Podcast: Assessing the fallout from the Coronavirus pandemic.

As COVID-19 continues to spread, the global impact to the economy also continues to evolve at an unprecedented speed. J.P. Morgan Research examines what lies ahead for the markets as we head into a global recession, the series of policy responses around the globe and which sectors will be hit the hardest.

Containing coronavirus triggers a global recession in the first half of 2020

The World Health Organization (WHO) officially declared the coronavirus outbreak a global pandemic on March 11th, as the outbreak has now spread to 100+ countries. Total infections outside of China are accelerating, with the global infection toll surpassing 200,000 as of March 18, with China’s contribution at more than 81,000. As coronavirus spreads at the community level, public health policies are shifting from ‘containment’ to ‘delaying’ and/or ‘mitigation.' This approach accepts the idea that the virus will spread in society and emphasizes slowing the speed and scale of the diffusion process.

J.P Morgan economists’ views on the economic consequences of the virus shock have evolved dramatically in recent weeks with respect to the severity and duration of the outbreak. J.P. Morgan Global Economics Research now expects the global economy to experience an unprecedented contraction during the first half of the year as containment measures are driving deep collapses in monthly economic activity.

The U.S. economy is projected to contract by 14% in the second quarter, after experiencing a 4% contraction in the first quarter, before recovering to 8% and 4% growth in the third and fourth quarters. Euro area GDP will suffer an even deeper contraction, with double-digit declines of 15% and 22% in the first and second quarters, before rebounding by 45% and 3.5% in the third and fourth quarters.

“There is no longer doubt that the longest global expansion on record will end this quarter. We now think that the COVID-19 shock will produce a global recession, as nearly all of the world contracts over the three months between February and April,” said Bruce Kasman, Chief Economist at J.P. Morgan. Initially, the expectation was the novel-recession may generate limited labor market damage, but J.P. Morgan Research is now forecasting the unemployment rate for developed markets as a whole will rise 1.6 percentage points in the next two quarters.

“The rise in unemployment will be sharper in the U.S. than in the Euro area. Most immediately, U.S. initial jobless claims should spike above 400,000 in the coming weeks,” said Michael Feroli, Chief U.S. economist at J.P. Morgan.

Global monetary policy response to the coronavirus pandemic

The outbreak has also weighed on global financial markets, which have seen a synchronized sell-off in stocks, bonds and commodities as investors, companies and financial institutions have raced to boost cash in an effort to help buffer themselves from the widening economic damage caused by the virus. The rout in U.S. stocks has erased almost a third of the value in the three major equity benchmarks over the past month.

Policymakers are acting in unison and taking actions beyond monetary policy to cushion the demand drop, keep illiquid firms solvent and prevent a seizing up in aggregate credit flows. On the evening of March 15th, the Federal Reserve (Fed) slashed its target range for the Fed funds rate by 100 basis points to the zero lower bound and also unveiled a massive package of measures which includes the purchase of assets ($500 billion of Treasuries and $200 billion of mortgage-backed securities), lowering the rate on discount window loans, lowering required reserve ratios to 0% and reducing the cost of cross-currency dollar swap lines.

In addition, on March 17th, the Fed re-introduced the Commercial Paper Funding Facility (CPFF) and Primary Dealer Credit Facility (PDCF) that were in place during the 2008/2009 financial crisis to ease stress on the credit side of money markets. Altogether, the U.S. stimulus package amounts to around $1.3 trillion. At an emergency meeting on March 19th, the Bank of England (BoE) cut its benchmark interest rate to a record low of 0.1% from 0.25% and said it would buy £200 billion ($232 billion) of U.K. government bonds. Policy makers concluded that further stimulus was needed to ease growing financial strain and support growth and inflation.

The European Central Bank (ECB) and Bank of Japan (BoJ) also announced greater asset purchases. On March 18th, the ECB announced a 750 billion euros ($807 billion) Pandemic Emergency Purchase Program (PEPP) above the ongoing Asset Purchase Program (APP), which includes Greek sovereign bonds and will bring total asset purchases to around $120 billion per month. The BoJ said it would double stock purchases and help companies get loans in response to the coronavirus pandemic. The central bank pledged to buy exchange-traded funds (ETFs) at an annual pace of around 12 trillion yen ($112.55 billion), double the amount it had pledged to buy up to now. The next focus will be whether the BoJ cuts the negative short-term policy rate further, along with compensation for profits of banks.

In total, global policy rates have been cut by 55 basis points year-to-date through March 18 and roughly 50%-60% of the world in GDP-weighted terms are at, or near, the effective lower bound.

