From startups to legacy brands, you're making your mark. We're here to help.

-

Innovation Economy

Fueling the success of early-stage startups, venture-backed and high-growth companies.

-

Midsize Businesses

Keep your company growing with custom banking solutions for middle market businesses and specialized industries.

-

Large Corporations

Innovative banking solutions tailored to corporations and specialized industries.

-

Commercial Real Estate

Capitalize on opportunities and prepare for challenges throughout the real estate cycle.

-

Community Impact Banking

When our communities succeed, we all succeed. Local businesses, organizations and community institutions need capital, expertise and connections to thrive.

-

International Banking

Power your business' global growth and operations at every stage.

Key Links

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

-

Asset Based Lending

Enhance your liquidity and gain the flexibility to capitalize on growth opportunities.

-

Equipment Financing

Maximize working capital with flexible equipment and technology financing.

-

Trade & Working Capital

Experience our market-leading supply chain finance solutions that help buyers and suppliers meet their working capital, risk mitigation and cash flow objectives.

-

Syndicated Financing

Leverage customized loan syndication services from a dedicated resource.

-

Commercial Real Estate

Capitalize on opportunities and prepare for challenges throughout the real estate cycle.

-

Employee Stock Ownership Plans

Plan for your business’s future—and your employees’ futures too—with objective advice and financing.

Key Links

Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

-

Institutional Investors

Putting your long-tenured investment teams on the line to earn the trust of institutional investors.

-

Markets

Direct access to market leading liquidity harnessed through world-class research, tools, data and analytics.

-

Prime Services

Helping hedge funds, asset managers and institutional investors meet the demands of a rapidly evolving market.

-

Global Research

Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice.

-

Securities Services Solutions

Helping institutional investors, traditional and alternative asset and fund managers, broker dealers and equity issuers meet the demands of changing markets.

Key Links

Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Center for Carbon Transition

J.P. Morgan’s center of excellence that provides clients the data and firmwide expertise needed to navigate the challenges of transitioning to a low-carbon future.

-

Corporate Finance Advisory

Corporate Finance Advisory (“CFA”) is a global, multi-disciplinary solutions team specializing in structured M&A and capital markets. Learn more.

-

Development Finance Institution

Financing opportunities with anticipated development impact in emerging economies.

-

Sustainable Solutions

Offering ESG-related advisory and coordinating the firm's EMEA coverage of clients in emerging green economy sectors.

-

Mergers and Acquisitions

Bespoke M&A solutions on a global scale.

-

Capital Markets

Holistic coverage across capital markets.

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

A uniquely elevated private banking experience shaped around you.

-

Banking

We have extensive personal and business banking resources that are fine-tuned to your specific needs.

-

Investing

We deliver tailored investing guidance and access to unique investment opportunities from world-class specialists.

-

Lending

We take a strategic approach to lending, working with you to craft the right financing solutions matched to your goals.

-

Planning

No matter where you are in your life, or how complex your needs might be, we’re ready to provide a tailored approach to helping your reach your goals.

Whether you want to invest on your own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor.

-

Invest on your own

Unlimited $0 commission-free online stock, ETF and options trades with access to powerful tools to research, trade and manage your investments.

-

Work with our advisors

When you work with our advisors, you'll get a personalized financial strategy and investment portfolio built around your unique goals-backed by our industry-leading expertise.

-

Expertise for Substantial Wealth

Our Wealth Advisors & Wealth Partners leverage their experience and robust firm resources to deliver highly-personalized, comprehensive solutions across Banking, Lending, Investing, and Wealth Planning.

For Companies and Institutions

-

Commercial Banking

From startups to legacy brands, you're making your mark. We're here to help.

-

Institutional Investing

Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

-

Credit & Financing

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

-

Investment Banking

Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

For Individuals

-

Private Bank

A uniquely elevated private banking experience shaped around you.

-

Wealth Management

Whether you want to invest on you own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Technology at our firm

- Tech Blog

- Solving quantum linear systems on hardware for portfolio optimization

Solving quantum linear systems on hardware for portfolio optimization

By Romina Yalovetzky, Dylan Herman, and Marco Pistoia

Global Technology Applied Research

Quantum Computing has the potential to speed up many financial use cases. To make this happen, we need new algorithmic developments that leverage new hardware features. Our work is a great example of this progress, bringing the industry closer to solving financial use cases with Quantum Computing.

Quantum computing for portfolio optimization

Quantum computing is poised to revolutionize computational finance. However, the capabilities of current quantum hardware significantly constrain the scale of experimental demonstrations. This makes it challenging to perform demonstrations on hardware of quantum algorithms for practically relevant use cases.

Portfolio optimization is an important use case in finance that lends itself to be tackled by quantum computing. The Harrow-Hassidim-Lloyd (HHL) algorithm solves linear systems of equations, and it can be used to solve portfolio optimization by casting this problem into a linear system. HHL solves a quantum version of the linear systems problem, whose solution can allow to observe useful properties about the optimal portfolio. However, most of the components of HHL are far out of the reach of noisy intermediate-scale quantum devices, which has led to the proposal of hybrid classical-quantum variants that leverage the power of both classical and quantum computation.

We introduce Hybrid HHL++ that bridges the gap between proposed near-term implementations of HHL and the kinds of quantum circuits that can be executed on today’s hardware. To demonstrate the effectiveness of our procedure, we successfully applied Hybrid HHL++ to small-scale portfolio-optimization problems on the Quantinuum System Model H-series trapped-ion quantum computers. This Hybrid HHL++ research paper has just been published in Nature Scientific Reports.

