Key takeaways

- The Bureau of Labor Statistics (BLS) reported that the U.S. economy added 114,000 jobs in July 2024, a sharp slowdown from June.

- The unemployment rate ticked up to 4.3% in July from 4.1% in June, the highest level since October 2021, signaling the labor market is continuing to cool. This should position the Fed to begin easing policy by September.

- Average hourly earnings rose by a softer 0.2% month-over-month (MoM) and 3.6% year-over-year (YoY), reflecting inflationary pressures are easing.

- The July jobs report underscores that the labor market is moderating, making a September interest rate cut from the Federal Reserve even more likely.

A softer labor market

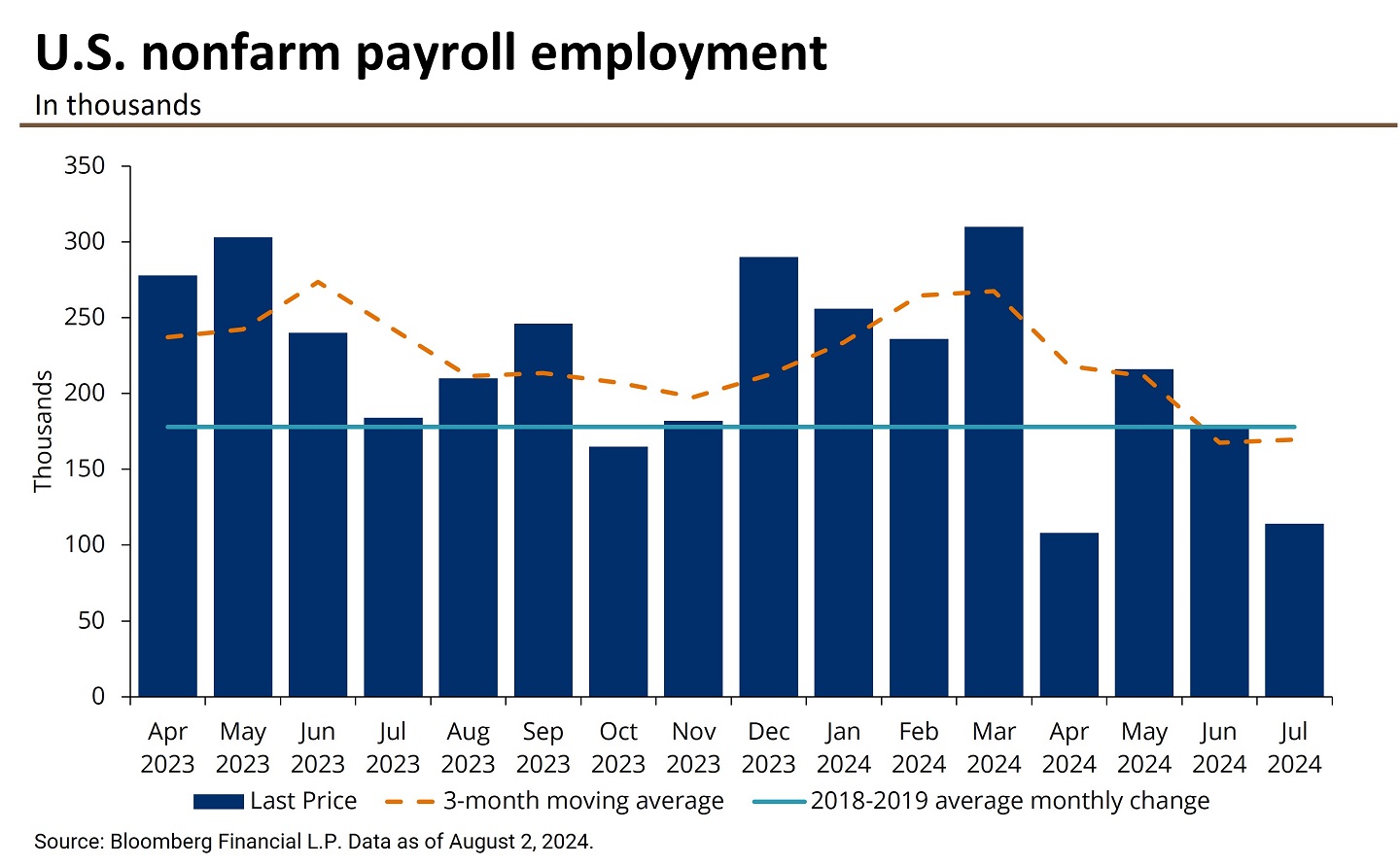

The July 2024 jobs report shows signs that the labor market is cooling down but remains stable. The U.S. labor market added 114,000 jobs in July, much lower than expected and the 179,000 rise in June. Payroll gains were revised down in June by 27,000 to 179,000 and May by 2,000 to 216,000.1

July’s nonfarm payroll gains bring the three-month average employment gain to 170,000, slightly lower than previously reported.2 This highlights that restrictive Federal Reserve policy is cooling the pace of job growth.