“From the beginning of the year through March 18th, 16 central banks have cut rates. As of that date, we forecast 24 more rate cuts by central banks by mid-year and at least 15 out of 22 emerging markets (EM) central banks will ease further. In total, EM central banks could potentially ease by another 80 basis points. In addition, fiscal policy is projected to add 1.3 percentage points to global GDP this year,” said Joyce Chang, Chair of Global Research at J.P. Morgan.

We forecast 24 more rate cuts by central banks by mid-year and at least 15 out of 22 EM central banks will ease further. In total, EM central banks could potentially ease by another 80 basis points.

Joyce Chang

Chair of Global Research, J.P. Morgan

Coronavirus and global airline travel

Countries and territories around the world have imposed travel restrictions to curb the spread of the coronavirus. The latest restrictions come from the president of the European Commission, who is proposing a 30-day ban on non-essential travel into the bloc.

On March 11th, the U.S. barred the entry of all foreign nationals who had visited China, Iran and a group of European countries during the previous 14 days. The ban was later extended to foreign nationals leaving the U.K. or Ireland. In China, most new arrivals in Beijing must now undergo a 14-day quarantine period at a designated hotel or other assigned location. In Europe, many countries have imposed a full suspension on all flights arriving and departing, as borders are closing around the world.

“The collapse in air travel demand brought on by these severe travel restrictions and the reluctance of travelers to fly has the potential to materially reshape global aviation more meaningfully than the events of September 11th,” said Jamie Baker, U.S. Airline and Aircraft Leasing Equity Analyst at J.P. Morgan.

North America drives one-fifth of global activity, but generates two-thirds of global profits. This implies that airline failures may solely occur elsewhere, thereby paving the way for higher international margins for the North American 'Big Four' (Air Canada, Delta, American and United) as the crisis fades. 2019 was already witness to a record number of airline failures despite a favorable fundamental backdrop.

Airline stock picking and credit selection has grown more complex, as investors must increasingly discount scenarios previously considered unthinkable such as prohibiting healthy Europeans from entering the U.S., or the partial or complete shutdown of the U.S. airspace, a scenario that cannot be ruled out.

“Liquidity analysis consistent with United’s stress-case scenario as recently described by its CEO does not lead to any insolvencies within our coverage space, which runs counter to the growing market view and results in attractive risk/reward, in our view, following the recent unprecedented volatility,” according to the stress test analysis and liquidity models developed by Baker and Mark Streeter, Equity and Credit U.S. Airline Analysts, respectively, at J.P. Morgan.

J.P. Morgan’s airline analysts do not see the industry on the precipice of a cash crunch in the coming weeks or even the next few months, but a longer-than-expected virus cycle remains a real risk. U.S. airline stocks and credit have responded positively to talks regarding potential government aid and J.P. Morgan Research expects improved market liquidity cognizance and further clarity on government intervention could potentially lift stocks and credit from here. However, the level of liquidity modeling that has been conducted is scant, and equities and credit may be discounting outcomes more dire than necessary, if the virus runs its course over a few months.

Global growth outlook

The coronavirus outbreak is a large and unexpected supply and demand shock both for the Chinese and global economy, given the important role China now plays in global growth. China now accounts for around 17% of global GDP, compared to only 4% in 2003 at the time of the SARS episode. In 2003, China accounted for less than 4% of global tourist spending compared to just under 20% at present. In the U.S., the list of affected activities is already long and includes the cancelation or suspension of major U.S. sports leagues and the closure of Broadway theaters.

“Overall, we think the consumer spending categories that are most at risk of virus-related disruptions account for around 7% of GDP. We assume activity in this group falls to 63% of normal activity in March, followed by 25% in April, 63% in May, and fully recovers to 100% of normal activity in June,” said Michael Feroli, Chief U.S. economist.

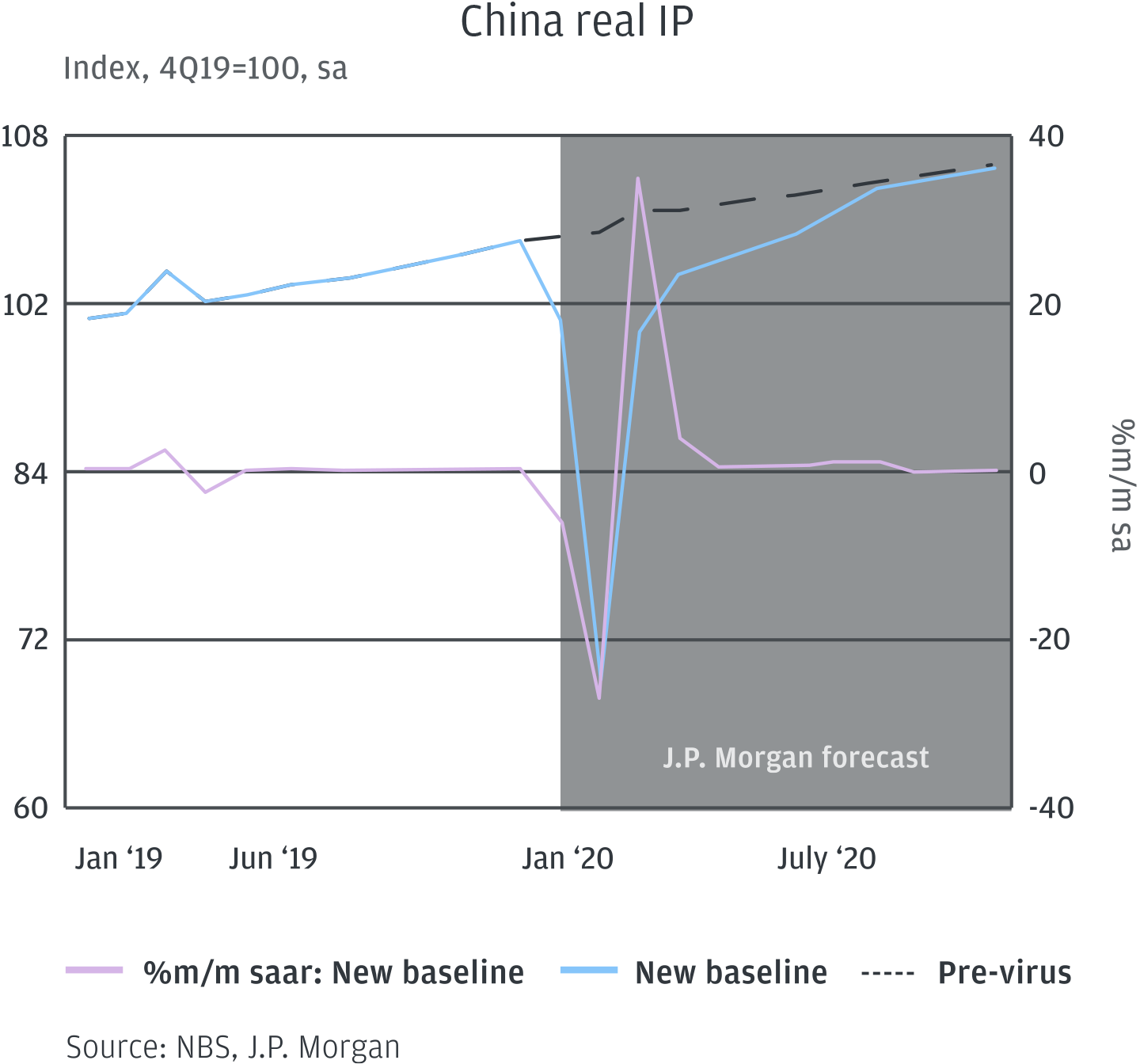

J.P. Morgan Research has further revised down China’s growth forecast in 2020 in response to the deterioration in the COVID-19 outlook in recent weeks. Economic activity and industrial production have not recovered as quickly as previously forecasted.

“We expect normalization of the work resumption rate to occur only in the second half of March, and the rebound in the second quarter will not be enough to offset first quarter losses,” said Haibin Zhu, Chief China Economist and Head of China Equity Strategy at J.P. Morgan.

“Our new forecast assumes a dramatic negative shock in the first quarter. The coronavirus is an unexpected demand shock and it has also become a notable supply shock due to prolonged factory shutdowns. We expect China’s GDP will contract by 41% quarter-over-quarter when seasonally adjusted (annualized rate), down from a pre-virus forecast of 6.3% growth,” said Zhu.

“This should be followed by a strong rebound in the second quarter at 57% quarter-over-quarter when seasonally adjusted. However, because the global pandemic will lead to a disruption in global demand and likely also global production and delay China’s normalization of economic activity due to concerns about a second wave of contagion, we now forecast full-year growth in China at merely 1.1% (versus a pre-virus forecast of 5.9%),” added Zhu.

The key outlook issue is whether this two-quarter downturn becomes a more traditional and longer-lasting downturn, which depends on the path of the virus and the success of measures taken to insure rapid containment.

“We now expect the infection curve in China to peak at 105,000 by mid-June in our base-case scenario, but negative risks persist as we see a potential second infection wave in our pessimistic case which includes 130,000 infected by mid-August” said MW Kim, Head of J.P. Morgan’s Asia-ex Insurance team.

The model created by J.P. Morgan’s Insurance and Pharma and Biotech analysts, Ashik Musaddi and Richard Vosser, now projects Germany, France, Italy, Spain and the UK (also known as the EU5) will peak towards the end of March, with a peak in active infections close to 80,000.

