solutions that mitigate the burden on IT departments are particularly beneficial. They allow the focus to remain on strategic initiatives rather than becoming mired in the details of daily operational tasks.

In addition, solutions that can operate outside of the traditional IT structures, such as cloud-based services, allow you to streamline implementation and reduce the impact on existing staff workloads.

“Offering and supporting more digital payments means that public sector organizations must also specifically prepare for and safeguard against new and increasing vectors of payment fraud to support their missions responsibly.”

Grayson Hahnstadt

Executive Director, Payments Sales Manager, Public Sector, J.P. Morgan Payments

Partner with an experienced provider

The selection of a solution provider is a decision that requires careful deliberation. It is essential for you to partner with a provider that has a proven track record delivering for the public sector, ongoing technological investment in their solutions, and the capability to drive efficient implementations so as not to burden existing operations.

Providers must also be able to meet the unique demands of your agency today, as well as anticipate your needs for the future, to ensure a targeted approach to fraud prevention. Forward-thinking providers who are capable of adapting to the evolving landscape of fraud prevention will prove to be invaluable allies in the ongoing fight against fraud.

The bottom line

By leveraging these convincing reasons, federal agency financial management leaders can effectively spearhead the charge for the adoption of new fraud solutions within their agencies. And with their implementation, you can help strengthen security measures, controls and enhance operational efficiency, thereby achieving more responsible payment practices and helping to safeguard taxpayer funds from fraud.

By championing these solutions, you can help ensure that your agency remains vigilant and well-prepared to face future challenges, preserving the trust and integrity that is the cornerstone of public service.

References

Navigating the payments matrix: Payments 2025 and beyond, PwC, May 7, 2021

Improper Payments, U.S. Government Accountability Office

Federal Government Made $236 billion “Improper Payments” Last Fiscal Year, U.S. Government Accountability Office, March 26, 2024

“2022 AFP Payments Fraud and Control Report,” Association for Financial Professionals