For Companies and Institutions

-

Commercial Banking

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

-

Global Corporate Banking

We help clients achieve their long-term strategic goals through financing, liquidity, payments, risk management and investment banking solutions.

-

Investment Banking

Providing investment banking solutions, including M&A, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Institutional Investing

We support the entire investment cycle with market-leading research, asset management, analytics, execution, and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

For Individuals

-

Wealth Management

With J.P. Morgan Wealth Management, you can invest on your own or work with an advisor to design a personalized investment strategy. We have opportunities for every investor.

-

Private Bank

A uniquely elevated private banking experience shaped around you.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Insights

- Payments

- Payment Trends & Innovation

- J.P. Morgan Payment Trends Report: Key trends to drive your payments strategy

By Doug Smith

Executive Director, J.P. Morgan Merchant Services

By Paul Sammer

Vice President, J.P. Morgan

By Doug Smith , Paul Sammer

As the pandemic changed everything about daily life in the past year, merchants learned to pivot quickly. They developed and accelerated new ways to engage with consumers, who responded with enthusiasm. There are now more ways than ever to pay, a trend that will continue in 2021, as payments become increasingly seamless, embedded and contextual.

Here's a summary of our findings:

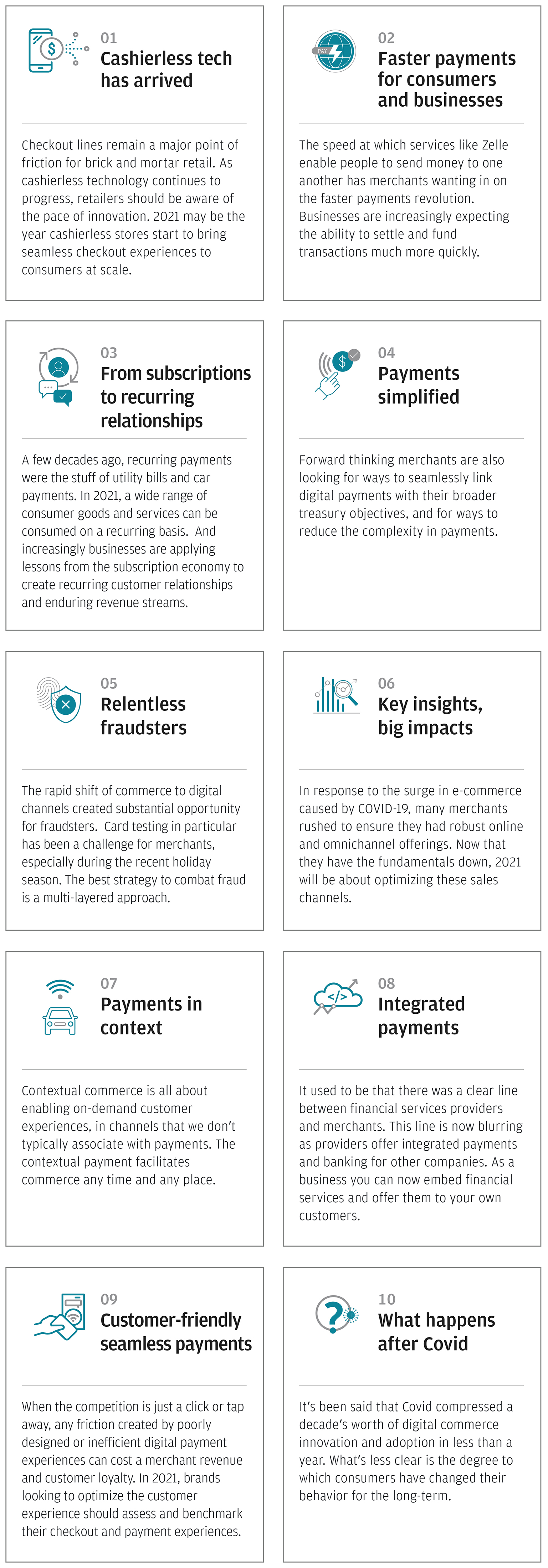

Key trends to drive yours payment strategy

1. Cashierless tech has arrived Checkout lines remain a major point of friction for brick and mortar retail. As cashierless technology continues to progress, retailers should be aware of the pace of innovation. 2021 may be the year cashierless stores start to bring seamless checkout experiences to consumers at scale.

