Elevated banking services

Tailored for high-net-worth and ultra-high-net-worth clients, you can access customized banking services to cover your every day expenses or the cash allocation you need in your long-term investment portfolio with the personalized support of your Wealth Advisor.

Banking that complements your overall wealth strategy

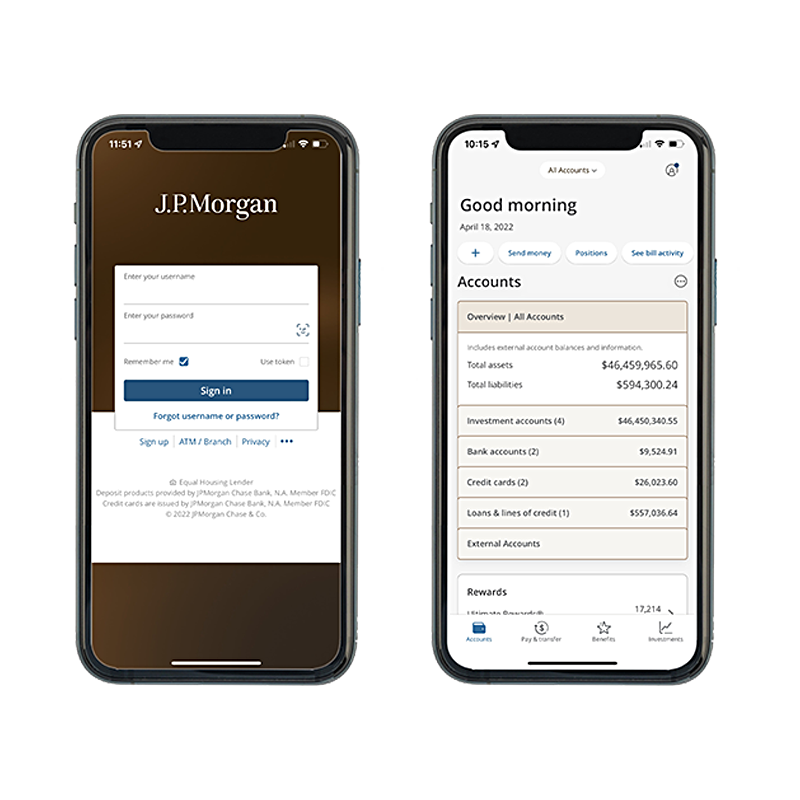

At. J.P. Morgan, your Wealth Advisor offers a comprehensive approach to your wealth by bringing your banking, planning, and investing into one view - all with a personalized focus on your unique lifestyle and aspirations.

Banking that follows your lead with guidance from your wealth advisor

Banking that follows your lead with guidance from your wealth advisor

Personal banking

Access checking, savings and CDs customized to your unique needs, with convenient access to funds from anywhere and real-time support for special requests.

Business banking

Optimize your operating cash on a business banking platform built for passive entities with limited monthly transactions, like trusts and LLCs.

Experienced Banking Service Team

Our dedicated service team will help you transition your accounts, as well as assist with account inquiries and day-to-day transactions.

Committed to security and stability

With J.P. Morgan, you can feel comforted knowing that your assets are protected. We continue to invest in robust cybersecurity and fraud protection, and our fortress balance sheet has held strong through various market cycles

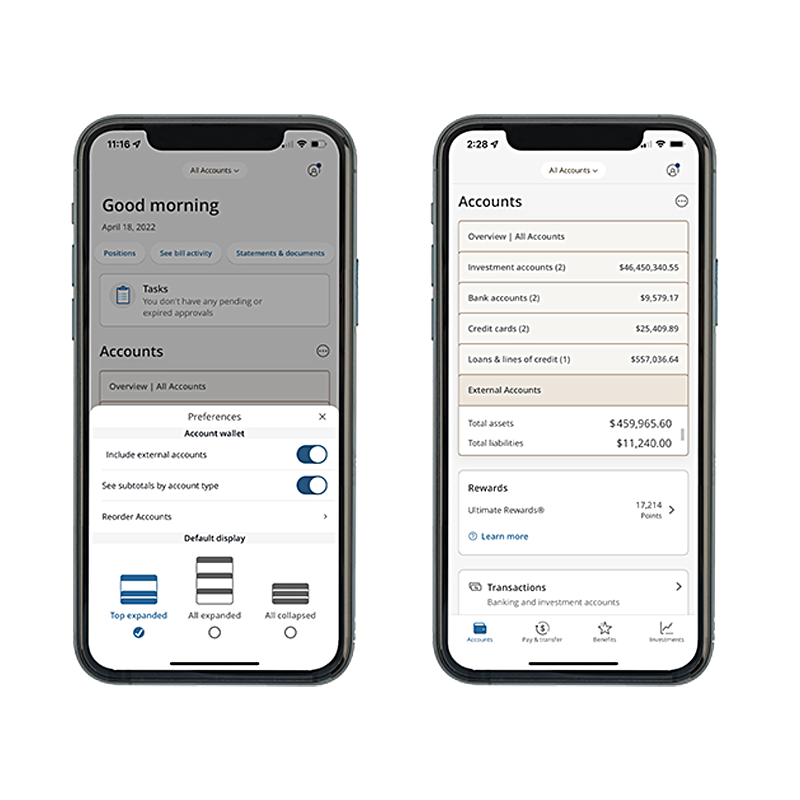

Secure digital tools

Manage your day-to-day finances, monitor your portfolio and set up additional account protection to help you safeguard your assets.

