Over the past few years, the number of women-led funds has started to rise, making a dent in a landscape long dominated by men. And while the numbers are still low, we’re heading in the right direction.

That’s the message from two longstanding experts of the VC ecosystem, Pamela Aldsworth and Katie Taormino of J.P. Morgan. Here, they discuss the changes they’ve seen, how women can support one another and why “paying it forward” is the best path for women in VC.

In your experience, how has the culture of VC changed for women? Where do you see the most progress?

Few women can say they’ve been working in venture for more than two decades. Twenty years ago, venture wasn’t a welcoming space for women. Ten years ago, women were still an anomaly in VC. Five years ago, it was better: VC firms founded by women were no longer a novelty but signaled the next wave of venture.

While the industry has begun to respond to these inequalities— prompted in part by the #MeToo movement—we won’t immediately feel the positive effects. But the arrival of newer independent media channels is something to celebrate. They not only cover venture deals but also spotlight topics that matter to underrepresented entrepreneurs. We are coming to expect this kind of transparency, and that’s a step in the right direction.

From our vantage point—covering both coasts and engaging with hundreds of investors and founders—one of the biggest steps forward has been women creating spaces to build networks. All Raise, Equity Summit and a number of women-founded firms represent meaningful departures from the status quo.

"All Raise marked a turning point because it galvanized women in venture; it fortified the community with a way to focus efforts. And Equity Summit spurs access to capital for underrepresented investors. Both exemplify what’s happening at a national level to improve the path forward for everyone."

Katie Taormino

Managing Director and Relationship Executive, Venture Capital Coverage, J.P. Morgan Commercial Banking

