In Chicago, the stark contrast between neighborhoods is more than just a matter of geography—it’s a matter of opportunity and wellness. While many areas thrive, others face significant challenges, with residents living more than 10 years less, on average, than their neighbors across town. 1

To help bridge that gap, JPMorganChase Community Development Banking has invested more than $250 million since 2019 to empower Chicago community development organizations that share our dedication to creating opportunities across the city. That includes:

- $207 million to develop and finance 1,227 affordable rental homes

- $49 million in New Markets Tax Credit equity investments in facilities providing essential services such as health care centers, workforce development programs, education and shelter for young people experiencing homelessness

- $14 million to finance 160 affordable homes through government-sponsored enterprise agency lending

Our 30 local Community Development Banking and Agency Lending employees have built strong relationships with community development organizations that are deeply engaged with the communities they serve, helping ensure that our support lands where it’s most needed to create a better Chicago.

“When you combine Chicago’s expertise and talent in community development with the resources and people we have at JPMorganChase, it’s a recipe for showing the art of the possible in community development finance.”

Kevin Goldsmith

Head of Tax Credit and Intermediaries

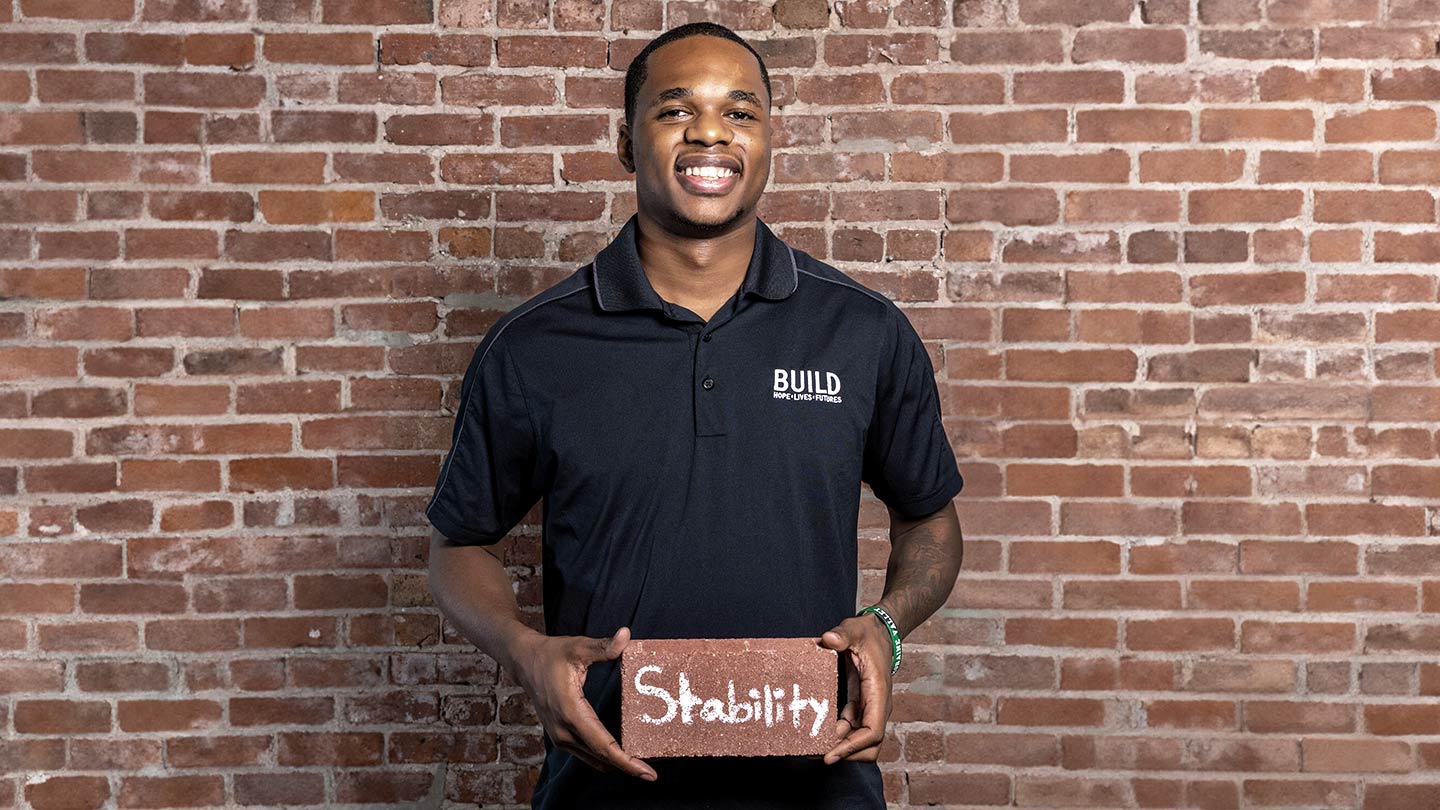

Learn more about our impact through the individual voices that make up Chicago

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/cb-disclaimer for disclosures and disclaimers related to this content.