8 min read

Key takeaways

- Now Kinexys by J.P. Morgan, Onyx is moving into its next chapter.

- As transaction volumes grow with our existing clients, the same goes for new clients who have chosen Kinexys. Through cutting-edge infrastructure, our clients are able to easily transfer money across borders past the close of markets, tokenize assets, and seamlessly exchange and validate financial data.

- Soon, we'll be adding foreign exchange (FX) capabilities to Kinexys Digital Payments (formerly JPM Coin System)¹. We've also announced a proof-of-concept (POC) from Kinexys Digital Assets and Kinexys Labs. This POC demonstrates on-chain privacy, identity and composability—major themes that will play significantly into our continued evolution.

What’s new

For nearly a decade, J.P. Morgan has been at the forefront of innovation in financial services. This evolved with the launch of the world’s first bank-led blockchain platform—Onyx by J.P. Morgan—reflecting the untold power of the technology we were yet to discover. As we approach 2025, we have a clear vision for blockchain and its potential. Today at the Singapore Fintech Festival, Umar Farooq, co-head of J.P. Morgan Payments, announced that Onyx is now Kinexys by J.P. Morgan—the next chapter for our blockchain business unit.

Kinexys is driven by our two core differentiators: a relentless focus on building next-generation financial infrastructure and deep industry expertise. We’re helping our clients realize the future of finance by reimagining the way money, assets and financial information move.

