Key takeaways

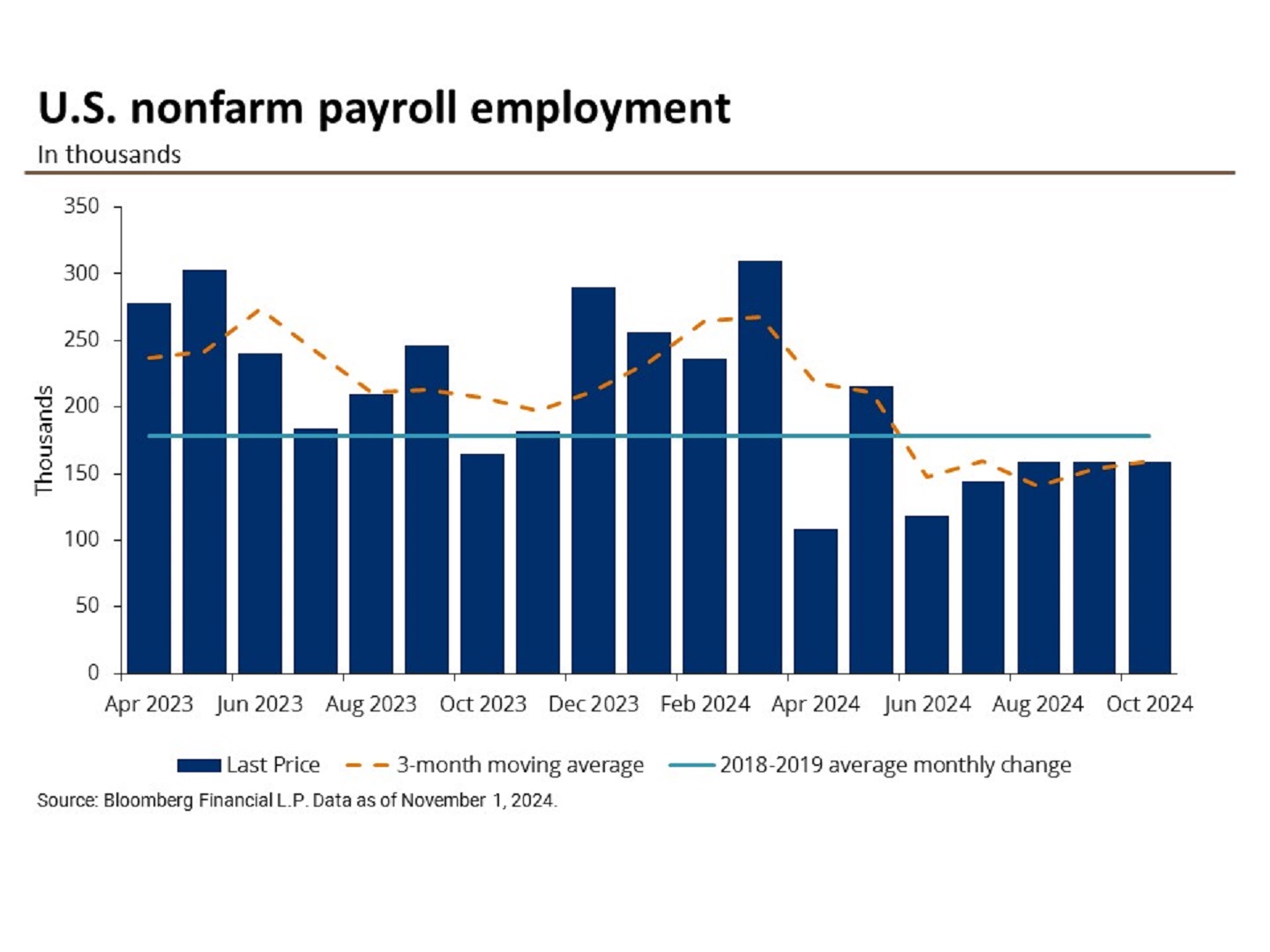

- In October 2024, the U.S. economy added only 12,000 jobs, marking the slowest growth since 2020. This figure fell significantly short of the anticipated 100,000 increase and the 223,000 jobs added in September. Additionally, job gains for August and September were revised downward by a total of 112,000.

