One month into his second term, President Donald Trump is already making sweeping changes. He’s issued executive orders at a rate of more than two per day, focusing on issues such as immigration, deregulation, foreign policy and more.

Some of these headline-making changes surround tariffs, which he threatened to impose on Canada, Mexico and China. The tariff on Chinese imports, set at 10%, took effect in early February, and the tariffs on Canada and Mexico are set for early March.,

As we get deeper into 2025, investors may be wondering how the president’s actions are impacting the economy. More specifically, how do his actions affect investment markets? Here’s an overview of where the economy and investments stand now, as well as what’s expected through the end of the year.

The consensus among specialists is that the U.S. economy looked pretty good coming into 2025.

“My expectation for 2024 was two-zero-two-four – 2% growth, zero recessions, inflation coming down to about 2% and unemployment running at about 4%,” said Dr. David Kelly, Chief Global Strategist at J.P. Morgan Asset Management. “That turned out to be close. Honestly, if it wasn't for some of the policy issues, which may affect things a bit, I'd say it's a reasonable baseline for 2025.”

Strong consumer spending continues to drive the economy, and Kelly expects another year of 2% GDP growth. He also doesn’t see a recession in the cards, but he points out that inflation remains a little high and prices are unlikely to come down.

One impact of Trump’s immigration policies could be less job growth. According to Kelly, 70% of the people that immigrate to the U.S. are working age, between 18 and 64 years old. With less immigration going forward – including legal immigration – it’s reasonable to assume that job growth could stagnate. But coupled with fewer workers, Kelly expects the unemployment rate to stay close to current levels.

