For Companies and Institutions

-

Commercial Banking

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

-

Global Corporate Banking

We help clients achieve their long-term strategic goals through financing, liquidity, payments, risk management and investment banking solutions.

-

Investment Banking

Providing investment banking solutions, including M&A, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Institutional Investing

We support the entire investment cycle with market-leading research, asset management, analytics, execution, and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

For Individuals

-

Wealth Management

With J.P. Morgan Wealth Management, you can invest on your own or work with an advisor to design a personalized investment strategy. We have opportunities for every investor.

-

Private Bank

A uniquely elevated private banking experience shaped around you.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Payments

- Treasured

Treasured: resources to empower treasurers

Treasurers are changing the world - and given digital transformation, collaborating across departments to inform effective outcomes is on the rise. Treasurers are finding new ways to create value by speaking the language of their peers across the business and leading with influence.

Treasury goes beyond numbers and borders; it’s an art where strategy meets purpose, and where the strongest bonds aren’t always financial. To thrive, treasurers must embody resilience, foresight, and healthy obsession with balance.

APAC Treasurer, Leading Luxury Skincare

Treasury creates the greatest impact when it aligns with business goals. Gaining insight into commercial, supply chain and operations strengthens financing and risk management strategies

Treasury Manager, Asia Pacific, Agricultural Science Company

The more the business is challenged, the more treasury involvement should happen.

CEO, Sony Ventures Corporation

Treasury has evolved to having a seat at the table along with the business and other functions of the organization when critical business decisions are made.

Former Fortune 100 Treasury, Business Lead

It’s vital to understand the perspective of different stakeholders and build healthy relationships.

Treasury BD & Capital Market Leader

Treasury needs people with an open mind about AI... I am convinced these are the skills the next generation of treasurers need to develop.

Head of Treasury – Europe, GXO Logistics

The role of the treasurer will evolve over time, becoming less operational and increasingly more strategic.

Treasury Senior Director, Mercado Libre

Treasury goes beyond numbers and borders; it’s an art where strategy meets purpose, and where the strongest bonds aren’t always financial. To thrive, treasurers must embody resilience, foresight, and healthy obsession with balance.

APAC Treasurer, Leading Luxury Skincare

Treasury creates the greatest impact when it aligns with business goals. Gaining insight into commercial, supply chain and operations strengthens financing and risk management strategies.

Treasury Manager, Asia Pacific, Agricultural Science Company

Treasury world is evolving fast, so Treasurers need to learn and adapt to the new ways which are not just restricted to Liquidity or Risk management, but also extend to Tech adaption and Talent development.

Asia Pacific Treasurer, ADM

The more the business is challenged, the more treasury involvement should happen.

CEO, Sony Ventures Corporation

Treasury has evolved to having a seat at the table along with the business and other functions of the organization when critical business decisions are made.

Former Fortune 100 Treasury, Business Lead

It’s vital to understand the perspective of different stakeholders and build healthy relationships.

Treasury BD & Capital Market Leader

Treasury needs people with an open mind about AI... I am convinced these are the skills the next generation of treasurers need to develop.

Head of Treasury – Europe, GXO Logistics

Treasurers: Shaping the

future of business

Lourenço Cassandre

Treasury Senior Director, Mercado Libre

As companies adapt to new challenges, treasurers are taking on a bigger role. Lourenço Cassandre, Treasury Senior Director at Mercado Libre—Latin America’s e-commerce giant—shares his firsthand experience and thoughts on how treasurers can impact business moving forward.

Leverage

new technologies

Technology can help transform businesses and increase Treasury efficiency in day-to-day tasks, freeing up time to focus on more strategic collaborations. Treasurers who have a foundational understanding of tech in key areas can advocate for solutions that work cohesively with their treasury management systems.

Automate

Streamline

Prepare

APIs can support digital transformations such as real-time payments and real-time visibility into cash positioning. These innovations can delight both partners and treasurers, but they require treasurers to have a foundational understanding of APIs, so they can advise on where they are more additive to business goals and communicate this to technology teams.

LEARN MOREVirtual accounts allow treasurers to aggregate accounts, which offers benefits such as detailed reporting and seamless accounting. These features are foundational building blocks to support digital innovation across the business, and treasurers who understand what their peers want can better frame the need for virtual accounts within the context of how it helps different functions.