- Despite this slower than expected growth, we aren’t overly concerned. We had expected there would be heavy data distortions due to the recent hurricanes and the dockworkers’ strike.

- The unemployment rate held steady at 4.1% and wage growth edged higher, up 0.4% month-over-month and 4% year-over-year. This suggests that the labor market remains firm despite signs of weakening.

- Our strategists believe that the underlying softness in the October jobs report, coupled with recent soft inflation data, will keep the Federal Reserve (Fed) on its programmatic rate-cutting cycle, regardless of the upcoming U.S. presidential election results. They maintain their forecast that the Fed will reduce its policy rates by 25 basis points in both its November and December meetings.

Contributors

Associate, Wealth Planning & Advice

In October 2024, the U.S. economy added only 12,000 jobs, marking the slowest growth since 2020. This figure fell significantly short of the anticipated 100,000 increase and the 223,000 jobs added in September. Notably, the response rate in the Establishment Survey (which collects data on employment, hours and earnings of nonfarm payroll employees) was the lowest since January 1991,1 which may have impacted the reports’ ability to capture the full employment picture.

The August and September jobs reports were revised lower, down by 81,000 and by 31,000, respectively.2 Despite this slower than expected growth, our strategists aren’t overly concerned. They had anticipated there would be heavy data distortions due to the recent hurricanes and the dockworkers’ strike.

Additionally, this report follows recent stronger than expected economic data, revealing that the U.S. economy staged robust growth in the third quarter. These developments further solidify our view that the economy is gradually cooling, but remains firm.

Industry breakdown

In October, the increase in nonfarm payrolls was primarily fueled by sustained growth in the health care (+52,000) and government (+40,000) sectors.3

Employment in all other sectors remained little changed or negative. Retail trade, transportation and warehousing, and leisure and hospitality jobs were adversely affected by weather related disruptions. These disruptions drove a reduction of 49,000 temporary help services jobs within the professional and business services sector. Since peaking in March 2022, temporary help services jobs have decreased by a total of 577,000.4

Hurricane Helene and Hurricane Milton both struck during the reference period for the October nonfarm payrolls report, making landfall on September 26 and October 9, respectively. According to the Bureau of Labor Services (BLS), these hurricanes “caused severe damage in the southeast portion of the country,” which “likely” impacted the payroll data – although, the BLS expressed “it is not possible to quantify the net effect.” 5 Our heartfelt sympathies go out to all those affected by these devastating storms.

Manufacturing jobs (–46,000) posted the largest decline since April 2020. This downturn was largely attributed to a decrease of 44,000 jobs in the transportation equipment manufacturing sector. 6 The decline was primarily driven by the ongoing dockworkers’ strike, which disrupted trade on the U.S. East and Gulf coasts.

Employment in construction, mining, wholesale trade and other major industries were little changed. 7

Unemployment rate

The unemployment rate held steady at 4.1% in October, with the number of unemployed individuals little changed at 7 million. These readings remain above the 3.8% unemployment rate and 6.4 million unemployed individuals from a year ago,8 reflecting labor market conditions have moderated since.

There was a slight increase in the number of individuals who permanently lost their jobs in October, marking the largest rise since February. The amount of individuals who were temporarily laid off and the long-term unemployed (those out of work for 27 weeks or more) showed little change.9

The labor force participation ticked down to 62.6% from 62.7% in September, indicating there are slightly fewer workers who are either employed or searching for jobs. The prime age employment ratio (i.e., workers aged 25 to 54) fell to 83.5%,10 the lowest rate since April.

Wage growth and average hours worked

Wage growth edged higher in October, with average hourly earnings up 0.4% month-over-month (MoM) and 4% year-over-year (YoY),11 matching the growth from the prior month.

Meanwhile, average hours worked remained unchanged at 34.3 hours in October.12 Coupled, these data points show pockets of strength in the labor market. The resilient wage growth should support consumer spending, and in turn, economic growth in upcoming months.