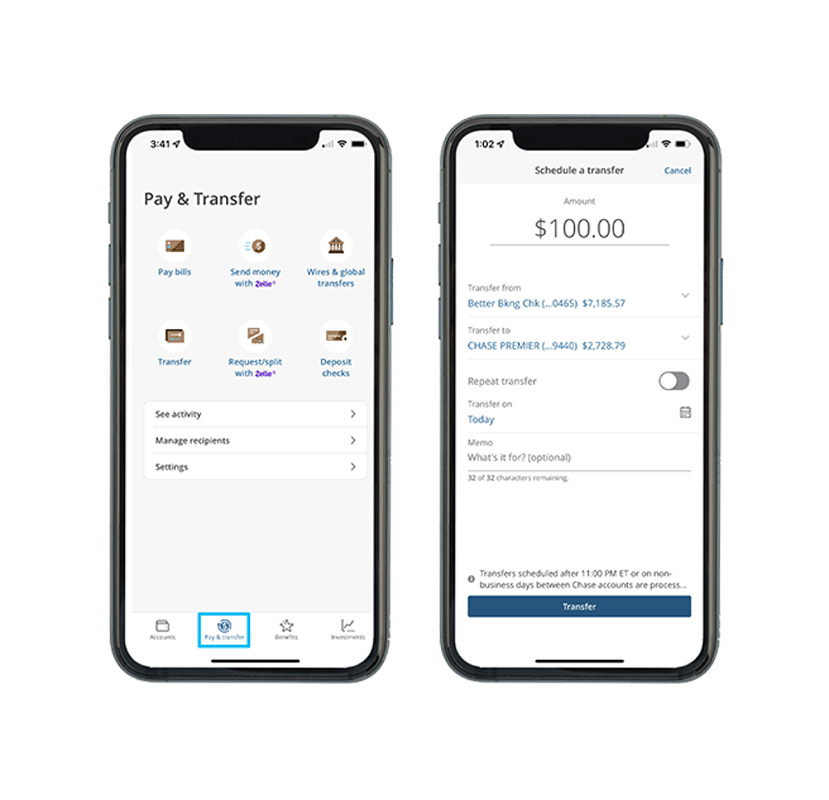

Move money instantly

See your activity, and balances from any device, and move funds from one account to another with J.P. Morgan Online and the J.P. Morgan Mobile app.

- Set up autopay, pay multiple bills all at once, and manage payees with ease.

- See FX rates in real time and send wires quickly within the United States or internationally.

Access your portfolio anywhere, anytime

Monitor how your portfolio is performing over time, and stay on top of market trends to help you make investment decisions informed by our proprietary data and award-winning research.

- Set up watchlists for U.S. traded securities, and find mutual funds, ETFs and stocks that may support your goals.

- View your alternative investments in a dedicated portal and see details on your positions and transactions.

Help safeguard yourself and your accounts

We continually monitor your accounts for any unusual activity and provide expert support to help you detect and deal with fraud, scams and cyber crime.

- Access tools in our Security Center to set up alerts, manage who has access to your accounts and more.

- Receive free identify monitoring with Credit Journey and get notified if we detect potential data breaches or changes to your credit report.

Cybersecurity

Parents, you need to teach your kids about financial fraud

Oct 23, 2025

With the increasing complexity of fraud schemes, it’s important your kids understand how to keep their accounts and personal information safe.

Read more

Start a conversation

Our partnership begins by getting to know you personally. To get started, you can search our network to find a Wealth Advisor to work with locally or virtually, or click here to tell us about your needs and we’ll reach out to you.

Explore more services

Explore more services

Lasting family wealth

Our seasoned specialists help support your family dynamics and governance, philanthropy, lifestyle and family office needs.

Holistic investment management

Your Wealth Advisor will help you allocate your assets, navigate

market trends and capitalize on investment opportunities that align with your goals and priorities.

Personalized lending solutions

Explore customized financing options and strategies to help you meet liquidity demands and fund large purchases, such as real estate, fine art, yachts and private aviation.

LEARN MORE ABOUT OUR FIRM AND INVESTMENT PROFESSIONALS AT FINRA BROKERCHECK.

To learn more about J.P. Morgan’s investment business, including our accounts, products and services, as well as our relationship with you, please review our J.P. Morgan Securities LLC Form CRS (PDF) and Guide to Investment Services and Brokerage Products.

This website is for informational purposes only, and not an offer, recommendation or solicitation of any product, strategy service or transaction. Any views, strategies or products discussed on this site may not be appropriate or suitable for all individuals and are subject to risks. Prior to making any investment or financial decisions, an investor should seek individualized advice from a personal financial, legal, tax and other professional advisors that take into account all of the particular facts and circumstances of an investor's own situation.

This website provides information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC (JPMS). When JPMS acts as a broker-dealer, a client's relationship with us and our duties to the client will be different in some important ways than a client's relationship with us and our duties to the client when we are acting as an investment advisor. A client should carefully read the agreements and disclosures received (including our Form ADV disclosure brochure, if and when applicable) in connection with our provision of services for important information about the capacity in which we will be acting.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA, and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Investments in alternative investment strategies is speculative, often involves a greater degree of risk than traditional investments including limited liquidity and limited transparency, among other factors and should only be considered by sophisticated investors with the financial capability to accept the loss of all or part of the assets devoted to such strategies.

Borrowing with securities as collateral involves certain risks, including the possibility that you may need to deposit additional securities and/or cash in the account to meet a maintenance call, and that securities in the account may be sold to meet the maintenance call. Proper management of your account and a thorough understanding of the conditions that may affect your investments will assist you in effectively using the margin lending program.

Please read additional Important Information in conjunction with these pages.

INVESTMENT AND INSURANCE PRODUCTS ARE:

• NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED