4 min read

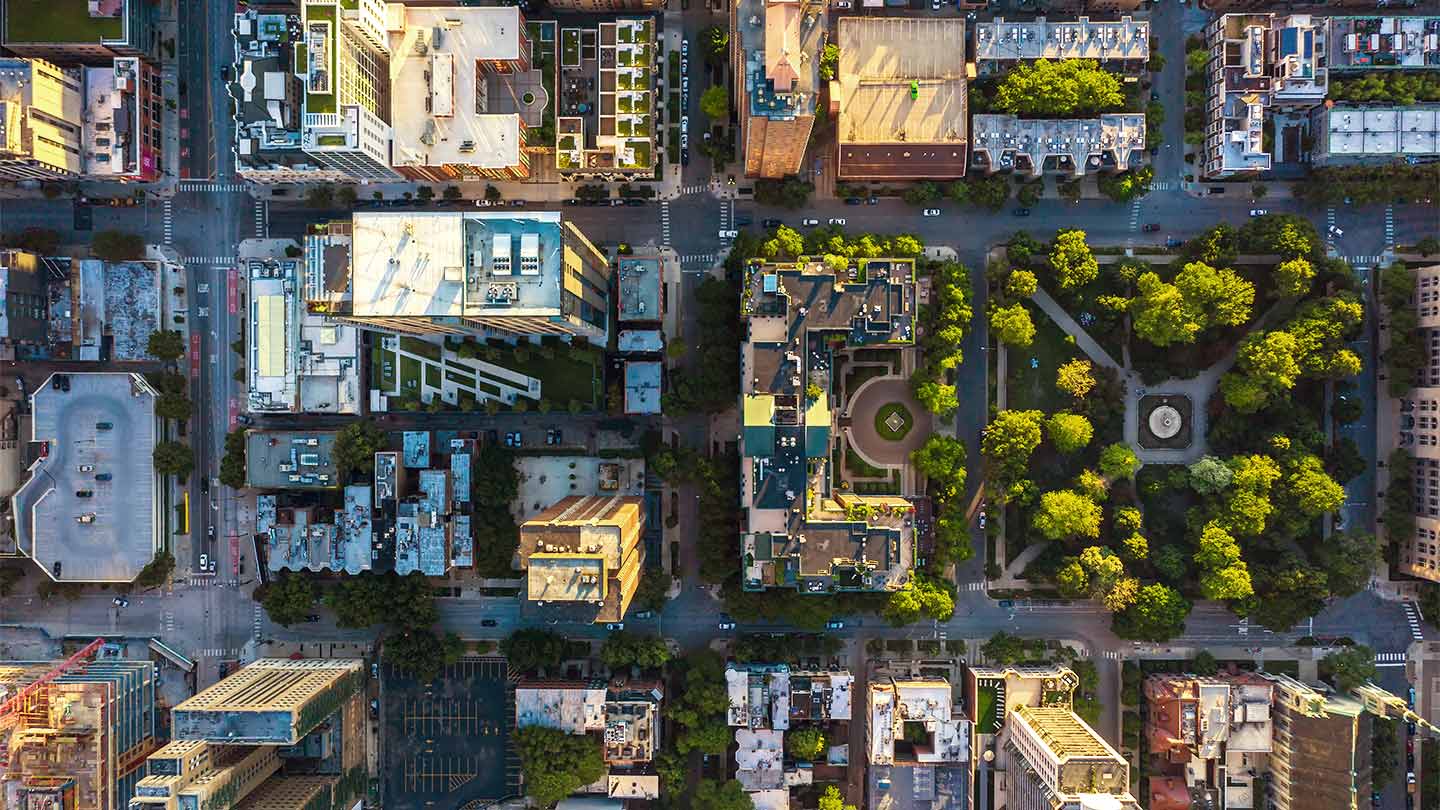

Identifying the ideal location for your next multifamily investment can seem daunting. A well-researched location strategy can help.

“‘Location, location, location’ is a cliché for a reason. Location drives appreciation, rental income and overall return on investment,” said Brooke Richartz, Senior Regional Sales Manager at Chase.

A location strategy can guide investment decisions, helping investors maximize returns and minimize risks by identifying areas with strong demand, favorable economic conditions and potential for growth.

