Key takeaways

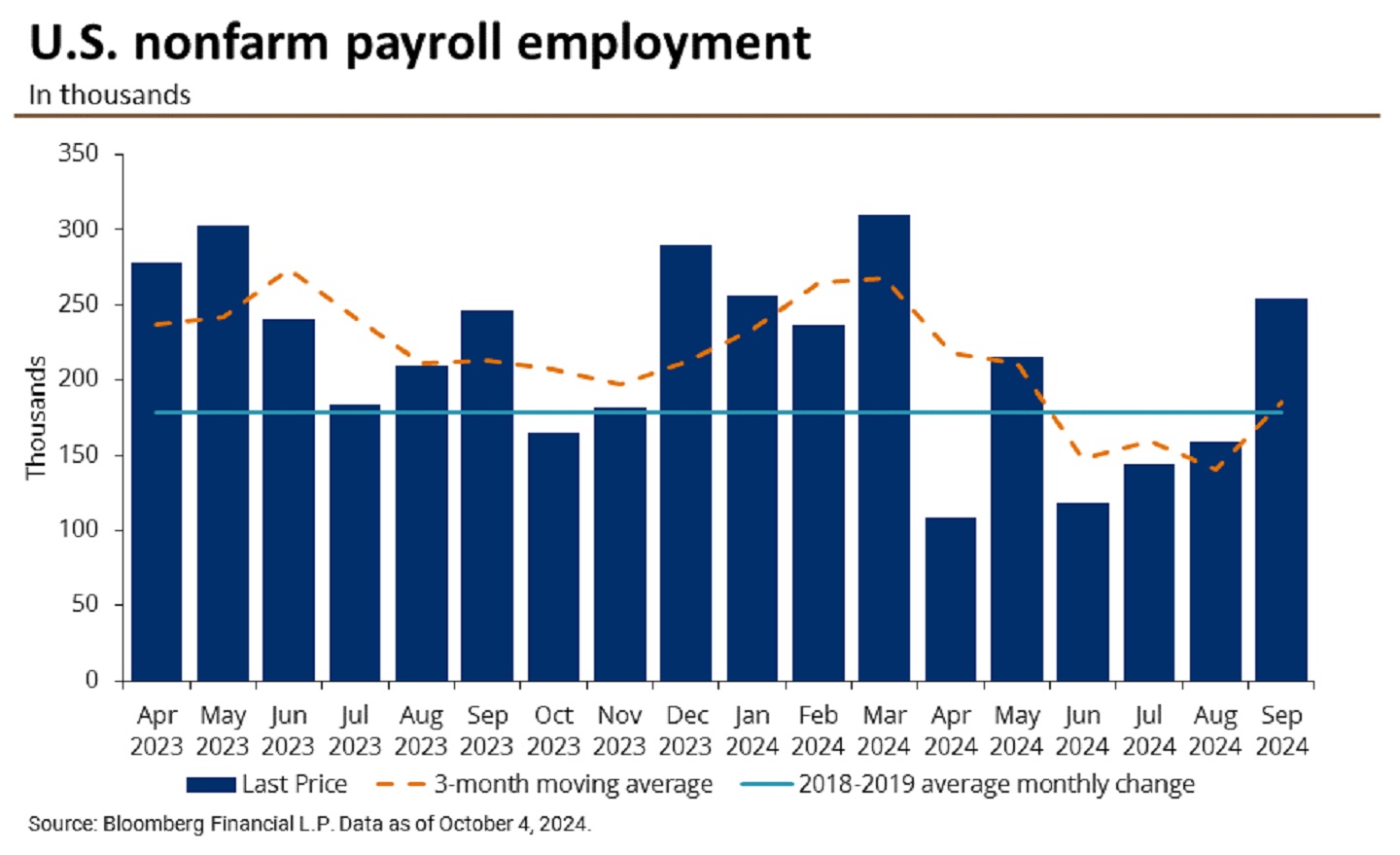

- The U.S. economy added 254,000 jobs in September 2024, exceeding expectations for 142,500. The July and August jobs reports were also revised higher, up 55,000 and 17,000, respectively. This upside surprise defies fears that the labor market is breaking.