Industry breakdown

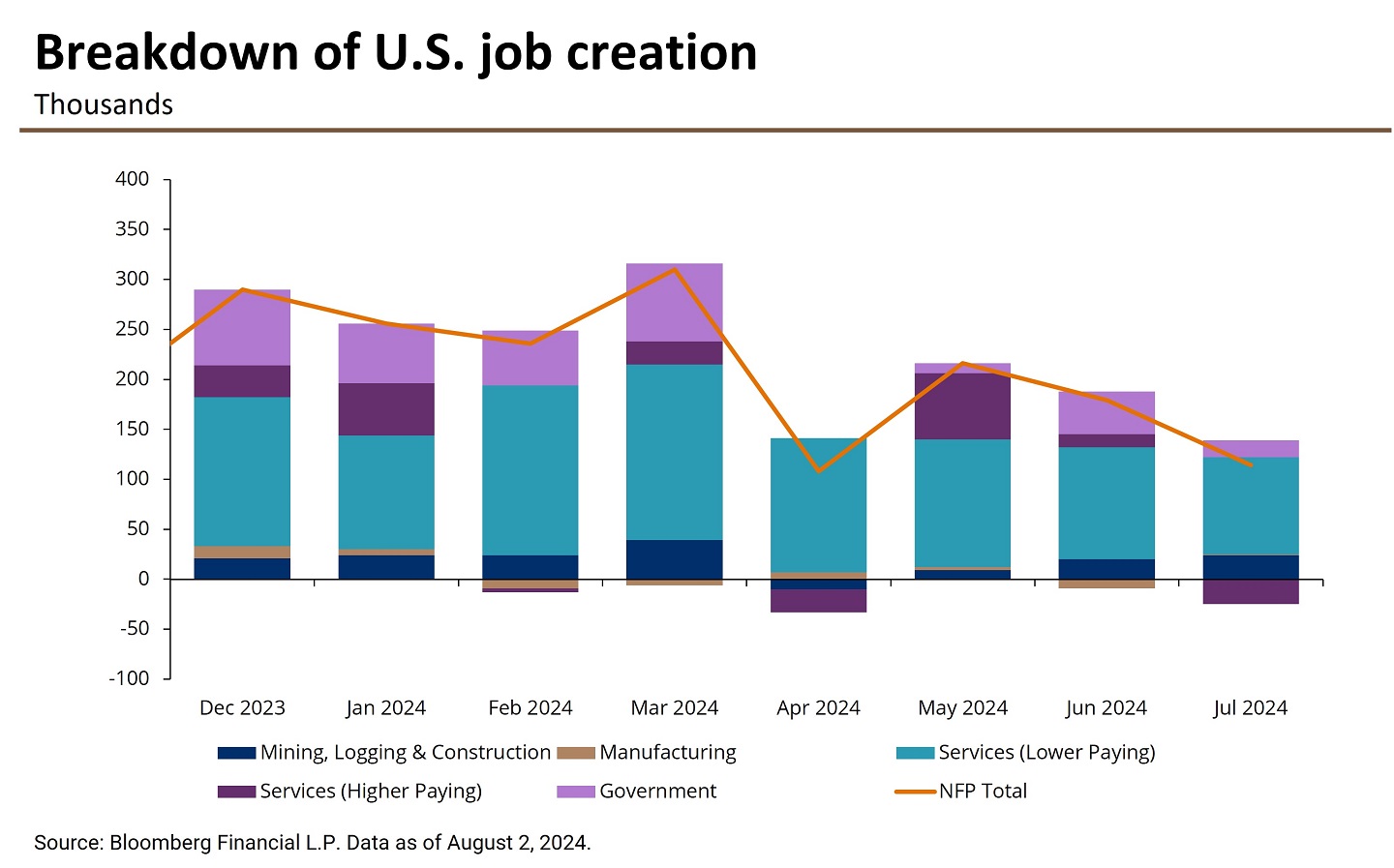

Job growth was mostly broad-based in July, with health care (+55,000), construction (+25,000) and transportation and warehousing (+14,000) jobs accounting for a majority of the total job gains.3

Health care jobs were driven upward by strong gains in home health care services, nursing and residential care facilities. Specialty trade contractors continued to boost construction jobs, while job gains were seen in the couriers and messengers, and warehousing storage fueled transportation sectors. These gains offset a loss in transit and ground passenger transportation.4

Private sector employment increased by 97,000, the slowest pace of job growth since March 2023. Meanwhile, government jobs were little changed (+17,000) as they continue to slow from their 2023 and early 2024 highs. Job gains were little changed among the mining, manufacturing and leisure and hospitality industries. Employment declined largely by 20,000 in information jobs,5 partially offsetting the total job gains.

Unemployment rate

The unemployment rate ticked up to 4.3% in July from 4.1% in June, the highest level since October 2021, signaling the labor market is continuing to cool. This should position the Fed to begin easing policy by September.6

The rise in unemployment was driven by a continued robust increase in the labor force, up 420,000, and an increase in the labor force participation rate for prime-age workers to 84%,7 the highest level since 2001. The rise in prime-age workers (i.e., 25 to 54 years old) suggests that the labor market is in better shape than the unemployment rate indicates, as during a recession prime-age workers typically become discouraged and leave the labor force.

