Key takeaways

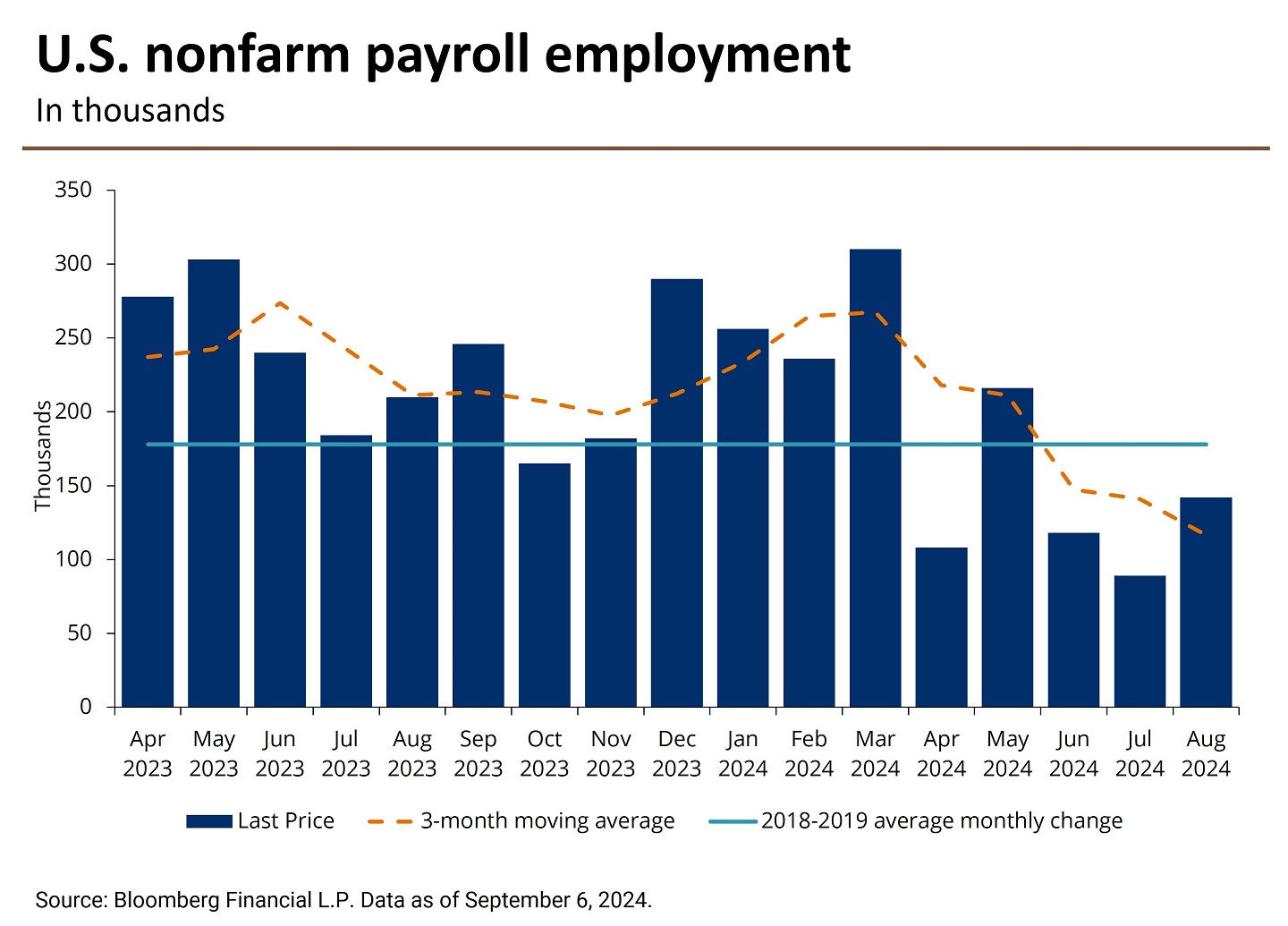

- The Bureau of Labor Statistics (BLS) reported that the U.S. economy added 142,000 jobs in August 2024, 28,000 more than in July. That said, job growth over the prior two months was revised down by 89,000 jobs. Private payrolls increased by 118,000.

- The unemployment rate fell a tenth of a percent to 4.2%, driven by a reversal of the temporary layoffs that were present in the July jobs report.

- Wage growth came in slightly above expectations, up 3.8% year-over-year, which is consistent with Federal Reserve Chairman Jerome Powell’s comments at Jackson Hole that the labor market currently isn’t posing an inflationary threat.

- The August employment report reinforces the view that the U.S. labor market is slowing but not breaking. It also appears that the “hard landing” sell-off following the July jobs report was perhaps an overreaction.

- This leaves the Fed in a position of comfort for a rate cut at the Federal Open Market Committee (FOMC) meeting later this month. Immediately after the print, markets slightly increased the odds of a 50-basis-point move.

Contributors

Associate, Wealth Planning & Advice

The August employment report reinforces the view that the U.S. labor market is slowing but not breaking. It also appears that the “hard landing” sell-off following the July jobs report was perhaps an overreaction.

Nonfarm payrolls missed expectations but increased to a robust 142,000. Private nonfarm payrolls additionally came in stronger than the prior month at 118,000.1

That said, nonfarm payroll gains for June and July were revised down a net 86,000. These downward revisions bring the three-month average employment gain to 116,000.2 This marks the lowest reading since the pandemic when there were outright job losses and underscores our view that economic growth is cooling.