- The unemployment rate fell to 4.1% from 4.2% in August, reiterating our strategists’ view that the Sahm rule, a recession indicator, is sending a false alarm.

- Wage growth rose by a firm 0.4% month-over-month and 4% year-over-year. However, our strategists currently aren’t very concerned about the inflation implications of firming wage growth.

- The September jobs report underscores our strategists’ calls for a soft economic landing and a gradual pace of Federal Reserve rate cuts from here.

Contributors

Associate, Wealth Planning & Advice

The solid September employment report reveals a positive close for the third quarter of 2024, with a rise in payroll additions, a downtick in the unemployment rate and solid wage gains.1 Our strategists think the data supports their expectation for a soft economic landing.

According to the Bureau of Labor Statistics (BLS), the U.S. economy added 254,000 jobs in September 2024, exceeding expectations for 142,500. The July and August jobs reports were also revised higher, up 55,000 and 17,000 respectively.2 These upside surprises defy fears that the labor market is breaking.

These upward revisions raise the three-month moving average pace of jobs growth to 186,000 from 116,000 the prior month,3 reiterating the economy remains strong.

Industry breakdown

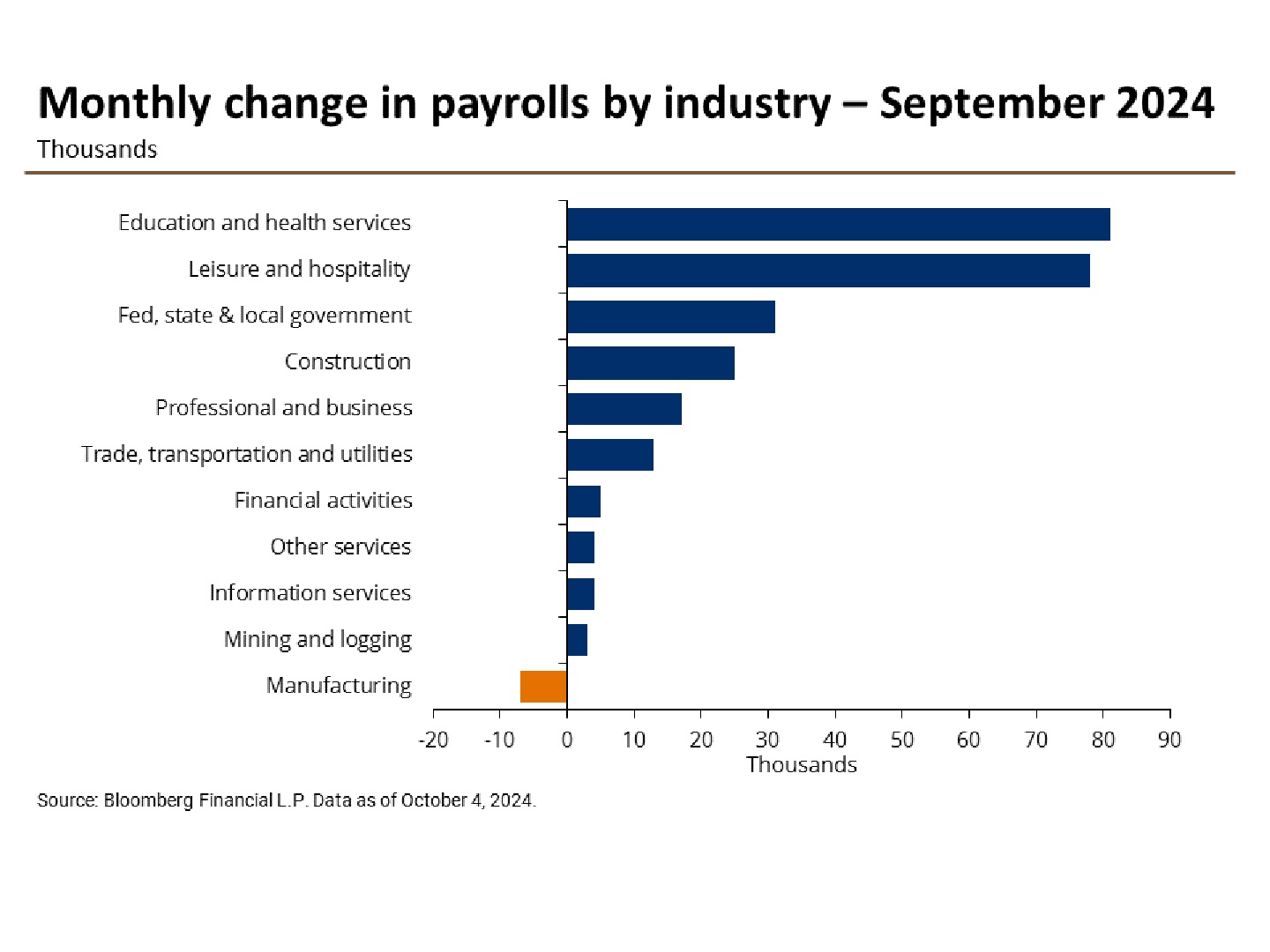

The breadth of nonfarm payroll growth markedly improved in September, with the diffusion index rising to 57.6 from a local low of 49.2 in July.4

Job growth was primarily driven by gains in the leisure and hospitality (+78,000) sector, which posted the strongest monthly print since January 2023. Within that sector, food services and drinking places (+69,000) rose significantly higher than the past twelve months.5

Employment growth was additionally fueled by solid gains in education and health care (+45,000), government (+31,000), social assistance (+27,000) and construction (+25,000). Elsewhere, other sectors showed little payroll changes, including the mining, oil and gas extraction and manufacturing sectors.6

Unemployment rate ticked down

The unemployment rate fell to 4.1% in September from 4.2% in August. While the rate remains above the 3.8% unemployment rate from a year ago,7 the downtick eases concerns of a sharp slowdown in the labor market.

The number of jobless claims fell, while the number of long-term unemployment was little changed. The number of people working part-time due to economic reasons and people that aren’t in the labor market but looking for roles were both little changed in September. Within the latter group, there was a 204,000 increase in workers who had been looking for work the past 12 months but haven’t continued to search in the past four weeks.8

The labor force participation rate held steady at 62.7% for the third straight month, as the prime age employment ratio (i.e., workers aged 25 to 54) remained unchanged at the cycle high of 80.9, which is above its pre-pandemic ratio.9

The 4.1% unemployment rate and overall strong labor market data reiterates our view that the labor market is not breaking. This, in turn, affirms our strategists’ view that the Sahm rule, a recession indicator, is sending a false alarm.10

Wage growth accelerated while average hours worked eased

Wage growth came in slightly above forecasts, with average hourly earnings up by 0.4% month-over-month and 4% year-over-year.11 However, our strategists currently aren’t very concerned about the inflation implications of firming wage growth. Market risks have been skewed towards a hard landing outcome rather than a “no landing” outcome, and recent data on productivity has come in solidly. Real wage growth may continue to benefit from this.

Average hours worked in a week declined to 34.2 in September from 34.3 in August. The average workweek was unchanged in manufacturing, while overtime declined by 0.1 hour, and unchanged in production and nonsupervisory employees.12

It doesn’t look as though there were any obvious distortions in the September employment data. The survey reference week was September 8–14. Following that period, Hurricane Helene hit North Carolina and Tennessee and the three-day dockworkers’ strike paused trade on the U.S. East and Gulf coasts. Unfortunately, the hurricane has caused much heartache and destruction across the Southeast, and we express our deepest sympathies to those affected. We expect the October employment report to reflect the toll of these events.

Job openings rebounded to three-month high

The number of job openings rose to 8.04 million in August, up from 7.71 million in July, highlighting that the labor market is stronger than expected. This rebound to a three-month high was driven by the largest rise in construction openings since 2029 and a sharp rise in local government sector openings.13

Rate implications

The Fed delivered its first rate cut in four years at its September Federal Open Market Committee (FOMC) meeting in response to the progress on its dual mandate to restore prices and achieve maximum employment. The Fed acknowledge it now views the labor market as a bigger risk factor than inflation, which is notably closer to the Fed’s 2% target. The Fed’s own projections expressed the potential for further cuts this year.14

We view the September’s jobs data as a welcome report for the Fed, as it demonstrates the economy’s resilience and supports our expectation that the Fed will gradually cut rates from here. Our strategists expect the Fed will lower rates by 25 basis points at the next FOMC meeting on November 6–7.