While the number of unemployed individuals rose by a sharp 352,000 in July, 249,000 of those individuals were temporarily laid off. 8 Layoffs related to Hurricane Beryl may have partially contributed to these temporary layoffs; despite the hurricane’s heavy emotional toll, it likely did not have much impact on the broader labor market data in July.

Average hourly earnings and job openings

The preliminary reading for the July average hourly earnings data, an important measure for inflation, rose by a softer 0.2% month-over-month (MoM) and 3.6% year-over-year (YoY) in July, down from 3.8% YoY in June, reflecting inflationary pressures are easing. Other measures of wage growth also point to the further slowing of wage gains, suggesting wage growth is trending in the right direction for inflation to fall to the Fed’s 2% target.9

The number of job openings fell to 8.18 million in June from 8.23 million in May according to the BLS Job Openings and Labor Turnover Summary report released the week before last.10 The survey reported the pace of hiring and layoffs both slowed, while the quits rate fell, pointing to a gradual cooling trend in the labor market.

Rate implications

The July jobs report underscores that the labor market is moderating, making a September interest rate from the Fed even more likely.

At July’s Federal Open Market Committee (FOMC) meeting, the Fed unanimously voted to hold policy rates steady for the eighth consecutive time, leaving the federal funds target rate unchanged at 5.25% to 5.5%.11 Fed Chairman Jerome Powell signaled the Fed is leaving the door open to start cutting rates in September, given welcomed progress on its dual mandate of maximum employment and stable prices.