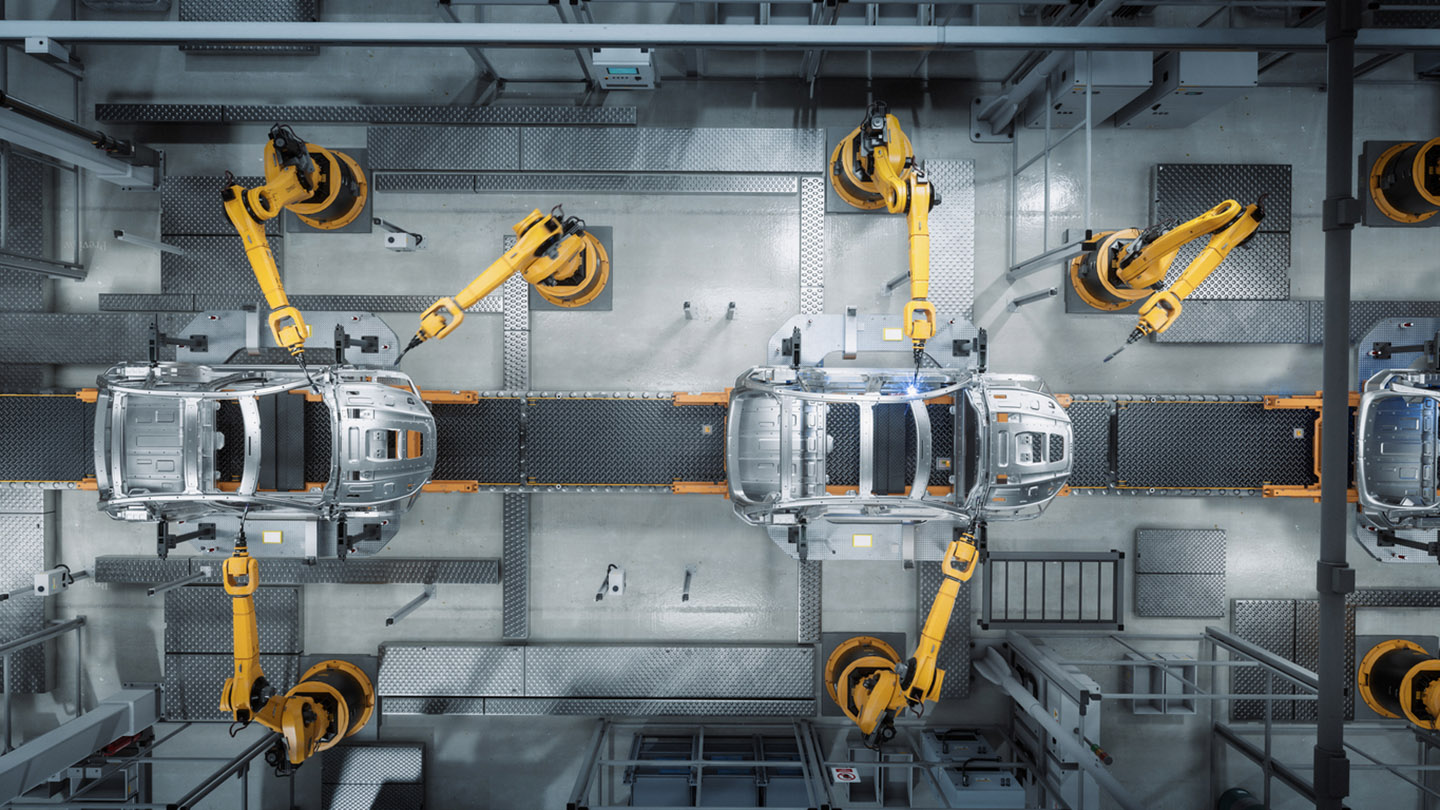

Trump was clear about his position on tariffs on the campaign trail, so it’s no surprise that taxes on imports have entered the conversation in his first 30 days in office. The big talking pieces have been his 10% tariff on Chinese goods, which went into effect on February 4, and 25% tariff on imported steel and aluminum, which are set to enter into force on March 12. Trump also ordered 25% tariffs on imports from Canada and Mexico, though those were postponed until March 4 after negotiations with Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum.

“What I think you can say with some degree of clarity is we're going to have higher tariff rates at the end of the year than at the start,” Kelly said. “Tariffs are an import tax; [they] generate revenue. He's looking at that tax revenue as part of the revenue that will offset some of the cost of extending his 2017 tax cuts and other promises.”

However, it’s hard to say exactly which tariffs will be in place when all is said and done, and this makes it difficult for business owners to account for price changes.

“The problem with tariffs is two-fold,” Kelly explained. “One: Tariffs push up prices in your own country. That hurts your consumers [in terms of] imported goods and buying services. The other thing: Then they put tariffs back on you. So people in exports industries – we export a lot, too – they’re all vulnerable to this. If you try to protect those people by [giving them] more government subsidies or something, that costs you revenue.”

He added, “The market realizes this could hurt profits. It adds to uncertainty; the stock market never likes uncertainty.”

Trump’s crackdown on immigration – including mass deportations and increasing border troops – has dramatically reduced the amount of people coming into the country.

In addition to fewer border crossings, “We're also going to see a big slowdown in people immigrating the traditional way,” Kelly said. “It is important to recognize that immigration, when done in an orderly way, has been an enormous advantage to the United States.”

Last year, the U.S. population grew by 3.3 million people. Of those, 2.8 million were through immigration. Without that same level of immigration, the working-age population could shrink by 700,000 to 800,000 per year.

“If we hit zero or if we get close to zero in terms of net immigration, it could have some significantly negative impacts in the ability of the economy to grow,” Kelly said.

The industries that can be hurt the most are likely restaurants, lower-end retailers and homebuilding, which employ a lot of immigrants.

Another key focus of the Trump administration is on deregulation, which can have positive impacts on investing.

“I think deregulation or lack of additional regulation can certainly help some areas, particularly for financial markets,” Kelly said.

He noted we could see an increase in bank lending and private credit. Of those who stand to gain the most from deregulation, Kelly mentioned private equity markets and cryptocurrencies.

On the other hand, it’s important to have some kind of regulation. “The things that have killed the economy in the 21st century were all in some ways a failure to regulate,” Kelly remarked. For instance, “9/11 was a failure to regulate who learns how to fly planes in America and keep track of people. The financial crisis was a lack of regulation on the mortgage industry.”

In a more complex world, with artificial intelligence (AI) and cyberattacks, there is a need for regulation, but the question remains how much and what that looks like.