The bottom line

Going forward, the Fed will carefully assess upcoming data prints. The September Consumer Price Index report (set for release on October 10), the Personal Consumption Expenditures (PCE) deflator (set for release on October 31) and the October jobs report (set for release on November 1), will likely play large roles in the Fed’s decision-making.

References

Bureau of Labor Statistics (BLS), “The Employment Situation—September 2024.”

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Federal Reserve Bank of St. Louis, “Sahm Rule Recession Indicator.”

Bureau of Labor Statistics (BLS), “The Employment Situation – September 2024.”

Ibid.

BLS, “August Job Openings and Labor Turnover Summary.” (October 2024)

Federal Reserve, “Federal Reserve issues FOMC statement.”

Connect with a Wealth Advisor

Reach out to your Wealth Advisor to discuss any considerations for your current portfolio. If you don’t have a Wealth Advisor, click here to tell us about your needs and we’ll reach out to you.

IMPORTANT INFORMATION

This material is for informational purposes only, and may inform you of certain products and services offered by J.P. Morgan’s wealth management businesses, part of JPMorgan Chase & Co. (“JPM”). Products and services described, as well as associated fees, charges and interest rates, are subject to change in accordance with the applicable account agreements and may differ among geographic locations. Not all products and services are offered at all locations. If you are a person with a disability and need additional support accessing this material, please contact your J.P. Morgan team or email us at accessibility.support@jpmorgan.com for assistance. Please read all Important Information.

GENERAL RISKS & CONSIDERATIONS. Any views, strategies or products discussed in this material may not be appropriate for all individuals and are subject to risks. Investors may get back less than they invested, and past performance is not a reliable indicator of future results. Asset allocation/diversification does not guarantee a profit or protect against loss. Nothing in this material should be relied upon in isolation for the purpose of making an investment decision. You are urged to consider carefully whether the services, products, asset classes (e.g. equities, fixed income, alternative investments, commodities, etc.) or strategies discussed are suitable to your needs. You must also consider the objectives, risks, charges, and expenses associated with an investment service, product or strategy prior to making an investment decision. For this and more complete information, including discussion of your goals/situation, contact your J.P. Morgan representative.

NON-RELIANCE. Certain information contained in this material is believed to be reliable; however, JPM does not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. No representation or warranty should be made with regard to any computations, graphs, tables, diagrams or commentary in this material, which are provided for illustration/reference purposes only. The views, opinions, estimates and strategies expressed in this material constitute our judgment based on current market conditions and are subject to change without notice. JPM assumes no duty to update any information in this material in the event that such information changes. Views, opinions, estimates and strategies expressed herein may differ from those expressed by other areas of JPM, views expressed for other purposes or in other contexts, and this material should not be regarded as a research report. Any projected results and risks are based solely on hypothetical examples cited, and actual results and risks will vary depending on specific circumstances. Forward-looking statements should not be considered as guarantees or predictions of future events.

Nothing in this document shall be construed as giving rise to any duty of care owed to, or advisory relationship with, you or any third party. Nothing in this document shall be regarded as an offer, solicitation, recommendation or advice (whether financial, accounting, legal, tax or other) given by J.P. Morgan and/or its officers or employees, irrespective of whether or not such communication was given at your request. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions.

Legal Entity and Regulatory Information.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

This document may provide information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC (“JPMS”). The agreements entered into with JPMS, and corresponding disclosures provided with respect to the different products and services provided by JPMS (including our Form ADV disclosure brochure, if and when applicable), contain important information about the capacity in which we will be acting. You should read them all carefully. We encourage clients to speak to their JPMS representative regarding the nature of the products and services and to ask any questions they may have about the difference between brokerage and investment advisory services, including the obligation to disclose conflicts of interests and to act in the best interests of our clients.

J.P. Morgan may hold a position for itself or our other clients which may not be consistent with the information, opinions, estimates, investment strategies or views expressed in this document. JPMorgan Chase & Co. or its affiliates may hold a position or act as market maker in the financial instruments of any issuer discussed herein or act as an underwriter, placement agent, advisor or lender to such issuer.