Notably, Powell said the labor market is “normalizing” and “inflation has eased substantially” over the past year, positioning the labor market for a more accommodative stance if needed. The Consumer Price Index (CPI) rose by a weaker 3% in June and eased across the board, a decline from the 3.4% YoY rise in May.12

While Powell said “the time is approaching” for a rate cut and the July 2024 jobs report provides compelling evidence that growth is moderating, our strategists expect the Fed to carefully assess upcoming data prints before making this decision.13 The July inflation report, set to be released on August 14, and the Personal Consumption Expenditures (PCE) deflator (i.e., the Fed’s preferred measure of inflation), set to be released on August 30, will likely play large roles in the Fed’s decision-making moving forward.

References

Bureau of Labor Statistics (BLS), “The Employment Situation—July 2024.”

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

BLS, “June Job Openings and Labor Turnover Summary.” (July 2024)

Federal Reserve, “Federal Reserve issues FOMC statement.”

BLS, “Consumer Price Index – June 2024.”

Board of Governors of the Federal Reserve System, “Speech – Opening Remarks.”

Connect with a Wealth Advisor

Our Wealth Advisors begin by getting to know you personally. To get started, tell us about your needs and we’ll reach out to you.

IMPORTANT INFORMATION

This material is for informational purposes only, and may inform you of certain products and services offered by J.P. Morgan’s wealth management businesses, part of JPMorgan Chase & Co. (“JPM”). Products and services described, as well as associated fees, charges and interest rates, are subject to change in accordance with the applicable account agreements and may differ among geographic locations. Not all products and services are offered at all locations. If you are a person with a disability and need additional support accessing this material, please contact your J.P. Morgan team or email us at accessibility.support@jpmorgan.com for assistance. Please read all Important Information.

GENERAL RISKS & CONSIDERATIONS. Any views, strategies or products discussed in this material may not be appropriate for all individuals and are subject to risks. Investors may get back less than they invested, and past performance is not a reliable indicator of future results. Asset allocation/diversification does not guarantee a profit or protect against loss. Nothing in this material should be relied upon in isolation for the purpose of making an investment decision. You are urged to consider carefully whether the services, products, asset classes (e.g. equities, fixed income, alternative investments, commodities, etc.) or strategies discussed are suitable to your needs. You must also consider the objectives, risks, charges, and expenses associated with an investment service, product or strategy prior to making an investment decision. For this and more complete information, including discussion of your goals/situation, contact your J.P. Morgan representative.

NON-RELIANCE. Certain information contained in this material is believed to be reliable; however, JPM does not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. No representation or warranty should be made with regard to any computations, graphs, tables, diagrams or commentary in this material, which are provided for illustration/reference purposes only. The views, opinions, estimates and strategies expressed in this material constitute our judgment based on current market conditions and are subject to change without notice. JPM assumes no duty to update any information in this material in the event that such information changes. Views, opinions, estimates and strategies expressed herein may differ from those expressed by other areas of JPM, views expressed for other purposes or in other contexts, and this material should not be regarded as a research report. Any projected results and risks are based solely on hypothetical examples cited, and actual results and risks will vary depending on specific circumstances. Forward-looking statements should not be considered as guarantees or predictions of future events.

Nothing in this document shall be construed as giving rise to any duty of care owed to, or advisory relationship with, you or any third party. Nothing in this document shall be regarded as an offer, solicitation, recommendation or advice (whether financial, accounting, legal, tax or other) given by J.P. Morgan and/or its officers or employees, irrespective of whether or not such communication was given at your request. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions.

Legal Entity and Regulatory Information.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

This document may provide information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC (“JPMS”). The agreements entered into with JPMS, and corresponding disclosures provided with respect to the different products and services provided by JPMS (including our Form ADV disclosure brochure, if and when applicable), contain important information about the capacity in which we will be acting. You should read them all carefully. We encourage clients to speak to their JPMS representative regarding the nature of the products and services and to ask any questions they may have about the difference between brokerage and investment advisory services, including the obligation to disclose conflicts of interests and to act in the best interests of our clients.

J.P. Morgan may hold a position for itself or our other clients which may not be consistent with the information, opinions, estimates, investment strategies or views expressed in this document. JPMorgan Chase & Co. or its affiliates may hold a position or act as market maker in the financial instruments of any issuer discussed herein or act as an underwriter, placement agent, advisor or lender to such issuer.