From startups to legacy brands, you're making your mark. We're here to help.

-

Innovation Economy

Fueling the success of early-stage startups, venture-backed and high-growth companies.

-

Midsize Businesses

Keep your company growing with custom banking solutions for middle market businesses and specialized industries.

-

Large Corporations

Innovative banking solutions tailored to corporations and specialized industries.

-

Commercial Real Estate

Capitalize on opportunities and prepare for challenges throughout the real estate cycle.

-

Community Impact Banking

When our communities succeed, we all succeed. Local businesses, organizations and community institutions need capital, expertise and connections to thrive.

-

International Banking

Power your business' global growth and operations at every stage.

Key Links

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

-

Asset Based Lending

Enhance your liquidity and gain the flexibility to capitalize on growth opportunities.

-

Equipment Financing

Maximize working capital with flexible equipment and technology financing.

-

Trade & Working Capital

Experience our market-leading supply chain finance solutions that help buyers and suppliers meet their working capital, risk mitigation and cash flow objectives.

-

Syndicated Financing

Leverage customized loan syndication services from a dedicated resource.

-

Commercial Real Estate

Capitalize on opportunities and prepare for challenges throughout the real estate cycle.

-

Employee Stock Ownership Plans

Plan for your business’s future—and your employees’ futures too—with objective advice and financing.

Key Links

Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

-

Institutional Investors

Putting your long-tenured investment teams on the line to earn the trust of institutional investors.

-

Markets

Direct access to market leading liquidity harnessed through world-class research, tools, data and analytics.

-

Prime Services

Helping hedge funds, asset managers and institutional investors meet the demands of a rapidly evolving market.

-

Global Research

Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice.

-

Securities Services Solutions

Helping institutional investors, traditional and alternative asset and fund managers, broker dealers and equity issuers meet the demands of changing markets.

Key Links

Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Center for Carbon Transition

J.P. Morgan’s center of excellence that provides clients the data and firmwide expertise needed to navigate the challenges of transitioning to a low-carbon future.

-

Corporate Finance Advisory

Corporate Finance Advisory (“CFA”) is a global, multi-disciplinary solutions team specializing in structured M&A and capital markets. Learn more.

-

Development Finance Institution

Financing opportunities with anticipated development impact in emerging economies.

-

Sustainable Solutions

Offering ESG-related advisory and coordinating the firm's EMEA coverage of clients in emerging green economy sectors.

-

Mergers and Acquisitions

Bespoke M&A solutions on a global scale.

-

Capital Markets

Holistic coverage across capital markets.

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

A uniquely elevated private banking experience shaped around you.

-

Banking

We have extensive personal and business banking resources that are fine-tuned to your specific needs.

-

Investing

We deliver tailored investing guidance and access to unique investment opportunities from world-class specialists.

-

Lending

We take a strategic approach to lending, working with you to craft the right financing solutions matched to your goals.

-

Planning

No matter where you are in your life, or how complex your needs might be, we’re ready to provide a tailored approach to helping your reach your goals.

Whether you want to invest on your own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor.

-

Invest on your own

Unlimited $0 commission-free online stock, ETF and options trades with access to powerful tools to research, trade and manage your investments.

-

Work with our advisors

When you work with our advisors, you'll get a personalized financial strategy and investment portfolio built around your unique goals-backed by our industry-leading expertise.

-

Expertise for Substantial Wealth

Our Wealth Advisors & Wealth Partners leverage their experience and robust firm resources to deliver highly-personalized, comprehensive solutions across Banking, Lending, Investing, and Wealth Planning.

For Companies and Institutions

-

Commercial Banking

From startups to legacy brands, you're making your mark. We're here to help.

-

Institutional Investing

Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

-

Credit & Financing

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

-

Investment Banking

Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

For Individuals

-

Private Bank

A uniquely elevated private banking experience shaped around you.

-

Wealth Management

Whether you want to invest on you own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Insights