Industry breakdown

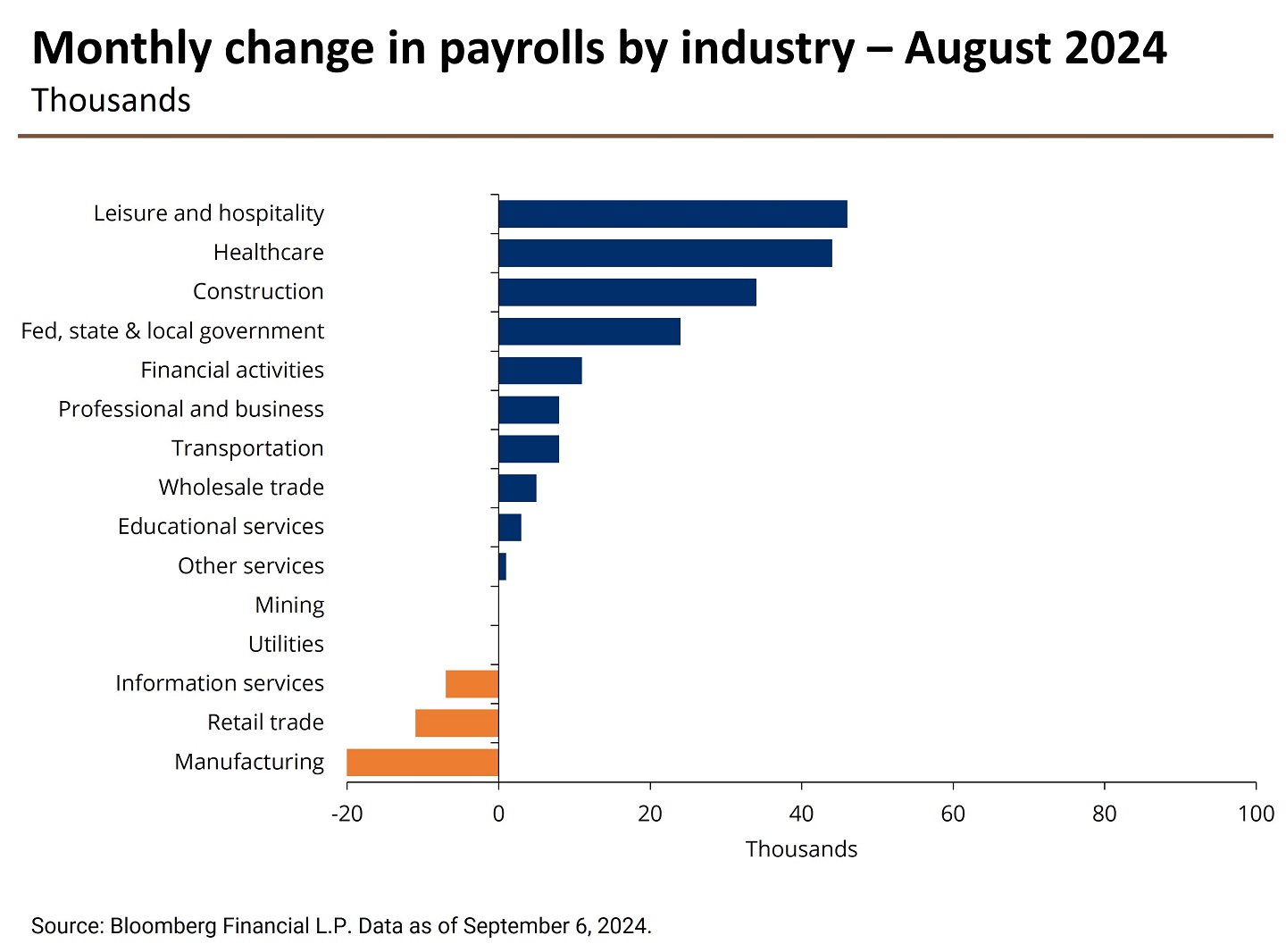

August’s nonfarm payroll gains were driven by construction (+34,000) and health care employment (+31,000). There were also strong gains in social assistance (+13,000) jobs.3

Private sector employment rose by 118,000 and government jobs rose by 24,000. Job gains in the health care sector have been trending slower recently, and increased by only 44,000 last month, the softest since early 2022.4

A surprising 24,000 decline in manufacturing jobs, in particular within transportation equipment, prevented nonfarm payrolls from meeting economists’ expectations. Motor vehicles related jobs accounted for around a quarter of the manufacturing job losses – however, we expect these jobs to rebound in September as summer auto manufacturing plant shutdowns subside.5

Jobs were little changed among other industries, including mining, quarrying, oil and gas extraction, retail trade and more.6

Unemployment rate ticked down

The unemployment rate fell a tenth of a percent to 4.2% in August, highlighting the labor market is not decelerating as quickly as forecasted. This fall was driven by a reversal of the temporary layoffs (down 190,000) from the July jobs report. This brings the total rise in workers temporarily laid off to 249,000 and signals healthier labor market demand.7 The spread of temporary workers was broad-based and largely attributable to seasonal factors.

The labor force increased by 120,000 in August, significantly weaker than the 420,000 jump in July. Employment in the household survey and household employment both rose by 168,000. The labor force participation rate was unchanged at 62.7%, with no changes to prime age employment (i.e. workers aged 25 to 54).8

The 4.2% unemployment rate continues to trigger the Sahm rule,9 which signals the start of a recession when the three-month average unemployment rate is 0.5% or more above the three-month average within the past year – although, our strategists are less concerned about this signal given the unemployment rate hasn’t been accompanied by a steep increase in workers with permanent job losses.

Wage growth and average hours worked rose slightly

Wage growth came in slightly above expectations, with average hourly earnings up by a robust 3.8% YoY.10 This moderate print is consistent with Powell’s comments at Jackson Hole that the labor market currently isn’t posing an inflationary threat.11 Likewise, the majority of wage growth measures show wage growth that is consistent with the Federal Reserve’s (Fed) 2% inflation target.

On another positive note, average hours worked in a week recovered to 34.3 from 34.2. Rises in the workweek are typically associated with an increase in labor demand.12

Job openings fell

The number of job openings fell to 7.7 million in July from a revised down 7.9 million in June, according to the BLS Job Openings and Labor Turnover Summary.13 This survey fell to the lowest reading since January 2021 and indicates labor demand continues to moderate.

Rate implications

The Fed has dual mandates: 1) to achieve price stability, and 2) maximum employment. Raising and keeping interest rates elevated has been the Fed’s main transmission mechanism to slow economic growth, with the goal of cooling inflation. Given recent compelling readings that show inflation is moving closer to its 2% target, the Fed’s attention has shifted more toward the labor market.14

Therefore, August’s jobs report is likely to be a major factor in the Fed’s decision at the September FOMC meeting to cut interest rates. The report mitigates concerns of a sharp slowdown in the labor market and raises the likelihood of a soft economic landing.

This leaves the Fed in a position of comfort for a rate cut at the Federal Open Market Committee (FOMC) meeting later this month. Worth noting, immediately after the print, markets slightly increased the odds of a 50-basis-point move.