LEARN MORETreasurers who take a long-term approach to technological development, and work in lockstep with Tech and Innovation teams can make a huge impact on business efficiency. With a seat at the table, Treasurers can apply their financial expertise to advise on tech and cash flow in a way that creates operational efficiencies and saves costs.

LEARN MORE"Now more than ever, data management, standardization and how we can create more efficiency through technology drives treasury business and dictates the types of banking partners we chose to work with."

Head of Treasury Operations

Business Lead

Consider

user needs

Businesses are increasingly using payments as an avenue towards digital transformation, by creating additive experiences for the customer or supplier on the other side of the transaction. Treasurers who understand users' expectations of omni-channel and frictionless payments can influence the build of an ideal solution.

Customers

Gig Workers

Suppliers

Businesses now view a best-in-class customer experience as a competitive advantage, much like price or product quality. Payments can help to drive that experience: consumers now expect frictionless, often invisible payments, embedded within their buying journey, and want the ability to connect their experience across channels.

LEARN MOREThe explosion of the gig economy now means that many organizations employ on-call or temporary workers. These employees may make employment decisions around the ability to instantly receive their pay, making earned wage access a competitive differentiator for platform-based business models.

LEARN MOREBusinesses have seen in recent years how critical an efficient supply chain is to meeting business needs. Many Operational Executives have adopted practices such as nearshoring, diversification of suppliers and closer inventory management. Treasurers have a huge role to play here, by advocating for payment solutions that enhance these practices and analysing the impact on a firm’s cash flow.

LEARN MORE"We’re excited about the potential of this brand-new tool. With Real-Time Payments, there’s no more waiting. I just hope the rest of the commercial real estate industry adopts this technology."

Treasurer and Senior Vice President

Hunt Companies

Know

your industry

Businesses can learn a lot from transformations taking place within their industry. This context helps to illuminate additional solutions that could develop their business, and Treasurers who understand this context can be proactive in helping to build and shape this vision.

Healthcare

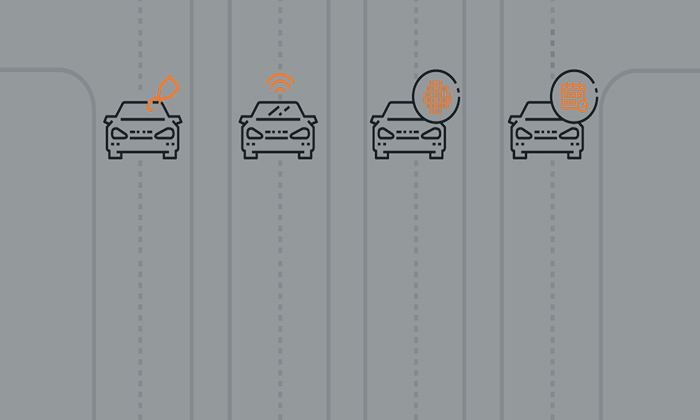

Automotive

Technology

Digital payment solutions can provide a myriad of benefits, such as increasing patient centricity, connecting healthcare ecosystems, increasing inclusion in the space and supporting innovation. All of these aid in increased operational efficiencies, driving progress within the industry.

LEARN MORE Mobility is driving the future; drivers and riders can now benefit from seamless payments across their entire mobility journey, from financing (or even subscribing to) a car, intelligent insurance, to in-vehicle purchases. These solutions open the door to new cross-industry partnerships and new ecosystems surrounding the automotive journey.

Disclaimer: Future capabilities of mobility payment solutions are under development; features and timelines are subject to change at the Bank's sole discretion.

Payments can support new technology within marketplaces, super apps and social media commerce platforms, which are transforming the digital economy. Platform owners and large B2B companies have an opportunity to drive innovation that supports their small business partners.

LEARN MORE"The marketplace was a natural next step. We expect to have 100 sellers onboarded by year end, and the expectation is that it will grow to 700 at the end of five years."

Vice President of Treasury

L’Oréal

Risk

perspective

Risk management is an inherent part of the role of the Treasurer, but peers may struggle to understand the need for additional trust and safety layers that fortify against emerging and ongoing concerns.

Integration

Implementation

Provider

Selection

An understanding of how new technology integrates into preexisting systems can help Treasury identify operational risks, cash flow risks and even potential impacts on credit risk.

LEARN MOREBeing able to communicate the workflow of new trust and safety tools, such as proactive controls which can help stop fraud before it happens, can be helpful in bringing the business up the learning curve throughout implementation. It’s equally important to communicate any bottlenecks or timeline updates.

