Industrial transformation seeking to enhance opportunity, utilization, productivity and optimization–in essence, doing more with less–has been a perennial opportunity and challenge. New technologies, industries and companies have been formed, scaled and evolved to catalyze the human experience and shape our global economic landscape.

In the middle of the 18th century, the First Industrial Revolution occurred in Britain. It brought the mechanization of textile production powered by steam, leading to the adoption and growth of the factory system. The increases in labor productivity were substantial and laid the foundation for numerous economic transformations, including urbanization, financial markets, technological innovation and improved standards of living.

J.P. Morgan and its predecessors have been a pivotal enabler since the beginning. As the First Industrial Revolution gained momentum, J.P. Morgan’s earliest predecessor, the Manhattan Company, was founded as New York City’s first water company. By 1893, during the Second Industrial Revolution, J.P. Morgan provided financial backing for nearly 20% of America’s railroads and was critical to the formation of the electrical and steel industries. When the Third Industrial Revolution arrived, Chase Manhattan Bank was an early adopter of computers–the room-sized ones–and drove the automation of banking. Now more than 250 years since the first steam engines, we are scaling the Fourth Industrial Revolution (4IR) which is rapidly merging into the Fifth (5IR). J.P. Morgan is as invested as ever in championing innovation, advocating for entrepreneurship and facilitating connection and collaboration across industries.

Accelerating the Fourth Industrial Revolution and the dawn of the Fifth

First coined at the Hannover Fair in 2011 but popularized around 2015 and 2016, the 4IR is the combination of technologies bringing together the digital, physical and biological worlds. The term is broad and includes a variety of technologies including AI, robotics, spatial computing, autonomous vehicles and quantum. The combination and application of these technologies is addressing numerous challenges to global economic growth while also providing opportunity for an enhanced quality of life.

5IR envisions a future where humans and machines work synergistically. 5IR will be driven by the continued evolution of AI, including scaling and broad-based application of generative AI models. AI will be an integrated component of our daily lives—enhancing our decision-making, creativity and productivity.