As we inch closer to a potential rate cut, our strategists expect the Fed to carefully assess upcoming data prints. The August Consumer Price Index report, set to be released on September 11, and the Personal Consumption Expenditures (PCE) deflator (the Fed’s preferred measure of inflation), set to be released on September 27, will likely play large roles in the Fed’s decision-making.

References

Bureau of Labor Statistics (BLS), “The Employment Situation—August 2024.”

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Federal Reserve Bank of St. Luis, “Sahm Rule Recession Indicator.”

Bureau of Labor Statistics (BLS), “The Employment Situation—August 2024.”

Board of Governors of the Federal Reserve System, “Review and Outlook.” (August 23, 2024)

Bureau of Labor Statistics (BLS), “The Employment Situation—August 2024.”

BLS, “July Job Openings and Labor Turnover Summary.” (July 2024)

Federal Reserve, “Federal Reserve issues FOMC statement.”

Connect with a Wealth Advisor

Our Wealth Advisors begin by getting to know you personally. To get started, tell us about your needs and we’ll reach out to you.

This material is for informational purposes only, and may inform you of certain products and services offered by J.P. Morgan’s wealth management businesses, part of JPMorgan Chase & Co. (“JPM”). Products and services described, as well as associated fees, charges and interest rates, are subject to change in accordance with the applicable account agreements and may differ among geographic locations. Not all products and services are offered at all locations. If you are a person with a disability and need additional support accessing this material, please contact your J.P. Morgan team or email us at accessibility.support@jpmorgan.com for assistance. Please read all Important Information.

GENERAL RISKS & CONSIDERATIONS. Any views, strategies or products discussed in this material may not be appropriate for all individuals and are subject to risks. Investors may get back less than they invested, and past performance is not a reliable indicator of future results. Asset allocation/diversification does not guarantee a profit or protect against loss. Nothing in this material should be relied upon in isolation for the purpose of making an investment decision. You are urged to consider carefully whether the services, products, asset classes (e.g. equities, fixed income, alternative investments, commodities, etc.) or strategies discussed are suitable to your needs. You must also consider the objectives, risks, charges, and expenses associated with an investment service, product or strategy prior to making an investment decision. For this and more complete information, including discussion of your goals/situation, contact your J.P. Morgan representative.

NON-RELIANCE. Certain information contained in this material is believed to be reliable; however, JPM does not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. No representation or warranty should be made with regard to any computations, graphs, tables, diagrams or commentary in this material, which are provided for illustration/reference purposes only. The views, opinions, estimates and strategies expressed in this material constitute our judgment based on current market conditions and are subject to change without notice. JPM assumes no duty to update any information in this material in the event that such information changes. Views, opinions, estimates and strategies expressed herein may differ from those expressed by other areas of JPM, views expressed for other purposes or in other contexts, and this material should not be regarded as a research report. Any projected results and risks are based solely on hypothetical examples cited, and actual results and risks will vary depending on specific circumstances. Forward-looking statements should not be considered as guarantees or predictions of future events.

Nothing in this document shall be construed as giving rise to any duty of care owed to, or advisory relationship with, you or any third party. Nothing in this document shall be regarded as an offer, solicitation, recommendation or advice (whether financial, accounting, legal, tax or other) given by J.P. Morgan and/or its officers or employees, irrespective of whether or not such communication was given at your request. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions.

Legal Entity and Regulatory Information.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

This document may provide information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC (“JPMS”). The agreements entered into with JPMS, and corresponding disclosures provided with respect to the different products and services provided by JPMS (including our Form ADV disclosure brochure, if and when applicable), contain important information about the capacity in which we will be acting. You should read them all carefully. We encourage clients to speak to their JPMS representative regarding the nature of the products and services and to ask any questions they may have about the difference between brokerage and investment advisory services, including the obligation to disclose conflicts of interests and to act in the best interests of our clients.

J.P. Morgan may hold a position for itself or our other clients which may not be consistent with the information, opinions, estimates, investment strategies or views expressed in this document. JPMorgan Chase & Co. or its affiliates may hold a position or act as market maker in the financial instruments of any issuer discussed herein or act as an underwriter, placement agent, advisor or lender to such issuer.