Unlocking modern claim payments

With a financial and regulatory landscape that’s constantly in flux – combined with ever-increasing expectations from customers – insurers face a growing need to evolve their business.

Resolving everyday matters quickly, with a modern claims payout experience consumers expect, helps cultivate loyalty and promotes the insurer’s brand. But how can a $6T+ industry1 move away from slow yet proven methods and make the leap to transforming the customer experience? The key is collaborating with the right partner who understands insurers' unique needs.

Bridging the gap between treasurers and claims processing

Making the journey toward transformation is easier with a partner that insurers can trust to cover all of their priorities, from financial requirements to intuitive, fast and seamless payment experiences.

The treasurer’s role for insurers is crucial. They need to ensure account structures are built to maximize access to cash, so that the insurer has the necessary cash on hand locally in order to disburse claims in a timely manner. They’re also concerned about digitizing paper processes and reducing manual efforts. From a global perspective, treasurers are looking for opportunities to optimize FX flows in order to manage risk and market volatility, as well as ensure relevant regulatory and legal compliance.

Meanwhile, the goal for claims is to enhance the customer experience. This includes integrating insurance products and coverage options into the customer’s buying experience, streamlining the claims process for enhanced speed and convenience, and optimizing cross-currency payments to improve disbursements for

global customers.

6 key challenges global treasurers must overcome in the insurance industry

-

Reconciliation

Manual processes create error-prone decisioning and reduce effciency in claims and other payments.

-

Trapped cash

Due to regulatory requirements for insurers to hold capital at an entity level in various locations, which they can’t always repatriate.

-

Lack of balance visibility

Caused by multiple banking providers, complex account structures and the number of internal systems.

-

High volumes of currencies

Managed differently across different banks.

-

Digital disruption

Insurtechs quickly entering the market while insurers are hamstrung by legacy systems and pressure to innovate.

-

Flexible disbursement

Need to make it simple to reconcile and manage your entire cash picture.

The $6T+ insurance industry typically relies on slow-moving legacy methods like paper checks and traditional mail. J.P. Morgan can help pave the way for faster, more convenient disbursements.

