Only a year ago, leaders of midsized businesses reported dramatic impacts to their operations due to the COVID-19 pandemic. Global supply chain disruptions grew and vaccines were still months away from approval, much less widespread distribution.

Even still, most executives who responded to the 2020 Business Leaders Outlook Pulse survey—fielded in June 2020—were hopeful about their outlook, with 1 in 2 predicting a full return to pre-pandemic business conditions within 12 months.

Talk about sticking the landing.

With the economy reopening and vaccination expanding, many of the 1,375 executives who responded to the 2021 Business Leaders Outlook Pulse survey said they see unprecedented economic opportunity and significant hiring needs in the next 6-12 months. They also revealed plans to build on pandemic resiliency strategies and shared timely views on new workplace models that could redefine how they recruit, train and lead.

Keep reading to learn how your fellow executives plan to navigate continuing challenges and seize new opportunities for the final months of 2021 and beyond.

Big Ideas

-

Rebound

The percentage of business leaders who are optimistic about their companies and industries was the highest recorded in 11 years of the Business Leaders Outlook. Some 80% expect higher revenue/sales and 71% expect profits to increase for the remainder of 2021.

-

Resiliency

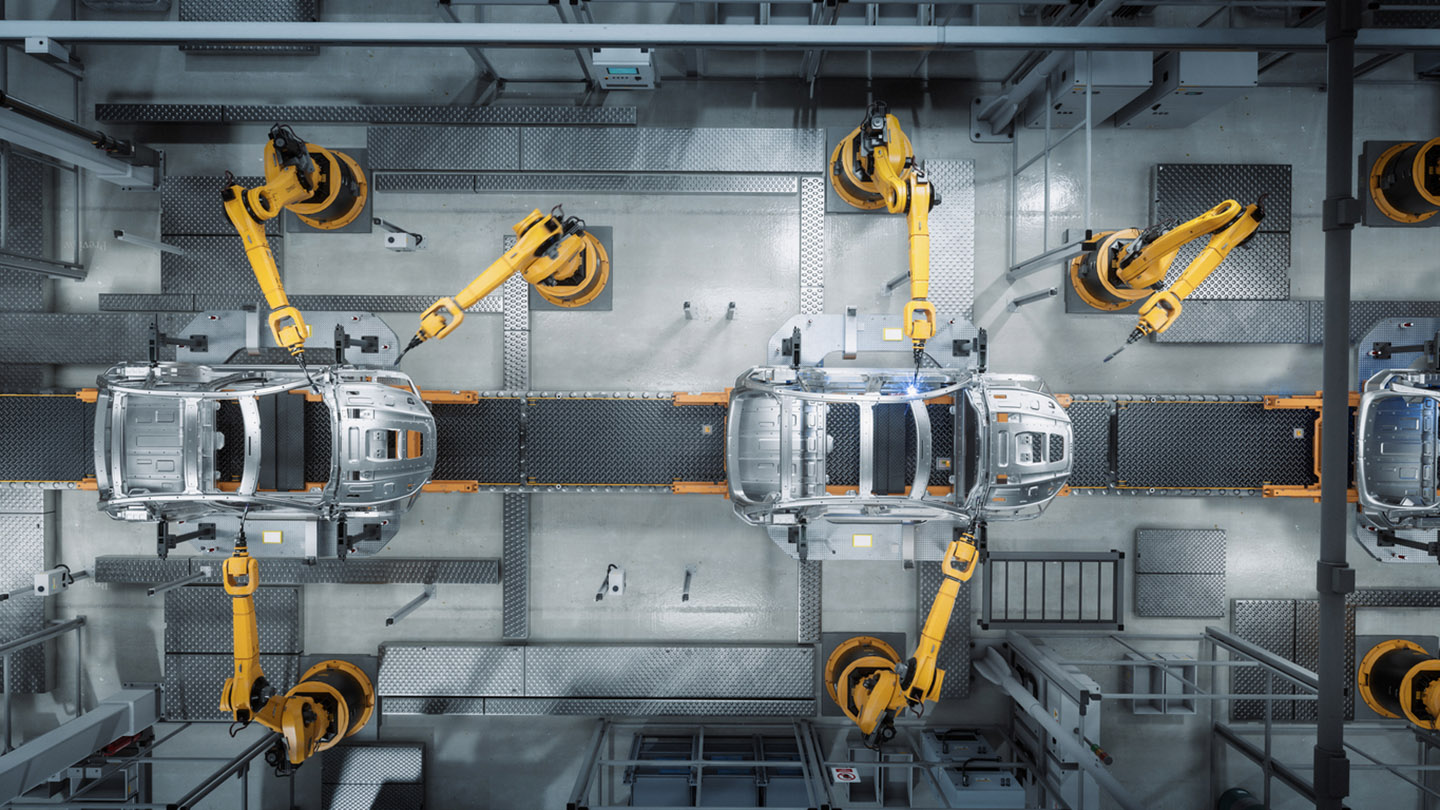

Nearly two-thirds of respondents say they added new product/service lines in response to the pandemic that they’ll keep afterward. Most say they’ll keep pandemic-era supply chain strategies, too.

-

Return to work

More than half of businesses already have or plan to launch a flexible working model, but this may be a work in progress because 73% of business leaders say preserving their company culture remains a top concern as they test alternating employees on- and off-site.

Big Idea #1: Economic rebound

Market and economic outlook is largely optimistic

After more than a year of pandemic disruptions, executive optimism at midyear 2021 is striking. Leaders’ view of business opportunity is particularly staggering when compared with the two most recent Business Leader Outlook surveys. Optimism about the local economy alone is the highest of any previous Business Leader Outlook survey—signaling rally expectations at the community level and a readiness for rebound.