2. Faster payments for consumers and businesses The speed at which services like Zelle enable people to send money to one another has merchants wanting in on the faster payments revolution. Businesses are increasingly expecting the ability to settle and fund transactions much more quickly.

3. From subscriptions to recurring relationships A few decades ago, recurring payments were the stuff of utility bills and car payments. In 2021, a wide range of consumer goods and services can be consumed on a recurring basis. And increasingly businesses are applying lessons from the subscription economy to create recurring customer relationships and enduring revenue streams.

4. Payments simplified Forward thinking merchants are also looking for ways to seamlessly link digital payments with their broader treasury objectives, and for ways to reduce the complexity in payments.

5. Relentless fraudsters The rapid shift of commerce to digital channels created substantial opportunity for fraudsters. Card testing in particular has been a challenge for merchants, especially during the recent holiday season. The best strategy to combat fraud is a multi-layered approach.

6. Key insights, big impacts In response to the surge in e-commerce caused by COVID-19, many merchants rushed to ensure they had robust online and omnichannel offerings. Now that they have the fundamentals down, 2021 will be about optimizing these sales channels.

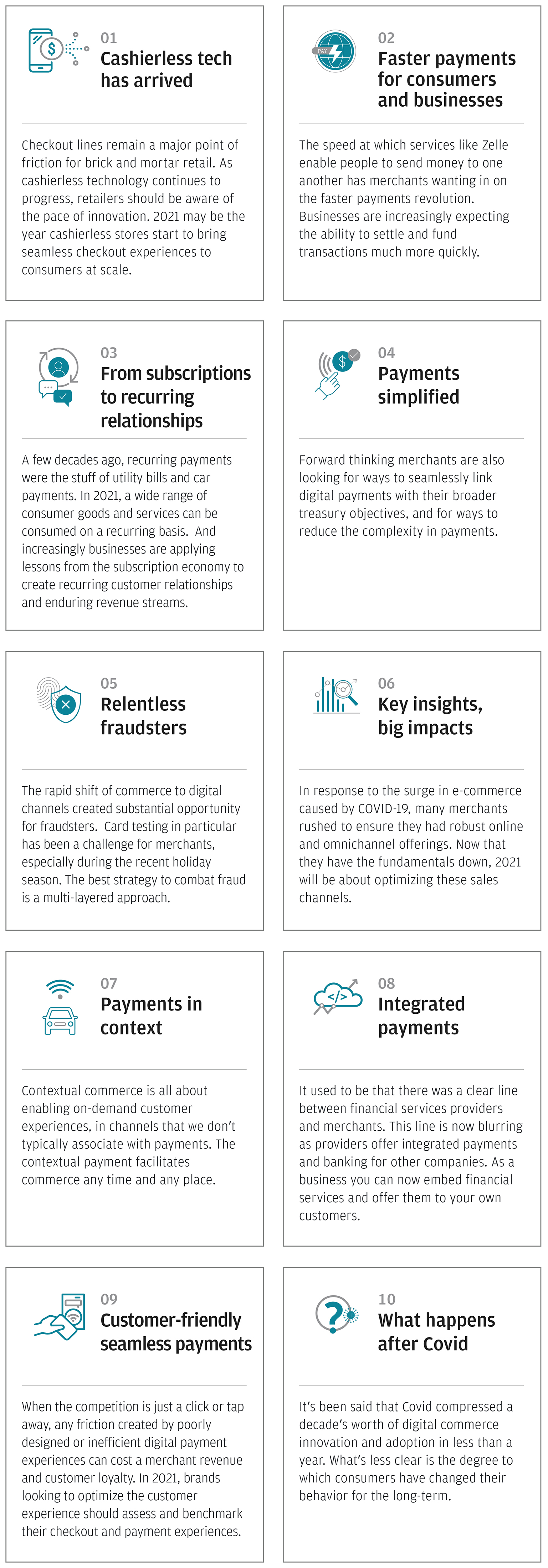

7. Payments in context Contextual commerce is all about enabling on-demand customer experiences, in channels that we don’t typically associate with payments. The contextual payment facilitates commerce any time and any place.

8. Integrated payments It used to be that there was a clear line between financial services providers and merchants. This line is now blurring as providers offer integrated payments and banking for other companies. As a business you can now embed financial services and offer them to your own customers.

9. Customer-friendly seamless payments When the competition is just a click or tap away, any friction created by poorly designed or inefficient digital payment experiences can cost a merchant revenue and customer loyalty. In 2021, brands looking to optimize the customer experience should assess and benchmark their checkout and payment experiences.

10. What happens after Covid It’s been said that Covid compressed a decade’s worth of digital commerce innovation and adoption in less than a year. What’s less clear is the degree to which consumers have changed their behavior for the long-term.

Do you have an effective digital payment strategy?