LEARN MOREFor many procurement exercises, the number of potential providers can be overwhelming. Treasurers who are able to articulate the financial non-negotiables for new partners can positively influence business outcomes and streamline the selection process.

LEARN MORE"Our Company has been focused on continued rationalization of bank accounts and implementing the best possible liquidity structure. As part of our treasury evolution, we have been transitioning away from physical accounts into a virtual account environment. ... So far the experience is everything we hoped it would be."

Assistant Treasurer and Director of Global Risk Management

Hitachi Vantara

Enhance

your core skills

Most treasurers understand risk, but their partners may fail to understand the need for additional trust and safety layers that fortify against emerging and ongoing concerns. Beyond understanding the value of new trust and safety tools, treasurers must prepare to communicate around a few key topics with partners.

Related insights

TREASURY AND PAYMENTS

Future of shopping

Digital innovations have changed the way that consumers shop. Businesses are already responding by elevating customer experiences through adding new players to the mix.

E-COMMERCE

Corporate treasury’s next big opportunity: other people’s money

Post-pandemic, as businesses grow and scale their e-commerce platforms, the matter of third-party money (3PM) is coming to the fore.

TREASURY AND PAYMENTS

Fueling the connected car economy

As cars become increasingly more connected, they are no longer just a product to be sold and maintained.

ESG

Empowering financial inclusion through payments

Learn how Earned Wage Access (EWA) is becoming a mainstream tool for employers as a way to enable financial inclusion amongst their employee base.

TREASURY AND PAYMENTS

Streamline your multinational treasury through centralized trading centers

In the wake of Covid-19, efficiency, agility and optimization are critical objectives for today's corporates.

TREASURY AND PAYMENTS

The future of resorts, gaming and entertainment is closer than you think

The next decade will transform the resorts, gaming and entertainment industry as it increasingly blends physical and digital experiences

TREASURY AND PAYMENTS

PAYMENTS are eating THE WORLD

The next decade of payments promises to be even more transformational than the last.

The next decade of payments promises to be even more transformational than the last.

The next decade of payments promises to be even more transformational than the last.

YOUR DIGITAL WALLET ON WHEELS

The seamless journey isn’t just about getting you from A to B, but smoothing every part of the ride ADA text for “infographics” – Your Digital Wallet on Wheels

- Targeted offers sent based on location, payment and mobility data – accruing loyalty points as you make in-vehicle purchases

- Instant, in-vehicle payments for car-related services like EV charging

- Pay-per-use or tailored insurance premiums based on your car performance and driver behavior data

- Rent a car on-demand and pay automatically for the number of miles driven

- Seamlessly pay for car upgrades such as firmware, servicing or new parts -

- Personalized alerts when approaching your favorite shops or restaurants, with the option to pre-order and pay in advance

Modal title

Related insights

Markets and Economy

Software shock: AI’s broken logic

Feb 06, 2026

Software rout sparks indiscriminate selling despite long-term artificial intelligence (AI) winners.

Real Estate

Protecting commercial properties from cybersecurity threats

Feb 06, 2026

Learn how to protect your payments and data from common cybersecurity threats affecting commercial real estate owners and operators.

Banking

Five trends shaping healthcare in 2026

Feb 05, 2026

What healthcare’s largest global conference tells us about the road ahead.

2:22 - Business Planning

How BuDhaGirl’s consumer-first strategy drove growth

Feb 04, 2026

Founder and CEO Jessica Jesse explains how listening closely to consumer feedback and team ideas creates loyalty and fosters growth.

2:21 - Business Planning

BuDhaGirl founder Jessica Jesse’s ‘3 C’s’ for business resilience

Feb 04, 2026

BuDhaGirl Founder and CEO Jessica Jesse shares strategies that can help business leaders navigate uncertainty.

2:25 - Business Planning

Strategic expansion: Insights from BuDhaGirl’s growth

Feb 04, 2026

From bangles to bubbles: BuDhaGirl Founder, CEO and Creative Director Jessica Jesse explains her approach to identifying opportunities to diversify and scale.

2:25 - Business Planning

BuDhaGirl founder Jessica Jesse talks scaling amid economic uncertainty

Feb 04, 2026

For Jessica Jesse, focusing on factors within her control and a strong bank relationship helped fuel investment in growth.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.