5 min read

At Syracuse, N.Y.’s Salt City Market, customers can sample globe-spanning flavors from a dozen up-and-coming food entrepreneurs. But it’s a lot more than a spot to grab a delicious meal.

The 78,000-square-foot development transformed a vacant lot in an underserved area of downtown Syracuse into a community hub—one that’s creating jobs, catalyzing investment and helping launch first-time entrepreneurs into small business ownership.

“It’s a generational wealth strategy, and it ripples out to the people they employ,” said Meg O’Connell, Executive Director of the Allyn Family Foundation, which developed Salt City Market.

Salt City Market takes shape

The concept for a food hall that would create opportunities for local entrepreneurs emerged from Syracuse’s rich history as a haven for resettled refugees. “We knew there were these pockets of hidden culinary and entrepreneurial talent in our community,” O’Connell said.

Syracuse faces economic challenges, with a poverty rate more than double New York state’s, according to the U.S. Census Bureau. This has historically made it difficult for residents to access capital and resources needed to start businesses.

While community organizers had success with small business development programs and a pop-up food court, creating a permanent food hall required significant capital investment and infrastructure. The Allyn Family Foundation stepped forward with an innovative solution.

In 2018, the foundation formed the nonprofit Syracuse Urban Partnership (SYRUP) to bring the community food hall concept to life. Salt City Market opened three years later, ready to serve as both a culinary destination and small business incubator.

Customers dine at Salt City Market

Community impact in action

In its first four years, Salt City Market has incubated 15 small businesses—most founded by Syracuse residents with little to no prior entrepreneurial experience. Several business owners have hit financial milestones such as buying a car or home, and two have opened additional locations, said CJ Butler, Marketing and Communications Manager for the Allyn Family Foundation and SYRUP.

The Allyn Family Foundation designed Salt City Market to support its vendors and the broader community by including:

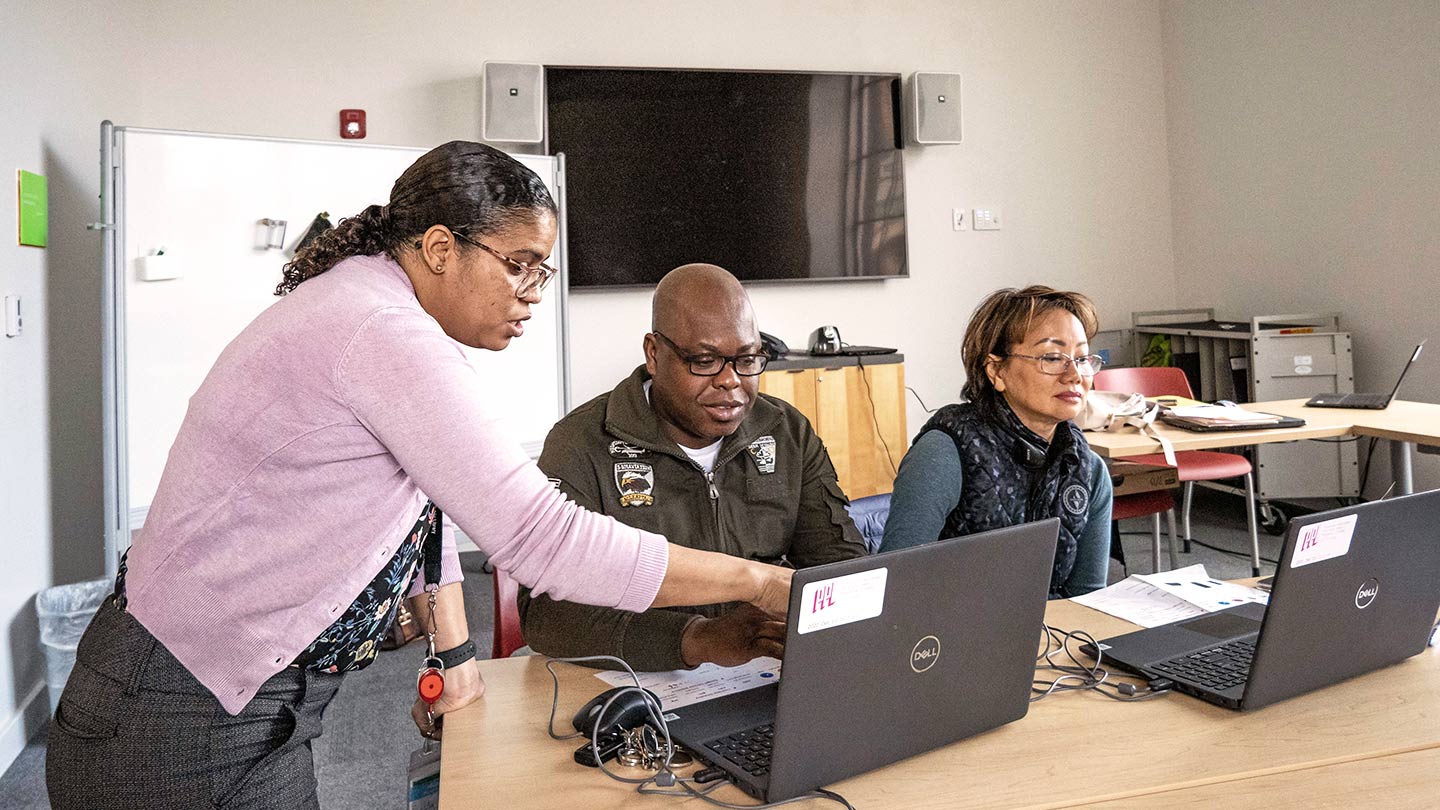

- Business coaching: Salt City Market offers vendors technical assistance and learning opportunities. “It’s important to us to make sure we’re not just creating businesses, we’re creating successful businesses,” Butler said.

- Job creation: Most vendors employ five to 10 people. Cake Bar expanded to a second location and now employs 30 people. The market itself employs 28 people directly and created a workforce-development program employing people who have experienced homelessness for hospitality and security roles.

- Access to healthy food: Syracuse Cooperative Market anchors the food hall with downtown Syracuse’s only full-service grocery store.

- New housing: Above the market, 26 apartments offer a mix of affordable, workforce and market-rate housing.

- Community input: Salt City Market was shaped by local voices throughout development, from its name—referencing Syracuse’s salt industry heritage—to vendor selection. “We try to incorporate feedback at every level, because we want people to feel ownership of the market,” Butler said.

Salt City Market includes a full-service grocery store with fresh produce

Financing innovative community development

The Allyn Family Foundation committed about $25 million to create Salt City Market. JPMorganChase provided a crucial $5.3 million New Markets Tax Credit (NMTC) investment—a financing tool designed to attract private capital to underserved communities—helping get the project across the finish line.

Though the foundation’s deep knowledge of Syracuse gave them confidence in the project’s potential, attracting additional funding proved challenging.

“NMTC was huge for us. Even with the foundation being very creative, there aren’t a lot of other vehicles to get resources for a project like this,” O’Connell said.

Salt City Market’s impact, by the numbers:

15

Small business incubated

350,000

Customers per year

26

Mixed-income apartments

Catalyzing investment

Building on Salt City Market’s success—and JPMorganChase’s initial investment—the Allyn Family Foundation is converting a historic office building across the street into 152 mixed-income apartments. The demand is clear: Salt City Market’s apartments have a waitlist of more than 500.

The redeveloped Chimes Building, designed by the same architects as the Empire State Building, will include a mix of affordable, workforce and market-rate units integrated throughout the building. All apartments will feature the same design regardless of affordability level, with access to amenities including a fitness center, community room and rooftop patio. JPMorganChase provided an $11.8 million Historic Tax Credit equity investment to support the redevelopment, which is expected to finish in early 2026.

“Our investment in Salt City Market underscores our commitment to community development and local entrepreneurship in Syracuse. This vibrant marketplace is a hub for culinary experiences and a catalyst for economic growth. By supporting Salt City Market and the Allyn Family Foundation, we are investing in Syracuse’s future, empowering small businesses and contributing to downtown revitalization. We are excited to be part of this transformative journey,” said En Jung Kim, Head of New Markets Tax Credit at JPMorganChase.

The neighborhood’s transformation continues to gain momentum. Beyond Salt City Market’s direct impact, the area is attracting new investment, including plans to reopen a shuttered high school with an innovative STEAM curriculum focused on science, technology, engineering, art and math.

“The beauty of Salt City Market is it shows that amazing things can come to this city,” Butler said. “I think it’s given a lot of hope to the city that we’re in a new era.”

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/commercial-banking/legal-disclaimer for disclosures and disclaimers related to this content.