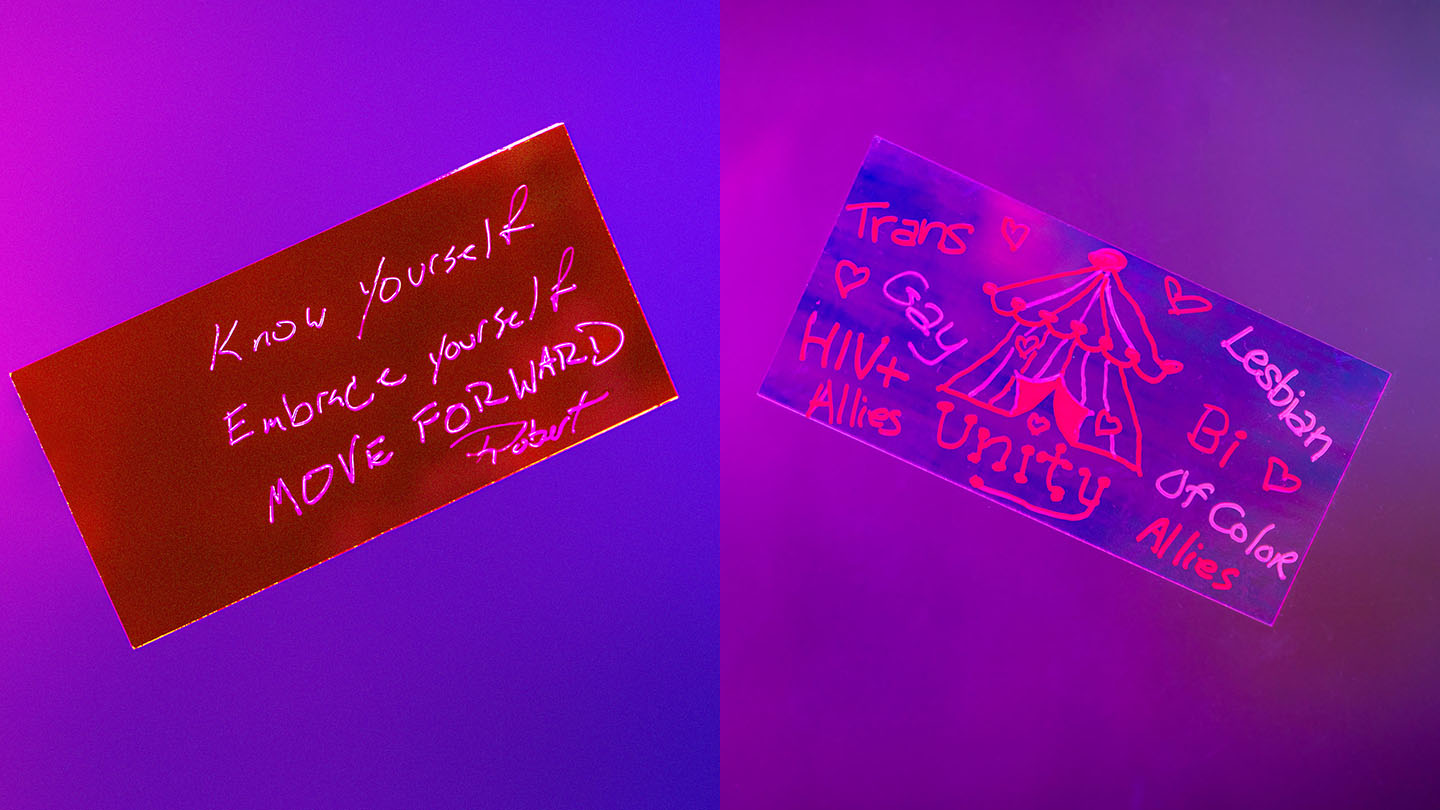

Women now have their own proprietary networks in the VC community. As a result, we’re starting to see an acceleration of those small-but-mighty local cohorts of female and underrepresented investors. We’re witnessing more collaboration, deal sharing, and referrals. There’s a spirit of “paying it forward” matched by fierce independence and a sense of empowerment.

Are firms updating their recruitment efforts to facilitate greater representation from within?

Many firms are being more intentional in hiring decisions to improve diversity among their ranks, which is a step forward. We have started to see progress in the associate and principal levels. However, finding women in senior positions is still rare because they often haven’t received the same access and/or mentorship as their male predecessors. The traditional path to becoming a partner can take up to 10 years. So, in addition to intentional recruitment, intentional retention and advancement of diverse talent is just as critical to making sustainable progress.

As more women are now in charge of LP decisions at foundations and institutions, this could also help move the ball forward with venture firms, as well. Many VC firms realize they have an opportunity to help shape the future of the innovation ecosystem and will want to demonstrate progress in areas clearly of value to LPs.

We believe a more inclusive and diverse venture ecosystem is possible. Despite how far we have to go, the culture is evolving.

Do you expect the market conditions that emerged in 2022 to disproportionately affect female founders?

The shorter fundraising cadence in recent years is an additional challenge for newer—and in many cases, female—managers, as it leaves less time between raises to build track records and networks. Smaller funds or newer managers won’t have the access when LPs have capital tied up with established managers or have already committed to new funds in their existing networks. J.P. Morgan Asset Management’s Project Spark initiative is helping bridge this gap.

J.P. Morgan has written some of the first checks for funds managed by these early-stage GPs. Having an institutional investor can both have a halo effect and increase the probability of success for these managers.

"The Project Spark program is designed to help minority-, women- and veteran-led emerging managers. In addition to committing $140 million of the firm’s proprietary capital to funds managed by diverse managers, J.P. Morgan is leveraging its brand and expansive network to help close the funding gap and strengthen diversity across the ecosystem."

Jamie Kramer

Head of J.P. Morgan Asset Management’s Alternatives Solutions Group and Project Spark Investment Committee Chair

From your perspective, what’s in store for the next generation of venture leaders?

The next generation of venture is already here. They’re associates and principals in some of the most established VC firms, learning about the business and building their networks. They may be first-time founders or serial entrepreneurs, but tomorrow they’re angel investors or launching their own funds.

The new frontier will see women investing across all stages, with decision-making powers in the Series A, B, C, and D funds. It will see women who are managing partners, who fundraise, and who sit at the table and lead $100 million rounds. This is where female and underrepresented entrepreneurs can find momentum and get their firepower.

With everyone playing their role, progress will happen. And for those of us who have the mic, we must pull our weight. If you are part of this ecosystem, stand up. If you can mentor, good. If you can give access to your network, do that. Everyone got their start somewhere; everyone had an advocate.

*This article originally appeared in PitchBook’s All In report.