Demographic shifts

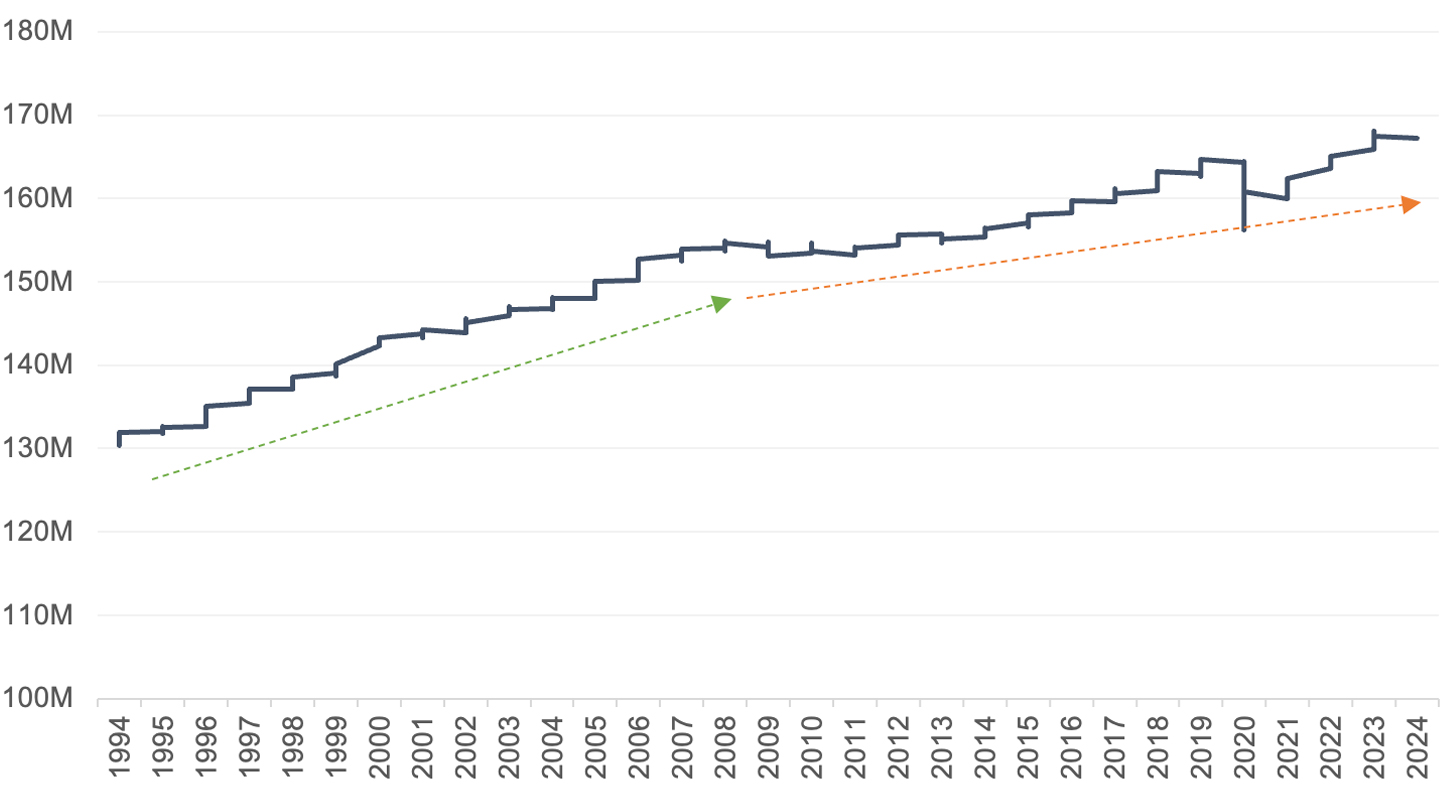

A major input into economic growth is the number of qualified workers available, or the labor force growth. U.S. demographic shifts, such as an aging population and declining birth rate, along with a declining labor force participation rate, have limited the growth in the civilian labor force. As such, the contribution to U.S. GDP from labor growth has slowly declined in each decade since the 1970s.

Total U.S. civilian labor force

Source: Federal Reserve Bank of St. Louis.