For example, “If you have huge capital requirements on the traditional banking industry, but you don't do anything to private credit, then you'll have all the risk-taking going on there,” Kelly said. “You know, you don't need more regulation or less regulation. You need good regulation.”

A looming deadline on the tax front is with the Tax Cuts and Jobs Act (TCJA) of 2017, which is set to expire at the end of the year. It was one of the biggest acts of legislation from Trump’s first term and will likely be extended now that he’s president again.

“We may also see some other tax breaks,” Kelly said. “We're going to keep our eye on the president's proposal to cut the capital gains tax to 15% for domestic production. [This] could help push up corporate profits and help the stock market.”

Trump has also mentioned getting rid of income taxation on tips, overtime and Social Security; restoring the state and local tax deduction; and adding a special tax break for buying new vehicles.

Of course, a byproduct of tax breaks is an increase in the federal deficit. Kelly expected that extending the Tax Cuts and Jobs Act (TCJA) will increase the deficit from about $2 trillion to $3 trillion. If you add in the other breaks, it could balloon to $4 trillion.

Interest rates probably won’t be influenced by Trump in the near term, at least until we can see the longer-term impacts of his policies.

“Back in November, just after the election, [Federal Reserve Chair] Jay Powell was speaking at his press conference after a Fed meeting. Somebody asked him about these policies. He said, ‘Look, we don't guess, we don't speculate, we don't assume.’ I actually think that is very wise. The Federal Reserve just wants to see how this plays out,” Kelly said.

“If you go back six months ago, a lot of people thought that they would cut multiple times this year. [But] if you have a tariff policy that could push up inflation, immigration could push up inflation, a stimulus package could push up inflation… They want inflation at 2%. They're not going to do anything. They will sit on their hands until there's more clarity.”

Kelly’s outlook on corporate profitability this year is very good.

“What we're seeing is a broadening out of profits,” he said. “It used to be technology companies and the Mag Seven and so forth that were making money. Now in the fourth quarter [of 2024], nine out of 11 S&P 500 sectors saw a gain. Materials is very marginally down; energy is down. Everything else is up. What is happening is American businesses are doing a great job of taking advantage of whatever growth there is but also holding down wage growth.”

He added, “From an investor perspective, you have to look at the S&P ratio. It's very high by historical standards – 40% of the value of the market in the top 10 stocks.”

While this can present opportunities, Kelly warned investors to be careful when making market decisions.

We’re still in the early stages of artificial intelligence, but Kelly expects an “exponential process” of growth that will impact investment markets, business productivity and more.

“The early stages of artificial intelligence are like the early stages of the internet boom, which started in the 1990s, where you're seeing a lot of money being thrown at this but not necessarily all at the right places,” Kelly said. “I think most AI investments can be valuable.”

In the long term, AI could drastically accelerate business productivity and remove the need for labor in a lot of places. This could also increase profitability, as businesses could be able to produce faster while paying fewer workers.

“There's a dark side to this, too, which is that AI has the potential manipulate minds,” Kelly warned. “You look at what smartphones have done to a lot of teenage brains, which is really terrible … We should recognize that it could have negatives which could undermine society. Ultimately, all of these profits and capital markets are based on a stable society. So if you mess with that, then you could obviously have some consequences.”

Trump’s first 30 days in office have been marked by huge policy moves on immigration, tariffs and deregulation. With these changes plus expected tax cuts on the horizon, what does this mean for the economy and investors? In the near term, not a whole lot. For 2025, Kelly expected a similar year economically to 2024.

That’s not to say Trump’s actions won’t have large or lasting impacts down the line. If these policies push up inflation, this could lead to an interest rate hike. On the other hand, corporate deregulation and tax breaks can likely drive profitability, which is good for investments and economic growth. It’s a wait-and-see game for investors.

“I think markets appreciate and I appreciate the extraordinary resilience of the American economy,” Kelly said. “We have 340 million people that don't know when to say when. They work too hard, spend too much, always trying to get ahead. This economy can take quite a licking and keep ticking. So far, I think markets see all this uncertainty, but they don't see anything that says near-term recession.”

With that said, investors should continue to look to the long term and make decisions that align with their financial goals. A J.P. Morgan advisor can help you adapt to political and economic shifts while sustaining your overall strategy.