Key factors to consider in a multifamily location strategy

Developing a location strategy starts with thorough research into current and historical macroeconomic, demographic and real estate trends in your potential target market. The goal: understanding whether local conditions support commercial real estate performance that aligns with your risk tolerance and investment goals.

1. Demand drivers

A location strategy should assess market characteristics that foster sustained demand for apartments, including:

- Employment: A strong local economy with job growth and low unemployment supports a robust renter pool. Don’t forget to assess the diversity of employment opportunities. “A market with jobs heavily concentrated in one employer or industry may pose a higher risk,” Richartz said.

- Demographic trends: Ideally, a market’s population would be growing or at least stable, rather than declining. Steady or rising household formation rates can also drive demand for multifamily housing.

- Amenities and infrastructure: Look for features that enhance quality of life and draw renters to a market, such as quality schools, parks, retail and easy access to transportation. These assets can also help you identify promising areas within a larger market. “Factors as simple as proximity to a subway stop or local supermarket, or relative levels of crime, can make one location more successful than another,” Richartz said.

2. Supply factors

Demand is only part of the equation—it needs to be assessed in the context of a market’s apartment supply. Data on vacancy rates, new apartment construction and absorption can help you assess the competitive landscape and development pipeline.

Also consider supply constraints, such as geographic or regulatory limits on new development, which affect how easily the supply and demand balance can shift.

“High barriers to entry for new supply help reduce volatility in cash flow caused by competition from newer assets entering the market,” Richartz said.

3. Capital markets strength

Location can affect a multifamily owner’s access to capital to finance commercial real estate investments. National lenders like Chase and lenders offering agency loans play an important role as sources of capital throughout the real estate cycle.

Access to equity investment capital is also important, but more isn’t always better.

“You want to see a stable pool of investors in a market. If there is too much interest, it could indicate a bubble is forming,” Richartz said.

4. Full-cycle performance

Understand how the market has fared throughout multiple economic and real estate cycles, and whether those ups and downs fit your risk tolerance. Consider capital availability as well as metrics such as rents, vacancies and cap rates.

This can be particularly important for smaller markets. Major metropolitan areas with well-developed real estate and job markets tend to experience less volatility as they remain attractive to renters throughout cycles.

5. Regulatory environment

Research local regulations, including those governing multifamily properties and relationships between property owners and renters, as well as zoning laws affecting future development. While regulations can change, it’s important to understand local policies that can meaningfully impact a property’s finances.

Location strategy best practices

Keep these tips in mind as you research your location strategy:

- Pair data with human insight: There are a wide range of sources for data on key location strategy factors, including free, publicly available options such as the U.S. Census Bureau and the Bureau of Labor Statistics. Local real estate brokers also typically have market reports highlighting area trends. But don’t stop at numbers. “Real estate is a people business, and experienced market participants have valuable boots-on-the-ground knowledge. Go to the market, meet with locals and attend networking events with industry experts,” Richartz said.

- Get local: If you don’t live in or have extensive experience in your target market, team up with proven local experts. “Do your own research to validate the direction they offer, and be present,” Richartz said. “Periodically walk your properties, even if you hired on-site management.”

- Be cautious with hot markets: Hot markets’ hype doesn’t always last. “Focus on actual data vs. speculation about where a market is going,” Richartz said. “If a market isn’t ‘there’ yet, there’s a chance a positive trend won’t materialize.” Studying past cycles and the factors driving those cycles can help. If you see a similar pattern forming, the next phases of the cycle may follow the pattern, too.

- Monitor and adapt: Your location strategy should evolve as your investing goals shift or market conditions change in ways that don’t support those goals. Regularly monitoring supply and demand trends and other important factors in your target area can help you know when it’s time to adjust your location strategy.

The bottom line: A full-cycle view of local supply and demand drivers, capital markets strength and other key factors can help multifamily investors create a location strategy that maximizes returns, minimizes risks and supports their investment goals.

Once you’ve developed a location strategy, it’s time to find your ideal property. Here’s what to look for when investing in a multifamily property.

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/cb-disclaimer for disclosures and disclaimers related to this content.