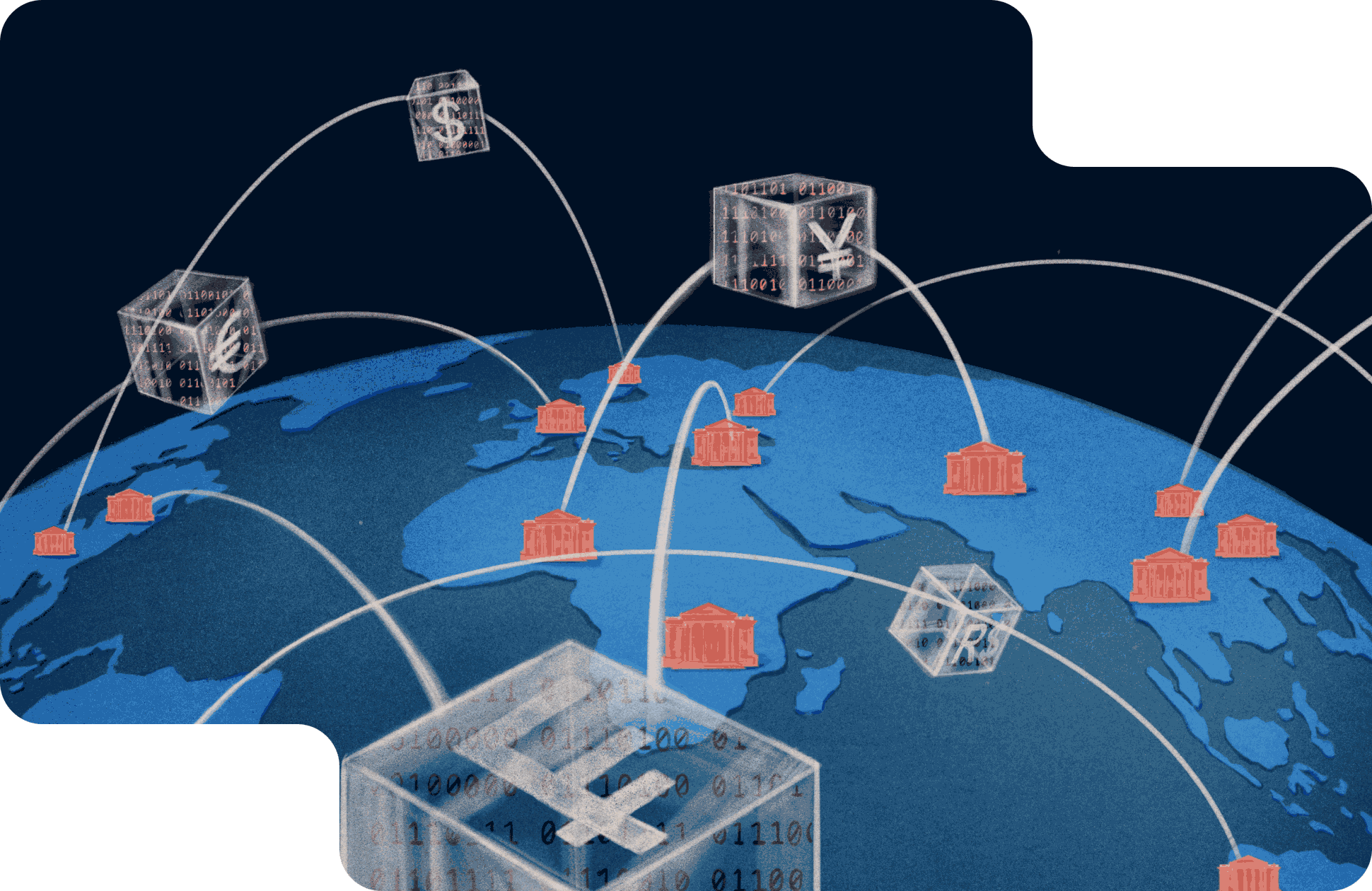

With more than 150 years of industry experience,2 J.P. Morgan Payments can bring these aspects of your business together. We can enable insurers to do more with their payments and help them build successful relationships across cross-functional business partners. Working with a payments provider who partners with insurtechs—and understands the insurance landscape—can help optimize your customer experience via comprehensive insurance-centric workflows for single-party or multi-party lienholder, vendor and provider claims. Our insurtech partnerships combine industry expertise with cutting-edge digital payment solutions that deliver flexibility and agility throughout the insurance lifecycle.

Doing business with nearly 3 out of 4 top insurers globally (Fortune 500),3 we have a proven ability to deliver efficient and dependable payment solutions at scale as you evolve, with the security you’d expect from a trusted innovator in payments. Let us propel you further, faster over the long-term with global and local expertise you can bank on.

Let’s design payment flows that do more for your business.

To learn more about how we can support your business, please contact your J.P. Morgan representative. And take a look at how we help financial institution groups like yours through our cross-currency solutions, innovative technology and liquidity optimization.

Member FDIC. Deposits held in non-U.S. branches are not FDIC insured. All rights reserved.

The statements herein are confidential and proprietary and not intended to be legally binding. Not all products and services are available in all geographical areas. Visit jpmorgan.com/paymentsdisclosure for further disclosures and disclaimers related to this content.

References

Statista, Global insurance industry - statistics & facts, 2023

J.P. Morgan “History of our Firm”

Internal data, 2023.

Related insights

Treasury

Virtual Account Management: Considerations on future-ready solutions

Get the visibility, control and optimization you need to manage your cash position and enhance your decision making.

Read more

J.P. Morgan Reports

The race to rewire cross border payments

The world may be entering a period of deglobalization, but cross border payments are on the rise. International transfers are expected to increase five percent per year until 2027.

Learn more