Our novel contributions

Common challenges for implementing quantum algorithms on current hardware are the limited number of qubits, typically ranging from tens to hundreds on near-term devices, and the fact that deep circuits are prone to hardware noise. To address them we make two novel contributions: (1) propose a novel algorithm that maximizes the utility of the number of ancillary qubits, by determining a scaling factor for the linear system matrix, and (2) introduce a heuristic for compressing the HHL circuit.

We demonstrate the efficacy of our work by running Hybrid HHL++ on the Quantinuum System Model H-series trapped-ion quantum computers to solve different problem instances of small-scale portfolio optimization problems, leading to the largest experimental demonstrations of HHL for an application to date.

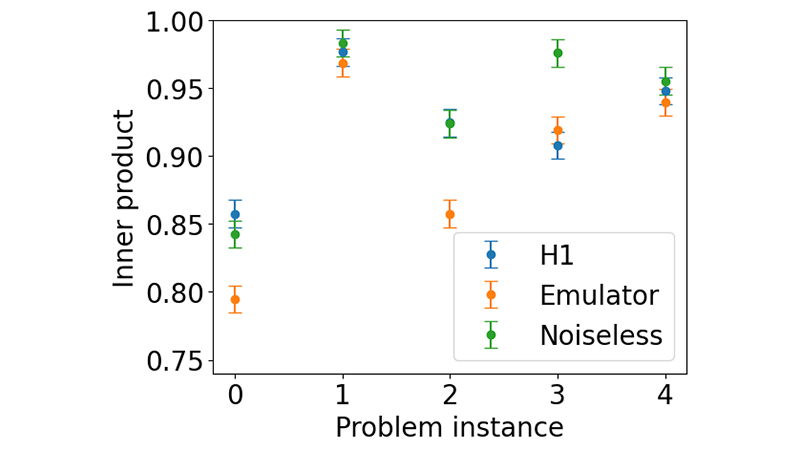

The efficiency of the proposed algorithm is evaluated by different figures of merit, including the inner product, as shown in Figure 1 and Table 1. The quality of the solution to the portfolio-optimization problems is very high, and close to the one obtained in noiseless simulation, illustrating thar our proposed algorithm Hybrid HHL++ is more robust to hardware noise. This work represents a milestone towards the evaluation of quantum algorithms to tackle relevant use cases in quantum hardware available today.

The infographic illustrates the inner product that measures the quality of the solution obtained with Hybrid HHL++ for each of the portfolio-optimization problem instances considered.

Short description:

Plot of the inner product between the output quantum state of Hybrid HHL++ and the analytical solution for each of the portfolio-optimization problem instances with two assets.

Long description:

The inner product quantifies the quality of the solution obtained, being the closer to 1, the better the solution. Displayed is the inner product corresponding to the execution of the circuits on hardware, its emulator with approximated noise and in noiseless simulation.

Figure 1: Inner product between the output quantum state of Hybrid HHL++ and the analytical solution for each of the portfolio-optimization problem instances with two assets. The inner product quantifies the quality of the solution obtained, being the closer to 1, the better the solution. It is displayed the inner product corresponding to the execution of the circuits on hardware, its emulator with approximated noise and in noiseless simulation.

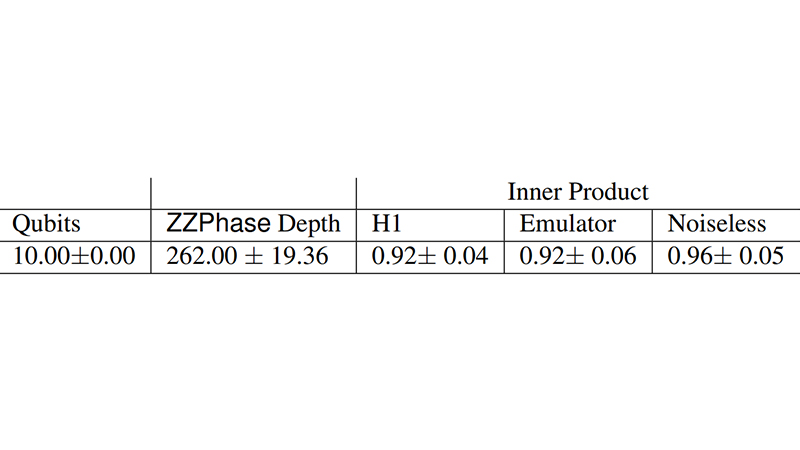

The infographic illustrates the main results in terms of the quality of the solution obtained by Hybrid HHL++ on quantum hardware, its emulator and noiseless simulation.

Short description:

Summary of the results obtained in terms of the inner product. Shown is the number of qubits and depth of the circuits of the implementation of Hybrid HHL++.

Long description:

It is observed that the inner product (i.e., quality of the solution) obtained on hardware (H1 device) overlaps with the quality obtained on noiseless simulation, illustrating that the proposed algorithm Hybrid HHL++ is more resistant to hardware noise.

Table 1: Summary of the results obtained, where we show the number of qubits utilized and the circuit depth. It is observed that the inner product (i.e., quality of the solution) obtained on hardware (H1 device) overlaps with the quality obtained on noiseless simulation, illustrating that the proposed algorithm Hybrid HHL++ is more resistant to hardware noise.

To learn more about Global Technology Applied Research at JPMorganChase, please visit https://www.jpmorgan.com/technology/applied-research.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.