- Outlook

- Business Leaders Outlook

- 2023 Business Leaders Outlook: Commercial Real Estate

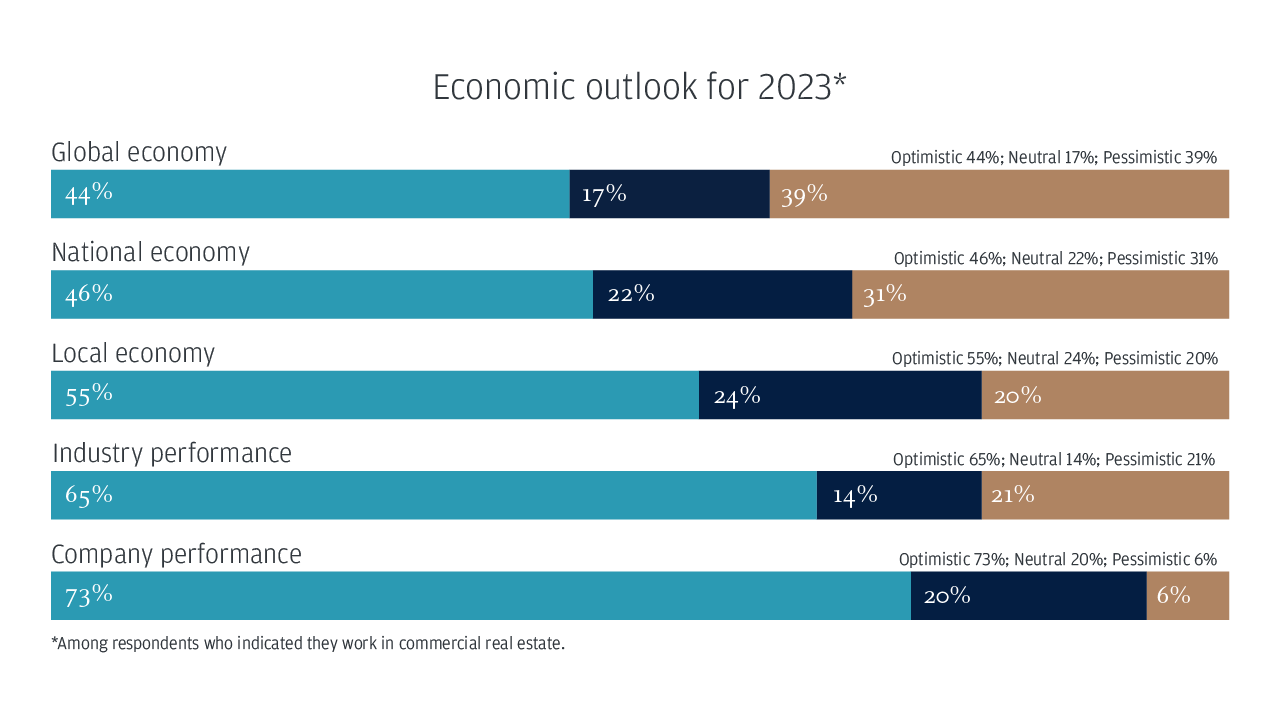

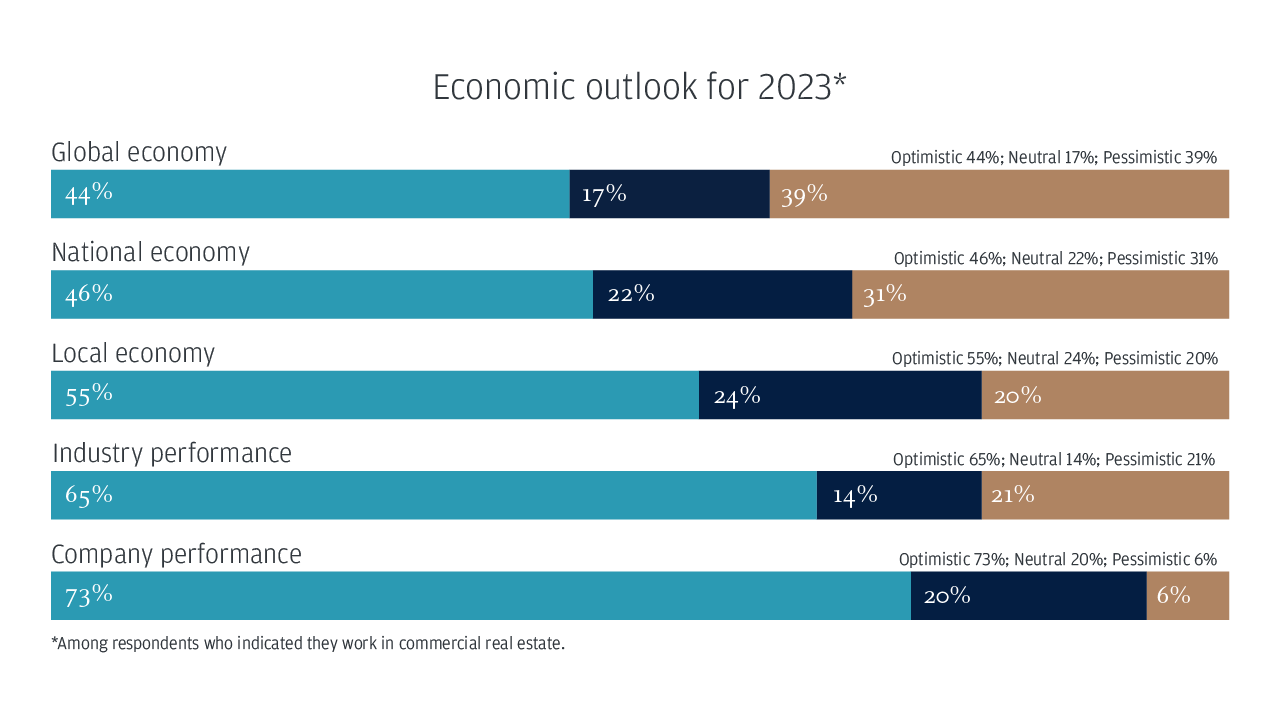

Commercial real estate professionals are slightly more optimistic about the year ahead than U.S. leaders overall, according to our 2023 Business Leaders Outlook survey.

The commercial real estate leaders surveyed hold various assets, with a concentration in multifamily. Nearly three quarters of these professionals expect increases in their revenue/sales and capital needs (both at 71%)—significantly higher rates than U.S. business leaders in general. Almost half of real estate leaders are optimistic about the global (44%) and national economy (46%). Nearly two-thirds (65%) are also optimistic about the industry’s performance in 2023, with 73% optimistic about their own company’s performance.

Leaders still anticipate challenges ahead—55% expect a recession in 2023. If an economic downturn occurs, real estate professionals were evenly divided on their first action: making strategic acquisitions (27%) or maintaining a steady state (27%).

Interest rates remain a prominent issue; 67% of respondents said rising interest rates/increased cost of capital are driving up business costs. Aside from the rate environment, leaders said the most pressing concerns facing the industry are lack of affordable housing (28%) and supply chain issues (28%).

Most respondents are also experiencing inflation challenges and rising costs (72%) but at a lesser degree than the total U.S. sample (91%). These challenges, however, may not hinder their growth; more than half of leaders plan to expand into new domestic markets.

About the survey

Started in 2011, the annual and midyear Business Leaders Outlook survey series provides snapshots of the challenges and opportunities facing executives of midsize companies in the United States.

This year, 791 respondents completed the online survey between Nov. 29 and Dec. 13, 2022. Of those respondents, 157 self-identified as working in commercial real estate. The 2023 survey captures those responses for the inaugural Business Leaders Outlook: Commercial Real Estate.

Results are within statistical parameters for validity; the error rate is plus or minus 7.9% at the 95% confidence interval.