Coronavirus implications for cruise travel

In mid-March, the entire global cruise industry effectively halted operations for 30 days, with some international brands suspending service for 3 weeks and Princess Cruises voluntarily halting for 2 months. This move was under direct pressure from the U.S. government and greatly reduces the risk of perhaps several more 'Diamond Princess'-like scenarios. It also comes at a time when cancelations for forward bookings are significantly elevated and new bookings have been materially lower.

“It’s more likely than not that the industry won't resume operations in 30 days and cash burn for the industry in the interim is significant. Stock performance has passed the point of expecting any industry profitability in 2020, in our view and is now trading on liquidity risk, an analysis that largely depends on the ultimate duration of the outbreak,” said Brandt Montour, Gaming and Lodging Analyst at J.P. Morgan.

J.P. Morgan estimates Carnival, Royal Caribbean and Norwegian will lose roughly 7.5% of full-year capacity per month. In terms of run-rate expenses, about 13-15% is fuel, 7-11% is food, 20-30% is ship-based labor, 20-30% is other operating and 25-30% is selling, general and administrative expenses (SG&A).

In terms of reducing costs, significant expense savings can most likely be found in fuel and food, while comparatively little will be found in labor near term, given the difficulty of re-staffing just 30 days in the future. Flexibility in SG&A will depend on each operator’s own level of disruption and strategy from here, but roughly 50% of marketing expense has likely already been cut, as well as a small portion of G&A. J.P. Morgan Research estimates deeper cost cuts to the extent the shutdown gets extended. 2020 capital investment plans, outside of pre-financed new ships, are also being dramatically cut.

The impact from the shutdown is in addition to the other canceled sailings year-to-date. This has taken place mostly in Asia and worth 6-8% of pre-virus earnings before interest, tax, depreciation and amortization (EBITDA) and due to ongoing damage to future sailings from increased cancelations and a sharp drop-off in bookings activity.

This hit to earnings is severe, even when compared to the impact September 11th had on the industry. Cruise bookings declined around 40-50% in the immediate aftermath of 9/11 and normalized after 2-3 months, leaving a hole in the region of 5% net revenue yields over the next 12 months; a move that impacted industry EBITDA by around 12.5% according to J.P. Morgan estimates. By comparison, the Global Financial Crisis impacted net yields in 2009 by around 10%, but the sensitivity here is not linear and operators will start cutting when net yields breach below 5%.

“We don't see the cruise lines tripping debt covenants anytime soon, but a cash shortfall becomes a greater risk as the shutdown persists later into the year. Taking into account recently announced financing actions and the latest capital expenditure (capex) plans, the team estimates Royal Caribbean and Norwegian would have to lose 70% and 65% of pre-virus EBITDA, respectively, before there would be a cash shortfall in 2020,” added Montour. This assumes flat working capital, an increasingly optimistic case, given the large deferred revenue liability in the form of customer deposits, which could become a significant drag and depends on how many customers choose to rebook at a later date (and take the incentives, in the form of extra cruise credits) or opt for a full refund.

There is no longer doubt that the longest global expansion on record will end this quarter. We now think that the COVID-19 shock will produce a global recession as nearly all of the world contracts over the three months between February and April.

Bruce Kasman

Chief global economist, J.P. Morgan

In Context

Hide

In Context

Hide

Related insights

-

Global Research

Global Research

Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice.

-

Global Research

What U.S.-Iran tensions mean for oil, gold and stocks

January 29, 2020

How will the markets respond to the renewed conflict between the U.S. and the Middle East?

-

Global Research

Stock buybacks: Is excess cash being spent wisely?

August 15, 2019

Corporate buybacks have returned $5 trillion to shareholders since 2009, but the cycle may have peaked as the global economy slips slowly into sub-trend growth.

This communication is provided for information purposes only. Please read J.P. Morgan research reports related to its contents for more information, including important disclosures. JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively, J.P. Morgan) normally make a market and trade as principal in securities, other financial products and other asset classes that may be discussed in this communication.

This communication has been prepared based upon information, including market prices, data and other information, from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy except with respect to any disclosures relative to J.P. Morgan and/or its affiliates and an analyst's involvement with any company (or security, other financial product or other asset class) that may be the subject of this communication. Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument. J.P. Morgan Research does not provide individually tailored investment advice. Any opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein. Periodic updates may be provided on companies, issuers or industries based on specific developments or announcements, market conditions or any other publicly available information. However, J.P. Morgan may be restricted from updating information contained in this communication for regulatory or other reasons. Clients should contact analysts and execute transactions through a J.P. Morgan subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of J.P. Morgan. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitutes your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorized officer of J.P. Morgan.