4 min read

Key takeaways

- An economic rebound may not be on the immediate horizon, but multifamily investors can still make preparations for the future.

- Multifamily investors should look at economic indicators, such as housing markets, interest rates, and political and geopolitical dynamics to get a clearer picture of the economy.

- Performing market research, proactively reaching out to building owners and optimizing liquidity can help multifamily investors position themselves for success when the economy rebounds.

The economy performed better than expected in 2023. But interest rates, inflation and other economic indicators remain in flux, leaving the future—and the timeline for an economic recovery—uncertain.

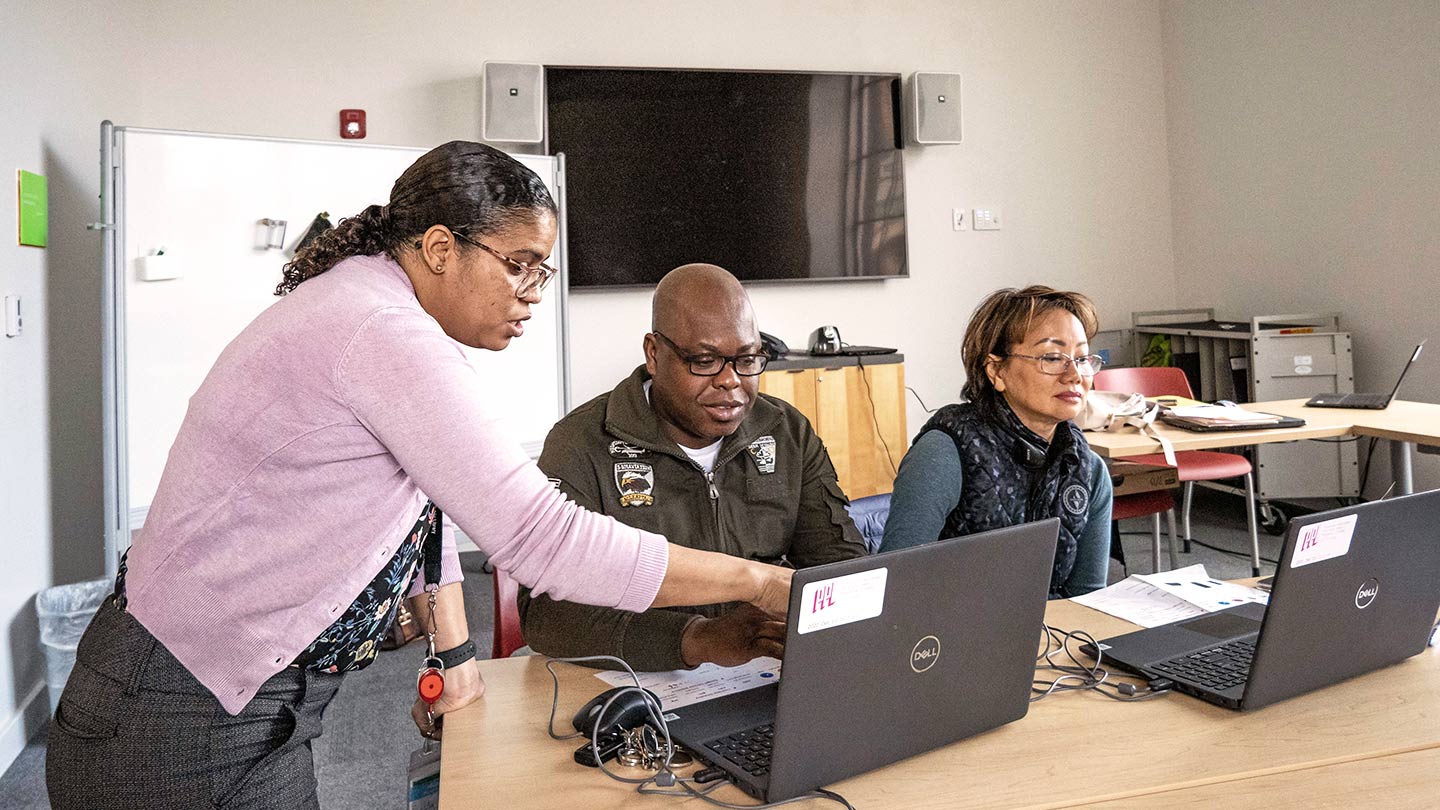

“The market right now is like the offseason,” said Al Brooks, Vice Chair of Commercial Banking at JPMorganChase. “In the offseason you’ve got to be eating better. You’ve got to be working out harder. You’ve got to be ready to compete when the season begins.”