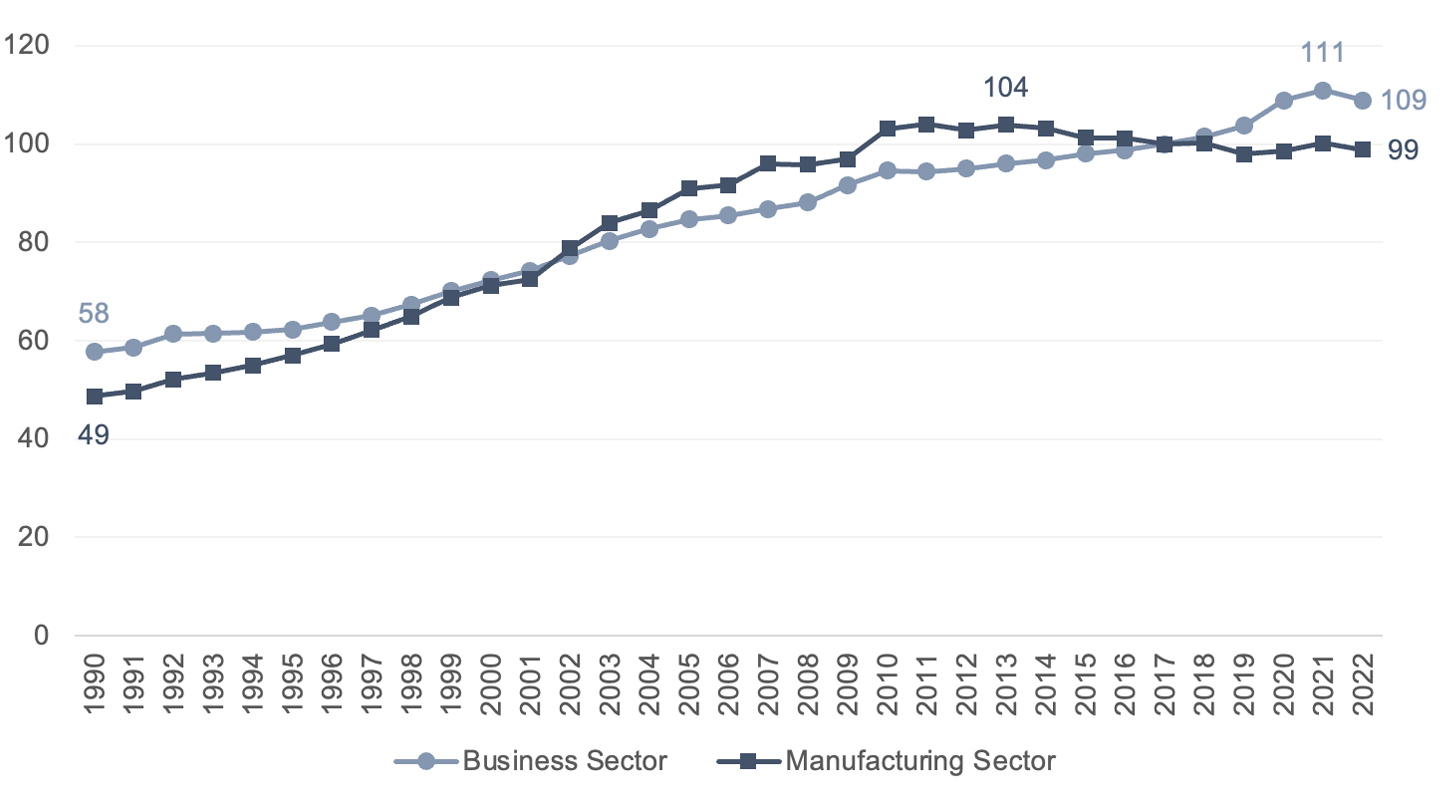

Labor productivity

Productivity is another major input in the growth equation. Without significant expansion of the qualified labor pool, growth will have to come from productivity gains. U.S. labor productivity in the manufacturing sector has been stalled since 2010. By comparison, the business sector (namely information, finance and professional services) has consistently made gains in productivity until recently. If manufacturing sector productivity continues to fall and business sector productivity starts to plateau, the ramifications could be significant as the manufacturing sector contributes $2.3 trillion or 10% of U.S. GDP and the business sector contributes $9.5 trillion combined or 42% of U.S. GDP (both as of Q3 2023). Some of the causes of slowing labor productivity include worker skill gaps, worker shortages and limited adoption of automation. However, there is a renewed focus on innovation that can address the causes of slowing labor productivity.

U.S. labor productivity for select sectors (indexed to 2017)

Source: Bureau of Labor Statistics. Note: Business sector excludes government, private households, non-profits, farming.

Technological advancements

Automation, typically robots, have been used in manufacturing since the 1960s. Initially, many manufacturers such as automakers benefitted from a strong increase in productivity through the incorporation of automation—but automation has more recently seen its efficacy plateau. The limited “intelligence” of these machines and their physical nature capped the number of use cases, especially within the business sector. However, with the most recent leap in AI innovation, there is the potential to reenergize productivity across both the manufacturing and business sectors by either redirecting or augmenting humans.

J.P. Morgan’s leadership in championing next generation technology companies

The J.P. Morgan Global Banking franchise is proud to advise, connect, and finance technology companies across the broader applied technology and AI sectors. The breadth of our capabilities enables us to partner with companies throughout their lifecycles, from early-stage equity capital and venture debt financing, across late-stage private capital fundraising and IPOs, to M&A and shareholder defense, in addition to day-to-day treasury and operating capital advice and access. We have built a leading semiconductor franchise on Wall Street, and maintain the #1 market position across the broader Applied Technology Investment Banking sector [Source: Dealogic, North America FY2023].