Economic outlook for 2023*

Global economy: Optimistic 44%; Neutral 17%; Pessimistic 39%

National economy: Optimistic 46%; Neutral 22%; Pessimistic 31%

Local economy: Optimistic 55%; Neutral 24%; Pessimistic 20%

Industry performance: Optimistic 65%; Neutral 14%; Pessimistic 21%

Company performance: Optimistic 73%; Neutral 20%; Pessimistic 6%

*Among respondents who indicated they work in commercial real estate.

National and global optimism

Optimism on national economy

U.S. commercial real estate leaders 46%

U.S. business leaders in general 22%

Optimism on global economy

U.S. commercial real estate leaders 44%

U.S. business leaders in general 8%

Pending recession

U.S. commercial real estate leaders: Yes 55%; No 36%; Not sure 10%

U.S. business leaders in general: Yes 65%; No 16%; Not sure 18%

Most likely business response to an economic downturn*

Make strategic acquisitions: 27%;

Maintain a steady state: 27%;

Optimize operations: 23%;

Adjust rents: 13%;

Reposition assets: 10%

*Among respondents who indicated they work in commercial real estate.

Bullish on their own businesses

Nearly two-thirds of real estate leaders expect their profits to increase in 2023. Most expect their capital needs to increase as well.

Business expectations*

Profits: Increase: 65%; Remain the same: 18%; Decrease: 17%

Capital needs: Increase: 71%; Remain the same: 22%; Decrease: 6%

*Among respondents who indicated they work in commercial real estate.

Inflation challenges

Inflation is increasing business costs. The majority of commercial real estate leaders are passing those expenses onto consumers.

What’s driving up the cost of doing business*

Rising interest rates/increased cost of capital: 67%;

Increased cost of energy: 67%;

Increased costs of retaining/hiring employees: 65%;

Increased costs related to supply chain issues: 63%;

Increased costs of raw materials: 59%

*Among commercial real estate respondents who indicated they are experiencing inflation challenges/costs rising.

Percentage of increased costs passed onto consumers/buyers*

Up to 25%: 21%;

26%–50%: 19%;

51%–75%: 24%;

76%–99%: 6%;

100%: 7%;

None: 23%

*Among commercial real estate respondents who indicated they are experiencing inflation challenges/costs rising.