Platform momentum

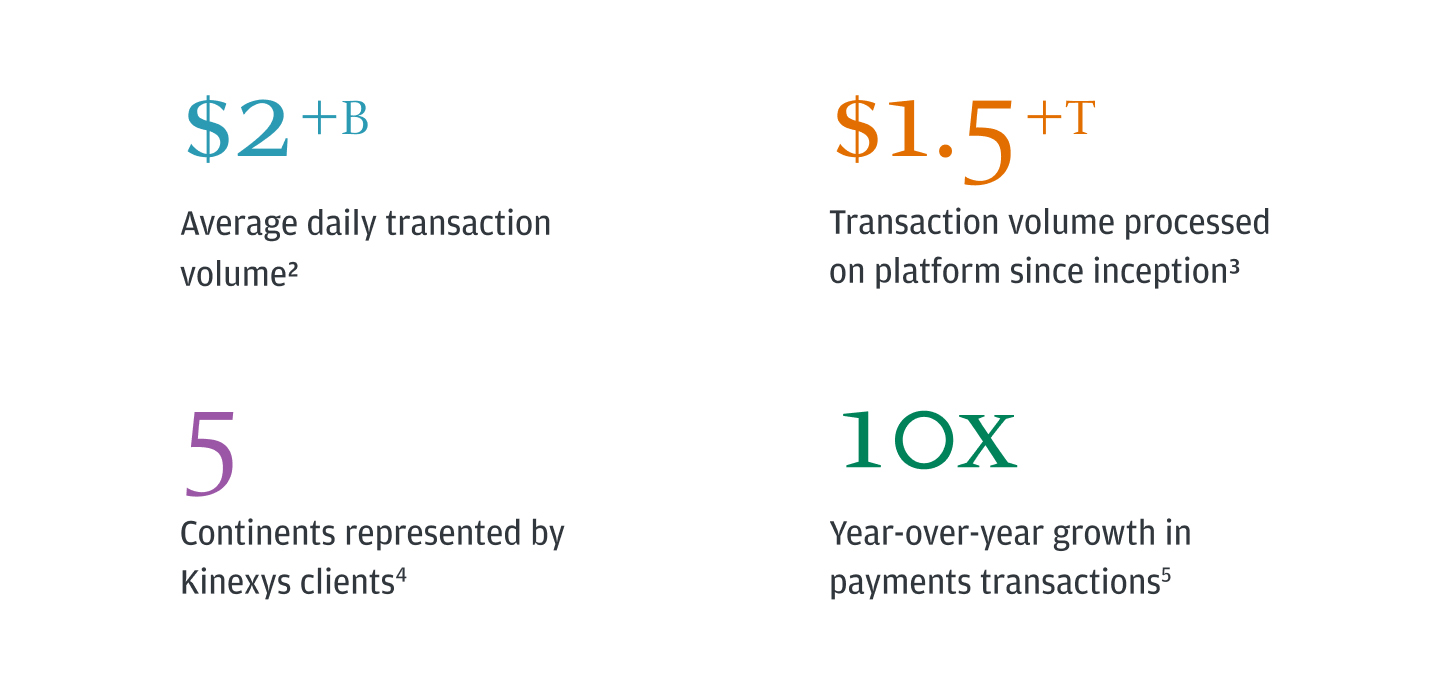

With Kinexys, we’re building on the momentum of Onyx. Since inception, the platform has exceeded $1.5 trillion in notional value, processing an average of more than $2 billion daily in transaction volume. Moreover, payments transactions have grown by 10x year-over-year, and we have executed some of the largest repo transactions on any blockchain globally. Now serving clients across five continents, we’re helping businesses around the world harness the speed and efficiency that blockchain technology enables.

Client innovation

As existing clients continue to grow their transaction volumes, the pace of new client adoption is also increasing. With Kinexys solutions, leading corporations, financial institutions and fintechs can streamline money movement, improve asset settlement times, unlock liquidity and create new revenue opportunities. This includes global innovators such as Siemens, Ant International and BlackRock.

Clients across the globe have chosen Kinexys to enhance their payment capabilities, allowing near real-time, 24/76 programmable cross-border transactions and intragroup funding. This provides on-demand access to working capital, optimizing liquidity management, and will also help reduce transaction costs—participants can now pay disbursement to counterparties without the need for prefunding.

A new name grounded by our vision

The name Kinexys is derived from the word “kinetic,” meaning “caused by motion.” This is representative of the way we move money, assets and financial information around the world with speed, ease and efficiency. Kinexys also denotes “connection” and “a link or tie,” mirroring our vision for financial services.

“Together with our clients, we aim to move beyond the limitations of legacy technology and realize the promise of a multichain world,” Farooq said. “Our goal is to foster a more connected ecosystem to break down disparate systems, enable greater interoperability and reduce the limitations of today’s financial infrastructure.”

Product expansion

Kinexys Digital Payments is now integrating with J.P. Morgan FX Services to enable FX settlement on chain, initially in USD and EUR, with plans to expand to more currencies.7 Clients will be able to execute near real-time FX transactions and settlement by connecting to the J.P. Morgan global FX platform as early as the first quarter of 2025—reducing FX settlement risk and speeding up trade settlements. This lays the groundwork for future automation of 24/7 near real-time multicurrency clearing and settlement, based on client-defined instructions.

Exploring what’s possible

In addition to expanding its product portfolio, Kinexys continues to investigate the bounds of distributed ledger technology in reshaping financial services. Today, we’re furthering our exploration of privacy, identity and composability in blockchain ecosystems and publishing a whitepaper to demonstrate a new POC. Enhanced privacy measures are crucial for improving access to digital assets, while streamlining identity management is intrinsically linked to the potential for tokenized assets at scale. The Kinexys Digital Assets and Kinexys Labs Privacy POC explores these areas in further detail to better understand current solutions and potential implementations across the board.

“We've built our business on a history of innovation, and like the industries we serve, we are always evolving. We are excited for this new chapter and are looking forward to continuously shaping the future of financial services together with our clients.”

Umar Farooq

Co-head of J.P. Morgan Payments

References

In development

Based on mean average transactions (USD) for 2024 YTD.

Cumulative transactions (USD) across Kinexys products since inception.

By geographical location of client headquarters for clients using at least one Kinexys product.

Based on Jan-Aug 2023 vs 2024 YoY transactions volume attributed to growth driven by Kinexys Digital Payments.

Transfers on the network are completed on a 24/7/365 and same day basis. Moving funds to and from the network from traditional Demand Deposit Accounts on legacy systems to Blockchain Deposit Accounts has a three-hour downtime over the weekend (3-6 p.m. EST every Saturday). Enhancement is under development.

In development