Leaders expect business expansion in multiple forms

Most midsized business leaders expect their revenue/sales and profits to increase for the rest of this year. In support of this growth, many also anticipate that their capital expenditures and credit needs will increase. Notably, the credit needs increase response is at the highest level in the history of the Business Leaders Outlook—following a time when many business leaders shied away from credit utilization. These are all strong indicators that executives are getting ready for future expansion or their businesses are at least stable for now—a sizable change from a year ago.

Hiring plans are up

With higher expectations for business revenues and profits for the rest of the year, most business leaders’ hiring plans are on the rise. Juxtapose this with the challenging labor market and business leaders may need to rethink their typical hiring and retention methods in order to keep pace with anticipated growth.

Big Idea #2: Business resilience

Top business challenges in the next 6-12 months

Almost all survey respondents (95%) anticipate at least one business challenge in the next 6-12 months. Not surprisingly, the major challenge is ongoing supply chain issues, as lingering bottlenecks are making it difficult to keep up with consumer demand. Business leaders can likely expect supply chains to be a significant growing pain to overcome over the next several months.

How leaders will sustain pivots made in response to COVID-19 business challenges

For business leaders, resiliency came in many forms during the pandemic. In some cases, it propelled their businesses forward in ways that enabled them to sustain or grow operations, satisfy consumer demand and address new challenges. From utilizing new suppliers to delivering new products or services at midyear 2021, leaders expressed a desire to continue leveraging their pandemic pivots in ongoing operations.

Growth, sustainability and agility pivots

Resiliency strategies emerged throughout the pandemic, but significantly in two areas: new product/service lines inside and outside traditional company portfolios and digital adjustments to operations. In each category, nearly two-thirds* of leaders said they made changes, additions or upgrades that they plan to continue post-pandemic.

*Nearly two-thirds (61% and 64%) represents the unduplicated calculation of those who have delivered new products/service lines within and/or outside of their traditional portfolio and/or those who have expanded e-commerce capabilities, digitized accounts payables/receivables processes and/or updated or enhanced fintech systems, respectively.

Companies battled cybersecurity threats during the pandemic

Significantly, one-third of companies surveyed were directly impacted by some form of cyberattack or fraud during the pandemic. While cyber fraud evolves over time, business email compromise (BEC) was cited as the most common attack, followed by payments fraud and malware. Experts urge midsize companies to build stronger defenses—and according to respondents, several of those measures are proving effective at protecting against attacks.

Big Idea #3: Return to Work

Will workspaces change?

Many experts have wondered whether the pandemic would shrink the need for office space, but two-thirds of respondents say they have not and do not plan to make any changes. Meanwhile, business leaders planning to increase their workspace cited business growth/expansion as the key reason (89%). For those planning reductions in office space, employee preference for working remotely was the primary driver (65%) in their decision-making. Whether executives are taking a wait-and-see position regarding their space or are prepared to keep or expand facilities long-term, commercial real estate strategies may continue as one of 2022’s most compelling topics.

Is flexible work the future?

Business leaders are split in their approach to returning to work. Nearly 40% of companies expect all employees to return to on-site work post-pandemic, though more than half are continuing, expanding or newly implementing some form of remote work model as a result of COVID-19. The split could indicate that business leaders are taking a thoughtful approach to return to work, considering the needs of customers and employees as well as market conditions.

Strategies for the future

At midyear 2021, the nation seems to have a better handle on the pandemic, and optimism on the stock market and at the Federal Reserve stand at historic highs. For many executives, a central worry will be growing pains—how to handle potentially historic demand in a reopening global economy.

It’s an environment that will require midsize companies to stay agile. Luckily, pivots made in response to the pandemic can continue to strengthen your company’s competitive edge. Keeping a close watch on market dynamics and future business needs will help focus your strategic decision-making in three key areas:

- Recruiting, Hiring and Training: In a highly competitive job market, midsized businesses can be at a disadvantage unless they play up their strengths. Lean in to what makes your business great. Things like culture, community and opportunity for growth can be just as appealing as a competitive benefits and salary package. Work with HR partners to understand where your labor needs are today versus where they may be tomorrow so you can be sure to attract and retain the talent you’ll need for the long haul.

- Digital Adoption: During the pandemic, 64% of business leaders made at least one digital adjustment to grow or sustain their business, and the majority intend to make them permanent. While your digital adoption may have accelerated, it can’t stop. Take careful consideration when looking at ways to streamline processes and meet consumer demand in a more digital-forward environment.

- Resiliency Now and for the Future: Simply being able to say, ‘I sustained or grew my business during a pandemic’ is an incredible feat. And while you may want to put the events of the last 18 months behind you, the lessons learned are invaluable. Whether you made changes to your supply chain, digitized certain operations or expanded into new products/services, use these shifts as a model to prepare for future disruptions.

About the survey

The 2021 Business Leaders Outlook Pulse survey provides a six-month view of the current business environment from 1,375 senior executives from midsized U.S. companies with annual revenue between $20 million and $500 million. The survey was conducted June 7-18, 2021.

For year-over-year trends, current data is compared to data collected in second quarter of 2020. Data is also compared to the annual survey, which was conducted in fourth quarter of 2020.

Results are within statistical parameters for validity; the error rate is +/-2.6% at a 95% confidence rate. Some graphical numbers may not add up to 100% due to rounding.