Business challenges

Leaders in real estate face a litany of challenges, including rising interest rates, supply chain issues and cyberattacks.

Top external business threats*

Cost of debt/interest rates/access to capital: 34%

Energy prices: 11%

Cybersecurity and fraud concerns: 10%

China and trade/policy concerns : 10%

General market volatility: 10%

*Among respondents who indicated they work in commercial real estate.

Top issues facing the commercial real estate industry*

Lack of affordable housing: 28%

Supply chain issues: 28%

Unclear future of office: 18%

Speed of technology innovation: 15%

Climate change: 11%

*Among respondents who indicated they work in commercial real estate.

Cyberattacks experienced in last six months*

Not directly impacted: 34%

Payments fraud: 33%

Business email compromise: 29%

Malware (including ransomware): 28%

Crashing of company’s online service or site: 27%

*Among respondents who indicated they work in commercial real estate.

Business growth plans

More than half of leaders are planning to expand into new domestic markets. More than a third count strategic partners/investments, new products/services and new distribution channels among their growth strategies.

Growth strategies for the next 12 months*

Expand into new domestic markets: 54%

Strategic partnerships/investments: 37%

Introduce new products/services: 36%

Expand into new distribution channels: 31%

Focus on most profitable products: 29%

*Among respondents who indicated they work in commercial real estate.

Corporate responsibility

Top areas of focus within corporate responsibility*

45% Diversity, equity and inclusion; 43% Governance; 41% Social

*Among respondents who indicated they work in commercial real estate.

Election effects

From the regulatory environment to infrastructure, most real estate leaders feel the same or better about key issues after the midterm elections.

Sentiment following the 2022 elections*

Regulatory environment: Worse 29%; Same 39%, Better 32%

Corporate taxes : Worse 27%; Same 39%, Better 33%

Infrastructure: Worse 15%; Same 46%, Better 39%

*Among respondents who indicated they work in commercial real estate.

Survey demographics

Who took the survey*

Chief Financial Officer: 34%

Owner/founder: 26%

CEO/chairperson: 24%

Other: 17%

*Among respondents who indicated they work in commercial real estate.

Assets owned/managed*

Multifamily: 71%

Office: 53%

Industrial: 52%

Mixed use: 49%

Affordable housing: 46%

Community impact developments: 32%

Retail: 24%

*Among respondents who indicated they work in commercial real estate.

Company size by number of employees*

1–49: 22%

50–99: 11%

100–249: 24%

250–499: 12%

500–999: 24%

1,000–4,999: 8%

*Among respondents who indicated they work in commercial real estate.

Company size by annual revenue*

Under $20mm: 15%

$20mm-$100mm: 39%

$101mm-$499mm: 43%

$500mm+: 3%

*Among respondents who indicated they work in commercial real estate.

Note: Some numbers may not equal 100% due to rounding.

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/cb-disclaimer for disclosures and disclaimers related to this content.

Related insights

Outlook

U.S. adds 228K jobs in March amidst market volatility: How investors should read the numbers

Apr 07, 2025

The March 2025 jobs report was stronger than expected, though the unemployment rate slightly ticked up. How might the Fed react and what does the data mean for investors?

Outlook

2025 Outlook update: How to parse policy uncertainty

Mar 24, 2025

From tariffs to technology, clashing forces are driving global markets.

Outlook

March 2025 Fed meeting: Interest rates kept steady, slower economic growth projected

Mar 20, 2025

Fed held rates steady for a second straight month and provided economic projections forecasting slower growth and higher inflation by year-end.

Outlook

Eye on the Market: Fifty days of grey

Mar 12, 2025

In this edition of Eye on the Market, Michael Cembalest gives his take on the Trump administration’s economic policies 50 days in, as well as their effect on markets thus far.

Outlook

Investment implications of President Trump’s first month in office

Mar 12, 2025

In his first 30 days, President Trump has made policy decisions on tariffs, immigration and deregulation. Here’s what investors need to know moving forward.

Outlook

US unemployment ticks slightly higher, economy adds 151K jobs in February

Mar 10, 2025

The February 2025 jobs report was slightly weaker than expected and the unemployment rate ticked up. How might the Fed react and what does the data mean for investors?

Outlook

Eye on the Market Energy Paper: Heliocentrism

Mar 04, 2025

In the 15th annual Eye on the Market Energy Paper, Michael Cembalest dives into the speed of the renewable energy transition, tariffs and more.

Outlook

Feb 17, 2025

In a series of dynamic conversations, leaders across regions and sectors explore the trends and ideas shaping the future.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.