Brooks, along with Ginger Chambless, Head of Research for Commercial Banking at JPMorganChase, and Tom LaSalvia, Head of Commercial Real Estate Economics at Moody’s Analytics CRE, weighed in on the current economic environment and how commercial real estate investors can prepare now for an economic recovery.

What to consider in the current economy

From labor markets to inflation, there’s no shortage of economic indicators for investors to keep an eye on. But a few factors stand out, including:

- Political and geopolitical dynamics: “Globally, the variety of conflicts elevate the probability of supply-side shocks—to oil, freight and intermediate goods—enough to warrant consistent monitoring,” LaSalvia said. Domestically, U.S. political parties’ lack of cooperation, which nearly led to a debt default last year, could delay critical spending on infrastructure and research and development and potentially damage the economy. Plus, 2024 is an election year, which could fuel market volatility.

- Housing markets: “The lock-in effect within single-family housing could affect supply for years to come,” LaSalvia said. Combined with high construction costs, single-family home prices will likely remain high, helping drive demand for multifamily properties among would-be homebuyers.

- Interest rates: “A higher-for-longer rate environment seems likely,” Chambless said. “The pace of disinflation has slowed in recent months and labor markets are holding up. While the Fed has opened the door to lowering policy rates in 2024, it doesn’t appear to be in a rush to do so.”

“It’s tough to envision an economic boom in the near term given where we are in the economic cycle; equity markets are near all-time highs and GDP momentum is slowing from an above trend pace last year,” Chambless said.

LaSalvia agreed. “I believe the economy has peaked in terms of growth rate, and we’re heading for a softer environment,” he said. “This in no way means a recession is likely, but instead points to a somewhat weaker labor market and below-average GDP growth. Our expectation is for one to two years of slightly below-average growth before the economy picks up.”

What investors can do now to prepare for an economic rebound

In the meantime, commercial real estate investors can prepare for an economic recovery in several ways, including:

- Performing market research: Smart investors are familiar with their local markets, including rent prices, regulations and cap rates. Likewise, they’re familiar with cost, cash flow and sales comparison value approaches.

- Proactively reaching out to building owners: In performing due diligence and market research, investors may come across properties to help optimize their portfolios. However, these properties may not always be for sale. “Smart buyers approach building owners all the time,” Brooks said. “They know every deal in the market, and they know who owns it. Investors proactively reach out to let the owners know that—should the occasion arise—they’re interested buyers.” This is especially true for buildings in prime locations, such as on a waterfront.

- Increasing liquidity and cash on hand: Real estate’s cyclical nature allows investors with cash on hand to buy properties at discounted prices in a down market. Raising equity is an option for investors looking to make acquisitions, as is treasury management. With the latter, commercial real estate businesses can save time and money by implementing cash management tools and rent payment solutions.

- Doing the math, factor in the sweat equity: In a down market, commercial real estate investors can benefit from discounted prices on existing properties, which can help save on costs and increase their bottom line. For example, a new-construction 10-unit building may cost $500,000 per unit. If investors acquire an older 10-unit building at $300,000 a unit, they can gain a big rent advantage—especially in sought-after neighborhoods. And if investors put sweat equity into the property they can profit even more. For example, installing stainless steel appliances, laminate wood flooring, unique amenities and proptech may require limited upfront expenses and can command higher rents.

Regardless of the market, you can grow your multifamily portfolio by keeping a few tips in mind.