In addition to advising companies on their strategic and financing objectives, J.P. Morgan itself is a developer, evaluator and adopter of 4IR and 5IR technologies. These technologies are applied both for our customers' use and benefit, and for internal corporate applications, supported by our $15 billion technology budget. Of paramount importance is to maintain customer trust and privacy and adhere to regulatory and cybersecurity imperatives, whether the technology solutions are developed in-house or by a third party. We believe the incorporation of AI into various aspects of our business–including trading to risk management to customer service–are enhancing our capabilities to serve clients and communities better and are necessary to maintain a competitive advantage.

J.P. Morgan has over 900 data scientists, 600 machine learning engineers and approximately 1,000 people involved in data management, in addition to a 200-person AI research team solving the most intricate problems across the finance ecosystem.

As noted by Global Chief Information Officer Lori Beer during our 2023 Investor Day, “We have increased the number of AI use cases in production 34% year-over-year, with more than 300 in production. And we are actively evaluating opportunities with large language models and see great potential in that space.”

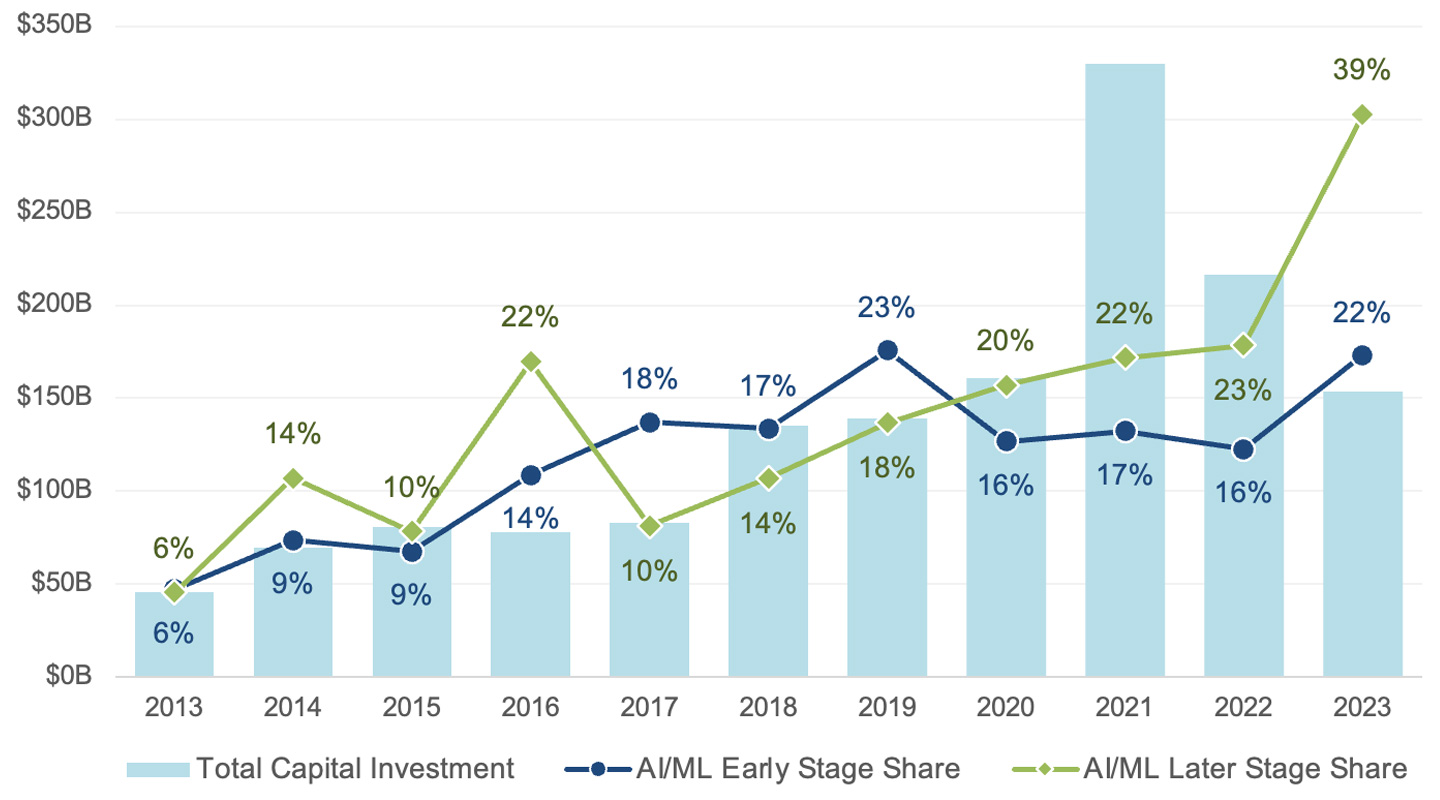

4IR and 5IR technology companies are cutting-edge and enormously transformational, yet many of these technologies and applications are still early in their development and commercialization phase. To support continued proliferation of these companies, a variety of financing sources are being utilized. Of note, the private capital flowing towards the U.S. AI sector in particular saw a substantial increase in 2023 and represented 22% of early stage and 39% of later stage capital investment.

U.S. venture investment in AI and machine learning companies

Notes: Early-stage is defined as a Series A to Series B round that occurred within five years of the company's founding date. Later stage is defined as a Series C to Series D round, or a round that occurs more than five years after the company's founding date. AI/ML based on PitchBook’s vertical classification. Source: PitchBook.

Commercialization opportunities and considerations

Advice from Dr. Manuela Veloso, Head of J.P. Morgan Chase AI Research and Herbert A. Simon University Professor Emerita at Carnegie Mellon University:

“I have seen the great progress of autonomous AI agents through my career, and encourage people to get comfortable with the idea of autonomous devices moving through their workplaces and homes. Such physical AI presence will be of great help, in particular with transportation, guidance, and monitoring tasks.”

4IR and 5IR technology companies are focusing their efforts on evolving and integrating into the industrial, transportation, energy and defense sectors, among others. “Traditional” businesses in these sectors are actively looking to adopt next-generation technologies, including AI, automation and sustainability. The potential applications are vast across all of their processes–whether it’s the manufacturing floor, the front and back office or their in-field solutions–and so are the potential human capital and financial returns.

While these businesses are excited about the prospects these new technologies offer, they also are carefully moving forward, as they have spent their entire existence building and refining customer relationships where trust and reliability are table stakes.

Founders across the 4IR and 5IR sectors who recognize and can articulate and provide solutions for both the risks and the rewards of their technologies have the immense opportunity and responsibility to shape and reshape the global economic stage and redefine the next generation of market leaders. At J.P. Morgan, we are committed to continuing to advocate for, finance and partner with next-generation innovators who are powering the Industrial Revolution. Learn more about how we can help your company achieve its goals at jpmorgan.com/innovationeconomy.

J.P. Morgan Disclaimer

J.P. Morgan is a party to the SEC Research Settlement and as such, is generally not permitted to utilize the firm's research capabilities in pitching for investment banking business. All views contained in this presentation are the views of J.P. Morgan’s Investment Bank, not the Research Department. J.P. Morgan’s policies prohibit employees from offering, directly or indirectly, a favorable research rating or specific price target, or offering to change a rating or price target, to a subject company as consideration or inducement for the receipt of business or for compensation. J.P. Morgan also prohibits its research analysts from being compensated for involvement in investment banking transactions except to the extent that such participation is intended to benefit investors.

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/cb-disclaimer for disclosures and disclaimers related to this content.