Consumers want the ability to make transactions whenever and wherever they prefer – and to do so without worrying about fraud or other security threats. However, staying on the leading edge of payments can be resource-intensive for engineering and IT teams. J P. Morgan’s flexible payment APIs and scalable cloud platforms can help businesses maintain best-in-class capabilities without dedicating excessive resources to managing the complexity behind payments.

As a global provider of innovative payment and treasury solutions, J.P. Morgan is helping the world’s most successful brands accelerate digital transformation and enhance their ability to create and grow value.

For more insights, access our full Payment Trend Report

To learn more, please contact your J.P. Morgan representative.

Contributors

Doug Smith

Executive Director, J.P. Morgan Merchant Services

Paul Sammer

Vice President, J.P. Morgan

Related insights

Payments

How Klook optimized cross-border & FX payments with J.P. Morgan

Jan 28, 2026

With a tailored API-powered FX platform from J.P. Morgan Payments, Klook now delivers streamlined, real-time cross-border payments—empowering travelers and merchants worldwide.

Payments

J.P. Morgan Payments and Docker foster autonomy and problem-solving within developer communities

Jan 15, 2026

Developers need easy and secure access to a rich ecosystem of tools and solutions in order to approach and solve challenges.

Payments

Strategic insights: Navigating the future of payments

Jan 07, 2026

Explore how emerging payment technologies—from real-time rails to biometrics—are reshaping business agility, security and client experience.

Payments

Cargill and J.P. Morgan Payments transform agricultural payments in Brazil

Dec 15, 2025

Learn how the global agricultural leader is supporting financial stability for farmers with real-time payments.

Payments

We’re putting developers in the driver’s seat

Dec 05, 2025

Discover the J.P. Morgan Payments Developer Portal, where you can access APIs, tools, and resources to help build secure and robust treasury and payment solutions.

Payments

Plan for the holiday season ahead: How shoppers are redefining retail expectations

Nov 21, 2025

Recent Customer Insights data shows Gen Z is driving new trends in retail, payment preferences and omnichannel shopping. Retailers who adapt to these evolving habits may be better positioned to benefit from future spending this holiday season.

Payments

Bridging the gap: G20's vision for inclusive and efficient global payments

Nov 18, 2025

The G20 and Financial Stability Board, supported by key industry players like J.P. Morgan, are focused on improving cross-border payments by making them faster, cheaper, more transparent and more accessible.

Payments

JDS Industries unlocks 10% savings and 50% faster processing with J.P. Morgan

Nov 05, 2025

Discover how JDS Industries leveraged J.P. Morgan Commerce Solutions to streamline operations and drive strategic growth.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.