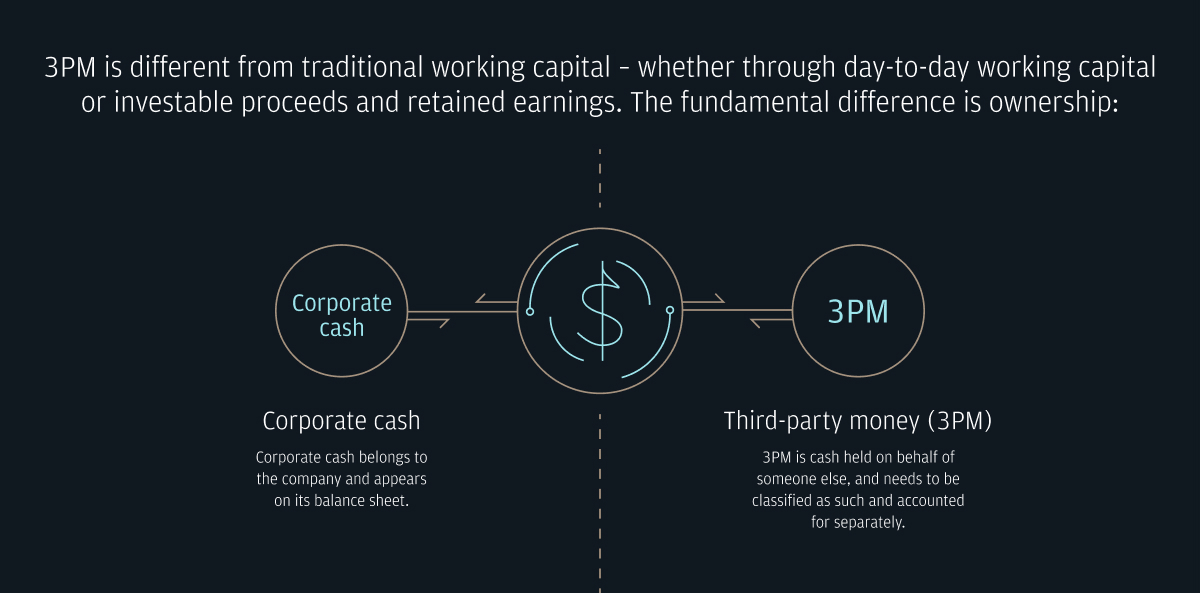

Third-party money (3PM)

The shift to an increasingly online, digital economy is creating new opportunities and considerations for treasury operations. One of the biggest new developments is third-party money (3PM)—managing cash that does not belong to your company.

Key considerations for treasurers

Corporate treasurers have to think about a number of areas when tasked with managing a flow of funds destined for different receivers, including:

-

Setting up more accounts to take care of divergent fund flows

-

Paying out cash to multiple external businesses

-

Aligning with different licensing or regulatory models

-

Maintaining the separation of fund types without sacrificing visibility and efficiency

Major opportunities for third-party money (3PM)

As 3PM becomes more important, the role of corporate treasury will continue to evolve, shifting the primary focus from areas like multicurrency management and risk management to encompassing settlement optimization, frictionless payments and complex new account structures. Opportunities include:

- Treasury optimization

- Payments as a service

- Loyalty and rewards

- Data collection and insights

Treasury

The next frontier: Notional pooling for third-party money

Oct 03, 2023

With the power of today’s digital technology, many businesses are embracing third-party money (3PM) commerce opportunities. The question is: Can they also reap the benefits of managing 3PM through advanced liquidity techniques such as notional pooling?

Read more

Let's talk about solutions for your business

icon

Loading...