Rate implications

The October employment report serves as the final major economic data release before two pivotal events: the Federal Open Market Committee (FOMC) meeting on November 6–7 and the U.S. presidential election on November 5. At the September FOMC meeting, the Federal Reserve lowered interest rates by 50 basis points to bolster economic growth.13 The Federal Reserve’s decision exhibits a shift in their priorities, from easing inflation, which is notably closer to the Fed’s 2% target, to supporting the labor market.

Our strategists believe that the underlying softness in the October jobs report, coupled with recent soft inflation data, will keep the Federal Reserve on its programmatic rate-cutting cycle, regardless of the upcoming presidential election results. They maintain their forecast that the Fed will reduce its policy rates by 25 basis points in both its November and December meetings.

Connect with a Wealth Advisor

Reach out to your Wealth Advisor to discuss any considerations for your current portfolio. If you don’t have a Wealth Advisor, click here to tell us about your needs and we’ll reach out to you.

IMPORTANT INFORMATION

This material is for informational purposes only, and may inform you of certain products and services offered by J.P. Morgan’s wealth management businesses, part of JPMorgan Chase & Co. (“JPM”). Products and services described, as well as associated fees, charges and interest rates, are subject to change in accordance with the applicable account agreements and may differ among geographic locations. Not all products and services are offered at all locations. If you are a person with a disability and need additional support accessing this material, please contact your J.P. Morgan team or email us at accessibility.support@jpmorgan.com for assistance. Please read all Important Information.

GENERAL RISKS & CONSIDERATIONS. Any views, strategies or products discussed in this material may not be appropriate for all individuals and are subject to risks. Investors may get back less than they invested, and past performance is not a reliable indicator of future results. Asset allocation/diversification does not guarantee a profit or protect against loss. Nothing in this material should be relied upon in isolation for the purpose of making an investment decision. You are urged to consider carefully whether the services, products, asset classes (e.g. equities, fixed income, alternative investments, commodities, etc.) or strategies discussed are suitable to your needs. You must also consider the objectives, risks, charges, and expenses associated with an investment service, product or strategy prior to making an investment decision. For this and more complete information, including discussion of your goals/situation, contact your J.P. Morgan representative.

NON-RELIANCE. Certain information contained in this material is believed to be reliable; however, JPM does not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. No representation or warranty should be made with regard to any computations, graphs, tables, diagrams or commentary in this material, which are provided for illustration/reference purposes only. The views, opinions, estimates and strategies expressed in this material constitute our judgment based on current market conditions and are subject to change without notice. JPM assumes no duty to update any information in this material in the event that such information changes. Views, opinions, estimates and strategies expressed herein may differ from those expressed by other areas of JPM, views expressed for other purposes or in other contexts, and this material should not be regarded as a research report. Any projected results and risks are based solely on hypothetical examples cited, and actual results and risks will vary depending on specific circumstances. Forward-looking statements should not be considered as guarantees or predictions of future events.

Nothing in this document shall be construed as giving rise to any duty of care owed to, or advisory relationship with, you or any third party. Nothing in this document shall be regarded as an offer, solicitation, recommendation or advice (whether financial, accounting, legal, tax or other) given by J.P. Morgan and/or its officers or employees, irrespective of whether or not such communication was given at your request. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions.

Legal Entity and Regulatory Information.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

This document may provide information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC (“JPMS”). The agreements entered into with JPMS, and corresponding disclosures provided with respect to the different products and services provided by JPMS (including our Form ADV disclosure brochure, if and when applicable), contain important information about the capacity in which we will be acting. You should read them all carefully. We encourage clients to speak to their JPMS representative regarding the nature of the products and services and to ask any questions they may have about the difference between brokerage and investment advisory services, including the obligation to disclose conflicts of interests and to act in the best interests of our clients.

J.P. Morgan may hold a position for itself or our other clients which may not be consistent with the information, opinions, estimates, investment strategies or views expressed in this document. JPMorgan Chase & Co. or its affiliates may hold a position or act as market maker in the financial instruments of any issuer discussed herein or act as an underwriter, placement agent, advisor or lender to such issuer.